Aya Gold & Silver Inc. (TSX: AYA; OTCQX:

AYASF) (“Aya” or the “Corporation”) is pleased to announce an

updated Mineral Resource Estimate (“MRE”) prepared in accordance

with National Instrument 43-101 – Standards of Disclosure for

Mineral Projects (“NI 43-101”) at its Boumadine Project in the

Kingdom of Morocco. The updated MRE contains an Inferred Mineral

Resource of 29.2 million tonnes (“Mt”) at 82 grams per tonne

(“g/t”) silver (“Ag”), 2.63 g/t gold (“Au”), 2.11% zinc (“Zn”) and

0.82% lead (“Pb”) containing an estimated 76.8 million ounces

(“Moz”) of Ag, 2.4Moz of Au, 615 thousand tonnes (“kt”) of Zn

and 237 kt of Pb and an Indicated Mineral Resource of 5.2Mt at 91

g/t Ag, 2.78 g/t Au, 2.8% Zn and 0.85% Pb containing an estimated

15.1 Moz of Ag, 449 kilo ounces (“koz”) of Au, 145 kt of Zn and 44

kt of Pb.

Highlights

- Indicated Mineral

Resources of 5.2Mt at 91 g/t Ag, 2.78 g/t Au,

2.8% Zn and 0.85% Pb containing an estimated 15.1 Moz of Ag,

449 koz of Au, 145 kt of Zn and 44 kt of Pb. Representing 74.4 Moz

Silver equivalent (“AgEq”), an increase of 120%.

- Inferred Mineral

Resources of 29.2 Mt at 82g/t Ag, 2.63 g/t Au, 2.11% Zn

and 0.82% Pb containing an estimated 76.8 Moz of Ag, 2.4 Moz of Au,

615 kt of Zn and 237 kt of Pb. Representing 378Moz AgEq, an

increase of 19%.

- 49% of the Inferred Mineral

Resource is pit-constrained and reported above a cut-off

net smelter royalty (“NSR”) value of $95/t, and 51% deemed for

underground development NSR cut-off value of US$125/t.

- Additional mineral resource

potential to expand the deposit in all directions for

future mineral resource estimation. With a land package of 271.5

square kilometers (“km2”) in addition to a 600 km2 exploration

authorization, new targets are being tested.

“We are pleased to announce an updated

Mineral Resource Estimate for Boumadine, marking a 120% increase in

indicated resources and 19% in inferred resources since our April

2024 update,” said Benoit La Salle, President & CEO.

“In under three years, we have grown silver and gold ounces

across all classifications, demonstrating the team’s ability to

identify and grow Boumadine into a world class asset.

“Drilling has primarily focused on the

mining permit, which represents only a small portion of the broader

mineralized footprint. Over the past two years, we have expanded

our footprint by nearly 850% and continue to consolidate the area

while aggressively testing extensions of known mineralized trends.

Additionally, ongoing metallurgical studies are yielding promising

results as we advance the project toward large-scale

development.”

Boumadine Mineral Resource

The MRE is effective as of February 24, 2025,

and includes drilling conducted from 2018 through December 1, 2024.

The database comprises 428 surface diamond drill holes (“DDH”),

totaling 142,268 meters (“m”). For this updated MRE, 93 new DDH,

totaling 44,514m, were incorporated.

Historical mining was not depleted from the MRE

as the exact position and physical extent could not be accurately

measured. From the historical production reports, approximately

261kt of mineralized material were extracted and processed (less

than 1% of the current MRE), therefore it is considered not

material. Historical tailings were excluded from the MRE since the

bulk density, volumes and grades were not properly evaluated.

Molybdenum was excluded from both the cut-off and AgEq/AuEq

calculations since the process recoveries were not evaluated.

Table 1 –Boumadine MRE, as of February

24, 2025 (1-12)

|

|

Cutoff |

Tonnes |

Average Grade |

Contained Metal |

|

Ag |

Au |

Cu |

Pb |

Zn |

AgEq |

AuEq |

Ag |

Au |

Cu |

Pb |

Zn |

AgEq |

AuEq |

|

NSR US$/t |

(kt) |

(g/t) |

(g/t) |

(%) |

(%) |

(%) |

(g/t) |

(g/t) |

(koz) |

(koz) |

(kt) |

(kt) |

(kt) |

(koz) |

(koz) |

|

Pit-constrainedIndicated |

95 |

3,920 |

94 |

2.99 |

0.13 |

0.84 |

2.95 |

476 |

5.30 |

11,881 |

343 |

5 |

33 |

116 |

60,051 |

667 |

|

Pit-constrainedInferred |

95 |

14,258 |

90 |

2.89 |

0.10 |

0.81 |

2.38 |

450 |

5.00 |

41,135 |

1,102 |

14 |

115 |

339 |

206,293 |

2,293 |

|

Out-of-pitIndicated |

125 |

1,249 |

80 |

2.11 |

0.08 |

0.87 |

2.32 |

358 |

3.98 |

3,216 |

106 |

1 |

11 |

29 |

14,382 |

160 |

|

Out-of-pitInferred |

125 |

14,938 |

74 |

2.39 |

0.07 |

0.82 |

1.85 |

357 |

3.97 |

35,669 |

1,294 |

10 |

122 |

276 |

171,393 |

1,905 |

|

TotalIndicated |

95/ 125 |

5,169 |

91 |

2.78 |

0.12 |

0.85 |

2.80 |

448 |

4.98 |

15,097 |

449 |

6 |

44 |

145 |

74,433 |

827 |

|

TotalInferred |

95/ 125 |

29,196 |

82 |

2.63 |

0.08 |

0.82 |

2.11 |

402 |

4.47 |

76,804 |

2,396 |

25 |

237 |

615 |

377,686 |

4,198 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. The

estimate of Mineral Resources may be materially affected by

environmental, permitting, legal, title, taxation, socio-political,

marketing, or other relevant issues. There is no certainty that

Mineral Resources will be converted to Mineral Reserves.

- The Inferred Mineral Resource in

this estimate has a lower level of confidence than that applied to

an Indicated Mineral Resource and must not be converted to a

Mineral Reserve. It is reasonably expected that the majority of the

Inferred Mineral Resource could be upgraded to an Indicated Mineral

Resource with continued exploration.

- The Mineral Resources in this news

release were estimated in accordance with the Canadian Institute of

Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral

Resources and Mineral Reserves Definitions (2014) and Best

Practices Guidelines (2019) prepared by the CIM Standing Committee

on Reserve Definitions and adopted by the CIM Council, as may be

amended from time to time.

- A silver price of US$24/oz with a

process recovery of 89%, a gold price of US$2,200/oz with a process

recovery of 85%, a zinc price of US$1.20/lb with a process recovery

of 72%, a lead price of US$1.00/lb with a process recovery of 85%,

and a copper price of US$4.00/lb with a process recovery of 75%

were used in establishing the MRE.

- AgEq = Ag(g/t) + (Au(g/t) *Au

price/oz*Au recovery)/(Ag price/oz*Ag recovery) + Zn(%)*Zn

price/lb* Zn recovery/(Ag price/oz*Ag recovery)*685.7147973 +

Pb(%)*Pb price/lb* Pb recovery/(Ag price/oz*Ag

recovery)*685.7147973 + Cu(%)*Cu price/lb* Cu recovery/(Ag

price/oz*Ag recovery)*685.7147973

- AuEq = Au(g/t) + (Ag(g/t) *Ag

price/oz*Ag recovery)/(Au price/oz*Au recovery) + Zn(%)*Zn

price/lb* Zn recovery/(Au price/oz*Au recovery)*685.7147973 +

Pb(%)*Pb price/lb* Pb recovery/(Au price/oz*Au

recovery)*685.7147973 + Cu(%)*Cu price/lb* Cu recovery/(Au

price/oz*Au recovery)*685.7147973.

- The constraining pit optimization

parameters were US$3.5/t for mineralized material mining. US$2/t

for waste mining US$89/t for processing and US$6/t for G&A

totalling US$95/t for a cut-off and 50-degree pit slopes.

- The out-of-pit parameters used a

US$30/t mining cost, US$89/t processing cost and US$6/t G&A

totalling US$125/t for a cut-off The out-of-pit Mineral Resource

grade blocks were quantified above the US$125 NSR cut-off, below

the constraining pit shell and within the constraining mineralized

wireframes. Out–of-pit Mineral Resources exhibit continuity and

reasonable potential for extraction by the long hole underground

mining method.

- Individual calculations in tables

and totals may not sum due to rounding of original numbers.

- Grade capping of 800 g/t Ag,

30 g/t Au, 28% Zn, 10% Pb and 1.4% Cu was applied to

composites before grade estimation.

- Bulk density was evaluated

separately for each individual vein with values ranging from 3.20

to 4.00 t/m3 determined from drill core samples and used for the

MRE. For oxidized and transitional material, a bulk density of

2.65 t/m3 was used.

- 1.0 m composites were used during

grade estimation.

Tables 2 and 3 – Cut-Off Sensitivity

MRE (1-12)

|

Indicated InPit and Underground Resources |

|

UG-OP |

Tonnes |

Ag |

Ag |

Au |

Au |

Cu |

Pb |

Zn |

AgEq |

AgEq |

AuEq |

AuEq |

|

NSR US$/t |

(kt) |

(g/t) |

(koz) |

(g/t) |

(koz) |

(%) |

(%) |

(%) |

(g/t) |

(koz) |

(g/t) |

(koz) |

|

145-120 |

4,472 |

97 |

13,923 |

3.05 |

439 |

0.12 |

0.86 |

2.75 |

484 |

69,632 |

5.40 |

777 |

|

140-115 |

4,625 |

95 |

14,110 |

2.99 |

444 |

0.12 |

0.86 |

2.72 |

476 |

70,751 |

5.30 |

788 |

|

135-110 |

4,791 |

93 |

14,359 |

2.92 |

450 |

0.12 |

0.86 |

2.69 |

467 |

71,933 |

5.20 |

801 |

|

130-105 |

4,932 |

92 |

14,547 |

2.86 |

453 |

0.12 |

0.85 |

2.66 |

460 |

72,898 |

5.11 |

810 |

|

125-95 |

5,169 |

89 |

14,863 |

2.77 |

460 |

0.11 |

0.84 |

2.63 |

448 |

74,433 |

4.98 |

827 |

|

120-90 |

5,298 |

88 |

15,008 |

2.72 |

463 |

0.11 |

0.83 |

2.60 |

442 |

75,250 |

4.90 |

834 |

|

115-85 |

5,481 |

87 |

15,265 |

2.66 |

469 |

0.11 |

0.82 |

2.57 |

433 |

76,364 |

4.81 |

848 |

|

110-80 |

5,648 |

85 |

15,477 |

2.60 |

473 |

0.11 |

0.81 |

2.55 |

426 |

77,320 |

4.73 |

858 |

|

105-75 |

5,820 |

84 |

15,683 |

2.54 |

476 |

0.10 |

0.80 |

2.53 |

418 |

78,268 |

4.64 |

868 |

|

90-60 |

6,284 |

79 |

16,061 |

2.39 |

483 |

0.10 |

0.78 |

2.46 |

399 |

80,571 |

4.40 |

890 |

|

Inferred InPit and Underground

Resources |

|

UG-OP |

Tonnes |

Ag |

Ag |

Au |

Au |

Cu |

Pb |

Zn |

AgEq |

AgEq |

AuEq |

AuEq |

|

NSR US$/t |

(kt) |

(g/t) |

(koz) |

(g/t) |

(koz) |

(%) |

(%) |

(%) |

(g/t) |

(koz) |

(g/t) |

(koz) |

|

145-120 |

24,023 |

90 |

69,342 |

2.86 |

2,211 |

0.09 |

0.87 |

2.14 |

441 |

340,641 |

4.90 |

3,786 |

|

140-115 |

25,128 |

88 |

70,937 |

2.80 |

2,261 |

0.09 |

0.86 |

2.12 |

432 |

349,042 |

4.80 |

3,880 |

|

135-110 |

26,218 |

86 |

72,627 |

2.73 |

2,304 |

0.08 |

0.85 |

2.10 |

424 |

357,154 |

4.71 |

3,970 |

|

130-105 |

27,538 |

84 |

74,537 |

2.66 |

2,355 |

0.08 |

0.83 |

2.08 |

414 |

366,533 |

4.60 |

4,074 |

|

125-95 |

29,196 |

82 |

76,803 |

2.57 |

2,413 |

0.08 |

0.82 |

2.06 |

402 |

377,685 |

4.47 |

4,198 |

|

120-90 |

30,517 |

80 |

78,494 |

2.51 |

2,463 |

0.08 |

0.80 |

2.03 |

394 |

386,356 |

4.38 |

4,294 |

|

115-85 |

31,780 |

78 |

80,098 |

2.45 |

2,506 |

0.08 |

0.80 |

2.01 |

386 |

394,344 |

4.29 |

4,383 |

|

110-80 |

33,191 |

77 |

81,883 |

2.38 |

2,543 |

0.08 |

0.79 |

2.00 |

378 |

402,842 |

4.20 |

4,478 |

|

105-75 |

34,696 |

75 |

83,932 |

2.32 |

2,584 |

0.08 |

0.78 |

1.97 |

369 |

411,615 |

4.10 |

4,575 |

|

90-60 |

39,460 |

70 |

89,112 |

2.13 |

2,706 |

0.07 |

0.75 |

1.92 |

345 |

437,219 |

3.83 |

4,860 |

Figure 1 – Location of Zones Included in

Boumadine MRE, with Drill Holes and Magnetic Data (Residual Total

Field)

Figure 2 – Surface Plan of Boumadine

with Mineralized Envelope Included in the MRE

Figure 3 – Longitudinal Projection of

the Block Model of Boumadine MRE

Figure 4 – Typical Vertical

Cross-Section of the Boumadine Central Zone (Section

8850N)

Figure 5 – Typical Vertical

Cross-Section of the Boumadine South Zone (Section

6525N)

Resource-Supporting

Information

Geology and Geological

Interpretation

The Boumadine Project is located within the

Anti-Atlas belt, on the northwest side of the Ougnat Massif. The

geology of the Ougnat Inlier is formed by late-Precambrian (PIII)

predominantly calc-alkaline volcanic and intrusive rocks.

Mineralization is hosted within polymetallic massive Au-Ag-Zn-Pb

sulphide vein systems oriented N340. Mineral assemblage is

characterized by high concentration of pyrite and variable amounts

of arsenopyrite, sphalerite, and galena with local trace of

chalcopyrite. Veins are sub-vertical to steeply dipping (>70°)

with thickness generally varying from 1m to 5m: locally reaching

over 10m.

Mineralized boundaries for the current MRE have

been determined using a combination of logged sulphide percentage

and mineralization grade assay. 3D wireframes were created using

interval selection with the Seequent software Leapfrog GeoTM.

Sampling and Sub-sampling

Techniques

Only DDH samples were used for the Boumadine

deposit MRE.

DDH were cut and sampled at nominal 1m lengths,

except where lengths were altered to match geological boundaries.

Sampling was undertaken along the entire length of the DDH. Circa

2-to-4-kilogram (“kg”) samples were submitted to the laboratory for

analysis.

Sample Analysis Method

Samples were prepared by African Laboratory for

Mining and Environment (“Afrilab”) at its Boumadine prep-laboratory

facility or at its Zgounder prep-lab. A total of 250 grams (“g”) of

pulverized sample material was then submitted for analysis to

Afrilab Marrakech. Inductively Coupled Plasma (“ICP”) spectrometry

was used for Ag, Zn, Pb, Cu. Fire assaying was conducted for Au and

Ag results above 200 g/t.

QA/QC samples were inserted at a 5% rate. For a

batch of 25 samples: one certified reference material, one blank

and one drill core duplicate were inserted. At the end of each

month, a selection of 5% from the coarse rejects was submitted to

Afrilab and a selection of 5% of the pulp residues was sent to ALS

Sevilla, Spain acting as an umpire lab.

Regular reviews of the sampling and QA/QC

protocols were carried out by Aya’s project geologist under the

supervision of Aya’s Qualified Person, to ensure all procedures

were followed and best industry practices carried out. Monitoring

of results of duplicates, blanks and certified reference materials

was conducted by the database administrator each time an assay

batch was imported in the Geotic database.

Drilling Techniques

Drilling was carried out by Geosond Maroc SARL

using CT20 and CS140 drill rigs; and by FTE Drilling using

Versadrill and Marcotte rigs. DDH were drilled with HQ and NQ

diameters. Down-hole surveys were completed in each hole with a

first reading at 12.5m and then every 25m by reflex Ez-shot and

Devico-deviflex. All drill hole collars were surveyed by a

DGPS.

Drill and Data Spacing

Most of the deposit has been drilled on a 100m x

50m spacing grid through N70 cross-sections. In the northern and

southern sections, the spacing was extended to 200m x 100m. The

Indicated Mineral Resource was infilled to 50m x 50m grid

spacing.

Mineral Resource and Estimation

Methodology

84% of the Mineral Resource Estimate is

classified as Inferred, and the remaining 16% in the Indicated

category.

Data was composited to 1m. Top cuts were applied

to Au, Ag, Zn, Pb, Cu after review of composite log-normal

histograms.

Veins were interpolated independently by inverse

square distance. Wireframe modelling was developed using Seequent

Leapfrog GeoTM. Statistics, variography and estimations were

completed using the Geovariances Isatis NeoTM software. Open-pit

optimization was developed using the GEOVIA Whittle software.

Bulk density measurements were collected

systematically within mineralized zones and outside boundaries of

mineralized zones. Different bulk density values were allocated by

veins based on the vein average bulk density value. Transitional

materials were also allocated a different bulk density value.

Cut-off Grades

The geological domain boundaries were determined

using a cut-off grade of 100 g/t Ag equivalent. Mineral

Resources are reported using NSR values of US$125/t for the

out-of-pit and US$95/t for the open-pit.

NSR, Ag equivalent and Au equivalent are

calculated using the following parameters and formulas (Table

4).

Table 4 – Parameters and Formulas used to Calculate NSR,

Ag Equivalents and Au Equivalents

|

|

Au (oz) |

Ag (oz) |

Zn (lb) |

Pb (lb) |

Cu (lb) |

|

Prices in $USD |

$2,200 |

$24 |

$1.20 |

$1.00 |

$4.00 |

|

Recovery in % |

85.2% |

89.1% |

72.0% |

84.5% |

75.3% |

|

NSR ($/t) |

(Pb% x $10.74) + (Zn% x $13.58) + (Au g/t x $58.97) +

(Ag g/t x $0.64) +(Cu% x 63.08) |

|

Ag Equivalent (g/t) |

Ag(g/t) + (Au(g/t) *Au price/oz*Au recovery)/(Ag price/oz*Ag

recovery) + Zn(%)*Zn price/lb* Zn recovery/(Ag price/oz*Ag

recovery)*685.7147973 + Pb(%)*Pb price/lb* Pb recovery/(Ag

price/oz*Ag recovery)*685.7147973 + Cu(%)*Cu price/lb* Cu

recovery/(Ag price/oz*Ag recovery)*685.7147973 |

|

Au Equivalent (g/t) |

Au(g/t) + (Ag(g/t) *Ag price/oz*Ag recovery)/(Au price/oz*Au

recovery) + Zn(%)*Zn price/lb* Zn recovery/(Au price/oz*Au

recovery)*685.7147973 + Pb(%)*Pb price/lb* Pb recovery/(Au

price/oz*Au recovery)*685.7147973 + Cu(%)*Cu price/lb* Cu

recovery/(Au price/oz*Au recovery)*685.7147973 |

| |

|

Mining and Metallurgical Parameters

The mineralization at Boumadine starts at

surface and continues down to more than 600m in depth, making the

MRE appropriate for a combination of open pit and underground

mining.

Mining dimensions or mining dilution were not

considered as part of the pit optimization work, and a block

dimension of 2.5m x 5m x 5m was used, which is considered

acceptable in terms of a potential smaller selective mining unit.

Similarly, a crown pillar has not been accounted for between the

open pit and the underground mineral resources.

The preliminary metallurgical recoveries that

have been used for the NSR calculation are presented (Table 4)

along with the NSR calculation formula, and are 85.2% for Au, 89.1%

for Ag, 72% for Zn, 84.5% for Pb, and 75.3% for Cu.

The NSR US$/t value was based on estimated

metallurgical recoveries derived from a series of testwork, assumed

metal prices, and smelter terms, which include payable factors,

treatment charges, penalties, and refining charges.

Next Steps

Prior to 2020, the Boumadine Project had seen

limited near-mine drilling and no regional exploration. Since 2022,

the Aya team has conducted over 140,000 m of DDH programs on the

mining permit with the goal of delivering a MRE.

Significant upside potential exists to expand

the Boumadine Main Trend, which currently covers 5.4km of strike

length and remains open in all directions. Through 2025, the

Corporation plans to mobilize eleven diamond and three reverse

circulation drill rigs to complete the 140,000m drilling program.

Half of the program will test the continuation of the known trends

(Boumadine and Tizi) and infill. The remaining 50% will focus on

geological targets generated by previous work and will be informed

by the hyperspectral survey, high-resolution geophysical survey and

the mapping and prospecting campaigns. As the MobileMT survey

shows, there is a strong relation between apparent conductivity and

Boumadine type mineralization. A total of 24 new permits have been

acquired in the vicinity of the Boumadine permits since June 2023

(Figure 6). The results from ongoing geology work will determine

additional development work.

Figure 6 – Location of New Boumadine

Permits Overlayed with Apparent Conductivity at 175Hz

Qualified Person

The scientific and technical information

contained in this press release have been reviewed and approved by

David Lalonde, B. Sc, Vice-President of Exploration, Qualified

Person, and by Patrick Pérez, P.Eng., Director, Technical Services,

Qualified Person.

This Mineral Resource Estimate has been

completed in accordance with NI 43-101, and the Corporation will

prepare and file a Technical Report on SEDAR+ within 45 days of

this press release.

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a rapidly growing,

Canada-based silver producer with operations in the Kingdom of

Morocco.

The only TSX-listed pure silver mining company,

Aya operates the high-grade Zgounder Silver Mine and is exploring

its properties along the prospective South-Atlas Fault, several of

which have hosted past-producing mines and historical

resources.

Aya’s management team maximizes shareholder

value by anchoring sustainability at the heart of its production,

resource, governance, and financial growth plans.

For additional information, please visit Aya’s website at

www.ayagoldsilver.com or contact:

| Benoit La Salle, FCPA,

MBA President &

CEObenoit.lasalle@ayagoldsilver.com |

Alex Ball VP,

Corporate Development & IR alex.ball@ayagoldsilver.com |

| |

|

Forward-Looking Statements

This news release contains “forward-looking

information” or “forward-looking statements” within the meaning of

applicable securities laws and other statements that are not

historical facts. Forward-looking statements are included to

provide information about management’s current expectations and

plans that allows investors and others to have a better

understanding of the Corporation’s business plans and financial

performance and condition.

All statements, other than statements of

historical fact included in this news release, regarding the

Corporation’s strategy, future operations, financial position,

prospects, plans and objectives of management are forward-looking

statements that involve risks and uncertainties. Forward-looking

statements are typically identified by words such as “expand”,

“grow”, “increase”, “consolidate”, “promising”, “estimate”,

“assume”, “expect”, “intend”, “anticipate”, “believe”, “confirm”,

“remains”, “potential”, “complete”, “extend”, or variations of such

words and phrases or statements that certain actions, events or

results “may”, “could”, “would”, “might”, “will”, or are ”likely”

to be taken, occur or be achieved. In particular and without

limitation, this news release contains forward-looking statements

pertaining to the exploration and development potential of

Boumadine and the advancement of and success of the exploration

program at Boumadine, notably the potential to expand the deposit

in all directions and to grow the Resource Estimate.

Forward-looking information is based upon

certain assumptions and other important factors that, if untrue,

could cause the actual results, performance or achievements of the

Corporation to be materially different from future results,

performance or achievements expressed or implied by such

information or statements. There can be no assurance that such

information or statements will prove to be accurate. Key

assumptions upon which the Corporation’s forward-looking

information is based include the ability to obtain any requisite

governmental approvals, the accuracy of Mineral Reserve and Mineral

Resource Estimates (including, but not limited to, ore tonnage and

ore grade estimates), silver price, exchange rates, fuel and energy

costs, future economic conditions, anticipated future estimates of

free cash flow, and courses of action.

Readers are cautioned that the foregoing list is

not exhaustive of all factors and assumptions which may have been

used. Forward-looking statements are also subject to risks and

uncertainties facing the Corporation’s business, any of which could

have a material adverse effect on the Corporation’s business,

financial condition, results of operations and growth prospects.

Some of the risks the Corporation faces and the uncertainties that

could cause actual results to differ materially from those

expressed in the forward-looking statements include, among others,

the inherent risks involved in exploration and development of

mineral properties, including government approvals and permitting,

changes in economic conditions, changes in the worldwide price of

silver and other key inputs, changes in mine plans, throughput, the

speculative nature of exploration and development, including the

risks of diminishing quantities or grades of reserves; the fact

that reserves and resources, expected metallurgical recoveries,

capital and operating costs are estimates which may require

revision, the presence of unfavourable content in ore deposits,

inaccuracies in life of mine plans, unusual or unexpected

geological or structural formations, recoveries being affected by

metallurgical characteristics and other factors, such as project

execution delays, many of which are beyond the control of Aya. In

addition, readers are directed to carefully review the detailed

risk discussion in the Corporation’s 2023 Annual Information Form

dated March 28, 2024 filed on SEDAR+ at www.sedarplus.ca, which

discussion is incorporated by reference in this news release, for a

fuller understanding of the risks and uncertainties that affect the

Corporation’s business and operations. Furthermore, Aya’s corporate

update of May 28, 2020, in which it indicated that previous studies

regarding assets which the Corporation considered at that time not

to constitute material assets, remains applicable as of the date

hereof.

Although the Corporation believes its

expectations are based upon reasonable assumptions and has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended. There can thus be no assurance that

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such information. As such, these risks are not

exhaustive; however, they should be considered carefully. If any of

these risks or uncertainties materialize, actual results may vary

materially from those anticipated in the forward-looking statements

found herein. Due to the risks, uncertainties and assumptions

inherent in forward-looking statements, readers should not place

undue reliance on forward-looking statements.

Forward-looking statements contained herein are

presented for the purpose of assisting investors in understanding

the Corporation’s business plans, financial performance and

condition and may not be appropriate for other purposes.

The forward-looking statements contained herein

are made only as of the date hereof. The Corporation disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except to the extent required by applicable law. The

Corporation qualifies all of its forward-looking statements by

these cautionary statements.

In the foregoing, all references to Aya include

its subsidiaries unless the context requires otherwise.

Photos accompanying this announcement are available

at: https://www.globenewswire.com/NewsRoom/AttachmentNg/d033ee55-b601-4857-97bd-4007d67e122c

https://www.globenewswire.com/NewsRoom/AttachmentNg/148256e5-8289-43a8-beff-48d902992276

https://www.globenewswire.com/NewsRoom/AttachmentNg/148f635c-6cbd-473f-b209-d61bc52aca16

https://www.globenewswire.com/NewsRoom/AttachmentNg/270c6872-5a74-4f45-93f6-515e5064e24e

https://www.globenewswire.com/NewsRoom/AttachmentNg/69aa68d3-cefc-4d08-b855-8b1276568973

https://www.globenewswire.com/NewsRoom/AttachmentNg/c6bc57fd-e9cd-4e97-9238-68e1083757a0

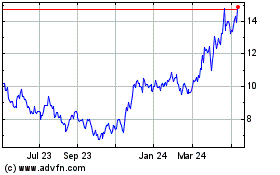

Aya Gold & Silver (TSX:AYA)

Historical Stock Chart

From Jan 2025 to Feb 2025

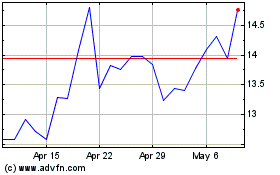

Aya Gold & Silver (TSX:AYA)

Historical Stock Chart

From Feb 2024 to Feb 2025