UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 22, 2024

MITESCO, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada | | 000-53601 | | 87-0496850 |

| (State or another jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| 505 Beachland Blvd., Suite 1377 Vero Beach, Florida 32963 |

| (Address of principal executive offices) (Zip Code) |

(844) 383-8689

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Advisory Board

In early 2024 the Board of Directors authorized the creation of a new Advisory Board whose participants shall include subject matter experts in certain business areas under consideration by the Company. These positions are “non-executive” and as such are not governed by Section 16 of the Securities Act. The compensation for the participants shall be $60,000 per year paid through the issuance of restricted common stock. The per share valuation to be used shall be determined by the Board of Directors based on the market of the Company’s common stock at the time of the appointment.

On November 22, 2024 the Company made a new appointment to its Advisory Board. The individual will receive $60,000 of restricted common stock for their services over the next 12 months. The Board has determined that the price per share for the restricted stock shall be $.80, resulting in the issuance of 75,000 shares for each member, in aggregate 150,000 shares.

Mr. Marty Valania is senior executive whose career has focused on the use of digital marketing in support of the newspaper industry, for both businesses (B2B), and direct to consumer selling. Since 2023 he has been head of digital marketing for Independent Newsmedia, Inc., who operates a digital news media and printing company based out of Arizona, Delaware, Florida and Maryland. Prior to that he spent six (6) years at Independent Newspapers, a Delaware newspaper operator. Before that assignment he was with Digital First Media, Inc., which followed a stint at Radiate Media, who provides hyper-local content, traffic information, advertising and interactive marketplace solutions to media partners and businesses nationwide, including on-air radio and television.

He has a bachelor's degree from the University of Delaware, and an MBA from Alfred Lerner College of Business & Economics at University of Delaware.

Insight as to the purpose of an Advisory Board is below:

https://www.dlapiperaccelerate.com/knowledge/2017/advisory-boards-what-why-who-when-and-how.html

An advisory board is a flexible, informal body that is created by the board of directors to provide the company's management team with non-binding strategic advice. Advisory boards can help budding companies acquire subject matter expertise, coach a CEO or management team, accelerate access to customers and channel partners by making industry-appropriate introductions that increase sales. It is possible to form advisory boards that address unique industry-specific concerns, such as scientific, medical, technical or energy issues. The idea of informality is key: the members of the advisory board do not have the authority to vote on matters brought to the board of directors and may only attend a meeting of the board of directors if they are invited. Also, the members of the advisory board are not bound by fiduciary duties and are not entitled to indemnification.

On December 2, 2024, the Company issued a press release updating shareholders on its financial results for the quarter ended September 30, 2024, and announcing the appointment noted above. A copy can is filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Forward-Looking Statements

This Form 8-K contains forward-looking statements. You can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future events or state other “forward-looking” information. There may be events in the future that we are not able to accurately predict or control. The forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. We cannot give any guarantee that these plans, intentions, or expectations will be achieved. All forward-looking statements involve risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: December 4, 2024

|

MITESCO, INC.

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Mack Leath

|

|

| |

|

Mack Leath

|

|

| |

|

Chairman and CEO

|

|

false

0000802257

true

0000802257

2024-11-22

2024-11-22

Exhibit 10.1

ADVISORY BOARD AGREEMENT

This Advisor Board Agreement (the “Agreement”) is by and between the undersigned company (the “Company”) and the undersigned advisor (the “Advisor”), effective as of the latest date set forth on the signature page (the “Effective Date”). This Advisory Board is a non-executive board and its participants shall not be subject to any of the regulations under Section 16 of the Securities Act.

1. Services. The Advisor will advise the Company on certain matters described on Exhibit A (the “Services”). The parties acknowledge and agree that the Services are outside the usual course of the Company’s business, that Advisor is customarily engaged in an independently established trade, occupation, or business of the same nature as the Services, and that the Company will not control the manner or means in which Advisor performs the Services.

2. Compensation. The Company agrees to provide to Advisor the compensation set forth on Exhibit A for the Services.

3. Term and Termination. This Agreement will begin on the Effective Date and continue until the end of any term described on Exhibit A (as may be extended), if any term is described on Exhibit A, or when earlier terminated by either party with five days of prior written notice. Upon termination of this Agreement, all rights and duties of the parties shall cease except that the Company must pay any amounts owed to Advisor for unpaid completed Services, and the provisions of Section 5 (Confidentiality), Section 6 (Ownership), Section 8 (Independent Contractor) and Section 9 (Miscellaneous) will survive.

4. Conflicts of Interest. Advisor represents that Advisor’s compliance with this Agreement and provision of the Services will not violate any duty that Advisor may have to a third party (such as a present or former employer). Advisor agrees to promptly notify the senior-most officer of the Company in writing of any potential conflict that arises, including Advisor’s engagement to provide services to any competitor of the Company. It is understood that in the event of an actual or potential conflict, the Company will review whether Advisor’s other activities are consistent with Advisor continuing to serve as an advisor to the Company. Advisor agrees not to use the funding, resources, facilities or time of any third party to provide the Services, or perform the Services in a manner that would give any third party rights to any intellectual property or other product of such work. Any products, technology, information, contacts or other intellectual property of the Advisor shall remain in the ownership of the Advisor and the Company shall have no rights to these items.

5. Confidentiality.

5.1 Definition of Confidential Information. “Confidential Information” means any Company information directly or indirectly disclosed by the Company to Advisor that is identified as confidential or which would appear to a reasonable person to be confidential, whether disclosed before or after the date of this Agreement, and whether disclosed in writing, orally, or by inspection of tangible objects. Confidential Information includes, but is not limited to, information relating to the Company’s finances, technology and operations, such as financial projections, customer lists, business forecasts, and source code. Confidential Information does not include information that: (i) is in the possession of Advisor at the time of disclosure without confidentiality obligations, as shown by Advisor’s files and records immediately prior to the time of disclosure; or (ii) becomes part of the public knowledge or literature, not as a direct or indirect result of any improper inaction or action of Advisor.

5.2 Disclosure and Use. Advisor agrees not to use any Confidential Information for Advisor’s own use or for any purpose other than to perform the Services. Advisor agrees to take all reasonable measures to protect the secrecy of and avoid disclosure or use of Confidential Information of the Company to any other person or entity. Notwithstanding the foregoing, Advisor may disclose Confidential Information with the prior written approval of the Company or pursuant to the order or requirement of a court, administrative agency or other governmental body.

5.3 Return of Materials; Survival. Upon termination of this Agreement or Company’s request, the Advisor will promptly return to the Company all materials in Advisor’s possession containing Confidential Information, as well as data, records, reports and any other property furnished by the Company to the Advisor or produced by the Advisor in connection with the Services, or copies thereof.

6. Ownership.

6.1 Advisor agrees that all notes, records, drawings, designs, software, inventions, improvements, developments, discoveries, trade secrets and other similar materials that Advisor conceives, discovers, develops or reduces to practice, solely or jointly with others that relate to the business or technology of the Company or that have been created in the course of performing the Services, as well as any copyrights, patents or other intellectual property rights relating to the foregoing (collectively, “Inventions”), are the sole property of the Company. Advisor also agrees to assign (or cause to be assigned) and hereby assigns fully to the Company all Inventions.

6.2 Advisor agrees to assist Company, or its designee, at the Company’s request and expense, in every proper way to secure the Company’s worldwide rights in Inventions, including by disclosing all pertinent information regarding Inventions, executing all instruments that the Company may deem necessary to apply for and obtain such rights and to assign and convey to the Company, its successors, assigns and nominees the sole and exclusive right, title and interest in and to all Inventions. This obligation shall continue after the termination of this Agreement.

6.3 Advisor will not incorporate any materials owned by any third party into any Invention without Company’s prior written permission. Advisor will inform Company in writing prior to incorporating any materials s/he owns into any Invention. Advisor hereby grants Company a nonexclusive, royalty-free, perpetual, irrevocable, worldwide license to reproduce, distribute, perform, display, create derivative works of, make, have made, modify, use, sell and otherwise exploit such materials as part of or in connection with such Invention, without restriction.

6.4 If the Company is unable to secure Advisor’s signature for the purpose of applying for or pursuing any application for any registrations covering the Inventions assigned to the Company in Section 6.1 above, then Advisor hereby irrevocably designates and appoints the Company and its duly authorized officers and agents as Advisor’s agent and attorney-in-fact, to act for and on Advisor’s behalf to execute and file any such applications and to do all other lawfully permitted acts to further the prosecution and issuance of patents, copyright and mask work registrations.

7. No Conflict. The Advisor represents that neither the execution of this Agreement nor the performance of the Advisor’s obligations under this Agreement will result in a violation or breach of any other agreement by which the Advisor is bound. The Company represents that this Agreement has been duly authorized and executed and is a valid and legally binding obligation of the Company, subject to no conflicting agreements.

8. Independent Contractor. The Advisor will at all times be an independent contractor, and as such will not have authority to bind the Company. The Advisor will not act as an agent or be deemed to be an employee of the Company for any purpose, and Advisor will not be eligible for any Company-sponsored employee benefit program. For example, the Advisor shall have no right to receive paid vacation, sick leave, medical insurance, 401k participation, a personal computer, mobile phone or other electronic device, an email address, or any other benefit of Company employment. Advisor must pay all self-employment and other taxes on the income received from the Company hereunder. As previously noted the Advisor shall not be subject to the provisions of Section 16 of the Securities Act ( https://www.investopedia.com/terms/s/section-16.asp#:~:text=According%20to%20Section%2016%2C%20anyone,statements%20required%20by%20Section%2016 ).

9. Miscellaneous. This Agreement (together with its Exhibit) is the sole agreement and understanding between the Company and Advisor concerning its subject matter, and it supersedes all prior agreements and understandings with respect to such matters. Any required notice shall be given in writing at the physical or e-mail address of each party on its signature page hereto, or to such other address as either party may substitute by written notice to the other. Neither this Agreement nor any right hereunder or interest herein may be assigned or transferred by Advisor without the prior written consent of the Company. The Company may assign this Agreement to an entity that succeeds to substantially all of the business or assets of the Company. This Agreement may only be amended or modified by a writing signed by both parties. Waiver of any term or provision of this Agreement or forbearance to enforce any term or provision by either party shall not constitute a waiver as to any subsequent breach or failure of the same term or provision or a waiver of any other term or provision of this Agreement. In the event that any provision of this Agreement becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable or void, this Agreement shall continue in full force and effect without such provision, provided that no such severability shall be effective if it materially changes the economic benefit of this Agreement to either Company or Advisor.

10. Protected Activity Not Prohibited. Nothing in this Agreement shall in any way prohibit Advisor from engaging in filing a charge, complaint, or report with, or otherwise communicating, cooperating, or participating in any investigation or proceeding that may be conducted by any federal, state or local government agency or commission, including the Securities and Exchange Commission, or otherwise disclosing information about unlawful conduct to relevant authorities to the extent required by or protected by law.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of

______________, 20__.

|

COMPANY:

|

|

ADVISOR:

|

| |

|

|

|

By:

|

|

By:

|

| |

|

|

|

Signature:

|

|

Signature:

|

| |

|

|

|

Name:

|

|

Name:

|

| |

|

|

|

Title:

|

|

Title:

|

| |

|

|

|

Address:

|

|

Address :

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

E-mail:

|

|

E-mail:

|

[Signature Page to Advisor Agreement]

EXHIBIT A

SERVICES AND COMPENSATION

1. Services. Advisor will render to Company the following Services:

| |

●

|

Serve as an expert advisor, including: meet with Company management, employees, consultants and other advisory board members, review goals of the Company and help develop strategies to achieve them, provide advice regarding the Company’s business model, timely respond to e-mail messages and phone calls, facilitate introductions to potential partners, prospects and other relevant contacts and speak with prospective or current investors to validate the Company’s strategy[, as well as attend a minimum of four (4) Company advisory board meetings per year at such times and locations as the Company requests]; and

|

| |

●

|

otherwise collaborate and provide advice and assistance to the Company per mutual agreement.

|

2. Compensation.

| |

●

|

Company shall pay Advisor through the issuance of restricted common stock in the Company. For the term of twelve (12) months the consideration shall be $60,000 of stock. The price per share shall be determined by the Company at the time of the issuance.

|

| |

●

|

Company shall reimburse Advisor for all reasonable travel expenses incurred by Advisor that are pre-approved by the Company. Advisor shall submit to the Company all statements for such expenses [and Services performed] on a monthly basis in a form acceptable to the Company, and the Company shall remit payment within 30 days.

|

3. Term. Subject to earlier termination pursuant to Section 3 of this Agreement, the term of this Agreement shall be for twelve months, one (1) year following the Effective Date, unless extended by mutual agreement in writing between the Company and the Advisor.

Exhibit 99.1

Mitesco Reports $2 Million Q3 Profit From Restructuring

Digital Marketing Pro Joins to Drive Growth

VERO BEACH, Fla., Dec. 02, 2024 (GLOBE NEWSWIRE) -- Mitesco, Inc. (OTC:MITI, “the Company”, www.mitescoinc.com) announced that its financial results for the quarter ended September 30, 2024, included a substantial gain from its restructuring efforts, and provides this update and perspective on the near term expectations for the Company. It also noted the addition of Marty Valania, a 25-year veteran of digital marketing and technology to its Advisory Board.

Highlights include:

| |

●

|

For the quarter ending September 30, 2024, the net income was $2.0 million income vs a loss in the year earlier of ($2.5 million).

|

| |

●

|

For the Q3 period, it reported a fully diluted income of $.29 EPS on 6.3 million shares outstanding, vs ($.48) loss on 5.3 million shares outstanding in the year prior.

|

| |

●

|

For the 9 months ending September 30, 2024, the operating expenses were $721,000 vs $2.4 million in the year prior.

|

| |

●

|

Net income for the 9-month period was $697,000 versus a loss of ($15.8 million).

|

| |

●

|

The expenses year to date were dominated by interest expense related to liabilities related to the prior clinic business, the majority of which have now been eliminated because of the restructuring effort.

|

Mack Leath, CEO, provided this commentary, “Clearly our restructuring effort is in gear and providing important results for our shareholders. We are finding support from our holders of our debt and senior securities who see the longer term potential. We still have much work ahead of us as we rebuild our balance sheet and create success of size in our operating businesses.”

He continued, “Since the end of the quarter we have converted an additional $4 million of debt, notes and senior securities, leaving mostly obligations from the discontinued clinic business and settlements from prior landlords at the seven (7) shuttered clinic sites. The remaining part of the quarter will include efforts to resolve these, and all other liabilities, through similar conversions into equity.”

As previously reported on Form 8k, over $25 million in liabilities has been restructured including over $13 million in senior securities being processed into a new non-interest-bearing security which amortizes over 36 months, and over $12 million of obligations debt eliminated through conversion into restricted common stock at $4.00 per share.

When asked about the new Centcore data center business (www.centcoreusa.com) and the Vero Technology Ventures effort, he replied, “Centcore is finding interest in its highly secure data center offerings, with a significant and growing pipeline of prospects. Interesting segments include municipal entities who are using GIS solutions from ESRI, with whom we have a relationship, and smaller financial institutions, which has been a surprise to us. It seems they have new security compliance issues to address that can be quite expensive and complicated, and where a move into our data center would resolve much of that complexity and cost expense. Our implementation partner, Accucom (www.accucomci.com), provides both the day-to-day systems support, as well as evaluating the conversion effort required for each client. The use of the Centcore Partner Program allows us to keep our overhead and costs down, and helps the partners find new revenue sources they otherwise might not uncover.”

“The Vero Technology Ventures effort is focused on cloud computing software solutions, generally where there is a significant data storage and retrieval need. This is the most profitable part of the data center operations, and we would like to build it more rapidly. We have an internal project aimed at A.I. based support for sales and marketing which we are starting this quarter, along with several investment situations that are likely efforts for FY2025,” Leath explained.

Regarding its interest in digital marketing, Leath noted, “We believe all B2B business development marketing will be driven by digital marketing going forward and accelerated by A.I. in both targeting and qualification of prospects. We intend to form a business unit that will focus on this area and have asked Mr. Valania to help us make that effort. His resume is impressive, and we expect his P&L responsibilities to make that effort contribute to our profitability quickly.”

He concluded, “We thank our shareholders for their continued support, and believe the data center business provides a platform for both short-term, and longer duration growth going forward.”

Contact:

Mitesco Investor Relations

Jimmy Caplan

jimmycaplan@me.com

512.329.9505

Mitesco Media Relations

Rick Eisenberg

eiscom@msn.com

917-691-8934

Forward-Looking Statements

This press release contains forward-looking statements, including, but not limited to, statements related to the expected foreclosure of several of our clinics. Words such as “expects,” “anticipates,” “aims,” “projects,” “intends,” “plans,” “believes,” “estimates,” “seeks,” “assumes,” “may,” “should,” “could,” “would,” “foresees,” “forecasts,” “predicts,” “targets,” “commitments,” and variations of such words and similar expressions are intended to identify such forward-looking statements. We caution you that the foregoing may not include all the forward-looking statements made in this press release.

These forward-looking statements are based on the Company’s current plans, assumptions, beliefs, and expectations. Forward-looking statements are subject to the occurrence of many events outside of the Company’s control. Actual results and the timing of events may differ materially from those contemplated by such forward-looking statements due to numerous factors that involve substantial known and unknown risks and uncertainties. These risks and uncertainties include, among other things, the ability to obtain additional financing,; the risk that defaults under the Company’s leases could trigger other damages and remedies; the risk that commenced and threatened litigation may result in material judgments against the Company; the risk that foreclosure of the Company’s clinics may adversely affect the Company’s internal programs and the Company’s ability to recruit and retain skilled and motivated personnel, and may be distracting to employees and management; the risk that foreclosure of the Company’s clinics may negatively impact the Company’s business operations and reputation with or ability to serve customers; and other risks and uncertainties included in the Company’s reports on Forms 10-K, 10-Q, and 8-K and in other filings the Company makes with the Securities and Exchange Commission from time to time, available at www.sec.gov.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

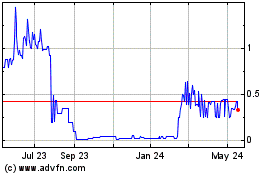

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Feb 2025 to Mar 2025

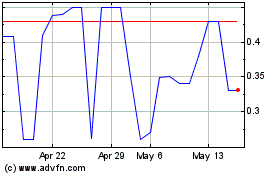

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Mar 2024 to Mar 2025