Gowest Gold Ltd. (“

Gowest” or the

“

Company”) (TSX VENTURE: GWA) provided an update

on its annual and special meeting of shareholders held today (the

“

Meeting”) at which a significant majority of

shareholders present or represented by proxy voted in favour of the

resolution approving the previously announced (see Gowest News

Release dated January 24, 2022) investment by Greenwater Investment

Hong Kong Limited (“

Greenwater”) of up to $19

million. In accordance with the policies of the TSX-V, Greenwater

and any of its related parties were excluded from voting on this

resolution.

The initial portion of this two-part private

placement financing (the “Offering”) was completed

on or prior to March 10, 2022, with the issuance and sale to

Greenwater of promissory notes in an aggregate principal amount of

$7,500,000 (the “Promissory Notes”), for an

aggregate purchase price of $7,500,000. The Promissory Notes will

now automatically convert into Units (as defined below) within five

business days in accordance with their terms.

Following today’s shareholder approval, and

subject to the terms of the subscription agreement between the

parties dated January 24, 2022, Greenwater has further agreed to

purchase from Gowest up to an aggregate of 88,461,358 units of the

Corporation (the “Units”), at an initial issue

price of $0.13 per Unit (the “Issue Price”), for

an aggregate purchase price of up to $11,500,000 (the “Unit

Offering”).

Each Unit issuable pursuant to the Offering will

comprise one common share of the Company and one common share

purchase warrant (a “Warrant”), with each Warrant

being exercisable to purchase one additional common share of the

Company for a period of two years following the receipt of

shareholder approval, at a price of $0.16 per Unit during the first

12-month period following the receipt of shareholder approval or at

a price of $0.17 per Unit during the second 12-month period

following the receipt of shareholder approval.

Assuming the completion of the Offering in full,

the Corporation will raise aggregate gross proceeds of $19,000,000.

Additional funds may be raised subsequently through the exercise of

the Warrants issued pursuant to the Offering.

Subsequent to the completion of the Offering,

Greenwater becomes a “Control Person” of the Corporation, in

accordance with the applicable policies of the TSX-V.

Dan Gagnon, President and Chief

Executive Officer of Gowest, commented, “On behalf of the

rest of the management team, I’d like to thank both Greenwater and

our shareholders for their support and recognition of the value of

Bradshaw Gold Deposit and the rest of our assets. With these funds

in hand, we are now able to move ahead with our plan to restart our

mining activities at Bradshaw and accelerate the development of our

promising gold portfolio.”

He added, “I look forward to providing more

detail on our progress in the coming weeks and months.”

Other Meeting Business

In addition, shareholders elected the directors

set out in the management information circular prepared in

connection with the Meeting, including two new Directors, Dan

Gagnon, and Gilbert Lawson. C. Fraser Elliott (Chairman), Peter

Quintiliani, Yungang Wu and Meirong Yuan were all re-elected to the

Board.

C. Fraser Elliott, Gowest

Chairman, stated, “On behalf of the rest of our directors,

I want particularly to welcome Gilbert Lawson to our Board. As the

former Chief Operating Officer of TMAC Resources Inc. and as the

former VP, Geology & Mine Planning of Goldcorp Inc., amongst

other roles, he adds a tremendous amount of experience to our team

at this critical time in the Company’s development.”

Other resolutions passed at the Meeting included

the re-appointment of McGovern Hurley LLP as auditors and the

re-approval and confirmation of the existing stock option plan.

About Gowest

Gowest is a Canadian gold exploration and

development company focused on the delineation and development of

its 100% owned Bradshaw Gold Deposit (Bradshaw) on the Frankfield

Property, part of the Corporation’s North Timmins Gold Project

(NTGP). Gowest is exploring additional gold targets on its

+100‐square‐kilometre NTGP land package and continues to evaluate

the area, which is part of the prolific Timmins, Ontario gold camp.

Currently, Bradshaw contains a National Instrument 43‐101 Indicated

Resource estimated at 2.1 million tonnes (“t”) grading 6.19 grams

per tonne gold (g/t Au) containing 422 thousand ounces (oz) Au and

an Inferred Resource of 3.6 million t grading 6.47 g/t Au

containing 755 thousand oz Au. Further, based on the

Pre‐Feasibility Study produced by Stantec Mining and announced on

June 9, 2015, Bradshaw contains Mineral Reserves (Mineral Resources

are inclusive of Mineral Reserves) in the probable category, using

a 3 g/t Au cut‐off and utilizing a gold price of US$1,200 / oz,

totaling 1.8 million t grading 4.82 g/t Au for 277 thousand oz

Au.

Forward-Looking Statements

Certain statements in this release constitute

forward-looking statements within the meaning of applicable

securities laws. Forward-looking statements in this press release

include, without limitation, statements relating to: the Offering;

the proposed use of proceeds of the Offering; the ability of the

parties, in particular the Corporation, to satisfy the conditions

precedent to the closing of the Offering; the requirement to obtain

regulatory approvals, including the approval of the TSXV; the

mailing of the management information circular in connection with

the Meeting and anticipated timing thereof; and the anticipated

timing of the completion of the Offering. Words such as “may”,

“would”, “could”, “should”, “will”, “anticipate”, “believe”,

“plan”, “expect”, “intend”, “potential” and similar expressions may

be used to identify these forward-looking statements although not

all forward-looking statements contain such words.

Forward-looking statements involve significant

risks, uncertainties, and assumptions. Many factors could cause

actual results, performance or achievements to be materially

different from any future results, performance or achievements that

may be expressed or implied by such forward-looking statements,

including risks associated with the Offering and financing

transactions generally. Additional risk factors are also set forth

in the Corporation’s management’s discussion and analysis and other

filings available via the System for Electronic Document Analysis

and Retrieval (SEDAR) under the Corporation’s profile at

www.sedar.com. Should one or more of these risks or uncertainties

materialize, or should assumptions underlying the forward-looking

statements prove incorrect, actual results, performance or

achievements may vary materially from those expressed or implied by

this press release. These factors should be considered carefully

and reader should not place undue reliance on the forward-looking

statements. These forward-looking statements are made as of the

date of this press release and, other than as required by law, the

Corporation does not intend to or assume any obligation to update

or revise these forward-looking statements, whether as a result of

new information, future events or otherwise.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

| For further information please

contact: |

| |

|

| Dan GagnonPresident & CEOTel: (416) 363-1210Email:

info@gowestgold.com |

Greg TaylorInvestor RelationsTel: (416) 605-5120Email:

gregt@gowestgold.com |

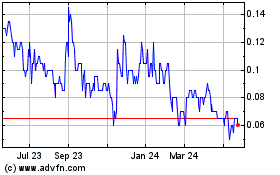

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Jan 2025 to Feb 2025

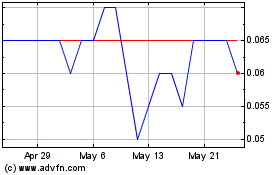

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Feb 2024 to Feb 2025