Exco Technologies Limited (TSX-XTC, OTCQX-EXCOF)

today announced results for its second quarter of fiscal 2023 ended

March 31, 2023. In addition, Exco announced a quarterly dividend of

$0.105 per common share which will be paid on June 30, 2023 to

shareholders of record on June 16, 2023. The dividend is an

“eligible dividend” in accordance with the Income Tax Act of

Canada.

|

|

|

Three Months Ended March 31 |

Six Months Ended March 31 |

|

|

(in $ thousands except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

| |

Sales |

$155,507 |

|

$119,303 |

|

$294,600 |

|

$220,282 |

|

| |

Net income for the period |

$6,288 |

|

$5,098 |

|

$10,811 |

|

$7,834 |

|

| |

Earnings per share: |

|

|

|

|

|

|

|

|

| |

Basic and Diluted –

Reported |

$0.16 |

|

$0.13 |

|

$0.28 |

|

$0.20 |

|

|

|

EBITDA |

17,841 |

|

$12,538 |

|

33,022 |

|

$21,855 |

|

“Exco’s second quarter results demonstrate solid

progress executing upon our various growth initiatives,” said

Darren Kirk, Exco’s President and CEO. “Despite challenging global

macro conditions, we remain confident our results will see

continued gains through the quarters ahead.”

Consolidated sales for the second quarter ended

March 31, 2023 were $155.5 million compared to $119.3 million in

the same quarter last year – an increase of $36.2 million, or 30%.

Excluding foreign exchange rate fluctuations sales increased 24%

during the quarter.

Strong sales were supported by the Company’s

various strategic growth initiatives. These initiatives are – in

turn – primarily driven by the increased adoption of electric

vehicles, the lightweighting and economizing of motor vehicles, the

broader global environmental sustainability movement and the

adoption of die-cast and extrusion tooling to meet these global

macroeconomic changes to manufacturing. The Company is making

significant investments in capital assets, non-cash working

capital, human resources and training, and other resources to

capture this growth. The impact of these investments is suppressing

near term profitability but will provide opportunities for

meaningful contributions over a multi-year horizon as increased

scale is achieved. The status of our various growth initiatives are

summarized as follows:

- Castool Morocco Greenfield Facility

– This new plant officially opened in November 2021 and positions

Castool to better penetrate the European die cast and extrusion

consumable tooling markets. The plant is ramping up slowly but

showing good traction in markets that have sizeable

opportunities.

- Castool Heat treatment operations -

Situated within our existing Newmarket Large Mould facility,

initial operations began in the Spring of 2022 and the last of the

major equipment was installed in April 2023. This facility provides

unmatched capabilities, particularly for larger tooling components

and enables the insourcing of Castool’s and Large Mould’s heat

treatment needs. Additional benefits of this operation include:

eliminating shipping and scheduling conflicts with third party

suppliers, shorter lead times, increased quality control, and a

reduction in the Company’s environmental footprint.

- Castool Mexico Greenfield Facility

– The building has been completed and equipment has started to

arrive. Initial production is planned for the third quarter of

fiscal 2023. This facility will increase manufacturing capacity and

position Castool to better penetrate the markets in Latin America

and the Southern US.

- Large Mould group Equipment

Additions – Has expanded Large Mould’s additive manufacturing

capacity, increased its crane lift capabilities to 100 tons, and

added several medium and large 5-axis milling machines in order to

capture growth in the very large die-cast market segment. All

equipment is now installed and operational.

- Extrusion group Heat Treatment –

added new heat treatment equipment to its plant in Mexico to

eliminate outsourcing, increased capacity in Texas, and replaced

equipment in Markham with new energy efficient equipment. All

equipment is now operational.

- Automotive Solutions – the Polytech

and Neocon facilities were expanded (combined 40,000 square feet)

to meet growing demand from significant program awards. The last of

the equipment became operational in the second quarter of fiscal

2023.

- Halex acquisition completed May 2,

2022 - Halex is the second largest manufacturer of aluminium

extrusion dies in Europe and the continent’s leading supplier of

complex extrusion dies and complements Exco’s existing extrusion

die operations. The acquisition provides Exco with well-established

and high-quality operations and more extensive opportunities to

better support our global customers and grow in new markets. Work

continues to integrate Halex into the Extrusion group operations

and realize synergies from the sharing of best practices.

The Automotive Solutions segment reported sales

of $83.1 million in the second quarter – an increase of $14.9

million, or 22% from the prior year quarter. Adjusting for the

impact of foreign exchange movements, sales increased 15% during

the quarter. The sales increase was driven by the ramp up of newer

programs, higher vehicle production volumes, select pricing actions

to compensate for inflationary pressures as well as favorable

vehicle mix. By comparison, blended vehicle production volumes in

North America and Europe were up about 13% in the quarter,

indicating continued gains in content per vehicle. Looking forward,

OEM vehicle production volumes are expected to increase as the

semiconductor chip shortages and other supply chain constraints

continue to improve. While industry growth may be tempered by

rising interest rates and emerging indicators of a global

recession, there remains significant pent-up customer demand for

new vehicles and dealer inventory levels are expected to be

replenished. As well, Exco will benefit from recent and future

program launches that are expected to provide ongoing growth in our

content per vehicle. Quoting activity remains very encouraging and

we believe there is ample opportunity to achieve our targeted

growth objectives.

The Casting and Extrusion segment reported sales

of $72.4 million for the second quarter – an increase of $21.3

million or 42%, from the same period last year. Adjusting for the

impact of foreign exchange movements, segment revenues increased

35% during the quarter. Casting and extrusion segment sales were

significantly influenced by the acquisition of Halex in Q3 fiscal

2022. Excluding Halex’s sales, segment sales increased by 12% in

the quarter as overall market demand remained firm and the Company

benefited from its various strategic growth initiatives. Demand for

our consumable extrusion tooling (i.e. dies, dummy blocks, stems,

etc.) and associated capital equipment (die ovens, containers,

etc.) remained relatively strong overall due to both industry

growth and ongoing market share gains, although we did see further

signs of market activity for certain extrusion tooling slowing

through the quarter in North America. In addition to its capital

asset growth agenda, Management remains focused on standardizing

manufacturing processes, enhancing engineering depth and

centralizing some support functions across its various plants.

These initiatives have reduced lead times, enhanced product

quality, expanded product breadth, increased capacity and provided

access to new geographies, all of which have supported market share

gains.

In the die-cast market, which primarily serves

the automotive industry, demand for new moulds, consumable tooling

(shot sleeves, rods, rings, tips, etc.), rebuild work and

additively printed tooling has continued to improve as industry

vehicle production recovers and new electric vehicles and more

efficient internal combustion engine/transmission platforms are

launched. Also, customer inventory levels increased as expectations

for higher vehicle production volumes improves. We believe the

segment is gaining market share, particularly for tooling that is

larger and more complex, which is the fastest growing portion of

the market. Sales in the quarter were also aided by price

increases, which were implemented to recover margins eroded by

higher input costs. Quoting activity within the die-cast end market

remains extremely robust while our backlog levels are at record

highs, which is expected to bode well for sales into fiscal

2024.

Consolidated net income for the second quarter

was $6.3 million or basic and diluted earnings of $0.16 per share

compared to $5.1 million or $0.13 per share in the same quarter

last year – an increase of net income of $1.2 million. Pretax

profits in the second quarter of this year were negatively impacted

by $1.6 million ($0.03/ share net of tax) of costs related to the

previously disclosed cyber incident in the Lage Mould group, which

has now been fully remediated. The consolidated effective income

tax rate of 21% in the current quarter compared to 23% in the prior

year quarter. The income tax rate in the quarter was impacted by

non-deductible losses from our Castool Morocco facility, offset by

geographic distribution, and foreign rate

differentials.

The Automotive Solutions segment reported pretax

profit of $8.7 million in the second quarter, an increase of $2.5

million from the prior year quarter. The increase in pretax profit

is largely attributable to higher sales, better absorption of

overheads, and from select pricing actions. These improvements were

partially offset by inefficiencies caused by launch costs from key

launches in the period. Industry vehicle volumes remain below

pre-pandemic levels and production flows remain somewhat erratic

due to ongoing supply chain challenges, but these challenges

lessened in the quarter while cost increases related to raw

materials, wages, and transportation also subsided. Management is

optimistic that its overall cost structure will return to

relatively normal levels in future quarters as scheduling and

predictability improves with strengthening volumes. Pricing

discipline remains a focus and action is being taken on current

programs where possible, though there is typically a lag of a few

quarters before the impact is realized. As well, new program awards

are priced to reflect management’s expectations for higher future

costs.

The Casting and Extrusion segment reported $3.9

million of pretax profit in the second quarter – an increase of

$1.2 million from the same quarter last year and $2.0 million from

the first quarter fiscal 2023. The second quarter pretax profit

improvement was driven by contributions from Halex, increased

overhead absorption and production efficiencies due to stronger

sales in the die-cast market (including new moulds, rebuilds, and

consumable tooling). These positive contributions were partially

offset by higher depreciation ($1.0 million in the quarter),

start-up costs at Castool’s new operations in Morocco, Mexico and

Heat Treat Newmarket, as well as higher raw material, energy,

freight and labour costs. As well, costs were also impacted by

roughly $0.6 million of expenses recorded in the segment due to

lost production time in the Large Mould group arising from the

cyber incident. Management expects to temper many of these costs

over the coming quarters through efficiency improvements and

pricing action where possible. Margins will also benefit as newer

operations mature and achieve greater scale. The higher

depreciation relates to the acquisition of Halex and the Company’s

investment in new capital that will improve operations and provide

access to new geographies to increase our market share. Castool

Morocco ramp-up is proceeding favorably, but has been slower than

anticipated due to the supply chain constraints, inflation, and the

Russian invasion of Ukraine. Castool’s new Mexican operation is

scheduled to open in the third quarter and ramp up quickly

contributing to increased market share gains in both the die-cast

and extrusion tooling markets in Mexico and Latin America.

Management remains focused on reducing its overall cost structure

and improving manufacturing efficiencies and expects such

activities together with its sales efforts to improve segment

profitability over time. Corporate segment

expenses were $2.6 million in the second quarter compared to $2.0

million in the prior year quarter. The Corporate segment incurred

$1 million of costs associated with the January cyber incident for

administrative, legal and monitoring costs, which are not expected

to recur in future quarters. These second quarter costs were

partially offset by lower foreign exchange and incentive expenses

compared to the prior year second quarter.

Consolidated EBITDA for the second quarter

totaled $17.8 million compared to $12.5 million in the same quarter

last year – an increase of $5.3 million or 42%. For the quarter,

EBITDA as a percentage of sales increased to 11.5% in the current

period compared to 10.5% the prior year driven by an improvement in

segment margins in both the Casting & Extrusion segment (13.6%

compared to 13.3%) and the Automotive Solutions segment (12.7%

compared to 11.4%). Excluding costs associated with the January

2023 cyber incident, consolidated EBITDA totaled $19.4 million

during the second quarter – an increase of 55% over the prior

year.

Exco generated cash from operating activities of

$6.0 million during the quarter and $1.1 million of Free Cash Flow

after $2.9 million in Maintenance Fixed Asset Additions and $2.0

million in interest expense. During the quarter the Company

invested 7.7 million in growth capital expenditures and $4.1

million in dividends. Exco ended the quarter with $13.1 million in

cash, $116.3 million in bank and long-term debt and $36.3 million

available in its credit facility, continuing Exco’s practice of

maintaining a strong balance sheet and liquidity position.

Outlook

Despite current macro-economic challenges,

including tightening monetary conditions, the overall outlook is

favorable across Exco’s segments into the medium term. Consumer

demand for automotive vehicles is currently outstripping supply in

most markets, which are constrained by a shortage of semiconductor

chips and, to a lesser extent, other raw materials, components and

availability of labour. Dealer inventory levels, although

increasing slightly, are near record lows, while average

transaction prices for both new and used vehicles are at record

highs and the average age of the broader fleet has continued to

increase to an all-time high. This bodes well for higher levels of

future vehicle production and the sales opportunity of Exco’s

various automotive components and accessories once supply chains

normalize. In addition, OEM’s are increasingly looking to the sale

of higher margin accessory products as a means to enhance their own

levels of profitability. Exco’s Automotive Solutions segment

derives a significant amount of activity from such products and is

a leader in the prototyping, development and marketing of the same.

Moreover, the rapid movement towards an electrified fleet for both

passenger and commercial vehicles is enticing new market entrants

into the automotive market while causing traditional OEM incumbents

to further differentiate their product offerings, all of which is

driving above average opportunities for Exco.

With respect to Exco’s Casting and Extrusion

segment, the intensifying global focus on environmental

sustainability is creating significant growth drivers that are

expected to persist through at least the next decade. Automotive

OEMs are looking to light-weight metals such as aluminum to reduce

vehicle weight and reduce carbon dioxide emissions. This trend is

evident regardless of powertrain design - whether internal

combustion engines, electric vehicles or hybrids. As well, a

renewed focus on the efficiency of OEMs in their own manufacturing

process is creating higher demand for advanced tooling that can

contribute towards their profitability and sustainability goals.

Certain new EV manufacturers have adopted the approach of utilizing

much larger die-cast machines to cast entire sub-frames of vehicles

out of an aluminum based alloy rather than assemble numerous pieces

of separately stamped and welded pieces of ferrous metal.

Traditional OEMs have started to adopt this trend and Exco is

positioning its operations to capitalize accordingly. Beyond the

automotive industry, Exco’s extrusion tooling supports diverse end

markets which are also seeing increased demand for aluminum driven

by environmental trends, including energy efficient buildings,

solar panels, etc.

On the cost side, inflationary pressures remain

elevated while prompt availability of various input materials,

components and labour remains challenging. We are offsetting these

dynamics through various efficiency initiatives and taking pricing

action where possible although there is typically several quarters

of lag before the counter measures are evident.

The Russian invasion of Ukraine has added

additional uncertainty to the global economy. And while Exco has

essentially no direct exposure to either of these countries,

Ukraine does feed into the European automotive markets and Europe

has significant dependence on Russia for its energy needs.

Exco itself is also looking inwards with respect

to ESG and sustainability trends to ensure its own operations are

sustainable. We are investing significant capital to improve the

efficiency and capacity of our own operations while lowering our

own carbon footprint. Our Sustainability Report is available on our

corporate website

at: www.excocorp.com/leadership/sustainability/.

Exco is currently targeting a compounded average

annual growth rate (excluding acquisitions) of approximately 10%

for revenues and slightly higher levels for EBITDA and Net Income

through fiscal 2026, which is expected to produce an annual EPS of

roughly $1.90 by the end of this timeframe. This target is expected

to be achieved through the launch of new programs, general market

growth, and also market share gains consistent with the Company’s

operating history. Capital investments will remain elevated in the

balance of the fiscal year in order to position the Company for the

significant growth opportunities we see.

For further information and prior year

comparison please refer to the Company’s First Quarter Condensed

Financial Statements in the Investor Relations section posted at

www.excocorp.com. Alternatively, please refer to www.sedar.com.

Non-IFRS Measures: In this News

Release, reference may be made to EBITDA, EBITDA Margin, Pretax

Profit, Free Cash Flow and Maintenance Fixed Asset Additions which

are not defined measures of financial performance under

International Financial Reporting Standards (“IFRS”). Exco

calculates EBITDA as earnings before interest, taxes, depreciation

and amortization and EBITDA Margin as EBITDA divided by sales. Exco

calculates Pretax Profit as segmented earnings before other

income/expense, interest and taxes. Free Cash Flow is

calculated as cash provided by operating activities less interest

paid and Maintenance Fixed Asset Additions. Maintenance Fixed Asset

Additions represents management’s estimate of the investment in

fixed assets that are required for the Company to continue

operating at current capacity levels. Given the Company’s elevated

planned capital spending on fixed assets for growth initiatives

(including additional Greenfield locations, energy efficient heat

treatment equipment and increased capacity) through the near term,

the Company has modified its calculation of Free Cash Flow to

include Maintenance Fixed Assets and not total fixed asset

purchases. This change is meant to enable investors to better gauge

the amount of generated cash flow that is available for these

investments as well as acquisitions and/or returns to shareholders

in the form of dividends or share buyback programs. EBITDA, EBITDA

Margin, Pretax Profit and Free Cash Flow are used by management,

from time to time, to facilitate period-to-period operating

comparisons and we believe some investors and analysts use these

measures as well when evaluating Exco’s financial performance.

These measures, as calculated by Exco, do not have any standardized

meaning prescribed by IFRS and are not necessarily comparable to

similar measures presented by other issuers.

Quarterly Conference Call –

April 28, 2023 at 10:00 a.m. (Toronto time):

To access the listen only live audio webcast,

please log on to www.excocorp.com, or

https://edge.media-server.com/mmc/p/bd5xq2cd a few minutes before

the event. Those interested in participating in the

question-and-answer conference call may register at

https://register.vevent.com/register/BI3a47dfb418914175b68bd256f4ba09d6

to receive the dial-in numbers and unique PIN to access the call.

It is recommended that you join 10 minutes prior to the event start

(although you may register and dial in at any time during the

call).

For those unable to participate on April 28, 2023, an archived

version will be available on the Exco website until May 15,

2023.

|

|

Source: |

Exco Technologies Limited (TSX-XTC, OTCQX-EXCOF) |

|

|

Contact: |

Darren Kirk, President and CEO |

|

|

Telephone: |

(905) 477-3065 Ext. 7233 |

|

|

Website: |

https://www.excocorp.com |

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier

of innovative technologies servicing the die-cast, extrusion and

automotive industries. Through our 20 strategic locations in

9 countries, we employ approximately 5,000 people and service a

diverse and broad customer base.

Notice To Reader: Forward Looking Statements

This press release contains forward-looking

information and forward-looking statements within the meaning of

applicable securities laws. We may use words such as "anticipate",

"may", "will", "should", "expect", "believe", "estimate", “5-year

target” and similar expressions to identify forward-looking

information and statements especially with respect to growth,

outlook and financial performance of the Company's business units,

contribution of our start-up business units, contribution of

awarded programs yet to be launched, margin performance, financial

performance of acquisitions, liquidity, operating efficiencies,

improvements in, expansion of and/or guidance or outlook as to

future revenue, sales, production sales, margin, earnings, earnings

per share, including the outlook for 2026, are forward-looking

statements. These forward-looking statements include known and

unknown risks, uncertainties, assumptions and other factors which

may cause actual results or achievements to be materially different

from those expressed or implied. These forward-looking statements

are based on our plans, intentions or expectations which are based

on, among other things, the current improving global economic

recovery from the COVID-19 pandemic and containment of any future

or similar outbreak of epidemic, pandemic, or contagious diseases

that may emerge in the human population, which may have a material

effect on how we and our customers operate our businesses and the

duration and extent to which this will impact our future operating

results, the impact of the Russian invasion of Ukraine on the

global financial, energy and automotive markets, including

increased supply chain risks, assumptions about the demand for and

number of automobiles produced in North America and Europe,

production mix between passenger cars and trucks, the number of

extrusion dies required in North America and South America, the

rate of economic growth in North America, Europe and emerging

market countries, investment by OEMs in drivetrain architecture and

other initiatives intended to reduce fuel consumption and/or the

weight of automobiles in response to rising climate risks, raw

material prices, supply disruptions, economic conditions,

inflation, currency fluctuations, trade restrictions, energy

rationing in Europe, our ability to integrate acquisitions, our

ability to continue increasing market share, or launch of new

programs and the rate at which our current and future greenfield

operations in Mexico and Morocco achieve sustained profitability.

Readers are cautioned not to place undue reliance on

forward-looking statements throughout this document and are also

cautioned that the foregoing list of important factors is not

exhaustive. The Company will update its disclosure upon publication

of each fiscal quarter's financial results and otherwise disclaims

any obligations to update publicly or otherwise revise any such

factors or any of the forward-looking information or statements

contained herein to reflect subsequent information, events or

developments, changes in risk factors or otherwise. For a more

extensive discussion of Exco's risks and uncertainties see the

'Risks and Uncertainties' section in our latest Annual Report,

Annual Information Form ("AIF") and other reports and securities

filings made by the Company. This information is available

at www.sedar.com or www.excocorp.com.

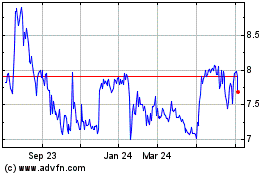

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Nov 2024 to Dec 2024

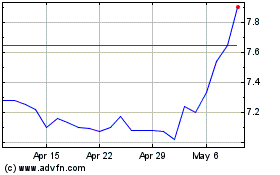

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Dec 2023 to Dec 2024