0001533357false--04-30FY2024false0.00010.00010.000120000000200000002000000029253691913655600000000180304297298784000000001005830000015333572023-05-012024-04-300001533357us-gaap:SubsequentEventMemberdtii:SeriesDPreferredMember2024-06-012024-06-230001533357us-gaap:SubsequentEventMemberdtii:SeriesBPreferredMember2024-06-012024-06-020001533357us-gaap:SubsequentEventMember2024-06-012024-06-100001533357us-gaap:SubsequentEventMember2024-07-012024-07-220001533357us-gaap:SubsequentEventMember2024-07-110001533357us-gaap:SubsequentEventMember2024-07-012024-07-110001533357dtii:MerrillWMosesMember2024-04-300001533357dtii:WSMGAdvisorsMember2023-05-012024-04-300001533357dtii:MerrillWMosesMember2023-05-012024-04-300001533357dtii:RabInvestmentsMember2023-05-012024-04-300001533357dtii:CharlesCHooperMember2023-05-012024-04-300001533357dtii:EmacHandelsAgMember2023-05-012024-04-300001533357dtii:DeferredTaxAssetsMember2024-04-300001533357dtii:DeferredTaxAssetsMember2023-04-300001533357dtii:DeferredTaxAssetsMember2022-05-012023-04-300001533357dtii:DeferredTaxAssetsMember2023-05-012024-04-300001533357us-gaap:SeriesDPreferredStockMember2024-04-300001533357dtii:CommonStocksMember2022-05-012023-04-300001533357dtii:PreferredStocksMember2022-05-012023-04-300001533357dtii:CommonStocksMember2023-05-012024-04-3000015333572021-05-012022-04-300001533357dtii:ConvertibleNotePayableTwoMember2018-02-012018-02-160001533357dtii:ConvertibleNotePayable1Member2023-05-012024-04-300001533357dtii:SeriesBPreferredMember2023-04-300001533357dtii:SeriesBPreferredMember2022-05-012023-04-300001533357dtii:ConvertibleNotePayableFourMember2018-10-012018-10-040001533357dtii:ConvertibleNotePayableFourMember2018-10-040001533357dtii:ConvertibleNotePayableThreeMember2018-03-050001533357dtii:ConvertibleNotePayableTwoMember2018-02-160001533357dtii:ConvertibleNotePayable1Member2024-04-300001533357dtii:ConvertibleNotePayable1Member2016-03-1000015333572018-07-012018-07-1200015333572018-07-1200015333572018-07-0600015333572018-03-050001533357dtii:StarAnchorMember2024-04-300001533357dtii:EMACHandelsAGMember2024-04-300001533357dtii:StarAnchorMember2023-04-300001533357dtii:EMACHandelsAGMember2022-05-0100015333572018-07-012018-07-1800015333572022-07-012022-07-290001533357us-gaap:SeriesBPreferredStockMember2022-05-012023-04-300001533357us-gaap:SeriesBPreferredStockMember2023-05-012024-04-3000015333572022-05-012022-05-020001533357dtii:StockOptionsMember2024-04-300001533357dtii:StockOptionsMember2023-05-012024-04-300001533357dtii:LicenseAgreementMemberdtii:AmendmentDefinitiveAgreementMember2023-05-012024-04-300001533357dtii:LicenseAgreementMemberdtii:DefinitiveLicenseAndContractorAgreementMember2023-05-012024-04-300001533357dtii:LicenseAgreementMember2023-05-012024-04-300001533357dtii:LicenseAgreementMember2023-04-300001533357dtii:LicenseAgreementMember2024-04-300001533357dtii:InitialLicenseFeeMemberdtii:JulyFifteenMemberdtii:CCSMember2023-05-012024-04-300001533357dtii:InitialLicenseFeeMemberdtii:JulyFifteenMemberdtii:CCSMember2024-04-300001533357us-gaap:FairValueInputsLevel3Member2023-04-300001533357us-gaap:FairValueInputsLevel2Member2023-04-300001533357us-gaap:FairValueInputsLevel1Member2023-04-300001533357us-gaap:FairValueInputsLevel3Member2024-04-300001533357us-gaap:FairValueInputsLevel2Member2024-04-300001533357us-gaap:FairValueInputsLevel1Member2024-04-300001533357us-gaap:NoncontrollingInterestMember2024-04-300001533357us-gaap:RetainedEarningsMember2024-04-300001533357us-gaap:AdditionalPaidInCapitalMember2024-04-300001533357us-gaap:CommonStockMember2024-04-300001533357us-gaap:PreferredStockMember2024-04-300001533357us-gaap:NoncontrollingInterestMember2023-05-012024-04-300001533357us-gaap:RetainedEarningsMember2023-05-012024-04-300001533357us-gaap:AdditionalPaidInCapitalMember2023-05-012024-04-300001533357us-gaap:CommonStockMember2023-05-012024-04-300001533357us-gaap:PreferredStockMember2023-05-012024-04-300001533357us-gaap:NoncontrollingInterestMember2023-04-300001533357us-gaap:RetainedEarningsMember2023-04-300001533357us-gaap:AdditionalPaidInCapitalMember2023-04-300001533357us-gaap:CommonStockMember2023-04-300001533357us-gaap:PreferredStockMember2023-04-300001533357us-gaap:NoncontrollingInterestMember2022-05-012023-04-300001533357us-gaap:RetainedEarningsMember2022-05-012023-04-300001533357us-gaap:AdditionalPaidInCapitalMember2022-05-012023-04-300001533357us-gaap:PreferredStockMember2022-05-012023-04-300001533357us-gaap:CommonStockMember2022-05-012023-04-3000015333572022-04-300001533357us-gaap:NoncontrollingInterestMember2022-04-300001533357us-gaap:RetainedEarningsMember2022-04-300001533357us-gaap:AdditionalPaidInCapitalMember2022-04-300001533357us-gaap:CommonStockMember2022-04-300001533357us-gaap:PreferredStockMember2022-04-3000015333572022-05-012023-04-300001533357us-gaap:SeriesBPreferredStockMember2023-04-300001533357us-gaap:SeriesBPreferredStockMember2024-04-300001533357us-gaap:SeriesAPreferredStockMember2023-04-300001533357us-gaap:SeriesAPreferredStockMember2024-04-3000015333572023-04-3000015333572024-04-3000015333572024-08-2900015333572023-10-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

For the Fiscal Year Ended April 30, 2024

☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _______________ to _______________

Commission File Number: 000-54851

DEFENSE TECHNOLOGIES INTERNATIONAL CORP. |

Delaware | | 99-0363802 |

(State of Incorporation) | | (I.R.S. Employer Identification Number) |

2683 Via De La Valle, Suite G418, Del Mar CA 92014

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (800) 520-9485

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The number of shares outstanding of the Company’s $0.0001 Par Value Common Stock as of August 29, 2024 was 30,416,738 The number of preferred shares outstanding was 3,354,085. The aggregate number of shares of the voting stock held by non-affiliates on October 31, 2023 was 588,086 with a market value of $194,068. For the purposes of the foregoing calculation only, all directors and executive officers of the registrant have been deemed affiliates.

DOCUMENTS INCORPORATED BY REFERENCE

A description of "Documents Incorporated by Reference" is contained in Part IV, Item 15.

DEFENSE TECHNOLOGIES INTERNATIONAL CORP.

TABLE OF CONTENTS

As used in this report, unless otherwise indicated, “we”, “us”, “our”, “DTII” and the “Company” refer to Defense Technologies International Corp.

PART I

Item 1. Business

Defense Technologies International Corp. (the “Company”) was incorporated in the State of Delaware on May 27, 1998. Effective June 15, 2016, the Company changed its name from Canyon Gold Corp. to Defense Technologies International Corp. to represent the Company’s expansion goals more fully into the advanced technology sector.

Our principal executive office is located at 2683 Via De La Ville Suite G418, Del Mar CA 92014 147, telephone (1-800) 520-9485. Additional office space is subleased from EMAC at 641 West 3rd Street, North Vancouver BC, Canada.

Our website address is http://www.defensetechnologiesintl.com.

Development of Scanner Technology Business

Defense Technologies International Corp.’s (the “Company”) subsidiary PSSI acquired the world-wide exclusive rights to the Passive Security Scan™ a ‘next generation, walk-through personnel scanning system. The Passive Portal™ a patented product (US Patent: 7408461) is an advanced passive scanning technology for detection and identifying concealed threats to be used for the security of schools and other public venues.

Our research shows The Passive Portal™ as the only known Walk-Through Scanner in today’s market that is based on PASSIVE SENSING – ZER0-RATION and is therefore totally harmless to the subject being scanned. All other Walk-Through Scanners in the market are based on ACTIVE SCANNING with radiation and therefore can be harmful over time.

PSSI has the exclusive World-Wide license to manufacture and sell the Passive Scanning Technology™. We added a Camera for the detection of Elevated Body Temperatures (EBT), our first products are:

Passive Portal™, Passive Portal™ EBT, Passive EBT Station

On October 19, 2016, the Company entered into a Definitive Agreement with Controlled Capture Systems, LLC ("CCS"), representing the inventor of the technology and assets that included a new exclusive Patent License Agreement and Independent Contractor agreement. Under the license agreement with CCS, the Company acquired the world-wide exclusive rights and privileges to the CCS security technology, patents, products and improvements. The term of the License Agreement shall be from October 19, 2016, until the expiration of the last to expire of the licensed issued patents or patents to be issued.

The Company agreed to pay CCS an initial licensing fee of $25,000 and to pay ongoing royalties at the end of each six-month period at the rate of the greater of 5% of gross sales used or sold, or the minimum royalty payment of $25,000. The Company also agreed to compensate investors that have provided funding for the development of CCS's technology with 250,000 shares of the Company's common stock. Additionally, CCS will be entitled to receive 1 shares of the Company's common stock upon completed sales of 1,000 passive scanner units based on the CCS technology. On December 14, 2017, the Company issued 20,000 shares of Series B preferred stock to Controlled Capture Systems, LLC to extend the exclusive rights to the Passive Security Scan to March 15, 2018.

On May 30, 2018, the Company and Control Capture Systems, LLC amended their license agreement as follows:

| 1. | Royalty payments of 5% of gross sale from the license agreement will be calculated and paid quarterly with a minimum of $12,500 paid each quarter. |

| | |

| 2. | All payment will be in US dollars or stock of the Company and or its subsidiary. The value of the stock will be a discount to market of 25% of the average trading price for the 10 days prior to conversion. The number of shares received by Control Capture prior to any reverse split are anti-dilutive. |

| | |

| 3. | Invoices for parts and materials will be billed separately of the license fees noted above. |

The Company capitalized the costs to acquire the License Agreement, including the $25,000 initial licensing fee and the estimated value of $353,600 of the 5shares of the Company's common stock issued on November 10, 2016, to the CCS investors, which value was based on the closing market price of the Company's common stock on the date of the Definitive Agreement. The Company recorded a current liability of $36,000 for the remaining obligation in its consolidated balance sheet as of April 30, 2019. Once sales of products based on the CCS technology begin, the Company will amortize the capitalized costs over the estimated life of the license agreement as determined by the legal life of patents issued. To date we have sold 10 units to two distributors. The Company reviewed the valuation of the license agreement and determined to impair the asset of $378,600.

Effective January 12, 2017, Passive Security Scan, Inc. ("PSSI") was incorporated in the state of Utah as a wholly owned subsidiary. The Company merged its wholly owned subsidiary, Long Canyon Gold Resources Corp. ("Long Canyon"), into PSSI, with PSSI the surviving entity. The Company transferred to PSSI its exclusive world-wide license to the defense, detection and protection security products previously acquired by the Company. The Company currently owns 76.28% of PSSI with 23.72% acquired by several individuals and entities. With the merger of Long Canyon into PSSI, the Company discontinued its mineral exploration business. The Company concluded the initial development of the technology and will proceed to put the system through the required Beta Test at a high school near Austin Tx. All sales and marketing activities will be executed through PSSI.

The security products licensed from CCS as developed by the Company are designed for personal and collateral protection. The proposed detection technology is intended to provide passive security scanning units for either walk-through or hand-held use to improve security for schools and other public facilities. The units use electromagnets and do not emit anything (such as x-rays) through the subject. The Company, in consultation with CCS, recently completed a prototype with optional “Digital Imaging” which will give the user of the scanner the ability to recall the entire traffic passing through the scanner at any time thereafter. The prototype scanner unit has successfully passed elaborate lab testing and is ready for deployment and demonstration.

On May 06, 2024 Passive Security Scan, Inc. (Subsidiary of DTII) signed a Cooperative Research nd Development Agreement (CRADA) with the Department of Homeland Security’s Science and Technology Directorate (DHS S&T). Subject to the CRADA program, the Passive Portal will undergo 3 days of laboratory and field testing.

Competition

We believe we have the only known passive scanner technology based on earth magnetic technology that is Radiation Free and does not cause any harm to the subject passing through the scanner. Our scanners are PASSIVE SENSING and are therefore uniquely suited for school systems and other public venues. Our competitors’ technology is ACTIVE SENSING based on X-Ray, microwave or radio signals, all of which are harmful over time. We believe this provides an advantage for our scanners over those developed by our competition.

Sales and Marketing

On November 04, 2020, we engaged the services of Jonathan Silver of Cumulus Media Inc of Atlanta GA to assist DTII in Investors Relations and Marketing of its Passive Portal and EBT Station.

Through our National Marketing Director. Mr. Jonathan Silver, we have contacted schools, synagogues as well as other venue holders that have expressed interest in having the Passive Security Scan Unit presented at the school for demonstration and evaluation. Furthermore, as funding permits, we plan to install a demonstration unit in every state free of charge via the state’s Governor’s Office. We expect major exposure through this program.

Jonathan Silver arranged the installation of Demo-Units of the Passive Portal and the EBT Camera (elevated body temperature) at the Coastal Carolina University, Convey SC; Florence County Sheriff’s Detention Center, Effingham, SC; Myrtle Beach Police Department Detention Center, Myrtle Beach, SC.

We have signed three Distributorship Agreements. A distributor will get 27% discount on Gross Sales but is required to purchase a minimum of 10 units at time of signing for an exclusive distributorship. General referrals will earn a 10% discount.

With the completion of requisite funding, we expect to place the first units during the fall of 2021 and commence a major marketing campaign at the same time. We believe that we will start production and sales within the coming three to six months.

With the start of initial sales, we believe that we will be able to raise major funding through more conventional sources for our production. Saale to date include four to Macon County schools in Tuskegee AL. six to Lanett City School, Lanett AL and ten to a distributor in Texas.

Production

We acquired the necessary machinery and equipment to manufacture and assemble up to 500 Passive Portals per month at our new Dallas, Tx production facility.

To date we have manufactured and assembled 35 Passive Portal Units and ten EBT Stations the first thirteen units which will mainly be used for demonstrations and donations to valuable future customers.

In addition, we have all parts for an additional twenty-five Passive Portals at our plant in Dallas, TX.

We installed three Passive Portals and three EBT Stations in S.C. which are working without any flaws as engineered and required by its technology and as endorsed by the end-users.

Trademarks and Copyrights

We acquired the world-wide exclusive rights and privileges to the CCS security technology, patents, products and improvements. The term of the License Agreement shall be from October 19, 2016, until the expiration of the last to expire of the licensed issued patents or patents to be issued. CCS currently owns 3 patents and 2 patents pending related to the technology.

Employees

We presently have five full and part-time Consultants and do not anticipate adding additional employees until our business operations and financial resources so warrant. The Independent Contractor Agreement between the Company and CCS provides that CCS will provide support for the development of the security technology and products. The management of our Company is provided through a series of service agreements with our officers and directors and key consultants.

Facilities

We presently rent office facilities at 2683 Via De La Ville Suite G418, Del Mar CA 92014 that serve as our principal executive offices. Additional office space is subleased from EMAC at 641 West 3rd Street, North Vancouver BC, Canada.

Employee Stock Plan

We have not adopted any kind of stock or stock option plan for employees at this time.

Industry Segments

No information is presented regarding industry segments. We are presently an emerging company seeking business opportunities in one segment, the defense, detection and protection products industry.

Item 1A. Risk Factors.

The occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations. A pandemic typically results in social distancing, travel bans, and quarantine. This may limit access to our suppliers, management, support staff and professional advisors. As the Company’s operations are primarily virtual and depends on numerous third-party consultants, we cannot measure the impact on our operations or financial condition at this point in time.

Item 1B. Unresolved Staff Comments.

This item is not required for a smaller reporting company.

Item 1C: Cybersecurity,

We are highly dependent on third-party provided software applications to conduct key operations. We depend on both our own systems as well as the systems, networks and technology of our contractors, consultants, vendors and other business partners.

Our cybersecurity evaluation identifies various risks and issues that we continue to mitigate to further improve our program. This includes:

• Establishing a cybersecurity training program.

•Setting up and implementing a third-party risk management program to support a Third-Party Risk Management Policy and process to assess the risks associated with our critical third-party vendor engagements.

• Setting up and testing a Cybersecurity Incident Response Plan.

• Establishing additional processes for identifying cybersecurity threats and vulnerabilities within the environment in which we operate.

• Enhancing our technical security safeguards and configurations.

Item 2. Properties.

We do not presently own any property.

Item 3. Legal Proceedings.

There are no material pending legal proceedings to which the Company or its subsidiary is a party, or to which any property is subject and, to the best of our knowledge, no such action against us is contemplated or threatened.

Item 4. Mine Safety Disclosures.

This item is not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

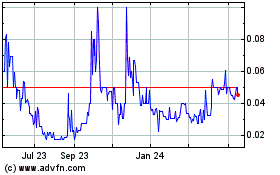

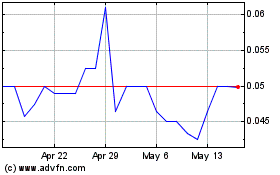

Our common shares are quoted on the OTCQB under the symbol “DTII”. Set forth in the table below are the quarterly high and low prices of our common stock as obtained from the OTCQB for the past two fiscal years ended April 30, 2024.

On June 28, 2022 the Company effected a reverse stock split of its issued and outstanding common stock on a one share for 500 shares basis. Prices set forth in the table below are adjusted to reflect that reverse stock split.

| | High | | | Low | |

| | | | | | |

Fiscal year ended April 30, 2023 | | | | | | |

First Quarter | | $ | 1.25 | | | $ | 0.10 | |

Second Quarter | | $ | 0.79 | | | $ | 0.13 | |

Third Quarter | | $ | 0.76 | | | $ | 0.13 | |

Fourth Quarter | | $ | 0.18 | | | $ | 0.06 | |

| | | | | | | | |

Fiscal year ended April 30, 2024 | | | | | | | | |

First Quarter | | $ | 0.09 | | | $ | 0.02 | |

Second Quarter | | $ | 0.08 | | | $ | 0.02 | |

Third Quarter | | $ | 0.07 | | | $ | 0.02 | |

Fourth Quarter | | $ | 0.06 | | | $ | 0.03 | |

As of April 30, 2024, there were approximately 155 stockholders of record of our common stock, which does not consider those shareholders whose certificates are held in the name of broker-dealers or other nominee accounts.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended April 30, 2024.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

During the year ended April 30, 2023, the Company issued 731,995 shares of series B preferred for the reduction of $2,901,836 of notes payable and accrued expenses. The issuance consisted of 279,026 shares to related parties for accrued expense of $1,074,250, 53,750 shares for the payment of $322,500 of notes payable and interest and 399,219 shares for the payment of $1,505,118 of accounts payable and accrued expenses.

During the year ended April 30, 2023, the Company issued 25,000 shares of series B preferred for $294,998 for service.

During the year ended April 30, 2023, the Company issued 1,023,626 shares of common stock for the conversion of $76,711 of convertible debt.

During the year ended April 30, 2023, the Company issued 292,119 shares of common stock for the conversion of 21,235 Series B preferred shares.

During the year ended April 30, 2023, the Company issued 79,766 shares of common stock for the conversion of 8 Series D preferred shares.

During the year ended April 30, 2024, the Company issued 200,000 shares of common stock with a value of $10,000 for cash.

During the year ended April 30, 2024 the Company issued 1,262,617 shares of common stock with a value of $25,996 for the conversion of convertible debt.

During the year ended April 30, 2024 the Company issued 1,380,191 shares of common stock for the conversion of series B preferred shares.

During the year ended April 30, 2024, the Company issued 685,825 shares of common stock with a value of $34,291 for convertible debt.

During the year ended April 30, 2024, the Company issued 200,000 shares of common stock with a value of $6,000 for service.

During the year ended April 30, 2024, the Company issued 3,902,340 shares of common stock for the conversion of series A preferred shares.

During the year ended April 30, 2024, the Company issued 295,863 shares of common stock for the conversion of series D preferred shares.

Dividends Policy

During 2022, we have declared a 7% interest in our outstanding series C convertible preferred shares with a total amount of $12,217 which was converted as of April 30, 2022. During the year ended April 30, 2023, the Company issued a series D preferred shares with a dividend of 5% interest. The deemed dividend was $29,424 for the year ended April 30, 2024. During the years ended April 30, 2024 and 2023 the Company has not formally declared any dividends, thus they are recognized as deemed and not as a liability.

Warrants and Options

The Company does not have any warrants or options outstanding

Item 6. Selected Financial Data.

This item is not required for a smaller reporting company.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following information should be read in conjunction with the financial statements and notes thereto appearing elsewhere in this Form 10-K.

The consolidated financial statements included in this annual report include the financial statements of the Company and those of Passive Security Scan, Inc. ("PSSI"), a consolidated subsidiary.

Effective January 12, 2017, PSSI was incorporated in the state of Utah as a wholly owned subsidiary. The Company merged its wholly owned subsidiary, Long Canyon Gold Resources Corp. ("Long Canyon"), into PSSI, with PSSI the surviving entity. The Company transferred to PSSI its exclusive world-wide license to the defense, detection and protection security products previously acquired by the Company. The Company currently owns 76.28% of PSSI with 23.72% acquired by four other individuals and entities. With the merger of Long Canyon into PSSI, the Company discontinued its mineral exploration business. The Company plans to continue the development of the technology and conduct all sales and marketing activities in PSSI.

Forward Looking and Cautionary Statements

This report contains forward-looking statements relating to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will” “should," “expect," "intend," "plan," anticipate," "believe," "estimate," "predict," "potential," "continue," or similar terms, variations of such terms or the negative of such terms. These statements are only predictions and involve known and unknown risks, uncertainties and other factors. Although forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment, actual results could differ materially from those anticipated in such statements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Going Concern

These consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America applicable to a going concern. Through April 30, 2024, the Company had revenue of $49,012, an accumulated deficit of $17,116,309 and a working capital deficit of $2,362,362 and expects to incur further losses in the development of its business, all of which cast substantial doubt about the Company’s ability to continue as a going concern. Management plans to continue to provide for the Company's capital needs during the year ending April 30, 2024, by issuing debt and equity securities and by the continued support of its related parties. The consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might be necessary should the Company be unable to continue in existence. There is no assurance that funding will be available to continue the Company’s business operations.

Results of Operations

We currently have a limited source of operating revenues. Accordingly, $49,012 of revenue was recorded in the year ended April 30, 2024 and none in the same period in 2023.

Our total operating expenses decreased to $631,143 in the year ended April 30, 2024, from $1,734,115 in the year ended April 30, 2023. The decreases are due primarily to lower development costs and consulting fees.

Our interest expense decreased to $31,782 in the year ended April 30, 2024, from $163,643 in the year ended April 30, 2023. In addition, our loss on extinguishment of debt was $849,329, in the year ended April 30, 2023, compared to none in the same time in 2024.

We recognized a change in derivative liability to a negative $13,009 compared to a gain of $165,506 in the years ended April 30, 2024, and 2023, respectively. We estimate the fair value of the derivative for the conversion feature of our convertible notes’ payable using the American Option Binomial pricing model at the inception of the debt, at the date of conversions to equity, cash payments and at each reporting date, recording a derivative liability, debt discount and a gain or loss on change in derivative liability as applicable. These estimates are based on multiple inputs, including the market price of our stock, interest rates, our stock price volatility, and variable conversion prices based on market prices as defined in the respective loan agreements. These inputs are subject to significant changes from period to period; therefore, the estimated fair value of the derivative liability and associated gain or loss on derivative liability will fluctuate from period to period and the fluctuation may be material.

As a result, we recognized a net loss of $575,766, and net loss of $2,627,564 on the years ended April 30, 2024, and 2023, respectively.

Because we own 76.28% of PSSI as of April 30, 2024, we include 76.28% of the net loss of PSSI for the year ended April 30, 2024, in our consolidated net loss and have reported non-controlling interest of 23.72% of the net loss of PSSI, or $16,011, for the year ended April 30, 2024 and $51,923 for the same period in 2023.

Liquidity and Capital Resources

On April 30, 2024, we had total current assets of $7,770, consisting of cash of $171 and inventory of $7,599. Current liabilities at April 30, 2024 were $2,370,132 resulting in a working capital deficit of $2,362,362. Included in our current liabilities and working capital deficit are payables to related parties of $1,191,708, convertible notes payable of $279,085, accounts payable and accrued expenses of $386,003 and derivative liabilities totaling $37,211, notes payable of $170,062 and accrued interest and fees payable of $178,188.

A significant portion of our current liabilities as of April 30, 2024 is comprised of amounts due to related parties of $1,191,708 compared to $910,524 for the same period in 2023. We anticipate that in the short-term, operating funds will continue to be provided by related parties and other lenders.

During the year ended April 30, 2024, we received cash proceeds of $16,370 in notes payable and repaid $30,500 in notes payable. The Company issued $20,000 in convertible notes plus sold common stock for cash with a value $10,000.

During the year ended April 30, 2024, we extinguished $25,996 in principal and accrued interest through conversion of convertible notes payable to common stock.

During the year ended April 30, 2024, net cash used in operating activities was $16,503 because of our net loss of $575,766, change in fair value of $13,009, increase in related party payables to $281,184, and decrease in accounts payable and accrued expense to $207,019.

During the year ended April 30, 2023, net cash used in operating activities was $109,607 as a result of our net loss of $2,627,564 offset an increase in payables to related parties of $430,135, a change in accounts payable of $943,841 stocks for service of $294,998 and loss on stock issuance of $849,329.

During the year ended April 30, 2024, net cash provided by financing activities was $15,870 comprised of net proceeds from convertible notes payable of $20,000, common stock sold for cash of $10,000, notes payable related parties of $16,370, offset by repayment of notes payable of $30,500.

During the year ended April 30, 2023, net cash provided by financing activities was $104,650 comprised of net proceeds from notes payable of $134,650 less repayment of $30,000.

We have not realized any significant revenues since inception and paid expenses and costs with proceeds from the issuance of securities as well as by loans from investor, stockholders, and other related parties.

Our immediate goal is to provide funding for the completion of the initial production of the Offender Alert Passive Scan licensed from CCS. The Offender Alert Passive Scan is an advanced passive scanning system for detecting and identifying concealed threats.

We believe a related party and other lenders will provide sufficient funds to carry on general operations in the near term and fund PSSI’s production and sales. We expect to raise additional funds from the sale of securities, stockholder loans and convertible debt. However, we may not be successful in our efforts to obtain financing to carry out our business plan.

As of April 30, 2024, we did not have sufficient cash to fund our operations for the next twelve months.

Inflation

In the opinion of management, inflation has not and will not have a material effect on our operations until such time as we begin to realize revenues from operations. At that time, management will evaluate the possible effects of inflation related to our business and operations following a successful acquisition or merger.

Net Operating Loss Carryforward

We have accumulated a net operating loss carryforward of approximately $8,127,926 as of April 30, 2024. This loss carry forward may be offset against future taxable income. The use of these losses to reduce future income taxes will depend on the generation of sufficient taxable income prior to the expiration of the net operating loss carryforward. In the event of certain changes in control, there will be an annual limitation on the amount of net operating loss carryforward that can be used. No tax benefit has been reported in the financial statements for the years ended April 30, 2024, and 2023 because it has been fully offset by a valuation reserve. The use of future tax benefit is undeterminable because we presently have no operations.

Critical Accounting Policies

Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to intangible assets, derivative liabilities, income taxes, contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

For further information on our significant accounting policies see Note 2 to our consolidated financial statements included in this Annual Report. There were no changes to our significant accounting policies during the year ended April 30, 2024. The following is a description of those significant accounting policies that involve estimates and judgment by management.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Derivative Liabilities

We have identified the conversion features of certain of our convertible notes payable as derivatives. We estimate the fair value of the derivatives using American Option Binomial pricing model. We estimate the fair value of the derivative liabilities at the inception of the financial instruments, at the date of conversions to equity and at each reporting date, recording a derivative liability, debt discount, and a gain or loss on change in derivative liabilities as applicable. These estimates are based on multiple inputs, including the market price of our stock, interest rates, our stock price volatility and variable conversion prices based on market prices as defined in the respective agreements. These inputs are subject to significant changes from period to period and to management's judgment; therefore, the estimated fair value of the derivative liabilities will fluctuate from period to period, and the fluctuation may be material.

Basic and Diluted Loss per Common Share

The Company computes net loss per share in accordance with ASC 260, Earnings per Share, which requires presentation of both basic and diluted loss per share (“EPS”) on the face of the statement of operations. Basic EPS is computed by dividing net loss available to common shareholders (numerator) by the weighted average number of common shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period including stock options and warrants, using the treasury stock method, convertible preferred stock, and convertible debt, using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all potentially dilutive common shares if their effect is antidilutive.

Impairment of Inventory

The Company reviews the carrying value of its assets annually or whenever events or changes in circumstances indicate that the historical cost carrying value of an asset may no longer be appropriate. The Company assesses recoverability of the asset by comparing the undiscounted future net cash flows expected to result from the asset to its carrying value. If the carrying value exceeds the undiscounted future net cash flows of the asset, an impairment loss is measured and recognized. An impairment loss is measured as the difference between the net book value and the fair value of the asset. The Company determined although their inventory is salable, none has been sold for over 2 years, but there is a potential of obsolescence to the asset. This could occur due to refinement of the finished product or enhancement of the parts used in the product. The Company has determined that some impairment has occurred and is reserving an impairment. As of April 30, 2023, the Company reserved $40,586 as an impairment of the value of the inventory.

Financial Instruments

Pursuant to ASC 820, Fair Value Measurements and Disclosures and ASC 825, Financial Instruments, an entity is required to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value using a hierarchy based on the level of independent, objective evidence when measuring fair value using a hierarch based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization with the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. The hierarchy prioritized the inputs into three levels that may be used to measure fair value:

Level 1: applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2: applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in markets that are not active.

Level 3: applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

As of April 30, 2024 and 2023, the Company believes the amounts reported for cash, payables, accrued liabilities and amounts due to related parties approximate their fair values due to the nature or duration of these instruments.

Liabilities measured at fair value on a recurring basis were estimated as follows at April 30, 2024 and 2023:

Balance at April 30, 2022 | | | 305,232 | |

| | | | |

Issuance and conversion of convertible debt, net | | | (73,900 | ) |

| | | | |

Gain on derivative liability | | | (165,506 | ) |

| | | | |

Balance at April 30, 2023 | | | 65,826 | |

| | | | |

Issuance and conversion of convertible debt, net | | | (41,173 | ) |

| | | | |

Gain on derivative liability | | | 13,009 | |

| | | | |

Balance at April 30, 2024 | | | 37,211 | |

Impairment of Long-Lived Assets

The Company continually monitors events and changes in circumstances that could indicate carrying amounts of long-lived assets may not be recoverable. When such events or changes in circumstances are present, the Company assesses the recoverability of long-lived assets by determining whether the carrying value of such assets will be recovered through undiscounted expected future cash flows. If the total of the future cash flows is less than the carrying amount of those assets, the Company recognizes an impairment loss based on the excess of the carrying amount over the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or the fair value less costs to sell.

Recent Accounting Pronouncements

See Note 2 to our consolidated financial statements included in this Annual Report for disclosure of recent accounting pronouncements.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

This item is not required for a smaller reporting company.

Item 8. Financial Statements and Supplementary Data.

The consolidated financial statements filed with this report are presented beginning on page F-1, immediately following the signature page.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

For purposes of this section, the term disclosure controls and procedures mean controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the “Act”) (15 U.S.C. 78a et seq.) is recorded, processed, summarized and reported, within the time periods specified in the Commission's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Act is accumulated and communicated to the issuer's management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. It should be noted that the design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote. As of the end of the period covered by this Annual Report, we carried out an evaluation, under the supervision and with the participation of our Chief Executive Officer and our Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on this evaluation, our CEO and CFO has concluded that the Company’s disclosure controls and procedures are not effective because of the identification of a material weakness in our internal control over financial reporting, which is identified below, which we view as an integral part of our disclosure controls and procedures.

Changes in Internal Controls over Financial Reporting

We have not made any changes in our internal controls over financial reporting that occurred during the period covered by this Form 10-K that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act of 1934. Our internal control system was designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes, in accordance with generally accepted accounting principles. Because of inherent limitations, a system of internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate due to change in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management conducted an evaluation of the effectiveness of our internal control over financial reporting as of April 30, 2024, using the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control—Integrated Framework (2013). Based on its evaluation, our management concluded that there are material weaknesses in our internal control over financial reporting was not effective as of April 30, 2024, and there are material weaknesses in our internal control over financial reporting. We lack full time personnel in accounting and financial staff to sufficiently monitor and process financial transactions in an efficient and timely manner. This allows for insufficient segregation of duties and a lack of multiple levels of supervision and review. Our history of losses has severely limited our budget to hire and train enough accounting and financial personnel needed to adequately provide this function. Consequently, we lacked sufficient technical expertise, reporting standards and written policies and procedures. A material weakness is a deficiency, or a combination of control deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

This Form 10-K does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

Item 9B. Other Information.

Not applicable.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Our executive officers and directors are as follows:

Name | | Age | | Position |

| | | | |

Merrill W. Moses | | 71 | | President, CEO, Secretary, Interim CFO and Director |

| | | | |

Eric Forrest | | 56 | | President, PSSI |

On April 30, 2016, the Board of Directors appointed Merrill W. Moses to replace Stephen M. Studdert as a director, President, CEO, acting CFO and Secretary of the Company.

During the year ended April 30, 2024 Eric Forrest was appointed as CEO of the subsidiary Passive Security Scans Inc.

All directors serve for a one-year term until their successors are elected or they are re-elected at the annual stockholders' meeting. Officers hold their positions at the pleasure of the board of directors, absent any employment agreement, of which none currently exists or is contemplated.

We presently anticipate that we will consider new, qualified persons to become directors in the future, although no new appointments or arrangements have been made as of the date hereof.

There is no arrangement, agreement or understanding between any of the directors or officers and any other person pursuant to which any director or officer was or is to be selected as a director or officer. Also, there is no arrangement, agreement or understanding between management and non-management stockholders under which non-management stockholders may directly or indirectly participate in or influence the management of our affairs.

The business experience of each of the persons listed above during the past five years is as follows:

Merrill W. Moses attended Brigham Young University and over the past 40 years has been an entrepreneur and founder of a variety of independent business ventures. He has also been involved in operating an independent oil and gas company and a mining and exploration company. Since 1992, Mr. Merrill has served as President and CEO of two oil and gas companies, Energy Pro Inc. and Dynamic Energy & Petroleum Inc. Mr. Moses is also a founding partner in 2007 of Liberty Capital International, Inc., an international financial and project management company that provides various private client financial and asset management services.

Eric Forrest brings a proven track record in sales, business development, and strategic leadership and vision. As President at Triloc LLC, Eric has been instrumental in the success of this privately held Merchant Banking, Insurance, and Investment Firm since its establishment in 2012. As a Financial Professional and Educator at Wealth Wave, Eric dedicated efforts to eradicate financial illiteracy worldwide and has been a driving force behind Wealth Wave’s mission, leveraging a clear vision and extensive experience to provide effective leadership and guidance. Eric has also served as the President of Business at Ground Zero Development Company LLP, a strategic consulting firm. With prior experience as the Director of Home Inspections at The Whitmire Group, Eric has exhibited expertise in conducting comprehensive inspections and providing accurate reports on the condition of various structural components. Previously, as the CEO and Founder of The Forrest Group of Companies, Eric led a diverse team of professionals with complementary disciplines in real estate, construction, lending, law, and marketing. During Eric's tenure as a Distributor at Kirby Company, Eric achieved the prestigious title of the #1 volume area distributor worldwide. Eric contributed to the success of the company by excelling in recruiting, marketing, sales, accounting, and customer service. With Eric's vast experience, exceptional leadership skills, and diverse expertise across multiple industries and with his unique combination of strategic thinking, business acumen, and a passion for achieving results, he is a valuable asset to both Defense Technologies International Corp. as an officer and as the President of the subsidiary Passive Security Scan, Inc.

None of our officers, directors or control persons has had any of the following events occur:

| · | any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer, either at the time of the bankruptcy or within two years prior to that time. |

| | |

| · | any conviction in a criminal proceeding or being subject to a pending criminal proceeding, excluding traffic violations and other minor offenses. |

| | |

| · | being subject to any order, judgment or decree, not substantially reversed, suspended or vacated, of any court of competent jurisdiction, permanently enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking business; and |

| | |

| · | being found by a court of competent jurisdiction in a civil action, the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated. |

No director is deemed to be an independent director. Our board of directors performs some of the functions associated with a nominating committee and a compensation committee, including reviewing all forms of compensation provided to our executive officers, directors, consultants and employees, including stock compensation. The board will also perform the functions of an audit committee until we establish a formal committee.

Compliance With Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than 10% of our common stock, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Reports were filed during the fiscal year 2024.

Code of Ethics

We currently do not have a code of ethics. We do intend to adopt a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions

Item 11. Executive Compensation.

We do not have a bonus, profit sharing, or deferred compensation plan for the benefit of employees, officers or directors. We currently have no employees and do not pay any salaries. Compensation for our officers and directors is generally established through a written Service Agreement.

The following table depicts compensation accrued to officers and directors for the fiscal years ended April 30, 2024 and 2023.

Name and Principal Position | | Year Ended April 30, | | Salary | | | Bonus | | | All Other Consideration | | | Total | |

Merrill W. Moses, President, CEO, Secretary, Interim CFO and Director (1)(1) | | 2024 | | $ | 0 | | | $ | 0 | | | $ | 150,000 | | | $ | 150,000 | |

| 2023 | | $ | 0 | | | $ | 0 | | | $ | 150,000 | | | $ | 150,000 | |

| | | | | | | | | | | | | | | | | | |

Eric Forrest CEO PSSI | | 2024 | | $ | 0 | | | $ | 0 | | | $ | 26,000 | | | $ | 26,000 | |

| 2023 | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

(1) Mr. Moses’ compensation for services as President, CEO, Secretary, Interim CFO and Director was accrued pursuant to a Service Agreement with the Company dated April 25, 2016. As of April 30, 2024, $157,500 was payable to Mr. Moses by the Company. In addition, pursuant to a Service Agreement with Passive Security Scan Inc. (“PSSI”), compensation of $67,500 was accrued for the year with the total payable from both Companies of $225,000 as of April 30, 2024.

During the fiscal year ended April 30, 2024, we accrued expenses and services rendered by EMAC in the amount of $387,738 pursuant to Administration Agreements with DTII and $507,970 with PSSI.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth certain information as of April 30, 2024 with respect to the beneficial ownership of our common stock and based on 9,729,878 shares outstanding:

| · | Each stockholder believed to be the beneficial owner of more than 5% of our common stock. |

| | |

| · | by each of our directors and executive officers; and |

| | |

| · | all of our directors and executive officers as a group. |

For purposes of the following table, a person is deemed to be the beneficial owner of any shares of common stock (I) over which the person has or shares, directly or indirectly, voting or investment power, or (ii) of which the person has a right to acquire beneficial ownership at any time within 60 days after the date of this report. “Voting power” is the power to vote or direct the voting of shares and “investment power” includes the power to dispose or direct the disposition of shares.

| | Amount and Nature of | | | | |

Name and Address of Beneficial Owner | | Beneficial Ownership(1) | | | Percent of Class | |

| | | | | | |

Directors and Executive Officers: | | | | | | |

Merrill W. Moses, President & CEO 4730 S. Fort Apache Road, Suite 300 Las Vegas, Nevada 89147 | | | 155,000 | | | | 0.01 | % |

Eric Forrest 4730 S. Fort Apache Road, Suite 300 Las Vegas, Nevada 89147 | | | 0 | | | | 0 | |

| | | | | | | | |

All directors and executive officers as a group (2 person) | | | 2,002 | | | | 0.1 | % |

(1) | Unless otherwise indicated, the named person will be the record and beneficially owner of the shares indicated. |

The following persons hold preferred shares that carry super voting power and are convertible into shares of the company’s common stock. The following table indicates the person, and the number of preferred and common shares held and the voting power representing the preferred shares.

| | | | | Percent Of Voting Power(3) |

5% Beneficial Owners: | | | | | |

| | | | | |

Emac Handels AG, Reinhard Hiestand, Control Person, | | preferred | 2,283,135 (22,831,350 votes) | 73,8% |

Churerstr. 106, Pfaeffikon/Switz | | common | 24,591,951 | | |

| | | | | |

Velania Treuhand AG, Reinhard Hiestand, Control Person, | | preferred | 252,000 (2,520,000 votes) | | 8.1% |

Churerstr. 106, Pfaeffikon/Switz | | | | | |

| (1) | Unless otherwise indicted, the named person will be the record and beneficial owner of the shares indicated. |

| (2) | Percentage ownership is based on 30,947,929 shares of common stock and 2,535,135 Preferred Series A Stock (Equal to 25,351,350 votes) outstanding as of April 30, 2024. |

| (3) | Assumes the named shareholder, and only the name shareholder, exercises the common stock voting power of the Series A Preferred Stock equal to 10 common stock votes per each share of preferred stock. |

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Except as set forth below, we have not entered into any other material transactions with any officer, director, nominee for election as director, or any stockholder owning greater than five percent (5%) of our outstanding shares, nor any member of the above referenced individuals' immediate family.

During the years ended April 30, 2024 and 2023, management and administrative services were compensated by the Company pursuant to: a Service Agreement between the Company and Merrill Moses, President, CEO, Secretary, acting CFO and director, dated April 25, 2016; a Service Agreement between the Company and Charles Hooper, director, dated May 20, 2016; a Service Agreement between the Company; and an Administration Agreement with EMAC Handles AG (“EMAC”), a shareholder of the Company and PSSI, executed on March 15, 2011 and renewed on May 1, 2014.

During the year ended April 30, 2024, management and administrative services were compensated by PSSI pursuant to a Service Agreement between PSSI and Merrill Moses, dated January 12, 2017 and effective February 1, 2017 and an Administration and Management Agreement dated January 12, 2017 between PSSI and RAB Investments AG (“RAB”), a significant lender of the Company and a shareholder of PSSI.

The fees are based on services provided and invoiced by the related parties on a monthly basis and the fees are paid in cash when possible or with the Company’s common stock. The Company also, from time to time, has some of its expenses paid by related parties with the intent to repay. These types of transactions, when incurred, result in payables to related parties in the Company's consolidated financial statements as a necessary part of funding the Company's operations.

On December 11, 2018, the Board of Directors resolved to change the terms of the company’s Series A and Series B Preferred Shares from ten (10) shares of DTII common stock for each one (1) share of Preferred Stock, to five (5) shares of DTII common stock for each one (1) share of Preferred Stock. The revised conversion terms applied to all issued and outstanding Preferred Shares and to future issuances of Series A and Series B Preferred Stock. On May 9, 2019, DTII’s Board of Directors unanimously resolved to revise the terms of the company’s Series A and Series B Preferred Shares. Under the new terms, the conversion right of both Series A and B Preferred Shares was changed from five (5) shares of DTII common stock for each one (1) share of Preferred Stock, to a new conversion right of ten (10) shares of DTII common stock for each one (1) share of Preferred Stock. The revised conversion terms apply to all issued and outstanding Preferred Shares and to future issuances of Series A and Series B Preferred Stock. The Board received the unanimous consent to the changed terms from each current Preferred shareholder.

As of April 30, 2024, the Company and PSSI had the following consolidated payable balances due to related parties, which resulted from transactions with significant shareholders and officers and directors of the Company.

EMAC | | $ | 895,708 | |

Merrill Moses, President, CEO, Secretary, acting CFO & director | | | 225,000 | |

Eric Forrest | | | 26,000 | |

Hooper | | | 45,000 | |

Total | | | 1,191,708 | |

None of our directors are deemed to be independent directors. We do not have a compensation, audit or nominating committee, rather those functions are carried out by the board as a whole.

Item 14. Principal Accounting Fees and Services.

The following tables present for each of the last two fiscal years the aggregate fees billed in connection with the audits of our financial statements and other professional services rendered by our independent registered public accounting firm Fruci & Associates II, PLLC:

| | 2024 | | | 2023 | |

Audit fees | | $ | 42,864 | | | $ | 67,000 | |

Audit related fees | | $ | -- | | | $ | -- | |

Tax fees | | $ | -- | | | $ | -- | |

All other fees | | $ | -- | | | $ | -- | |

Audit fees represent the professional services rendered for the audit of our annual financial statements and the review of our financial statements included in quarterly reports, along with services normally provided by the accounting firm in connection with statutory and regulatory filings or engagements. Audit-related fees represent professional services rendered for assurance and related services by the accounting firm that are reasonably related to the performance of the audit or review of our financial statements that are not reported under audit fees.

Tax fees represent professional services rendered by the accounting firm for tax compliance, tax advice, and tax planning. All other fees represent fees billed for products and services provided by the accounting firm, other than the services reported for in the other categories.

PART IV

Item 15. Exhibits, Financial Statement Schedules

(a) Exhibits

*The XBRL related information in Exhibit 101 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liability of that section and shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

| (1) | Filed as exhibit to Form S-1 filed on November 10, 2011. |

| (2) | Filed as exhibit to Amendment No. 1 to Form S-1 filed on March 12, 2012. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Defense Technologies International Corp. | |

| | | |

| By: | /S/ Merrill W. Moses | |

| | Merrill W. Moses | |

| | Chief Executive Officer | |

| | Dated: August 29, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Signature | | Title | | Date |

| | | | |

/S/ Merrill W. Moses | | Director | | August 29, 2024 |

Merrill W. Moses | | | | |

Defense Technologies International Corp. and Subsidiary

Index to Consolidated Financial Statements

Years Ended April 30, 2024 and 2023

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Defense Technologies International Corp.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Defense Technologies International Corp. and Subsidiary (“the Company”) as of April 30, 2024 and 2023, and the related consolidated statements of operations, stockholders’ deficit, and cash flows for each of the years in the two-year period ended April 30, 2024, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of April 30, 2024 and 2023 and the results of its operations and its cash flows for each of the years in the two-year period ended April 30, 2024, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has limited revenue, an accumulated deficit, and working capital deficiency. These factors, among others, raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

Revenue Recognition – Refer to Note 2 to the financial statements

Description of the Critical Audit Matter

The Company has material revenue with a revenue recognition policy in which determining when the performance obligation has been settled and obtaining appropriate and sufficient audit evidence took significant audit effort.

How the Critical Audit Matter was Addressed in the Audit

| · | Reviewed the Company's revenue recognition policy, independently analyzing the Company's conclusion to ensure consistency with the principles of ASC 606: Revenue from Contracts with Customers. |

| | |

| · | Substantively tested revenue transactions, including the relevance and reliability of supporting documentation, to determine if the Company’s recognition of new revenue transactions was in accordance with generally accepted accounting principles and recorded in the correct periods. |

Fruci & Associates II, PLLC – PCAOB ID #05525

We have served as the Company’s auditor since 2017.

Spokane, Washington

August 29, 2024

Defense Technologies International Corp. and Subsidiary |

Consolidated Balance Sheets |

|

| | April 30, | |

| | 2024 | | | 2023 | |

ASSETS | | | | | | |

| | | | | | |

Current assets: | | | | | | |

Cash | | $ | 171 | | | $ | 804 | |

Inventory | | | 7,599 | | | | 34,512 | |

Total current assets | | | 7,770 | | | | 35,316 | |

| | | | | | | | |

Fixed assets, net of depreciation of $34,911 and $26,235 | | | - | | | | - | |

Total assets | | $ | 7,770 | | | $ | 35,316 | |

| | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable and accrued expenses | | $ | 386,003 | | | $ | 260,765 | |

Accrued license agreement payment | | | 87,500 | | | | 37,500 | |

Accrued interest and fees payable | | | 178,188 | | | | 150,517 | |

Customer deposits | | | 40,375 | | | | 30,375 | |

Derivative liabilities | | | 37,211 | | | | 65,826 | |

Convertible notes payable, net of discount | | | 279,085 | | | | 319,767 | |

Payables – related parties | | | 1,191,708 | | | | 910,524 | |

Notes payable | | | 20,042 | | | | 64,092 | |

Notes payable- related party | | | 150,020 | | | | 115,600 | |

Total current liabilities | | | 2,370,132 | | | | 1,954,966 | |

| | | | | | | | |

Total liabilities | | | 2,370,132 | | | | 1,954,966 | |

| | | | | | | | |

Commitments and contingencies | | | | | | | - | |

| | | | | | | | |

Stockholders’ deficit | | | | | | | | |

| | | | | | | | |

Convertible preferred stock, $0.0001 par value; 20,000,000 shares authorized: Series A 2,535,135 and 2,925,369 shares issued and outstanding, respectively | | | 253 | | | | 292 | |

Series B 1,860,636 and 1,913,655 shares issued and outstanding, respectively | | | 186 | | | | 191 | |

Common stock, $0.0001 par value; 600,000,000 shares authorized, 9,729,878 and 1,803,042 shares issued and outstanding, respectively, post reverse split | | | 974 | | | | 181 | |

Additional paid-in capital | | | 15,067,580 | | | | 14,905,851 | |

Accumulated deficit | | | (17,116,309 | ) | | | (16,527,130 | ) |

Total | | | (2,047,316 | ) | | | (1,620,615 | ) |

Non-controlling interest | | | (315,046 | ) | | | (299,035 | ) |

Total stockholders’ deficit | | | (2,362,362 | ) | | | (1,919,650 | ) |

Total liabilities and stockholders’ deficit | | $ | 7,770 | | | $ | 35,316 | |

The accompanying notes are an integral part of these consolidated financial statements

Defense Technologies International Corp. and Subsidiary |

Consolidated Statements of Operations |

| | Years Ended April 30, | |

| | 2024 | | | 2023 | |

| | | | | | |

Revenue-net | | $ | 49,012 | | | $ | - | |

Cost of goods | | | 24,405 | | | | - | |

Gross Margin | | | 24,607 | | | | - | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

Consulting fees | | | 456,137 | | | | 1,180,900 | |

Depreciation | | | - | | | | 8,675 | |

Development | | | 321 | | | | 259,243 | |

General and administrative | | | 174,685 | | | | 285,297 | |

| | | | | | | | |

Total operating expenses | | | 631,143 | | | | 1,734,115 | |

| | | | | | | | |

Loss from operations | | | (606,536 | ) | | | (1,734,115 | ) |

| | | | | | | | |

Other income (expense): | | | | | | | | |

Gain (loss) on settlement of notes payable | | | 35,562 | | | | - | |

Gain (loss) on AP revaluation | | | 40,000 | | | | - | |

Impairment of asset | | | - | | | | (40,586 | ) |

Inventory adjustment | | | - | | | | (5,397 | ) |

Interest expense including penalty and debt discount | | | (31,783 | ) | | | (163,643 | ) |

Gain (loss) on derivative liabilities | | | (13,009 | ) | | | 165,506 | |

Gain (loss) on extinguishment of debt | | | - | | | | (849,329 | ) |

| | | | | | | | |

Total other income (expense) | | | 30,770 | | | | (849,449 | ) |

| | | | | | | | |

Gain(loss) before income taxes | | | (575,766 | ) | | | (2,627,564 | ) |

| | | | | | | | |

Provision for income taxes | | | - | | | | - | |

| | | | | | | | |

Net gain (loss) | | | (575,766 | ) | | | (2,627,564 | ) |

| | | | | | | | |

Non-controlling interest in net loss of consolidated subsidiary | | | 16,011 | | | | 51,923 | |

| | | | | | | | |

Net gain (loss) attributed to the Company | | $ | (559,755 | ) | | $ | (2,575,641 | ) |

| | | | | | | | |

Net loss per common share – basic and diluted | | $ | (0.10 | ) | | $ | (384.74 | ) |

| | | | | | | | |

Weighted average shares outstanding – basic and diluted | | | 5,641,917 | | | | 670,681 | |

The accompanying notes are an integral part of these consolidated financial statements

Defense Technologies International Corp. and Subsidiary Consolidated Statements of Stockholders’ Deficit For the Years Ended April 30, 2024 and 2023 |

| | Preferred stock | | | Common Stock | | | Additional Paid-In | | | Accumulated | | | Non-Controlling | | | Total Stockholders’ | |

| | Shares | | | Amount | | | Shares | | | Amount | | | Capital | | | Deficit | | | Interest | | | Deficit | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance at April 30, 2022 (reclassified) | | | 4,103,864 | | | | 410 | | | | 487,408 | | | | 49 | | | $ | 10,657,067 | | | | (13,916,844 | ) | | | (247,112 | ) | | | (3,506,430 | ) |

Common stock issued for convertible debt | | | | | | | - | | | | 1,023,626 | | | | 102 | | | | 76,609 | | | | - | | | | - | | | | 76,711 | |

Common stock issued for preferred shares conversion | | | (21,235 | ) | | | - | | | | 212,353 | | | | 29 | | | | (29 | ) | | | - | | | | - | | | | - | |

Preferred shares issued to related parties | | | 279,026 | | | | 28 | | | | - | | | | - | | | | 1,074,222 | | | | - | | | | - | | | | 1,074,250 | |

Preferred shares issued for accrued expense | | | 399,219 | | | | 39 | | | | - | | | | - | | | | 1,505,118 | | | | - | | | | - | | | | 1,505,157 | |

Preferred shares issued for service | | | 25,000 | | | | 2 | | | | - | | | | - | | | | 294,995 | | | | - | | | | - | | | | 294,997 | |

Preferred shares reclassified to equity | | | - | | | | - | | | | - | | | | 1 | | | | 17,499 | | | | - | | | | - | | | | 17,500 | |

Preferred shares for notes payable | | | 53,750 | | | | 4 | | | | - | | | | - | | | | 322,496 | | | | - | | | | - | | | | 322,500 | |