Canacol Energy Ltd. Announces Revised 2024 Capital Program, Comments on 2024 Guidance and Provides Drilling Update

20 September 2024 - 10:00PM

Canacol Energy Ltd. (“Canacol” or the “Corporation”) (TSX: CNE;

OTCQX: CNNEF; BVC: CNEC) announces that it has revised its 2024

capital program, comments on 2024 guidance and provides drilling

update.

Revised 2024 Capital

Program

The Corporation has revised its capital program

to now drill a total of 11 wells in 2024, with an estimated capital

spend of $138 million. The 11-well program includes five

exploration wells, and six development/appraisal wells. Canacol’s

original 2024 capital budget, as announced on February 5, 2024, had

included a range of $138 million (four exploration wells and three

development/appraisal wells) to $151 million (four exploration

wells and five development/appraisal wells). Drilling program

efficiency initiatives have contributed significantly to planning

for increased drilling activity without increases in total capital

program costs.

The Corporation currently anticipates 2024

EBITDA to be in the mid to higher range of its previously announced

guidance of $250 million to $290 million, with its natural gas and

oil sales volumes anticipated to average approximately 167 million

cubic feet equivalent per day.

The revised 2024 capital program has been

designed to achieve corporate production and reserve addition

targets. To date the Corporation has drilled six wells, which

include five successful wells that are currently on production

(Clarinete-10, Pomelo-1, Chontadura-1, 2 and 3) and the

unsuccessful Cardamomo-1 well.

Cardomomo 1 Exploration

Well

The Cardomomo 1 exploration well, located on the

VIM5 Exploration and Production (E&P) contract, was drilled to

a total depth of 11,591 feet measured depth targeting the Cienaga

de Oro Formation. The well encountered 203 feet true vertical depth

of net porous sandstones within the CDO with non commercial amounts

of natural gas. The Cardomomo 1 well has now been abandoned.

Go Forward Drilling Program

For the remainder of 2024, the Corporation plans

to drill 3 appraisal wells in producing gas fields and 2

exploration wells.

The Nispero 2 appraisal well will target gas

bearing sandstones of the CDO Formation within the Nispero gas

field which the Corporation discovered in 2016. The Corporation

anticipates spudding the well in early October 2024, with the well

entering production in late October 2024.

The Natilla 2 exploration well is targeting a

large natural gas prospect within the SSJN7 E&P contract. The

primary target of the Natilla 2 exploration well are sandstones of

the CDO Formation, with secondary sandstone targets in the

overlying Porquero Formation. The Corporation anticipates spudding

Natilla 2 in early October 2024 and anticipates that the well will

take approximately 2 months to drill.

The Siku 2 appraisal well will target gas

bearing sandstones within the CDO Formation in the Siku and Oboe

gas fields, which the Corporation discovered in 2016. The

Corporation anticipates spudding the well in early November 2024,

with the well entering production in late November 2024.

The Kite 1 exploration well is targeting

sandstones of the CDO Formation in a prospect located between the

Palmer gas field discovered in 2014 immediately to the south, and

the Pomelo and Chontaduro gas fields discovered in early 2024

immediately to the north. The Corporation anticipates spudding the

well in early October 2024, with results by late October 2024. If

successful, the Kite 1 well will be immediately tied into

production.

The Lulo 3 appraisal well is targeting gas

bearing sandstones of the CDO Formation within the Lulo gas field

discovered in early 2023. The Corporation anticipates spudding the

well in early December 2024, with the well entering production in

late December 2024.

About Canacol

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation's common stock trades on the Toronto Stock Exchange,

the OTCQX in the United States of America, and the Colombia Stock

Exchange under ticker symbol CNE, CNNEF, and CNE.C,

respectively.

Forward-Looking Information and Statements

This press release contains certain

forward-looking statements within the meaning of applicable

securities law. Forward-looking statements are frequently

characterized by words such as “plan”, “expect”, “project”,

“target”, “intend”, “believe”, “anticipate”, “estimate” and other

similar words, or statements that certain events or conditions

“may” or “will” occur, including without limitation statements

relating to estimated production rates from the Corporation’s

properties and intended work programs and associated timelines.

Forward-looking statements are based on the opinions and estimates

of management at the date the statements are made and are subject

to a variety of risks and uncertainties and other factors that

could cause actual events or results to differ materially from

those projected in the forward-looking statements. The Corporation

cannot assure that actual results will be consistent with these

forward looking statements. They are made as of the date hereof and

are subject to change and the Corporation assumes no obligation to

revise or update them to reflect new circumstances, except as

required by law. Information and guidance provided herein

supersedes and replaces any forward looking information provided in

prior disclosures. Prospective investors should not place undue

reliance on forward looking statements. These factors include the

inherent risks involved in the exploration for and development of

crude oil and natural gas properties, the uncertainties involved in

interpreting drilling results and other geological and geophysical

data, fluctuating energy prices, the possibility of cost overruns

or unanticipated costs or delays and other uncertainties associated

with the oil and gas industry. Other risk factors could include

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities, and other factors, many of which are beyond the control

of the Corporation. Other risks are more fully described in the

Corporation’s most recent Management Discussion and Analysis

(“MD&A”) and Annual Information Form, which are incorporated

herein by reference and are filed on SEDAR at www.sedar.com.

Average production figures for a given period are derived using

arithmetic averaging of fluctuating historical production data for

the entire period indicated and, accordingly, do not represent a

constant rate of production for such period and are not an

indicator of future production performance. Detailed information in

respect of monthly production in the fields operated by the

Corporation in Colombia is provided by the Corporation to the

Ministry of Mines and Energy of Colombia and is published by the

Ministry on its website; a direct link to this information is

provided on the Corporation’s website.

For more information please contact:

Investor Relations

South America: +571.621.1747 IR-SA@canacolenergy.com

Global: +1.403.561.1648 IR-GLOBAL@canacolenergy.com

http://www.canacolenergy.com

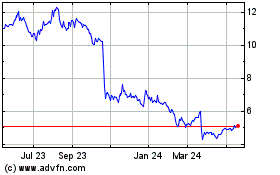

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Dec 2024 to Jan 2025

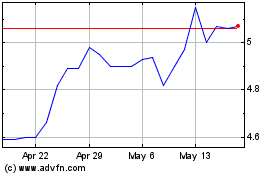

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Jan 2024 to Jan 2025