Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered upstream

production in the first quarter of 779,000 barrels of oil

equivalent per day (BOE/d)1 and downstream throughput of 457,900

barrels per day (bbls/d). The company generated $1.4 billion in

adjusted funds flow and cash used in operating activities was $286

million. First-quarter results reflect lower commodity prices,

reduced production in the upstream business and lower operating

throughput in the downstream compared with the fourth quarter.

Consistent with Cenovus’s commitment to shareholders, the Board of

Directors approved a 33% increase in the company’s base dividend,

to $0.56 per share annually starting in the second quarter of 2023.

“We are committed to demonstrating stronger performance across

our business, and reaching our $4 billion net debt target,” said

Alex Pourbaix, who moves from his role as Cenovus’s President &

Chief Executive Officer to Executive Chair of the Board following

today’s Annual Meeting of Shareholders. “As the year progresses, we

expect improved production and a fully operating downstream

business. The increase in our base dividend underscores our

confidence in the long-term success of the company.”

Corporate developments

- Achieved the safe and successful restart of the Superior

Refinery, with crude oil introduced mid-March. The refinery is

currently running barrels in preparation for expected

second-quarter refined product sales.

- Closed the Toledo Refinery transaction for approximately US$370

million and assumed operatorship.

- Oil sands production expected to be stronger in the second half

of the year due to pad timing, as the company continues to optimize

the business for future production growth.

- Revised 2023 corporate guidance

to reflect updated outlook for commodity prices, upstream

production and operating costs for the remainder of the year.

- U.S. Manufacturing throughput has

been revised to 480,000 bbls/d to 500,000 bbls/d.

|

Financial, production & throughput

summary |

|

(For the period ended March 31) |

2023 Q1 |

2022 Q4 |

% change |

2022 Q1 |

% change |

|

Financial ($ millions, except per share

amounts) |

|

Cash from (used in) operating activities |

(286) |

2,970 |

- |

1,365 |

- |

|

Adjusted funds flow2 |

1,395 |

2,346 |

(41) |

2,583 |

(46) |

|

Per share (basic)2 |

0.73 |

1.22 |

- |

1.30 |

- |

|

Per share (diluted)2 |

0.71 |

1.19 |

- |

1.27 |

- |

|

Capital investment |

1,101 |

1,274 |

(14) |

746 |

48 |

|

Free funds flow2 |

294 |

1,072 |

(73) |

1,837 |

(84) |

|

Excess free funds flow2 |

(499) |

786 |

- |

2,615 |

- |

|

Net earnings (loss) |

636 |

784 |

(19) |

1,625 |

(61) |

|

Per share (basic) |

0.33 |

0.40 |

- |

0.81 |

- |

|

Per share (diluted) |

0.32 |

0.39 |

- |

0.79 |

- |

|

Long-term debt, including current portion |

8,681 |

8,691 |

- |

11,744 |

(26) |

|

Net debt |

6,632 |

4,282 |

55 |

8,407 |

(21) |

|

Production and throughput (before royalties, net to

Cenovus) |

|

Oil and NGLs (bbls/d)1 |

636,200 |

664,900 |

(4) |

654,500 |

(3) |

|

Conventional natural gas (MMcf/d) |

857.0 |

852.0 |

1 |

865.3 |

(1) |

|

Total upstream production (BOE/d)1 |

779,000 |

806,900 |

(3) |

798,600 |

(2) |

|

Total downstream throughput (bbls/d) |

457,900 |

473,300 |

(3) |

501,800 |

(9) |

1 See Advisory for production by product type. 2 Non-GAAP

financial measure or contains a non-GAAP financial measure. See

Advisory.

First-quarter resultsOperating

results1Cenovus’s total revenues were

approximately $12.3 billion in the first quarter, a decrease from

$14.1 billion in the fourth quarter of 2022, mainly due to lower

benchmark commodity prices. Upstream revenues were $6.8 billion,

compared with $7.4 billion in the previous quarter and downstream

revenues were about $7.4 billion, compared with nearly $8.4 billion

in the fourth quarter.

Total operating margin3 was $2.1 billion, compared with about

$2.8 billion in the fourth quarter. Upstream operating margin4 was

$1.7 billion, down from $2.2 billion in the prior quarter,

primarily driven by lower Brent and West Texas Intermediate (WTI)

crude oil prices, a wider light-heavy differential, as well as

slightly lower production volumes. Downstream operating margin4 was

$391 million, compared with $558 million in the fourth quarter.

U.S. Manufacturing operating margin was impacted by higher

operating costs at the Superior Refinery, associated with the

continued commissioning of the facility as well as assuming full

ownership of the Toledo Refinery following the close of Cenovus’s

acquisition from bp. Downstream operating margin was further

impacted by a unit outage at the Wood River Refinery that occurred

in the fourth quarter of 2022, which reduced utilization as well as

refining margin capture. In addition, the cost of processing crude

oil purchased in prior periods at higher prices negatively impacted

operating margin in U.S. Manufacturing by approximately $255

million.

“The company has achieved major milestones with the safe

startups of the Superior and Toledo refineries under way,” said Jon

McKenzie, who moves from his role as Cenovus’s Executive

Vice-President & Chief Operating Officer to President

& Chief Executive Officer following today’s Annual Meeting of

Shareholders. “While the Lima Refinery continues to operate well,

the U.S. Manufacturing business as a whole has not performed to our

expectations. We are actively taking steps to improve performance

and expect meaningfully better results through this year and beyond

as we start demonstrating the full operating and financial

capabilities of our integrated business.”

In U.S. Manufacturing, crude utilization was 67% and throughput

was 359,200 bbls/d compared with 75% and 379,000 bbls/d in the

fourth quarter, due to unplanned outages and as planned turnaround

activities began at the non-operated Wood River and Borger

refineries. After experiencing impacts from a severe winter storm

in late December, the Lima Refinery quickly rebounded with strong

operating performance in the first quarter, achieving crude

utilization of 94%. The Superior Refinery introduced crude oil in

mid-March and remains on track to ramp up to full

operations through the second quarter of 2023. The acquisition

of the remaining 50% of the Toledo Refinery closed on February 28.

In April the Toledo Refinery’s smaller capacity 30,000 bbls/d crude

oil unit restarted and is currently producing refined products. The

larger capacity 120,000 bbls/d unit is expected to restart in May

and ramp up to full rates through the second quarter.

Following an incident in December 2022 at the non-operated Wood

River Refinery as well as severe weather around the end of the

quarter, crude utilization returned to normal rates in the first

quarter. Due to the unplanned downtime of the affected unit, the

partnership incurred significant cost associated with fulfilling

contractual obligations for finished product, which impacted gross

margins during the first quarter. The first phase of a planned

turnaround was completed by early April and the second phase, which

will also impact throughput, began in mid-April and is expected to

be completed in the second quarter.

First-quarter crude utilization in the Canadian Manufacturing

segment increased to 89% with throughput of 98,700 bbls/d compared

with crude utilization and throughput of 85% and 94,300 bbls/d in

Q4 2022. The fourth quarter was impacted by severe winter weather

and an unplanned outage at the Lloydminster Upgrader. First-quarter

results also reflect strong operating performance at the

Lloydminster Refinery, which achieved crude utilization of 99%

during the period.

Total upstream production was 779,000 BOE/d in the first

quarter, a slight decrease from the fourth quarter. Christina Lake

production was 237,200 bbls/d, down from fourth-quarter production

of 250,300 bbls/d due to the timing of new sustaining well pads.

Foster Creek production of 190,000 bbls/d was largely in line with

the previous quarter. Foster Creek and Christina Lake each have

three additional well pads coming online in the second half of the

year. Sunrise production was 44,500 bbls/d, relatively unchanged

from the fourth quarter. At the Lloydminster thermal projects,

production was 99,000 bbls/d, down slightly from the previous

quarter’s 102,500 bbls/d, as the company took some wells offline

for redevelopment and maintenance activity during the first

quarter. Conventional production was 123,900 BOE/d, largely in line

with the fourth quarter.

In the Offshore segment, production was 65,600 BOE/d compared

with 70,200 BOE/d in the previous quarter. In Asia Pacific,

production decreased slightly compared with the fourth quarter due

to lower contracted gas sales in China, partially offset by higher

sales in Indonesia as the MBH and MDA fields continue to ramp up.

In the Atlantic region, the non-operated Terra Nova floating

production, storage and offloading vessel remains dockside in

Newfoundland and Labrador, undergoing further maintenance as part

of its asset life extension program. Cenovus has removed Terra Nova

production volumes from its 2023 corporate guidance.

3 Non-GAAP financial measure. Total operating margin is the

total of Upstream operating margin plus Downstream operating

margin. See Advisory.4 Specified financial measure. See

Advisory.

Financial resultsFirst-quarter cash used in

operating activities, which includes changes in non-cash working

capital, was $286 million compared with almost $3.0 billion of cash

from operating activities in the fourth quarter of 2022, while

adjusted funds flow was $1.4 billion, down from $2.3 billion in the

previous period. Free funds flow fell to $294 million from $1.1

billion in the fourth quarter. First-quarter adjusted funds flow,

when compared to the fourth quarter, was impacted by lower overall

commodity prices and results in the U.S. Manufacturing segment were

lower by approximately $255 million due to the cost of processing

crude oil purchased in prior periods at higher prices. In addition,

Oil Sands segment sales volumes were lower compared to production

by approximately 12,500 BOE/d, as the company built inventory due

to the timing of sales, in addition to higher volumes of crude in

transit to the U.S. Gulf Coast. Capital investment of $1.1 billion

was primarily directed towards sustaining production in the oil

sands, the Superior Refinery rebuild and refining reliability

initiatives at the jointly-owned Wood River and Borger

refineries.

First-quarter net earnings were $636 million, compared with $784

million in the previous quarter. The decline in net earnings was

primarily due to lower operating margin and lower foreign exchange

gains, partially offset by lower general and administrative costs,

as well as a deferred income tax recovery related to the Toledo

acquisition.

Long-term debt, including the current portion, was $8.7 billion

at March 31, 2023, comparable to December 31, 2022. Net debt was

approximately $6.6 billion at March 31, 2023, an increase of about

$2.4 billion from December 31, 2022. The increase in net debt is

mainly attributable to a change in non-cash working capital of $1.6

billion due to a $1.2 billion cash payment for the company’s 2022

taxes and lower accounts payable, $465 million primarily related to

the close of the Toledo acquisition and the first variable payment

to bp as part of the 2022 Sunrise transaction, as well as $240

million for shareholder returns. Assuming commodity prices remain

around current levels, the company expects net debt to fall below

its $4.0 billion floor in the fourth quarter.

2023 guidance updateCenovus has revised its

2023 corporate guidance to reflect the company’s updated outlook

for commodity prices, production, throughput and operating costs

for the remainder of the year. It is available on cenovus.com under

Investors.

Changes to the company’s 2023 guidance include:

- Total production guidance of 790,000

BOE/d to 810,000 BOE/d, which includes a reduction of 10,000 bbls/d

from the Atlantic production range, reflecting the removal of Terra

Nova volumes.

- U.S. Manufacturing throughput of

480,000 bbls/d to 500,000 bbls/d, reflecting lower throughput

year-to-date at Cenovus’s non-operated refineries due to unplanned

outages early in the first quarter, as well as a longer ramp up

period than originally anticipated at Toledo. As a result, guidance

for U.S. Manufacturing unit operating expense has increased by

$1.00/bbl.

2023 planned maintenance The following table

provides details on planned maintenance activities at Cenovus

assets in 2023 and anticipated production or throughput

impacts.

|

2023 planned maintenance |

|

Potential quarterly production/throughput impact

(Mbbls/d) |

|

|

Q2 |

Q3 |

Q4 |

|

Upstream |

| Foster Creek |

18 - 20 |

- |

- |

| Lloydminster Thermals |

1 - 2 |

1 - 2 |

- |

|

Downstream |

| U.S. Manufacturing |

3 - 5 |

18 – 20 |

50 - 60 |

Dividend declarations and share purchasesThe

Board of Directors has declared a quarterly base dividend of $0.14

per common share, an increase of 33%, payable on June 30, 2023 to

shareholders of record as of June 15, 2023. On an annual basis, the

base dividend will increase to $0.56 per share from $0.42 per

share, and will continue to be declared and paid quarterly, at the

discretion of the Board. The base dividend continues to be a

structural component of the financial framework and is set at a

level Cenovus is confident can be sustainably covered at bottom of

the cycle pricing of about US$45 WTI, with additional capacity to

grow over the next five years.

In addition, the Board declared a quarterly dividend on each of

the Cumulative Redeemable First Preferred Shares – Series 1, Series

2, Series 3, Series 5 and Series 7 – payable on June 30, 2023

to shareholders of record as of June 15, 2023 as follows:

|

Preferred shares dividend summary |

|

|

Rate (%) |

Amount ($/share) |

| Share

series |

| Series 1 |

2.577 |

0.16106 |

| Series 2 |

6.294 |

0.39230 |

| Series 3 |

4.689 |

0.29306 |

| Series 5 |

4.591 |

0.28694 |

| Series 7 |

3.935 |

0.24594 |

All dividends paid on Cenovus’s common and preferred shares will

be designated as “eligible dividends” for Canadian federal income

tax purposes. Declaration of dividends is at the sole discretion of

the Board and will continue to be evaluated on a quarterly

basis.

Cenovus’s shareholder returns framework has a target of

returning 50% of excess free funds flow to shareholders for

quarters where the ending net debt is between $9 billion and $4

billion. In the first quarter, the company bought approximately 2

million shares under its normal course issuer bid, delivering $40

million in returns to shareholders. Subsequent to the end of the

quarter, as of April 21, 2023, the company had bought back

approximately 2.1 million shares for an additional $51 million.

SustainabilityIn the first quarter of 2023,

Cenovus and its Pathways Alliance peers continued to advance work

on plans to build one of the world’s largest carbon capture and

storage (CCS) projects, which is foundational to the net zero

ambitions of Canada’s six largest oil sands companies that comprise

the group. The Alliance awarded a contract to a global engineering

and consulting company to develop detailed plans for the

400-kilometre CO2 transportation pipeline that would eventually

link more than 20 oil sands facilities to a hub for permanent

carbon storage in Alberta’s Cold Lake region. Engineering and field

work is progressing rapidly to support an anticipated regulatory

application for the CCS network in the fourth quarter of this year.

Early engagement with more than 20 Indigenous communities along the

proposed CO2 transportation and storage network corridor is

underway, and formal engagement is expected to begin in the second

quarter.

Cenovus also continues to progress work towards its own

sustainability targets with further updates scheduled to be

released mid-year in the company’s 2022 ESG report.

Leadership transition updateIn addition to Alex

Pourbaix becoming Executive Board Chair and Jon McKenzie stepping

into the role of Cenovus’s President & Chief Executive Officer

following the close of the company’s Annual Meeting of

Shareholders, Claude Mongeau will become Lead Independent Director

of the Board. Jane Kinney will assume the position of Chair of the

Audit Committee, a role currently filled by Mongeau. Kinney, a

Cenovus director since April 2019 and a member of the Audit

Committee since June 2019, served in increasingly senior positions

with Deloitte LLP Canada until her retirement from the firm.

Conference call today

9 a.m. Mountain Time (11 a.m. Eastern Time)

Cenovus will host a conference call today, April 26, 2023,

starting at 9 a.m. MT (11 a.m. ET).To join the conference call

without operator assistance, please

register here approximately 5 minutes in advance to

receive an automated call-back when the session begins.

Alternatively, you can dial 877-400-0505 (toll-free in North

America) or 647-484-0475 to reach a live operator who will join you

into the call. A live audio webcast will also be available and

will be archived for approximately 90 days.

Cenovus will host its Annual Meeting of Shareholders today,

April 26, 2023, in a virtual format beginning at 11 a.m. MT (1 p.m.

ET). The webcast link to the Shareholders Meeting will be available

under Presentations and Events in the Investors section of

cenovus.com.

AdvisoryBasis

of PresentationCenovus reports

financial results in Canadian dollars and presents production

volumes on a net to Cenovus before royalties basis, unless

otherwise stated. Cenovus prepares its financial statements in

accordance with International Financial Reporting Standards

(IFRS).

Barrels of Oil

EquivalentNatural gas volumes have been

converted to barrels of oil equivalent (BOE) on the basis of six

thousand cubic feet (Mcf) to one barrel (bbl). BOE may be

misleading, particularly if used in isolation. A conversion ratio

of one bbl to six Mcf is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent value equivalency at the wellhead. Given that the value

ratio based on the current price of crude oil compared with natural

gas is significantly different from the energy equivalency

conversion ratio of 6:1, utilizing a conversion on a 6:1 basis is

not an accurate reflection of value.

Product types

|

Product type by operating segment |

|

|

Three months endedMarch 31,

2023 |

|

Oil Sands |

|

Bitumen (Mbbls/d) |

570.7 |

|

Heavy crude oil (Mbbls/d) |

16.8 |

|

Conventional natural gas (MMcf/d) |

12.0 |

|

Total Oil Sands segment production (MBOE/d) |

589.5 |

|

Conventional |

|

Light crude oil (Mbbls/d) |

6.4 |

|

Natural gas liquids (Mbbls/d) |

22.0 |

|

Conventional natural gas (MMcf/d) |

572.9 |

|

Total Conventional segment production

(MBOE/d) |

123.9 |

|

Offshore |

|

Light crude oil (Mbbls/d) |

8.9 |

|

Natural gas liquids (Mbbls/d) |

11.4 |

|

Conventional natural gas (MMcf/d) |

272.1 |

|

Total Offshore segment production (MBOE/d) |

65.6 |

|

Total upstream production (MBOE/d) |

779.0 |

Forward‐looking

InformationThis news release contains certain

forward‐looking statements and forward‐looking information

(collectively referred to as “forward‐looking information”) within

the meaning of applicable securities legislation about Cenovus’s

current expectations, estimates and projections about the future of

the company, based on certain assumptions made in light of the

company’s experiences and perceptions of historical trends.

Although Cenovus believes that the expectations represented by such

forward‐looking information are reasonable, there can be no

assurance that such expectations will prove to be correct.

Forward‐looking information in this document is identified by

words such as “anticipate”, “continue”, “deliver”, “expect”, “on

track”, “progressing”, “target”, and “will” or similar expressions

and includes suggestions of future outcomes, including, but not

limited to, statements about: performance across the business;

achieving net debt of $4.0 billion; improving production; product

sales at the Superior Refinery; stronger oil sands production and

optimization for future production; meaningfully better results in

the U.S. Manufacturing business; ramp up to full operations at the

Superior Refinery and Toledo Refinery and timing of the same;

planned turnaround activities; ramp up of MBH and MDA fields;

dividend payments; excess free funds flow under the shareholder

returns framework; working with Pathways Alliance to advance a

carbon capture and storage project toward a regulatory application

and formal engagement with Indigenous communities; progressing work

on the Company’s sustainability targets and providing further

updates in 2023; managing assets in a safe, innovative and

cost-efficient manner while integrating environmental, social and

governance considerations into the Company’s business plans; and

revised 2023 corporate guidance.

Developing forward‐looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which the forward‐looking information in this news release are

based include, but are not limited to: the allocation of free funds

flow to reducing net debt; commodity prices, inflation and supply

chain constraints; Cenovus’s ability to produce on an unconstrained

basis; Cenovus’s ability to access sufficient insurance coverage to

pursue development plans; Cenovus’s ability to deliver safe and

reliable operations and demonstrate strong governance; and the

assumptions inherent in Cenovus’s revised 2023 guidance available

on cenovus.com.

The risk factors and uncertainties that could cause actual

results to differ materially from the forward‐looking information

in this news release include, but are not limited to: the accuracy

of estimates regarding commodity prices, inflation, operating and

capital costs and currency and interest rates; risks inherent in

the operation of Cenovus’s business; and risks associated with

climate change and Cenovus’s assumptions relating thereto and other

risks identified under “Risk Management and Risk Factors” and

“Advisory” in Cenovus’s Management’s Discussion and Analysis

(MD&A) for the year ended December 31, 2022.

Except as required by applicable securities laws, Cenovus

disclaims any intention or obligation to publicly update or revise

any forward‐looking statements, whether as a result of new

information, future events or otherwise. Readers are cautioned that

the foregoing lists are not exhaustive and are made as at the date

hereof. Events or circumstances could cause actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward‐looking information. For additional

information regarding Cenovus’s material risk factors, the

assumptions made, and risks and uncertainties which could cause

actual results to differ from the anticipated results, refer to

“Risk Management and Risk Factors” and “Advisory” in Cenovus’s

MD&A for the period ended December 31, 2022, and to the

risk factors, assumptions and uncertainties described in other

documents Cenovus files from time to time with securities

regulatory authorities in Canada (available on SEDAR

at sedar.com, on EDGAR at sec.gov and Cenovus’s

website at cenovus.com).

Specified Financial MeasuresThis news release

contains references to certain specified financial measures that do

not have standardized meanings prescribed by IFRS. Readers should

not consider these measures in isolation or as a substitute for

analysis of the company’s results as reported under IFRS. These

measures are defined differently by different companies and,

therefore, might not be comparable to similar measures presented by

other issuers. For information on the composition of these

measures, as well as an explanation of how the company uses these

measures, refer to the Specified Financial Measures Advisory

located in Cenovus’s MD&A for the period ended March 31, 2023,

(available on SEDAR at sedar.com, on EDGAR at sec.gov and on

Cenovus's website at cenovus.com) which is incorporated by

reference into this news release.

Upstream Operating Margin and Downstream Operating

MarginUpstream Operating Margin and Downstream Operating

Margin, and the individual components thereof, are included in Note

1 to the interim Consolidated Financial Statements.

Total Operating MarginTotal Operating Margin is

the total of Upstream Operating Margin plus Downstream Operating

Margin.

| |

Upstream(1) |

|

Downstream(1) |

|

Total |

|

|

Q1 2023 |

|

Q4 2022 |

|

Q1 2022 |

|

Q1 2023 |

|

Q4 2022 |

|

Q1 2022 |

|

Q1 2023 |

|

Q4 2022 |

|

Q1 2022 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Sales |

7,415 |

|

8,307 |

|

10,897 |

|

7,368 |

|

8,380 |

|

|

8,116 |

|

14,783 |

|

16,687 |

|

19,013 |

| Less: Royalties |

596 |

|

875 |

|

1,185 |

|

— |

|

— |

|

|

— |

|

596 |

|

875 |

|

1,185 |

| |

6,819 |

|

7,432 |

|

9,712 |

|

7,368 |

|

8,380 |

|

|

8,116 |

|

14,187 |

|

15,812 |

|

17,828 |

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased Product |

1,069 |

|

1,157 |

|

1,818 |

|

6,222 |

|

7,071 |

|

|

6,817 |

|

7,291 |

|

8,228 |

|

8,635 |

| Transportation and

Blending |

2,994 |

|

2,962 |

|

3,194 |

|

— |

|

— |

|

|

— |

|

2,994 |

|

2,962 |

|

3,194 |

| Operating |

1,029 |

|

955 |

|

909 |

|

754 |

|

759 |

|

|

645 |

|

1,783 |

|

1,714 |

|

1,554 |

|

Realized (Gain) Loss on Risk Management |

16 |

|

134 |

|

871 |

|

1 |

|

(8 |

) |

|

110 |

|

17 |

|

126 |

|

981 |

| Operating

Margin |

1,711 |

|

2,224 |

|

2,920 |

|

391 |

|

558 |

|

|

544 |

|

2,102 |

|

2,782 |

|

3,464 |

(1) Found in Note 1 of the

March 31, 2023, or December 31, 2022, interim Consolidated

Financial Statements.Adjusted Funds Flow, Free Funds Flow

and Excess Free Funds Flow The following table provides a

reconciliation of cash from (used in) operating activities found in

Cenovus’s Consolidated Financial Statements to Adjusted Funds Flow,

Free Funds Flow and Excess Free Funds Flow. Adjusted Funds Flow per

Share – Basic and Adjusted Funds Flow per Share – Diluted are

calculated by dividing Adjusted Funds Flow by the respective basic

or diluted weighted average number of common shares outstanding

during the period and may be useful to evaluate a company’s ability

to generate cash.

| |

Three Months Ended |

| ($

millions) |

March 31, 2023 |

|

|

Dec. 31, 2022 |

|

|

March 31, 2022 |

|

|

|

Cash From (Used in) Operating Activities(1) |

(286) |

|

|

2,970 |

|

|

1,365 |

|

|

| (Add) Deduct: |

|

|

|

|

|

|

| Settlement of

Decommissioning Liabilities |

(48) |

|

|

(49) |

|

|

(19) |

|

|

| Net Change in

Non-Cash Working Capital |

(1,633) |

|

|

673 |

|

|

(1,199) |

|

|

| Adjusted

Funds Flow |

1,395 |

|

|

2,346 |

|

|

2,583 |

|

|

| Capital

Investment |

1,101 |

|

|

1,274 |

|

|

746 |

|

|

| Free Funds

Flow |

294 |

|

|

1,072 |

|

|

1,837 |

|

|

| Add (Deduct): |

|

|

|

|

|

|

| Base Dividends

Paid on Common Shares |

(200) |

|

|

(201) |

|

|

(69) |

|

|

| Dividends Paid on

Preferred Shares |

(18) |

|

|

- |

|

|

(9) |

|

|

| Settlement of

Decommissioning Liabilities |

(48) |

|

|

(49) |

|

|

(19) |

|

|

| Principal

Repayment of Leases |

(70) |

|

|

(74) |

|

|

(75) |

|

|

| Acquisitions, Net

of Cash Acquired |

(465) |

|

|

(7) |

|

|

- |

|

|

| Proceeds From

Divestitures |

8 |

|

|

45 |

|

|

950 |

|

|

| Excess

Free Funds Flow |

(499) |

|

|

786 |

|

|

2,615 |

|

|

(1) Found in the March 31, 2023, or the

December 31, 2022, interim Consolidated Financial

Statements.Cenovus Energy Inc.Cenovus Energy Inc.

is an integrated energy company with oil and natural gas production

operations in Canada and the Asia Pacific region, and upgrading,

refining and marketing operations in Canada and the United States.

The company is focused on managing its assets in a safe, innovative

and cost-efficient manner, integrating environmental, social and

governance considerations into its business plans. Cenovus common

shares and warrants are listed on the Toronto and New York stock

exchanges, and the company’s preferred shares are listed on the

Toronto Stock Exchange. For more information, visit

cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

Cenovus contacts

|

Investors |

Media |

| Investor Relations general

line403-766-7711 |

Media Relations general

line403-766-7751 |

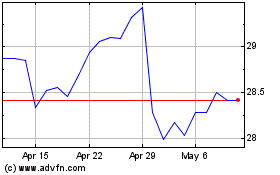

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cenovus Energy (TSX:CVE)

Historical Stock Chart

From Nov 2023 to Nov 2024