Kinbasha Gaming International, Inc. (OTCQX: KNBA), owner and

operator of retail pachinko gaming centers in Japan, has released

its financial results for its fiscal first quarter ended June 30,

2013.

Summary of Fiscal Q1 2014 Financial

Results

- Net revenues decreased to $18.7 million in fiscal Q1 2014,

compared to $23.9 million in fiscal Q1 2013.

- Net income improved to $761,000 in fiscal Q1 2014, compared to

a net loss of $1.9 million in fiscal Q1 2013.

- Fully diluted earnings per share (EPS) improved to $0.06 in

fiscal Q1 2014, compared to a loss of per share of $0.16 in fiscal

Q1 2013.

Analysis of Fiscal Q1 2014 Financial

Results

Kinbasha's functional currency is the yen, and accordingly its

earnings and assets are denominated in yen. As a result,

appreciation or depreciation in the value of the yen relative to

the dollar would affect its financial results reported in dollars

without giving effect to any underlying change in its business or

results of operations. For fiscal Q1 2014, the yen compared to the

dollar was materially weaker than for fiscal Q1 2013, as the

exchange ratio increased by 23%. Accordingly, Kinbasha's results of

its operations for fiscal Q1 2014 expressed in dollars appear

materially weaker than when expressed in yen.

Net revenues decreased to $18.7 million for the fiscal first

quarter ended June 30, 2013, from $23.9 million for the same period

in 2012. The principal reason for this decrease was the change in

the yen/dollar exchange rate. When expressed in yen, Kinbasha's

revenues decreased less than 2% between these periods. In addition,

Kinbasha sold three restaurants in July 2012, and thus had no

revenues from these restaurants during fiscal Q1 2014.

Net income attributable to common shareholders improved to

$761,000 for the quarter ended June 30, 2013 as compared to a net

loss of $1.9 million in the same period of 2012. As a result, fully

diluted EPS improved to $0.06 in the quarter ended June 30, 2013,

compared to a loss per share of $0.16 in the quarter ended June 30,

2012.

The improvement to net income is generally attributed to

enhanced market conditions, and the fact that in Q1 of fiscal 2013

the Company was still recovering from the March 2011

earthquake.

"We are pleased to report our financial results for fiscal Q1

2014," said Masatoshi Takahama, Chief Executive Officer of

Kinbasha. "Despite slightly lower revenues due to the weaker yen,

Kinbasha demonstrated the results of our continually streamlined

operations by posting net income of $761,000, compared to a loss in

the same quarter last year. As we continue to execute our strategic

growth initiatives, we believe the decisions we have made will

position Kinbasha to grow in our proven markets while also limiting

expenses and reducing debt."

During the first quarter of fiscal 2014 the Company was able to

reduce its total debt from $132.3 million at March 31, 2013 to

$122.5 million as of June 30, 2013. As of June 30, 2013, the total

debt included $100.2 million of principal and $22.3 million of

accrued interest. In addition, debt in default decreased from $97.1

million at March 31, 2013 to $92.0 million at June 30, 2013. For

the past several years, the Company has negotiated with its lenders

and in many cases has obtained formal or informal forbearances and

loan modifications that have allowed it to effectively extend the

maturity of its debt through interest only and/or reduced principal

payments.

Mr. Takahama concluded, "We believe the progress we have made in

improving our financial metrics and continuing to negotiate deals

with our banks will help us achieve our growth objectives. As the

only pachinko company that is listed in the United States, Kinbasha

has an advantage over our competition when it comes to building

awareness and raising capital overseas. Going forward in fiscal

2014, Kinbasha's growth strategy is based on leveraging our

existing brand and operational expertise to propel our expansion

initiatives and to build long term shareholder value."

Earnings Conference Call

Kinbasha will host its earnings conference call on Wednesday,

August 14, 2013, at 9:30 a.m. Eastern to discuss its fiscal Q1 2014

financial results. The conference call will include a Q&A

session where investors will have the opportunity to ask questions

of management.

The teleconference can be accessed by dialing 877-407-0782 when

calling within the United States or 201-689-8567 when calling

internationally. Please dial in 10 minutes prior to the beginning

of the call. There will be a playback available until August 27,

2013. To listen to the playback dial 877-660-6853 when calling

within the United States or 201-612-7415 when calling

internationally and use replay ID number: 419552.

The conference call will be simultaneously webcast and available

at: http://www.investorcalendar.com/IC/CEPage.asp?ID=171483

About Kinbasha Gaming International,

Inc.

Based in Hitachi City, Japan, Kinbasha Gaming International,

Inc. (OTCQX: KNBA) is a retail gaming company that operates 21

pachinko parlors in the Japanese prefectures of Ibaraki, Tokyo and

Chiba. For more than 50 years, the company's retail gaming

establishments have offered customers the opportunity to play the

games of chance known as pachinko and pachislo. Pachinko is played

on a device which resembles a vertical pinball machine and pachislo

is played on a machine that resembles a western style slot machine.

Pachinko and pachislo are collectively ranked as Japan's largest

leisure activity. For more information on Kinbasha, please visit:

www.kinbashainc.com

For comprehensive investor relations material, including fact

sheets, multimedia resources, and videos regarding Kinbasha, please

follow the appropriate link: Investor Portal, Overview Video and

Investor Fact Sheet

Kinbasha shares are listed on the OTCQX. Investors can access

free, real-time Level 2 quotes for the company at:

www.otcmarkets.com/stock/KNBA/quote

Safe Harbor Statement

This release contains certain "forward-looking statements"

relating to the business of the Company and its subsidiary

companies. All statements, other than statements of historical fact

included herein are "forward-looking statements" including

statements regarding: the Company's business and operations;

business strategy, plans and objectives of the Company and its

subsidiaries; and any other statements of non-historical

information. These forward-looking statements are often identified

by the use of forward-looking terminology such as "believes,"

"expects" or similar expressions, involve known and unknown risks

and uncertainties. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. Investors should

not place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. The Company's

actual results could differ materially from those anticipated in

these forward-looking statements as a result of a variety of

factors, including those discussed in the Company's periodic

reports that are filed with the Securities and Exchange Commission

and available on its website (http://www.sec.gov). All

forward-looking statements attributable to the Company or persons

acting on its behalf are expressly qualified in their entirety by

these factors. Other than as required under the securities laws,

the Company does not assume a duty to update these forward-looking

statements.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Investor Contact: Trilogy Capital Partners - Asia Darren

Minton President 212-634-6413 Email Contact

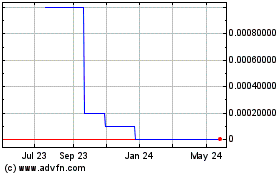

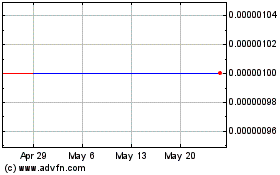

Kinbasha Gaming (CE) (USOTC:KNBA)

Historical Stock Chart

From May 2024 to Jun 2024

Kinbasha Gaming (CE) (USOTC:KNBA)

Historical Stock Chart

From Jun 2023 to Jun 2024