Canacol Energy Ltd. (“Canacol” or the “Corporation”) (TSX:CNE;

OTCQX:CNNEF; BVC:CNEC) is pleased to report its financial and

operating results for the three and six months ended June 30, 2024.

Dollar amounts are expressed in United States dollars, with the

exception of Canadian dollar unit prices (“C$”) where indicated and

otherwise noted.

Highlights for the

three and six months ended June 30, 2024

- Adjusted funds from

operations increased 70% and 50% to $57.1 million and $99.3 million

for the three and six months ended June 30, 2024, respectively,

compared to $33.7 million and $66.4 million for the same periods in

2023, respectively, mainly due to an increase in EBITDAX combined

with a decrease in current income tax expense.

- Adjusted EBITDAX

increased 21% and 10% to $73.2 and $134.2 million for the three and

six months ended June 30, 2024, respectively, compared to $60.7

million and $121.6 million for the same periods in 2023,

respectively. The increase is mainly due to an increase in the

realized sales price of natural gas and liquefied natural gas

(“LNG”), which averaged a record quarterly price of $6.84 per Mcf,

net of transportation, representing a 33% increase from the same

quarter in 2023.

- The Corporation’s

natural gas and LNG operating netback increased 36% and 29% to

$5.34 per Mcf and $5.12 per Mcf for the three and six months ended

June 30, 2024, respectively, compared to $3.94 per Mcf and $3.97

per Mcf for the same periods in 2023, respectively. The increase is

due to a 19% increase in average sales prices of firm long-term

fixed-priced contracts to $6.04 per Mcf for the six months ended

June 30, 2024, compared to $5.09 per Mcf for the same period in

2023, and the increase in interruptible prices.

- Total revenues, net

of royalties and transportation expenses for the three and six

months ended June 30, 2024 increased 18% and 12% to $88.3 and

$166.0 million, respectively, compared to $74.6 million and $148.5

million for the same periods in 2023, respectively, mainly due to

higher average sales price, net of transportation expenses, offset

by a decrease in realized natural gas and LNG sales volume.

- Realized

contractual natural gas sales volume decreased 14% and 17% to 158.5

MMcfpd and 154.5 MMcfpd for the three and six months ended June 30,

2024, respectively, compared to 184.8 MMcfpd and 185.2 MMcfpd for

the same periods in 2023, respectively.

-

The Corporation realized a net loss of $21.3 million and $17.6

million for the three and six months ended June 30, 2024,

respectively, compared to a net income of $40.0 and $56.9 million

for the same periods in 2023, respectively. The decrease in net

income is driven by a non-cash deferred income tax expense of $42.6

million in the three months ended June 30, 2024 as compared to a

deferred income tax recovery of $38.9 million for the same period

in 2023. The $42.6 million non-cash deferred income tax expense is

driven by an 8% Colombian peso devaluation.

-

Net cash capital expenditures for the three and six months ended

June 30, 2024 was $33.9 million and $69.7 million,

respectively.

-

As at June 30, 2024, the Corporation had $42.6 million in cash and

cash equivalents and $0.5 million in working capital surplus.

Outlook

For 2024, the Corporation remains focused on the

following objectives:

1) In line with maintaining and growing

Canacol’s reserves and production in its core gas assets in the

Lower Magdalena Valley Basin, the Corporation is executing

comprehensive development and exploration programs. The Corporation

aims to optimize its production and increase reserves by drilling

up to five development wells, installing new compression and

processing facilities, and through workover operations on producing

wells in the Corporation’s key gas fields. To date in 2024, the

Corporation has completed the drilling of two successful

exploration wells, Pomelo-1 and Chondaturo-1, and three successful

development wells, Clarinete-10, Chontaduro-2, and Chontaduro-3.

Through these above mentioned activities, the Corporation has

managed to stabilize its gas sales at an average rate of 159 MMcfpd

during Q2 of 2024. The high-impact Cardamomo-1 exploration well,

was spud on August 8, 2024. These development and exploration

activities are planned to support Canacol’s robust EBITDA and allow

the Corporation to capitalize on strong market dynamics in

2024.

2) Maintaining a low cost of capital, cash

liquidity and balance sheet flexibility to invest for the long

term. As of June 30, 2024, the Corporation had a cash balance of

approximately $43 million.

3) To secure government approval of a fourth

E&P contract in Bolivia that covers an existing gas field

reactivation, to begin development operations with a view to adding

reserves and production and commencing gas sales in 2025.

4) Continue with the Corporation’s commitment to

its environmental, social and governance strategy.

FINANCIAL & OPERATING HIGHLIGHTS

(in United States dollars (tabular amounts in thousands) except

as otherwise noted)

|

Financial |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

Total revenues, net of royalties and transportation expense |

88,288 |

|

74,605 |

|

18% |

|

165,979 |

|

148,518 |

|

12% |

| Adjusted EBITDAX(1) |

73,187 |

|

60,654 |

|

21% |

|

134,228 |

|

121,582 |

|

10% |

| Adjusted funds from

operations(1) |

57,121 |

|

33,686 |

|

70% |

|

99,347 |

|

66,379 |

|

50% |

|

Per share – basic ($)(1) |

1.67 |

|

0.99 |

|

69% |

|

2.91 |

|

1.95 |

|

49% |

|

Per share – diluted ($)(1) |

1.67 |

|

0.99 |

|

69% |

|

2.91 |

|

1.95 |

|

49% |

| Cash flows provided by

operating activities |

49,202 |

|

(24,413) |

|

n/a |

|

103,921 |

|

6,556 |

|

1,485% |

|

Per share – basic ($) |

1.44 |

|

(0.72) |

|

n/a |

|

3.05 |

|

0.19 |

|

1,505% |

|

Per share – diluted ($) |

1.44 |

|

(0.72) |

|

n/a |

|

3.05 |

|

0.19 |

|

1,505% |

| Net income and comprehensive

income |

(21,298) |

|

39,990 |

|

n/a |

|

(17,644) |

|

56,864 |

|

n/a |

|

Per share – basic ($) |

(0.62) |

|

1.17 |

|

n/a |

|

(0.52) |

|

1.67 |

|

n/a |

|

Per share – diluted ($) |

(0.62) |

|

1.17 |

|

n/a |

|

(0.52) |

|

1.67 |

|

n/a |

| Weighted average shares

outstanding – basic |

34,111 |

|

34,111 |

|

—% |

|

34,111 |

|

34,111 |

|

—% |

| Weighted average shares

outstanding – diluted |

34,111 |

|

34,111 |

|

—% |

|

34,111 |

|

34,111 |

|

—% |

| Net cash capital

expenditures(1) |

33,853 |

|

51,985 |

|

(35%) |

|

69,731 |

|

99,108 |

|

(30%) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

Jun 30, 2024 |

|

Dec 31, 2023 |

Change |

| |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

|

42,596 |

|

39,425 |

|

8% |

|

Working capital deficit |

|

|

|

|

514 |

|

(10,028 |

) |

n/a |

| Total debt |

|

|

|

|

714,286 |

|

713,435 |

|

—% |

| Total assets |

|

|

|

|

1,197,466 |

|

1,233,428 |

|

(3%) |

| Common shares, end of period

(000’s) |

|

|

|

|

34,111 |

|

34,111 |

|

—% |

|

|

|

|

|

|

|

|

|

|

|

Operating |

Three months endedJune 30, |

|

Six months endedJune 30, |

|

2024 |

|

2023 |

|

Change |

|

2024 |

|

|

2023 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

Production |

|

|

|

|

|

|

|

|

|

Natural gas and LNG (Mcfpd) |

162,652 |

|

187,687 |

|

(13%) |

|

158,348 |

|

|

188,033 |

|

(16%) |

|

Colombia oil (bopd) |

1,700 |

|

527 |

|

223% |

|

1,552 |

|

|

546 |

|

184% |

|

Total (boepd) |

30,235 |

|

33,455 |

|

(10%) |

|

29,332 |

|

|

33,534 |

|

(13%) |

| Realized contractual

sales |

|

|

|

|

|

|

|

|

|

Natural gas and LNG (Mcfpd) |

158,541 |

|

184,752 |

|

(14%) |

|

154,481 |

|

|

185,185 |

|

(17%) |

|

Colombia oil (bopd) |

1,681 |

|

523 |

|

221% |

|

1,535 |

|

|

555 |

|

177% |

|

Total (boepd) |

29,495 |

|

32,936 |

|

(10%) |

|

28,637 |

|

|

33,044 |

|

(13%) |

| Operating netbacks(1) |

|

|

|

|

|

|

|

|

|

Natural gas and LNG ($/Mcf) |

5.34 |

|

3.94 |

|

36% |

|

5.12 |

|

|

3.97 |

|

29% |

|

Colombia oil ($/bbl) |

21.98 |

|

18.57 |

|

18% |

|

21.14 |

|

|

22.39 |

|

(6%) |

|

Corporate ($/boe) |

29.95 |

|

22.36 |

|

34% |

|

28.77 |

|

|

22.61 |

|

27% |

(1) Non-IFRS measures – see “Non-IFRS

Measures” section within the MD&A.

This press release should be read in conjunction

with the Corporation’s interim condensed consolidated financial

statements and related Management’s Discussion and Analysis

(“MD&A”). The Corporation has filed its interim condensed

consolidated financial statements and related MD&A as at and

for the six months ended June 30, 2024 with Canadian securities

regulatory authorities. These filings are available for review on

SEDAR+ at www.sedarplus.ca.

Canacol is a natural gas exploration and

production company with operations focused in Colombia. The

Corporation’s shares are traded on the Toronto Stock Exchange under

the symbol CNE, the OTCQX in the United States of America under the

symbol CNNEF, the Bolsa de Valores de Colombia under the symbol

CNEC.

This press release contains certain

forward-looking statements within the meaning of applicable

securities law. Forward-looking statements are frequently

characterized by words such as “plan”, “expect”, “project”,

“target”, “intend”, “believe”, “anticipate”, “estimate” and other

similar words, or statements that certain events or conditions

“may” or “will” occur, including without limitation statements

relating to estimated production rates from the Corporation’s

properties and intended work programs and associated timelines.

Forward-looking statements are based on the opinions and estimates

of management at the date the statements are made and are subject

to a variety of risks and uncertainties and other factors that

could cause actual events or results to differ materially from

those projected in the forward-looking statements. The Corporation

cannot assure that actual results will be consistent with these

forward looking statements. They are made as of the date hereof and

are subject to change and the Corporation assumes no obligation to

revise or update them to reflect new circumstances, except as

required by law. Information and guidance provided herein

supersedes and replaces any forward looking information provided in

prior disclosures. Prospective investors should not place undue

reliance on forward looking statements. These factors include the

inherent risks involved in the exploration for and development of

crude oil and natural gas properties, the uncertainties involved in

interpreting drilling results and other geological and geophysical

data, fluctuating energy prices, the possibility of cost overruns

or unanticipated costs or delays and other uncertainties associated

with the oil and gas industry. Other risk factors could include

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities, and other factors, many of which are beyond the control

of the Corporation. Other risks are more fully described in the

Corporation’s most recent Management Discussion and Analysis

(“MD&A”) and Annual Information Form, which are incorporated

herein by reference and are filed on SEDAR at www.sedar.com.

Average production figures for a given period are derived using

arithmetic averaging of fluctuating historical production data for

the entire period indicated and, accordingly, do not represent a

constant rate of production for such period and are not an

indicator of future production performance. Detailed information in

respect of monthly production in the fields operated by the

Corporation in Colombia is provided by the Corporation to the

Ministry of Mines and Energy of Colombia and is published by the

Ministry on its website; a direct link to this information is

provided on the Corporation’s website. References to “net”

production refer to the Corporation’s working-interest production

before royalties.

Use of Non-IFRS Financial

Measures - Such supplemental measures should not

be considered as an alternative to, or more meaningful than, the

measures as determined in accordance with IFRS as an indicator of

the Corporation’s performance, and such measures may not be

comparable to that reported by other companies. This press release

also provides information on adjusted funds from operations.

Adjusted funds from operations is a measure not defined in IFRS. It

represents cash provided (used) by operating activities before

changes in non-cash working capital and the settlement of

decommissioning obligation, adjusted for non-recurring charges. The

Corporation considers adjusted funds from operations a key measure

as it demonstrates the ability of the business to generate the cash

flow necessary to fund future growth through capital investment and

to repay debt. Adjusted funds from operations should not be

considered as an alternative to, or more meaningful than, cash

provided by operating activities as determined in accordance with

IFRS as an indicator of the Corporation’s performance. The

Corporation’s determination of adjusted funds from operations may

not be comparable to that reported by other companies. For more

details on how the Corporation reconciles its cash provided by

operating activities to adjusted funds from operations, please

refer to the “Non-IFRS Measures” section of the Corporation’s

MD&A. Additionally, this press release references Adjusted

EBITDAX and operating netback measures. Adjusted EBITDAX is defined

as consolidated net income adjusted for interest, income taxes,

depreciation, depletion, amortization, exploration expenses and

other similar non-recurring or non-cash charges. Operating netback

is a benchmark common in the oil and gas industry and is calculated

as total natural gas, LNG and petroleum sales, net transportation

expenses, less royalties and operating expenses, calculated on a

per barrel of oil equivalent basis of sales volumes using a

conversion. Operating netback is an important measure in evaluating

operational performance as it demonstrates field level

profitability relative to current commodity prices. Adjusted

EBITDAX and operating netback as presented do not have any

standardized meaning prescribed by IFRS and therefore may not be

comparable with the calculation of similar measures for other

entities.

Operating netback is defined as revenues, net

transportation expenses less royalties and operating expenses.

Realized contractual sales is defined as natural

gas and LNG produced and sold plus income received from nominated

take-or-pay contracts without the actual delivery of natural gas or

LNG and the expiry of the customers’ rights to take the

deliveries.

The Corporation’s LNG sales account for less

than one percent of the Corporation’s total realized contractual

natural gas and LNG sales.

Boe Conversion

- The term “boe” is used in this news release. Boe may be

misleading, particularly if used in isolation. A boe conversion

ratio of cubic feet of natural gas to barrels oil equivalent is

based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. In this news release, we have

expressed boe using the Colombian conversion standard of 5.7 Mcf: 1

bbl required by the Ministry of Mines and Energy of Colombia. As

the value ratio between natural gas and crude oil based on the

current prices of natural gas and crude oil is significantly

different from the energy equivalency of 5.7 Mcf:1, utilizing a

conversion on a 5.7 Mcf:1 basis may be misleading as an indication

of value.

For further information please contact:

Investor Relations

South America: +571.621.1747 IR-SA@canacolenergy.com

Global: +1.403.561.1648 IR-GLOBAL@canacolenergy.com

http://www.canacolenergy.com

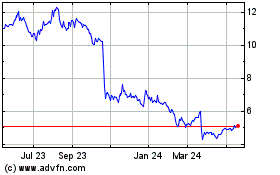

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Jan 2025 to Feb 2025

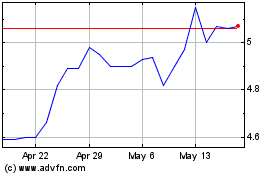

Canacol Energy (TSX:CNE)

Historical Stock Chart

From Feb 2024 to Feb 2025