SSE Subsidiary Agrees to GBP350 Million Placement to Support Renewables

01 April 2022 - 2:46AM

Dow Jones News

By Joe Hoppe

SSE PLC said Thursday that its subsidiary SSEN Transmission has

agreed a 350 million pound ($459.7 million) private placement to

fund investments in electricity transmission infrastructure for

renewable energy.

The FTSE 100 energy company said that the placements will be

issued in two equal tranches of GBP175 million, the first maturing

in June 2032 and the second in June 2037. The tranches carry rates

of 3.13% and 3.24% respectively.

The terms were agreed with Pricoa Private Capital, part of PGIM,

Inc. and include a three-month delayed draw, with the proceeds

expected to be received in June this year.

The proceeds will be used to fund part of SSEN's program of

investments in transmission network infrastructure, which will help

accommodate the significant increase in renewables needed to

transition the U.K. to net zero emissions, and will also cover

existing maturing debt.

"This placement is on attractive terms and demonstrates the

diversification of funding options available to the transmission

business as we deliver this growth," SSE Finance Director Gregor

Alexander said.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

March 31, 2022 11:31 ET (15:31 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

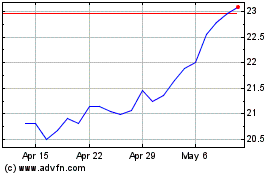

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Nov 2024 to Dec 2024

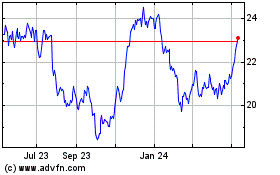

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about SSE PLC (PK) (OTCMarkets): 0 recent articles

More SSE PLC (PK) News Articles