0001762359FALSE00017623592024-06-032024-06-030001762359acrg:ClassESubordinateVotingSharesMember2024-06-032024-06-030001762359acrg:ClassDSubordinateVotingSharesMember2024-06-032024-06-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 3, 2024

Commission file number 000-56021 | | |

|

| ACREAGE HOLDINGS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | |

| British Columbia, Canada | | 98-1463868 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

366 Madison Ave, 14th floor | New York | New York | 10017 |

(Address of Principal Executive Offices) | | (Zip Code) |

(646) 600-9181

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

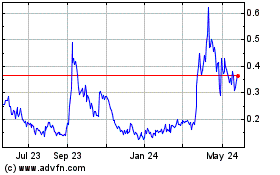

| Class E subordinate voting shares | | ACRHF | | OTC Markets Group Inc. |

| Class D subordinate voting shares | | ACRDF | | OTC Markets Group Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Amended and Restated Credit Agreement

As previously disclosed, Acreage Holdings, Inc. (the “Company” or “Acreage”), as parent, High Street Capital Partners, LLC (“HSCP”), as borrower, the other loan parties thereto from time to time, the lenders party thereto from time to time, AFC Agent LLC (“AFC Agent” and together with the AFC Lenders, as defined below, the “AFC Parties”) and VRT Agent LLC (“VRT Agent” and together with VRT, as defined below, the “VRT Parties”), are parties to a credit agreement, dated as of December 16, 2021, as amended on October 24, 2022 and April 28, 2023 (the “Existing Acreage Credit Agreement”).

11065220 Canada Inc. (the “Optionor”), a wholly-owned subsidiary of Canopy Growth Corporation (“Canopy Growth”), AFC Gamma, Inc. (“AFCG”), AFC Institutional Fund LLC (“AFCI” and together with AFCG, the “AFC Lenders”) and Viridescent Realty Trust, Inc. (“VRT” and together with the AFC Lenders, the “Acreage Lenders”) are parties to an option agreement, dated November 15, 2022 (the “Option Agreement”), whereby the Optionor has the right to acquire all of the interests of the Acreage Lenders under the Existing Acreage Credit Agreement. Pursuant to the Option Agreement, the Optionor previously deposited US$28.5 million (the “Option Premium”) into an interest-bearing escrow account.

On June 3, 2024, the Optionor entered into an assignment and acceptance agreement (the “AFC Assignment Agreement”) with the AFC Parties in order to acquire all of the AFC Parties’ rights in and interest to all obligations owing to the AFC Parties pursuant to the Existing Acreage Credit Agreement in an aggregate amount equal to approximately US$99.8 million (the “AFC Obligations”). As consideration for the acquisition of the AFC Obligations by the Optionor, pursuant to a direction by, among others, the Optionor, the AFC Parties and the VRT Parties, the Optionor and the VRT Parties agreed to release the Option Premium, plus all accrued interest thereon, to the AFC Parties and the Optionor made a cash payment of approximately US$69.8 million to the AFC Parties.

On June 3, 2024, the Optionor also entered into a commitment letter (the “Commitment Letter”) with VRT. Pursuant to the terms of the Commitment Letter, VRT agreed, among other things, to (i) retain its interest in the Existing Acreage Credit Agreement, (ii) capitalize certain overdue amounts, including interest, owing pursuant to the Existing Acreage Credit Agreement, (iii) release the Option Premium, plus all accrued interest thereon, to the AFC Parties, and (iv) become the sole agent under the A&R Credit Agreement, as defined below.

On June 3, 2024, the Company, HSCP, as borrower, the Optionor, VRT Agent and the loan parties thereto from time to time, entered into an amended and restated credit agreement (the “A&R Credit Agreement”). The A&R Credit Agreement will continue to bear interest at a variable rate of U.S. prime (“Prime”) plus 5.75% per annum, payable monthly in arrears, with a Prime floor of 5.50%, and a maturity date of January 1, 2026. Interest under the A&R Credit Agreement will be payable in cash or in kind, at the Company’s election, through November 30, 2024.

The foregoing description of the A&R Credit Agreement is qualified in its entirety by reference to the full text of the A&R Credit Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”).

On June 4, 2024, the Company issued a press release announcing the A&R Credit Agreement. A copy of the press release is attached to this Current Report as Exhibit 99.1.

Private Placement

On June 5, 2024, Acreage entered into a Subscription Agreement (the “Subscription Agreement”) with certain institutional investors (collectively, the “Investors”) pursuant to which the Company agreed sell to the Investors 12,000 units (the “Units”) of the Company in a private placement (the “Private Placement”) at a price of US$833.33 per Unit, for gross proceeds to the Company of US$10 million (the “Funded Amount”). The Private Placement closed on June 6, 2024 (the “Closing Date”). After the payment of the fees payable to the placement agents and estimated offering expenses payable by the Company in connection with the Private Placement, the Company received net proceeds of approximately $9.2 million. The net proceeds from the Private Placement were deposited into a segregated account and the Company intends to use the net proceeds for general corporate purposes.

Each Unit consists of: (i) US$1,000 principal amount of non-recourse unsecured convertible notes (the “Notes”), reflecting a 16.67% original issue discount, convertible into that number of Class E subordinate voting shares of the Company (the “Fixed Shares” and such Fixed Shares issuable upon conversion of the Notes, the “Underlying Note Shares”)) at the Conversion Price (as defined below); and (ii) Fixed Share purchase warrants (the “Warrants”), with each Warrant exercisable to acquire one Fixed Share at the Exercise Price (as defined below) (such Fixed Shares issuable upon exercise of the Warrants, the “Underlying Warrant Shares”, and the Underlying Warrant Shares together with the Underlying Notes Shares, the “Underlying Shares”) at any time and from time to time after the date that Canopy or Canopy USA, as the case may be, acquires of all of the issued and outstanding Fixed Shares in accordance with the Fixed Share Arrangement and one or before June 5, 2029. The number of Warrants to be issued to each Investor shall be the quotient obtained by dividing the aggregate US$10 million subscription amount of the Units by the Exercise Price.

The Notes will not bear interest.

The “Conversion Price” of the Notes is the price per Fixed Share determined by multiplying (i) the Exchange Ratio (as such term is defined in Fixed Share Arrangement Agreement) as the same shall be adjusted in accordance with the terms of the Fixed Share Arrangement Agreement by, (ii) the Fair Market Value (as such term is defined in the Fixed Share Arrangement Agreement) of the common shares of Canopy Growth (the “Canopy Shares”) on the business day prior to the closing of the Fixed Share Acquisition after giving effect to the conversion of the Notes and the determination of the number of Warrants issued in the Private Placement. The Conversion Price shall be determined at the closing of the Fixed Share Acquisition.

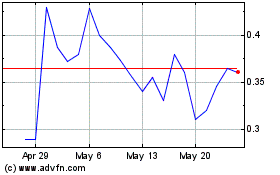

The “Exercise Price” of the Warrants shall equal the Conversion Price; provided, however, that in the event that the Put Right (as defined below) is exercised, the Exercise Price shall be not less than US$0.375.

In connection with the Private Placement, each Investor entered into a put agreement with Canopy USA, LLC (“Canopy USA”), pursuant to which such Investor has the right (the “Put Right”) to require Canopy USA to purchase the Notes and the Warrants subscribed for by it under the Private Placement if (i) the Fixed Share Acquisition is not completed before the date that is 15 months from the Closing Date (the “Maturity Date”), (ii) if the Fixed Share Acquisition is terminated at any time prior to the Maturity Date, or (iii) if the Company is subject to an insolvency event.

If the Acquisitions (as defined below) are completed before the Maturity Date: (i) each Note will be automatically converted immediately prior to the completion of the Fixed Share Acquisition at the Conversion Price; and (ii) each Warrant shall be exercisable for such number of Canopy Shares as the holder thereof would have been entitled to receive in accordance with the terms of the Fixed Share Arrangement Agreement (as defined below) had the holder exercised the Warrants prior to the closing of the Fixed Share Acquisition. If the Fixed Share Acquisition is not completed by the Maturity Date and, provided that the Put Right has been exercised, the outstanding Notes shall thereafter only represent an unsecured payment obligation of the principal amount thereof by Company in favor of Canopy USA.

While the number of Fixed Shares issuable upon conversion or exercise, as applicable, of the Notes and the Warrants remains unknown at this time, the completion of the Private Placement is expected to result in significant dilution of the Fixed Shares, particularly given that the Conversion Price of the Notes is based on the Exchange Ratio, which will be adjusted pursuant to the Fixed Share Arrangement Agreement for issuances in excess of the Purchaser Approved Share Threshold (as such term is defined in the Fixed Share Arrangement Agreement). The Private Placement is expected to result in the issuance of Fixed Shares under the Notes, and Warrants exercisable to acquire Fixed Shares, at the time of closing the Fixed Share Arrangement (as defined below), well in excess of the Purchaser Approved Share Threshold, with the effect that the Exchange Ratio will be significantly reduced. The Exchange Ratio reduction is expected to have a material and adverse effect on the number of Canopy Shares that holders of Fixed Shares could receive pursuant to the Fixed Share Arrangement Agreement may have a material and adverse effect on the value of the Fixed Shares.

The following table below sets forth the potential Exchange Ratio based on a range of Canopy Share prices during the previous 52-week period after giving effect to the Private Placement:

| | | | | |

Canopy Share Price (US$) | Fixed Share Exchange Ratio |

| US$5.00 | ≈ 0.00000 |

| US$6.00 | 0.00190 |

| US$7.00 | 0.00656 |

| US$8.00 | 0.01005 |

| US$9.00 | 0.01277 |

| US$10.00 | 0.01494 |

| US$11.00 | 0.01672 |

| US$12.00 | 0.01821 |

| US$13.00 | 0.01946 |

| US$14.00 | 0.02054 |

| US$15.00 | 0.02147 |

| US$16.00 | 0.02228 |

| US$17.00 | 0.02300 |

| US$18.00 | 0.02364 |

| US$19.00 | 0.02421 |

While the above chart shows indicative potential adjustment to the Fixed Share Exchange Ratio at the closing of the Fixed Share Acquisition (based on the number of Fixed Shares and securities convertible into or exercisable to acquire Fixed Shares, as of the date hereof), it assumes there have been no further actions taken by the Company to address the potential significant dilution and related impact on the Exchange Ratio.

Furthermore, as a result of the potential significant dilution of the Fixed Shares as described above, the Private Placement may result in the creation of a new Control Person (as defined in the policies of the Canadian Securities Exchange (“CSE”)), and, as a result, the Private Placement may be deemed to have Materially Affected Control (as defined in the policies of the CSE) of the Company. The Conversion Price of the Notes may also be lower than the market price of the Fixed Shares at such time less the Maximum Permitted Discount (as defined in the policies of the CSE). The Exercise Price of the Warrants may also be lower than the market price of the Fixed Shares as of the date hereof. The Company confirms that it has been granted approval by the CSE to avoid seeking securityholder approval for the Private Placement and the potential creation of a new Control Person in reliance on the exceptions outlined in section 4.6(2)(b) of CSE Policy 4, as the Company is in serious financial difficulty. No related person of the Company participated in the Private Placement.

The foregoing descriptions of the Notes, Warrants, and the Subscription Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of such agreements, which are attached to this Current Report as Exhibits 4.1, 4.2 and 10.2, respectively, and are incorporated herein by reference.

The Notes, the Warrants and the Underlying Shares have not been, and will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”) or the securities laws of any other jurisdiction. The Notes, the Warrants and the Underlying Shares may not be offered or sold in the United States absent registration or an applicable exemption from registration under the Securities Act and any applicable state securities laws. The Notes, the Warrants and the Underlying Shares were offered and sold to the Investors in transactions exempt from registration under the Securities Act in reliance on Section 4(a)(2) thereof and Rule 506(b) of Regulation D thereunder. The Investors are each an “accredited investor”as defined in Regulation D, and acquired the Notes and the Warrants, and will acquire the Underlying Shares, for investment purposes only, and not with a view towards, or for resale in connection with, the public sale or distribution thereof.

On June 5, 2024, the Company issued a press release announcing the Private Placement and on June 6, 2024, the Company issued a press release announcing the closing of the Private Placement. A copy of the press releases are attached to this Current Report as Exhibits 99.2 and 99.3, respectively.

This Current Report does not, and the exhibits attached hereto do not, constitute an offer to sell any security, including the Notes, the Warrants or any Underlying Shares, nor a solicitation for an offer to purchase any security, including the Notes, the Warrants or any Underlying Shares, nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration, qualifications, or exemption under the securities laws of any such jurisdiction.

Item 2.03 Creation of a Direct Financial Obligation.

The disclosures set forth in Item 1.01 of this Current Report regarding the issuance of the Notes are incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosures set forth in Item 1.01 of this Current Report regarding the issuance of the Notes and the Warrants are incorporated by reference into this Item 3.02.

Item 8.01 Other Events.

Call Option Exercise Notice

As previously disclosed, Acreage and Canopy Growth are parties to an arrangement agreement, dated April 18, 2019, as amended on May 15, 2019, September 23, 2020 and November 17, 2020 (the “Fixed Share Arrangement Agreement”). Acreage and Canopy Growth implemented the plan of arrangement set forth in the Fixed Share Arrangement Agreement on September 23, 2020 (the “Fixed Share Arrangement”) pursuant to which, among other things, the Canopy Growth acquired the option (the “Fixed Share Call Option”) to acquire all of the issued and outstanding Fixed Shares (the “Fixed Share Acquisition”), the completion of which remains subject to certain closing conditions, including, among other things, the satisfaction or waiver of the Purchaser Acquisition Closing Conditions (as defined in the Fixed Share Arrangement Agreement).

Acreage, Canopy Growth and Canopy USA are also parties to an arrangement agreement, dated October 24, 2022, as amended on March 17, 2023, May 31, 2023, August 31, 2023, October 31, 2023, December 29, 2023, March 29, 2024, April 25, 2024 and May 8, 2024 (the “Floating Share Arrangement Agreement”), pursuant to which Canopy USA has agreed to acquire all of the issued and outstanding Class D subordinate voting shares of Acreage (the “Floating Shares”) pursuant to a plan of arrangement set out in the Floating Share Arrangement Agreement (the “Floating Share Arrangement”). The completion of the

Floating Share Arrangement (the “Floating Share Acquisition” and together with the Fixed Share Acquisition, the “Acquisitions”) is subject to certain closing conditions, including, among other things, the satisfaction or waiver of the closing conditions contained in the Fixed Share Arrangement Agreement.

On June 3, 2024, the Fixed Share Call Option was exercised in accordance with the terms of the Fixed Share Arrangement Agreement. Upon closing of the Acquisitions, Canopy USA will own 100% of the Fixed Shares and Floating Shares and in connection therewith, Acreage would become a wholly owned subsidiary of Canopy USA. Closing of the Acquisitions remain subject to all of the closing conditions set forth in the Fixed Share Arrangement Agreement and the Floating Share Arrangement Agreement. There can be no certainty, nor can the Company provide any assurance, that all conditions precedent will be satisfied or waived, which may result in the Acquisitions not being completed.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d)Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| |

| Amended and Restated Credit Agreement by and among High Street Capital Partners, LLC, as Borrower, Acreage Holdings, Inc, as Parent, the other loan parties that are parties hereto, the lenders that are party hereto, as lenders and VRT Agent LLC, as Agent dated as of June 3, 2024 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

|

| |

Date: June 7, 2024 | /s/ Corey Sheahan |

| Corey Sheahan |

| Executive Vice President, General Counsel and Secretary |

THESE SECURITIES AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE NOT AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THESE SECURITIES AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO REGISTRATION UNDER THE U.S. SECURITIES ACT, OR (2) PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT, AND, IN EACH CASE, IN COMPLIANCE WITH ALL APPLICABLE STATE SECURITIES LAWS, AFTER THE SELLER FURNISHES TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING OR OTHER EVIDENCE OF EXEMPTION IN FORM AND SUBSTANCE REASONABLY SATISFACTORY TO THE COMPANY TO SUCH EFFECT.

NON-RECOURSE UNSECURED CONVERTIBLE NOTE CERTIFICATE

ACREAGE HOLDINGS, INC.

(Incorporated under the laws of the Province of British Columbia)

CERTIFICATE NO. 2024-[-] PRINCIPAL AMOUNT: US$[-]

PURCHASE PRICE: US$[-]

ACREAGE HOLDINGS, INC. (the “Company”), for value received, hereby acknowledges itself indebted to [-] (hereinafter referred to as the “Noteholder”) from June [-], 2024 (the “Issue Date”) in accordance with the terms set out in Appendix A attached hereto (the “Terms and Conditions”). The Principal Amount (as specified above) is subject to a 16.67% original issue discount (an “OID”) equal to US$1,066,688.00. This Note shall not bear interest. This Note is issued upon and subject to the Terms and Conditions.

In the event that the Transaction (as defined herein) is completed prior to 5:00p.m. (Toronto Time) on the Maturity Date (as defined herein), the outstanding Principal Amount under this Note (as defined herein) will be deemed to be automatically converted, without any action on the part of the Noteholder, into Fixed Shares (as defined herein) (the “Conversion Shares”), at the Conversion Price (as defined herein), subject to adjustment as hereinafter provided, immediately prior to the completion of the Transaction (an “Automatic Conversion”).

Upon the occurrence of an Automatic Conversion, all obligations of the Company, under, pursuant to, or otherwise in connection with this Note, direct, indirect, contingent or otherwise (the “Obligations”) shall be satisfied by the Company issuing the Conversion Shares to the Noteholder in accordance with the terms of this Note. For greater certainty, and without limiting the previous sentence or any other terms of this Note pertaining to the discharge of the Obligations, upon the issuance of the Conversion Shares in accordance with the terms of this Note, all Obligations shall immediately and automatically be considered satisfied in full and this Note shall be considered terminated without the requirement for any further action by, or notice to, any Person.

If the Transaction has not closed by the Maturity Date, and provided that the transfer of this Note has been completed upon the exercise of the Put Right (as defined herein) in accordance with the terms of the Put Agreement (as defined herein), on the 30th day following the Maturity Date, this Note shall thereafter only represent an unsecured payment obligation of the Principal Amount of this Note by Company. In the event that the Transaction has not closed on or prior to the Maturity Date, and the Put Right has not been exercised, this Note shall represent a right to receive an indeterminate number of Fixed Shares so long as the Put Right remains unexercised. Prior to the exercise of the Put Right and the transfer of this Note in accordance with the terms of the Put Agreement, nothing is intended to create, nor shall it be construed as creating, a payment obligation of the Company in respect of this Note.

All non-recourse unsecured convertible notes issued pursuant to the Offering, all of which shall be on substantially similar terms, as amended from time to time in an aggregate principal of US$12,000,000, are collectively referred to in this Note as the “Notes”.

[Remainder of page intentionally left blank. Signature page follows.]

IN WITNESS WHEREOF, the Company has caused this Note to be issued under the signature of a properly authorized officer of the Company.

DATED for reference this [-]th day of June, 2024.

| | | | | |

ACREAGE HOLDINGS, INC. |

|

|

Per: |

|

| Authorized Signing Officer |

[Note Certificate – Signature Page]

ACKNOWLEDGED AND AGREED this [-]th day of June, 2024.

| | | | | |

[-] |

|

|

Per: |

|

| Authorized Signing Officer |

[Note Certificate – Noteholder Acknowledgement]

APPENDIX A

TERMS AND CONDITIONS FOR NOTE

Article 1

DEFINITIONS AND INTERPRETATION

1.1Definitions

In this Note, unless there is something in the subject matter or context inconsistent therewith, the following words and terms shall have the meanings set out below.

(a)“Applicable Securities Laws” means, collectively, means, the Canadian Securities Laws, the U.S. Securities Laws and all applicable securities laws in each of the jurisdictions in which the Notes (and the securities underlying the Notes) are issued and acquired and the respective rules and regulations thereunder, together with applicable published policy statements, instruments, notices, orders and rulings of the securities regulatory authorities in such jurisdictions.

(b)“Automatic Conversion” shall have the meaning set forth on the face page of this Note Certificate.

(c)“Business Day” means a day, other than a Saturday, a Sunday or a day on which chartered banks are not open for business in Toronto, Ontario or New York, New York.

(d)“Canadian Securities Laws” means collectively, the applicable securities laws of each of the provinces and territories of Canada, their respective regulations, rulings, rules, orders (including blanket orders and discretionary orders), instruments (including national and multilateral instruments), fee schedules and prescribed forms thereunder, the applicable policy statements issued by the Securities Commissions or similar authority thereunder and the rules and policies of the Exchange.

(e)“Canopy” means Canopy Growth Corporation, a corporation organized under the federal laws of Canada.

(f)“Canopy Shares” means common shares in the capital of Canopy as constituted on the date hereof.

(g)“Canopy USA” means Canopy USA, LLC, a limited liability company existing under the laws of State of Delaware.

(h)“Company” means Acreage Holdings, Inc., and its successors and assigns.

(i)“Conversion Date” shall mean the date that the Automatic Conversion occurs, being the date that the Transaction is completed.

(j)“Conversion Price” means the price per Fixed Share that, immediately prior to giving effect to the Transaction, will result in the Holder holding that number of Canopy Shares having a value equal to the Principal Amount of this Note as of the Business Day prior to closing of the Transaction, which shall be the price per Fixed Share determined by multiplying (i) the Exchange Ratio (as such term is defined in the Fixed Share Arrangement Agreement) as the same shall be adjusted pursuant to the Fixed Share Arrangement by, (ii) the Fair Market Value (as such term is defined in the Fixed Share Arrangement Agreement) of the Canopy Shares on the Business Day prior to the closing of the Transaction after giving effect to the conversion of the Notes and the determination of the number of Warrants issued pursuant to the Offering;

(k)“Conversion Shares” means the Fixed Shares issuable upon the conversion of the Note.

(l)“Current Market Price” of the Fixed Shares at any date means the VWAP during the period of any 30 consecutive trading days ending not more than five (5) business days before such date; provided that if the Fixed Shares are not then listed on any Exchange, then the Current Market Price shall be determined by such firm of independent chartered accountants as may be selected by the Company, acting reasonably, the reasonable fees and expenses of which shall be paid by the Company.

(m)“Fixed Share” means a Class E subordinate voting share in the capital of the Company as constituted on the date hereof.

(n)“Fixed Share Arrangement” means an arrangement under Section 288 of the Business Corporations Act (British Columbia) on the terms and subject to the conditions set out in the Fixed Share Arrangement Agreement, which became effective on September 23, 2020.

(o)“Fixed Share Arrangement Agreement” means the arrangement agreement dated as of April 18, 2019, as amended on May 15, 2019, September 23, 2020 and November 17, 2020, between Canopy and the Company, including the schedules and exhibits thereto, as the same may be further amended, supplemented or restated.

(p)“Exchange” means the Canadian Securities Exchange, or such other stock exchange on which the Fixed Shares may, from time to time, principally trade, or if the Fixed Shares are not listed on any stock exchange, then on the over-the-counter market.

(q)“Issue Date” means the date specified on the face page of this Note Certificate.

(r)“Law” includes any law (including common law and equity), statute, treaty, regulation, rule, ordinance, order, injunction, writ, decree or award of any Official Body.

(s)“Maturity Date” means the day that is 15 months from the Issue Date.

(t)“Note” means this non-recourse unsecured convertible Note, as supplemented, amended or otherwise modified, renewed or replaced from time to time.

(u)“Notes” has the meaning specified on the face page of this Note Certificate.

(v)“Noteholder” has the meaning specified on the face page of this Note Certificate.

(w)“Obligations” has the meaning specified on the face page of this Note Certificate.

(x)“Offering” means the offering by the Company of 12,000 Units at a price of US$833.33 per Unit.

(y)“Official Body” means any government or political subdivision or any agency, authority, bureau, central bank, monetary authority, commission, department or instrumentality thereof, or any court, tribunal or arbitrator, whether foreign or domestic.

(z)“OID” has the meaning specified on the face page of this Note Certificate.

(aa)“OTCQX” means the OTCQX Best Market by OTC Markets Group.

(ab)“Person” means an individual, firm, corporation, syndicate, partnership, trust, association, unincorporated organization, joint venture, investment club, government or agency or political subdivision thereof and every other form of legal or business entity of whatsoever nature or kind.

(ac)“Principal Amount” means the principal amount outstanding under this Note from time to time which, for the avoidance of doubt, is presented following the capitalization and addition of the OID.

(ad)“Put Agreement” means the put agreement between the original Holder of this Note and Canopy USA dated as of the Issue Date.

(ae)“Put Right” means the right of the original Holder of this Note to require Canopy USA to acquire, among other things, this Note in accordance with the terms of the Put Agreement;

(af)“Regulation S” means Regulation S under the U.S Securities Act.

(ag)“Securities Commissions” means, collectively, the applicable securities commission or other securities administrator or regulatory authority in each of the provinces and territories of Canada.

(ah)“Toronto Time” means the local time in the City of Toronto, Ontario, Canada.

(ai)“Transaction” means the acquisition by Canopy or Canopy USA, as the case may be, of all of the outstanding Fixed Shares in accordance with the Fixed Share Arrangement.

(aj)“Unit” means a unit of the Company issued pursuant to the Offering, with each unit being comprised of: (i) a Note having a principal amount of US$1,000; and (ii) Warrants.

(ak)“U.S. Person” has the meaning ascribed to it in item 902(k) of Regulation S.

(al)“U.S. Securities Act” means the United States Securities Act of 1933, as amended.

(am)“U.S. Securities Laws” means the U.S. Securities Act, the United States Securities Exchange Act of 1934, as amended, and all rules and regulations promulgated thereunder and the applicable securities (Blue Sky) laws of the states of the United States and all rules and policies of the OTCQX.

(an)“United States”, or “U.S.” means the United States of America, its territories and possessions and any state of the United States, and the District of Columbia.

(ao)“Warrants” means the share purchase warrants forming part of the Units, with each warrant exercisable to acquire one Fixed Share at a price per Fixed Share equal to the Exchange Ratio (as such term is defined in the Fixed Share Arrangement Agreement) as the same shall be adjusted pursuant to the Fixed Share Arrangement multiplied by the Fair Market Value (as such term is defined in the Fixed Share Arrangement Agreement) of the Canopy Shares on the Business Day prior to the closing of the Transaction (subject to a minimum price of US$0.375 in the event the Put Right is exercised), subject to completion of the Transaction at any time on or before the date which is 60 months after the Issue Date.

1.2Interpretation

For the purposes of this Note, except as otherwise expressly provided herein:

(a)The words “herein”, “hereof”, and “hereunder” and other words of similar import refer to this Note as a whole and not to any particular Article, clause, subclause or other subdivision or Appendix.

(b)A reference to an Article means an Article of this Note and the symbol Section followed by a number or some combination of numbers and letters refers to the section, paragraph or subparagraph of this Note so designated.

(c)The headings are for convenience only, do not form a part of this Note and are not intended to interpret, define or limit the scope, extent or intent of this Note or any of its provisions.

(d)The word “including”, when following a general statement, term or matter, is not to be construed as limiting such general statement, term or matter to the specific items or matters set forth or to similar items or matters (whether or not qualified by non-limiting language such as “without limitation” or “but not limited to” or

words of similar import) but rather as permitting the general statement or term to refer to all other items or matters that could reasonably fall within its possible scope.

(e)Time will be of the essence hereof.

(f)Words importing the masculine gender include the feminine or neuter, words in the singular include the plural, words importing a corporate entity include individuals, and vice versa.

Article 2

NOTE

2.1Principal Amount

The Principal Amount will be subject to Automatic Conversion until 5:00 p.m. (Toronto Time) on the Maturity Date pursuant to the terms set forth in Section 4.1. The Principal Amount will not bear interest.

2.2Non-Recourse

Subject to Section 2.3 and Section 4.1, as applicable, this Note does not represent a right or entitlement of the Noteholder to payment of any amounts whatsoever by the Company, and without limiting the generality of the foregoing, the Noteholder will have no claim to repayment of the Principal Amount from the Company under the Note. Subject to Section 2.3 and Section 4.1, as applicable, this Note only represents the right of the Noteholder to convert the Principal Amount hereunder into Fixed Shares in accordance with the terms of Section 4.1 hereof prior to the Maturity Date and any such conversion of the Principal Amount into Fixed Shares shall be the Noteholder’s only recourse against the Company in respect of such Principal Amount outstanding from time to time hereunder and all other Obligations.

2.3Non-Convertible Unsecured Debt

Notwithstanding anything to the contrary contained herein, if the Transaction has not closed by the Maturity Date, and provided that the transfer of this Note has been completed upon the exercise of the Put Right in accordance with the terms of the Put Agreement, on the 30th day following the Maturity Date, this Note shall thereafter only represent only an unsecured payment obligation of the Principal Amount of this Note by Company. For clarity, if this Note has been transferred upon the exercise of the Put Right in accordance with the terms of the Put Agreement, the Noteholder shall thereafter have no entitlement whatsoever to convert the Principal Amount into Conversion Shares or any other securities of the Company and its sole recourse against the Company shall be for the payment of the Principal Amount of the Note outstanding from time to time.

Article 3

COVENANTS

3.1Covenants of the Company

The Company covenants and agrees with the Noteholder as follows, unless otherwise consented to in writing by the Noteholder:

(a)Reservation of Fixed Shares. The Company shall at all times have reserved for issuance out of its authorized capital a sufficient number of Fixed Shares to satisfy its obligations to issue and deliver Conversion Shares upon the due conversion of the Note in accordance with the terms of Section 4.1 hereof.

(b)Approvals and Filings. The Company shall make reasonable commercial efforts, in connection with the execution and delivery of this Note and the possible conversion of the Note into Conversion Shares, to obtain any and all statutory and regulatory approvals required to effect and complete the same and shall file

all notices, reports and other documents required to be filed by or on behalf of the Company pursuant to Applicable Securities Laws in respect thereof.

(c)Resale Restrictions. This Note and all Conversion Shares issued to the Noteholder upon conversion of the Note or any part thereof from time to time will be subject to resale restrictions imposed under Applicable Securities Laws and applicable federal and “blue sky” securities laws of the United States and the rules of regulatory bodies having jurisdiction.

(d)Restrictions in U.S. This Note and the Conversion Shares deliverable upon conversion hereof have not been and will not be registered under the U.S. Securities Act, or the securities laws of any state of the United States. This Note may not be converted in the United States, or by or for the account or benefit of a U.S. Person or a Person in the United States, unless (i) the Conversion Shares are registered under the U.S. Securities Act and the applicable laws of any such state, or (ii) an exemption from such registration requirements is available.

(e)Certificate Legend. A legend will be placed on the certificates or DRS advice statements representing the Fixed Shares issued on conversion of the Note denoting the restrictions on transfer imposed by Applicable Securities Laws, if applicable, including but not limited to the following legends:

THESE SECURITIES HAVE NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE "U.S. SECURITIES ACT"), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THESE SECURITIES MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO REGISTRATION UNDER THE U.S. SECURITIES ACT, OR (2) PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT, AND, IN EACH CASE, IN COMPLIANCE WITH ALL APPLICABLE STATE SECURITIES LAWS, AFTER THE SELLER FURNISHES TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING OR OTHER EVIDENCE OF EXEMPTION IN FORM AND SUBSTANCE REASONABLY SATISFACTORY TO THE COMPANY TO SUCH EFFECT.

(f)Canadian Securities Laws. Conversion Shares issued to the Noteholder upon conversion of this Note or any part thereof shall be made pursuant to an exemption from the prospectus requirements under Applicable Securities Laws.

(g)Exchange Approvals. To the extent that any adjustment to the Conversion Price or the number of Conversion Shares issuable upon the due conversion of this Note is subject to the prior approval of the Exchange, the Company shall, (i) use its commercially reasonable efforts to obtain such approval in a timely manner, in consultation with the Noteholder, and (ii) keep the Noteholder, or its agent, reasonably updated and informed with respect to such approval process.

Article 4

CONVERSION OF NOTE

4.1Automatic Conversion

The outstanding Principal Amount of this Note will be subject to Automatic Conversion, without any action on the part of the Noteholder, into Conversion Shares immediately prior to the completion of the Transaction. The Conversion Shares issued in connection with the Automatic Conversion shall be subject to the terms of the Fixed Share Arrangement. Upon the occurrence of an Automatic Conversion, the Noteholder shall be noted in the registrar of the Company as the registered holder (with the name and address specified on the face page of this Note) of such number of Conversion Shares calculated by dividing the Principal Amount by the Conversion Price, which Conversion Shares shall for all purposes be and be deemed to be outstanding as fully paid and non-assessable, provided however that the Noteholder shall not receive, nor be entitled to receive, any DRS advice statement(s) or

certificate(s) evidencing such Conversion Shares. The Conversion Shares issuable in accordance with the Automatic Conversion shall be subject to, and treated in accordance with, the Fixed Share Arrangement and the Transaction. Upon the issuance of the Conversion Shares in accordance with the terms of this Note, all Obligations shall immediately and automatically be considered satisfied in full and this Note shall be considered terminated without the requirement for any further action by, or notice to, any Person.

4.2No Requirement to Issue Fractional Shares

The Company shall not be required to issue fractional Conversion Shares upon the conversion of the Note. To the extent that a Noteholder is entitled to receive on the conversion or partial conversion of the Principal Amount of the Note hereunder a fraction of a Conversion Share, such number of Conversion Shares shall be rounded down to the nearest whole number of Conversion Shares.

Article 5

OTHER AGREEMENTS

5.1Withholding Taxes

If the Company is obliged to withhold any amount on account of present or future taxes, duties, assessments or other governmental charges required by Law, the Company shall make such withholding or deduction by reducing the number of Conversion Shares issuable upon conversion of the Principal Amount by an amount equal to the product obtained by multiplying the (i) amount of the withholding amount by (ii) the applicable Conversion Price.

5.2Amendment and Waiver

The Noteholder in its absolute discretion may at any time and from time to time by written notice waive any breach by the Company of any of its covenants or agreements herein. No failure or delay on the part of the Noteholder to exercise any right, remedy or power given herein or by any other existing or future agreement or now or hereafter existing by statute, at law or in equity will operate as a waiver thereof, nor will any single or partial exercise of any such right, remedy or power preclude any other exercise thereof or the exercise of any other such right, remedy or power, nor will any waiver by the Noteholder be deemed to be a waiver of any subsequent, similar or other event. Neither this Note nor any provision hereof may be amended, waived, discharged or terminated except by a document in writing executed by the party against whom enforcement of the amendment, waiver, discharge or termination is sought.

5.3Notices and Other Instruments

All notices, demands or other communications to be given to the Noteholder by the Company under this Note shall be delivered by hand, courier, ordinary prepaid mail or electronic mail and, if delivered by hand, shall be deemed to have been given on the delivery date, if delivered by ordinary prepaid mail shall be deemed to have been given on the fifth day following the delivery date and, if sent by electronic mail, on the date of transmission if sent before 5:00 p.m. (local time where the notice is received) on a Business Day or, if such day is not a Business Day, on the first Business Day following the date of transmission.

Notices to the Noteholder shall be addressed to the address of the Noteholder set out in this Note.

Notices to the Company shall be addressed to:

Acreage Holdings, Inc.

[-]

and a copy (which shall not constitute notice) to:

DLA Piper (Canada) LLP

[-]

Each of the Company and the Noteholder may change its address for service by notice in writing to the other of them specifying its new address for service under this Note.

5.4Maximum Rate

Notwithstanding any other provisions of this Note or any other agreement, the maximum value of the Fixed Shares issuable to the Noteholder under this Note (including taking into account OID and any discount on the value of the Fixed Shares) shall not exceed the maximum allowable return permitted under the laws of the Province of Ontario and the federal laws of Canada applicable therein, and the provisions of this Note and all other existing and future agreements are hereby modified to the extent necessary to effect the foregoing.

5.5Successors and Assigns

This Note shall be binding upon the Company and its successors. This Note is neither transferable nor assignable by either party, provided that the Noteholder may, upon the occurrence on or following the exercise of the Put Right, transfer or assign its right or interest in this Note to Canopy USA by delivering a duly completed transfer notice as set out in Appendix B hereto to the Company.

5.6Severability

The provisions of this Note are intended to be severable. If any provision of this Note shall be deemed by any court of competent jurisdiction or held to be invalid or void or unenforceable in whole or in part in any jurisdiction, such provision shall, as to such jurisdiction, be ineffective to the extent of such invalidity or unenforceability without in any manner affecting the validity or enforceability thereof in any other jurisdiction or the remaining provisions hereof in any jurisdiction.

5.7Modification

From time to time the Company may modify the terms and conditions hereof for any purpose not inconsistent with the terms hereof, including the correction or rectification of any ambiguities, defective provisions, errors or omissions herein.

5.8Governing Law

This Note shall be governed by and construed in accordance with the laws of the Province of Ontario and the federal laws of Canada applicable therein.

5.9Currency

Unless otherwise specified in this Note Certificate, all references to currency, monetary values and dollars set forth herein shall mean United States (U.S.) dollars and all payments hereunder shall be made in United States dollars.

5.10Mutilation, Loss, Theft or Destruction

In case this Note shall become mutilated or be lost, stolen or destroyed, the Company shall execute and deliver a new non-recourse unsecured convertible Note having the same date of issue upon surrender and cancellation of the mutilated Note, or in case this Note is lost, stolen or destroyed, in lieu of and in substitution for the same. In case of loss, theft or destruction, the Person applying for a substituted Note shall furnish to the Company such evidence of such loss, theft or destruction as shall be satisfactory to the Company (acting reasonably), shall furnish an indemnity satisfactory to the Company (acting reasonably) (but in any event in an

amount not exceeding the Principal Amount then outstanding) and shall pay all reasonable expenses incidental to the issuance of any substituted Note.

5.11Counterparts and Electronic Execution

This Note Certificate may be executed in two or more counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument. The Company and the Noteholder agree that the electronic signature of this Note is intended to authenticate this document and to have the same force and effect as a manual signature. Electronic signature means any electronic symbol, or process attached to or logically associated with a record and executed and adopted by a party with the intent to sign such record, including email electronic signatures or DocuSign. Delivery of an executed copy of this Note Certificate by electronic transmission constitutes valid and effective delivery.

[Remainder of page intentionally left blank.]

APPENDIX B

TRANSFER FORM

TO: ACREAGE HOLDINGS, INC. (the “Company”)

FOR VALUE RECEIVED, the undersigned transferor hereby sells, assigns and transfers unto

the Note registered in the name of the undersigned transferor represented by the attached Note Certificate.

The new Note Certificate representing the Note transferred hereby (please check one):

(a) should be sent by first class mail to the following address:

(b) should be held for pick up at the office of the Company at which the Note Certificate is deposited.

THE UNDERSIGNED TRANSFEROR HEREBY CERTIFIES AND DECLARES that the Note is being transferred in compliance with the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), including Regulation S thereunder, and are not being offered, sold or transferred to, or for the account or benefit of, a “U.S. person” (as defined in Regulation S under the U.S. Securities Act) or a person within the United States unless (i) registered under the U.S. Securities Act and any applicable state securities laws or (ii) an exemption from such registration is available.

DATED this day of , .

Signature of Registered Holder Signature Guarantee

(Transferor)

Print name of Registered Holder

Address

NOTE: The signature on this Transfer Form must correspond with the name as recorded on the face of the Note Certificate in every particular without alteration or enlargement or any change whatsoever or this Transfer Form must be signed by a duly authorized trustee, executor, administrator, or attorney of the Holder or a duly authorized signing officer in the case of a corporation. If this Transfer Form is signed by any of the foregoing, or any person acting in a fiduciary or representative capacity, the Note Certificate must be accompanied by evidence of authority to sign.

THESE SECURITIES AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE NOT AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THESE SECURITIES AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO REGISTRATION UNDER THE U.S. SECURITIES ACT, OR (2) PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT, AND, IN EACH CASE, IN COMPLIANCE WITH ALL APPLICABLE STATE SECURITIES LAWS, AFTER THE SELLER FURNISHES TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING OR OTHER EVIDENCE OF EXEMPTION IN FORM AND SUBSTANCE REASONABLY SATISFACTORY TO THE COMPANY TO SUCH EFFECT.

WARRANT TO PURCHASE

CLASS E SUBORDINATE VOTING SHARES OF ACREAGE HOLDINGS, INC.

Certificate Number: W-2024-[]

Face Value: US$[] [

THIS IS TO CERTIFY THAT for valuable consideration received by the undersigned, [Name, Address of Holder] (the “Holder”) is the registered holder of the number of Class E subordinate voting shares purchase warrants (each a “Warrant”) to be determined in accordance with Section 2 of Appendix A hereof, being the quotient obtained by dividing US$[] by the Exercise Price (as defined in Appendix A hereof). Each Warrant shall entitle the Holder to subscribe for and purchase, subject to the terms hereof, one Class E subordinate voting share (a “Share”) in the capital of Acreage Holdings, Inc. (the “Company”) at the Exercise Price at any time and from time to time from the Transaction Date until Expiry Date, all subject to adjustment as hereinafter provided in this warrant certificate, including for greater certainty the Appendices hereto (the “Warrant Certificate”). The Warrants will become void and the unexercised portion of the subscription rights represented by this Warrant Certificate will expire and terminate on the Expiry Date.

Unless otherwise specified in this Warrant Certificate, all references to currency, monetary values and dollars set forth herein shall mean United States (U.S.) dollars and all payments hereunder shall be made in United States dollars.

These Warrants do not entitle the Holder to any rights or interest whatsoever as a shareholder of the Company or any other rights or interests except as expressly provided in this Warrant Certificate.

If this Warrant Certificate or any replacement hereof becomes stolen, lost, mutilated or destroyed, the Company shall, on such terms as it may in its discretion impose, acting reasonably, issue and deliver a new certificate, in form identical hereto but with appropriate changes, representing any unexercised portion of the subscription rights represented hereby to replace the certificate so stolen, lost, mutilated or destroyed.

By acceptance hereof, the Holder hereby represents and warrants to the Company that the Holder is acquiring these Warrants as principal for its own account and not for the benefit of any other person.

This Warrant Certificate shall enure to the benefit of, and shall be binding upon, the Holder and the Company and their respective successors.

IN WITNESS WHEREOF the Company has caused this Warrant Certificate to be issued under the signature of a properly authorized officer of the Company.

DATED as of the day of June, 2024.

| | | | | |

ACREAGE HOLDINGS, INC. |

|

| By: | |

| Authorized Signatory |

|

APPENDIX A

Additional Terms and Conditions of this Warrant Certificate

1.Definitions: For the purposes of this Warrant, unless there is something in the subject matter or context inconsistent therewith, the words and terms defined below shall have the respective meanings specified therefor in this Section 1:

(a)“Adjustment Period” means the period commencing on the Transaction Date and ending on the Expiry Date;

(b)“Business Day” means a day, other than a Saturday, a Sunday or a day on which chartered banks are not open for business in Toronto, Ontario or New York, New York;

(c)“Canopy” means Canopy Growth Corporation, a corporation organized under the federal laws of Canada;

(d)“Canopy Shares” means common shares in the capital of Canopy as constituted on the date hereof;

(e)“Canopy USA” means Canopy USA, LLC, a limited liability company existing under the laws of State of Delaware;

(f)“Common Share Equivalents” means any securities of the Company which would entitle the holder thereof to acquire, at any time, Fixed Shares, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is, at any time, convertible into or exchangeable for, or otherwise entitles the holder thereof to receive, Fixed Shares or other securities that entitle the holder to receive, directly or indirectly, Fixed Shares;

(g)“Convertible Security” means a security convertible into or exchangeable for Shares;

(h)“Current Market Price” of the Shares at any date means the VWAP during the period of any 30 consecutive trading days ending not more than five (5) Business Days before such date; provided that if the Shares are not then listed on any Exchange, then the Current Market Price shall be determined by such firm of independent chartered accountants as may be selected by the Company, acting reasonably, the reasonable fees and expenses of which shall be paid by the Company;

(i)“director” means a director of the Company for the time being and, unless otherwise specified herein, a reference to action “by the directors” means action by the directors of the Company as a board or, whenever empowered, action by any committee of the directors of the Company;

(j)“Exchange” means the Canadian Securities Exchange or such other principal stock exchange on which the Shares are listed and posted for trading, or if the Shares are not listed on any stock exchange, then on the over-the-counter market;

(k)“Exercise Price” means the Exchange Ratio (as such term is defined in the Fixed Share Arrangement Agreement) as the same shall be adjusted pursuant to the Fixed Share Arrangement multiplied by the Fair Market Value (as such term is defined in the Fixed Share Arrangement Agreement) of the Canopy Shares on the Business Day prior to the

closing of the Transaction; provided, however, that in the event that the Put Right is exercised, the Exercise Price shall be not less than US$0.375;

(l)“Expiry Date” means June 5, 2029;

(m)“Fixed Share Arrangement” means an arrangement under Section 288 of the Business Corporations Act (British Columbia) on the terms and subject to the conditions set out in the Fixed Share Arrangement Agreement, which became effective on September 23, 2020;

(n)“Fixed Share Arrangement Agreement” means the arrangement agreement dated as of April 18, 2019, as amended on May 15, 2019, September 23, 2020 and November 17, 2020, between Canopy and the Company, including the schedules and exhibits thereto, as the same may be further amended, supplemented or restated;

(o)“Put Agreement” means the put agreement among the Holder and Canopy USA dated as of the date of issue of this Warrant Certificate;

(p)“Put Notice Date” means the date that Canopy USA and the Company receives a Put Notice pursuant to and in accordance with the terms of the Put Agreement;

(q)“Put Notice” means a notice delivered by the Holder to Canopy USA and the Company in accordance with the terms of the Put Agreement;

(r)“Put Right” has the meaning ascribed thereto in the Put Agreement;

(s)“trading day” with respect to an Exchange means a day on which such Exchange is open for business;

(t)“Transaction” means the acquisition by Canopy or Canopy USA of the issued and outstanding Shares pursuant to and in accordance with the Fixed Share Arrangement;

(u)“Transaction Date” means the date that Canopy or Canopy USA, as the case may be, acquires of all of the issued and outstanding Shares in accordance with the Fixed Share Arrangement; and

(v)“VWAP” means the volume weighted average trading price of the Shares on the Exchange, calculated by dividing the total value by the total volume of Shares traded for the relevant period.

2.Number of Warrants: The number of warrants represented by this Warrant Certificate shall be the quotient obtained by dividing US$[] by the Exercise Price, subject to adjustment in accordance with the terms hereof. For clarity and notwithstanding anything to the contrary contained herein, in the event that the Transaction Date does not occur prior to the Expiry Date, the Warrants will become void and the subscription rights represented by this Warrant Certificate will expire and terminate on the Expiry Date.

3.Partial Exercise: The Holder may subscribe for and purchase less than the full number of Shares which the Holder is entitled to purchase hereunder on delivery of this Warrant Certificate. In the event that the Holder subscribes for and purchases less than the full number of Shares entitled to be subscribed for and purchased under this Warrant Certificate prior to the Expiry Date, the Company shall issue a new Warrant Certificate to the Holder in the same form as this Warrant Certificate representing the right to purchase Shares not previously purchased with appropriate changes.

4.Exercise Mechanics:

(1)Generally. The Warrants may be exercised by the Holder in whole or in part, at any time or times on or after the Transaction Date and on or before the earlier of Expiry Date by surrender or delivery, as applicable, to the Company: (a) this Warrant Certificate, together with (b) a duly completed and executed subscription form in the form attached as Appendix B to this Warrant Certificate (the “Subscription Form”), and (c) payment in full of the Exercise Price in respect of the Shares subscribed for by certified cheque, bank draft or money order in lawful money of the United States payable to the Company or by transmitting same day funds in lawful money of the United States by wire to such account as the Company shall direct the Holder.

(2)Exercise. On the date upon which the Company receives this Warrant Certificate, the subscription form, and payment as aforesaid (the “Exercise Date”), the Shares subscribed for shall be deemed to be issued as fully paid and non-assessable shares and the Holder shall be deemed for all purposes to be the holder of record of the number of Shares to be so issued, unless the transfer books of the Company shall be closed on such Exercise Date, in which event the Shares so subscribed for shall be deemed to be issued, and the Holder shall be deemed to have become the holder of record of such Shares, on the date on which such transfer books are reopened.

5.Delivery of Shares: On or before the second trading day following the date of exercise as aforesaid (such date, the “Share Delivery Date”), the Company shall cause to be delivered to the Holder, by the Share Delivery Date, a DRS advice statement(s) or certificate(s) evidencing such Shares subscribed for and purchased by the Holder hereunder affixed with all required legends, and a replacement Warrant Certificate. The Company and the Holder agree that the delivery requirement described in the preceding sentence may be satisfied by either: (i) physical delivery of certificate(s) to the address specified in the Subscription Form, or (ii) electronic delivery of DRS advice statement(s) to the e-mail address specified in the Subscription Form.

6.No Fractional Shares: The Company shall not be required to issue fractional Shares upon the exercise of the Warrants evidenced hereby. If any fractional interest in a Share would be deliverable upon the exercise of the Warrants evidenced hereby, the Company shall, in lieu of delivering any certificate for such fractional interest, satisfy such fractional interest by rounding down the number of Shares issuable upon the exercise of the Warrants to the nearest whole number.

7.Covenants, Representations and Warranties: The Company hereby covenants and agrees that it is authorized to issue and that it will cause the Shares from time to time subscribed for and purchased in the manner provided in this Warrant Certificate and the certificate or certificates representing such Shares to be issued and that prior to the Expiry Date, it will reserve and there will remain unissued, out of the authorized capital of the Company, a sufficient number of Shares to satisfy the right of purchase provided in this Warrant Certificate, as such right of purchase may be adjusted pursuant to Section 9 hereof.

The Company hereby represents and warrants that all Shares which are issued upon the exercise of the right of purchase provided in this Warrant Certificate, upon full payment of the Exercise Price therefor, shall be and be deemed to be fully paid and non-assessable Shares, free from all taxes, liens and charges with respect to the issue thereof.

The Company hereby represents and warrants that this Warrant Certificate is a valid and enforceable obligation of the Company, enforceable in accordance with the provisions of this Warrant Certificate.

The Company further covenants that its issuance of this Warrant Certificate shall constitute full authority to its officers who are charged with the duty of issuing the necessary Shares upon the exercise of the purchase rights under this Warrant Certificate. Each of the Company and the Holder will take all such reasonable actions as may be necessary to assure that such Shares may be issued as provided herein without violation of any applicable law or regulation to which such party is subject, as applicable, or of any requirements of

the Exchange upon which the Shares may be listed. The Company covenants that all Shares which may be issued upon the exercise of the purchase rights represented by this Warrant Certificate will, upon due exercise of the purchase rights represented by this Warrant Certificate and payment in full for such Shares in accordance herewith, be duly authorized, validly issued, fully paid and non-assessable and free from all taxes, liens and charges created by the Company in respect of the issue thereof (other than taxes in respect of any transfer occurring contemporaneously with such issue).

Except as set out in this Warrant Certificate or otherwise to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its certificate of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant Certificate, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of the Holder as set forth in this Warrant Certificate against impairment. Without limiting the generality of the foregoing, the Company will (i) take all such action as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable Shares upon the exercise of this Warrant Certificate and (ii) use commercially reasonable efforts to obtain all such authorizations, exemptions or consents required to be obtained by the Company from any public regulatory body having jurisdiction over the Company, as may be, necessary to enable the Company to perform its obligations under this Warrant Certificate.

8.U.S. Securities Laws Matters

(1)The Holder, by acceptance of this Warrant Certificate, agrees to comply in all respects with the provisions of this Section 8 and the restrictive legend requirements set forth on the face of this Warrant Certificate and further agrees that such Holder shall not offer, sell or otherwise dispose of these Warrants or any Shares to be issued upon exercise of these Warrants except under circumstances that will not result in a violation of the Securities Act of 1933, as amended (the “Securities Act”). Any certificate representing Shares issued upon exercise of these Warrants, or if the Shares are entered into a direct registration or other electronic book-entry only system and the Holder does not directly receive a certificate representing the Shares issued upon exercise of these Warrants, the written notice confirming issuance thereof, will bear the following legend:

THESE SECURITIES HAVE NOT AND WILL NOT BE REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THESE SECURITIES MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED EXCEPT (1) PURSUANT TO REGISTRATION UNDER THE U.S. SECURITIES ACT, OR (2) PURSUANT TO AN AVAILABLE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT, AND, IN EACH CASE, IN COMPLIANCE WITH ALL APPLICABLE STATE SECURITIES LAWS, AFTER THE SELLER FURNISHES TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING OR OTHER EVIDENCE OF EXEMPTION IN FORM AND SUBSTANCE REASONABLY SATISFACTORY TO THE COMPANY TO SUCH EFFECT.”

(2)In connection with the issuance of this Warrant Certificate, the Holder specifically represents, as of the date hereof, to the Company by acceptance of this Warrant Certificate as follows:

(a)The Holder is either (i) a “qualified institutional buyer”, as such term is defined in Rule 144A promulgated under the Securities Act of 1933, as amended (the “U.S. Securities Act”), or (ii) an “accredited investor” as defined in Rule 501(a) of Regulation D promulgated under the Securities Act. The Holder is acquiring this Warrant Certificate

and the Shares to be issued upon exercise hereof for investment for its own account and not with a view towards, or for resale in connection with, the public sale or distribution of this Warrant Certificate or the Shares, except pursuant to sales registered or exempted under the Securities Act.

(b)The Holder understands and acknowledges that this Warrant Certificate and the Shares to be issued upon exercise hereof are “restricted securities” under the federal securities laws inasmuch as they are being acquired from the Company in a transaction not involving a public offering and that, under such laws and applicable regulations, such securities may be resold without registration under the Securities Act only in certain limited circumstances. In addition, the Holder represents that it is familiar with Rule 144 under the Securities Act, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act.

(c)The Holder acknowledges that it can bear the economic and financial risk of its investment for an indefinite period and has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of the investment in the Warrant Certificate and the Shares. The Holder has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the offering of the Warrant and the business, properties, prospects and financial condition of the Company.

(d)The Holder is resident only at the address appearing on the face page of this Warrant and is acquiring the Warrants as principal for its own account and not for the benefit of any other person.

9.Adjustment of Subscription and Purchase Rights:

(1)Adjustments:

(a)The Exercise Price and the number of Shares issuable upon exercise of the Warrants shall be subject to adjustment from time to time in the events and in the manner provided as follows.

(b)If at any time during the Adjustment Period, the Company shall:

(i)fix a record date for the issue of, or issue, Shares or Convertible Securities to the holders of outstanding Shares by way of a stock dividend;

(ii)fix a record date for the distribution to, or make a distribution to, the holders of outstanding Shares payable in Shares or Convertible Securities;

(iii)subdivide, redivide or change the outstanding Shares into a greater number of Shares; or

(iv)consolidate, combine or reduce the outstanding Shares into a lesser number of Shares,

(any such event being hereinafter referred to as a “Common Share Reorganization”), the Exercise Price shall be adjusted on the earlier of the record date on which holders of Shares are determined for the purposes of the Common Share Reorganization and the effective date of the Common Share Reorganization to the amount determined by multiplying the Exercise Price in effect immediately prior to such record date or effective date, as the case may be, by a fraction:

(A)the numerator of which shall be the number of Shares outstanding on such record date or effective date, as the case may be, before giving effect to such Common Share Reorganization; and

(B)the denominator of which shall be the number of Shares which will be outstanding immediately after giving effect to such Common Share Reorganization (including in the case of a distribution of Convertible Securities, the number of Shares that would be outstanding had such securities been exchanged for or converted into Shares on such date).

To the extent that any adjustment in the Exercise Price occurs pursuant to this subsection 9(1)(b) as a result of the fixing by the Company of a record date for the distribution of Convertible Securities, the Exercise Price shall be readjusted immediately after the expiry of any relevant exchange or conversion right to the Exercise Price which would then be in effect based upon the number of Shares actually issued and remaining issuable after such expiry and shall be further readjusted in such manner upon the expiry of any further such right.

(c)If at any time during the Adjustment Period the Company shall fix a record date for the issue or distribution to the holders of all or substantially all of the outstanding Shares of rights, options or warrants pursuant to which such holders are entitled, during a period expiring not more than 45 days after the record date for such issue (such period being the “Rights Period”), to subscribe for or purchase Shares or Convertible Securities at a price per Share to the holder (or in the case of Convertible Securities, at an exchange or conversion price per Share) at the date of issue of such securities of less than 95% of the Current Market Price of the Shares on such record date (any of such events being called a “Rights Offering”), the Exercise Price shall be adjusted effective immediately after the record date for such Rights Offering to the amount determined by multiplying the Exercise Price in effect on such record date by a fraction:

(i)the numerator of which shall be the aggregate of

(A)the number of Shares outstanding on the record date for the Rights Offering, plus

(B)the quotient determined by dividing:

(I)either: (a) the product obtained by multiplying the number of Shares offered during the Rights Period pursuant to the Rights Offering by the price at which such Shares are offered, or, (b) the product obtained by multiplying the exchange, exercise or conversion price of the securities so offered by the maximum number of Shares which the holders of securities offered pursuant to the Rights Offering are entitled to receive upon the exchange, exercise, or conversion of Convertible Securities, as the case may be, by

(II)the Current Market Price of the Shares as of the record date for the Rights Offering; and

(ii)the denominator of which shall be the aggregate of the number of Shares outstanding on such record date plus the number of Shares offered pursuant to the Rights Offering (including in the case of the issue or distribution of

Convertible Securities, the maximum number of Shares into which such Convertible Securities may be exchanged, exercised or converted),

If by the terms of the rights, options, or warrants referred to in this subsection 9(1)(c), there is more than one purchase, conversion or exchange price per Share, the aggregate price of the total number of additional Shares offered for subscription or purchase, or the aggregate conversion or exchange price of the Convertible Securities so offered, shall be calculated for purposes of the adjustment on the basis of the lowest purchase, conversion or exchange price per Share, as the case may be. Any Shares owned by or held for the account of the Company shall be deemed not to be outstanding for the purpose of any such calculation. Such adjustment shall be made successively whenever such a record date is fixed.

To the extent that any adjustment in the Exercise Price occurs pursuant to this subsection 9(1)(c) as a result of the fixing by the Company of a record date for the issue or distribution of rights, options or warrants referred to in this subsection 9(1)(c), the Exercise Price shall be readjusted immediately after the expiry of any relevant exchange, conversion or exercise right to the Exercise Price which would then be in effect based upon the number of Shares actually issued and remaining issuable after such expiry and shall be further readjusted in such manner upon the expiry of any further such right.

(d)If at any time during the Adjustment Period there shall occur:

(i)a direct or indirect reclassification, reorganization or redesignation of the Shares, any change of the Shares into other shares or securities or any other capital reorganization involving the Shares other than a Common Share Reorganization in one or more related transactions;

(ii)a direct or indirect consolidation, amalgamation or merger of the Company with or into any other body corporate which results in a reclassification or redesignation of the Shares or a change of the Shares into other shares or securities in one or more related transactions, including the Transaction; or

(iii)the direct or indirect transfer, sale, assignment, conveyance or other disposition of all or substantially all of the assets of the Company to another company, entity or person in one or a series of related transactions;

(any of such events being herein called a “Capital Reorganization”), after the effective date of the Capital Reorganization the Holder shall be entitled to receive, and shall accept, for the same aggregate consideration, upon exercise of the Warrants, in lieu of the number of Shares which the Holder was theretofore entitled to purchase or receive upon the exercise of the Warrants, the kind and aggregate number of Shares and other securities or property resulting from the Capital Reorganization which the Holder would have been entitled to receive as a result of the Capital Reorganization if, on the effective date thereof, the Holder had been the registered holder of the number of Shares to which the Holder was theretofore entitled to purchase or receive upon the exercise of the Warrants. If necessary, as a result of any Capital Reorganization, appropriate adjustments shall be made in the application of the provisions of this Warrant Certificate with respect to the rights and interest thereafter of the Holder to the end that the provisions of this Warrant Certificate shall thereafter correspondingly be made applicable as nearly as may reasonably be possible in relation to any shares or other securities or property thereafter deliverable upon the exercise of this Warrant Certificate.

(e)If at any time during the Adjustment Period any adjustment or readjustment in the Exercise Price shall occur pursuant to the provisions of subsections 9(1)(b), 9(1)(c), 9(1)(d) or 9(1)(f) hereof, then the number of Shares purchasable upon the subsequent exercise of the Warrants shall be simultaneously adjusted or readjusted, as the case may be, by multiplying the number of Shares purchasable upon the exercise of the Warrants immediately prior to such adjustment or readjustment by a fraction which shall be the reciprocal of the fraction used in the adjustment or readjustment of the Exercise Price.

(f)If at any time during the Adjustment Period the Company shall fix a record date for the issue or distribution to the holders of the Shares of:

(i)shares of the Company of any class other than Shares;

(ii)rights, options or warrants to acquire Shares or securities exchangeable or exercisable for or convertible into Shares (other than pursuant to a Rights Offering);