A.M. Best Affirms Credit Ratings of Beazley’s Lloyd’s Syndicates, Beazley Re Designated Activity Company & Beazley Insura...

08 April 2017 - 1:42AM

Business Wire

A.M. Best has affirmed the Financial Strength Ratings

(FSR) of A (Excellent) and the Long-Term Issuer Credit Ratings

(Long-Term ICR) of “a+” of Lloyd’s Syndicate 2623,

Lloyd’s Syndicate 623, Lloyd’s Syndicate 3623 and

Lloyd’s Syndicate 3622 (the syndicates) (United Kingdom).

Concurrently, A.M. Best has affirmed the FSRs of A (Excellent) and

the Long-Term ICRs of “a” of Beazley Re Designated Activity

Company (Beazley Re) (Ireland) and Beazley Insurance

Company, Inc. (BICI) (Farmington, CT). The outlook of these

Credit Ratings (ratings) is stable.

Syndicates 2623, 623, 3623 and 3622 are managed by Beazley

Furlonge Limited, and their ratings reflect the financial strength

of the Lloyd’s market, which underpins the security of all

syndicates. In addition, syndicates 2623 and 623 benefit from a

track record of excellent operating performance and strong

positions in the Lloyd’s market. Syndicates 2623 and 623 underwrite

business at Lloyd’s in parallel, with their individual shares of

combined business split according to each syndicate’s portion of

overall combined capacity. The capital of syndicates 2623, 3623,

3622 is provided by Beazley plc (Beazley) [LSE: BEZ] via its

corporate member, whilst syndicate 623 is supported by third-party

capital. The excellent performance of syndicates 2623 and 623 is

demonstrated by a five-year average combined ratio of 83%

(2012-2016).

Syndicate 3623 writes accident and health business, and

reinsures Beazley’s U.S. admitted carrier, BICI. Syndicate 3622 is

a dedicated life syndicate, writing life business associated with

Syndicate 3623’s accident and health portfolio. The performance of

these two smaller syndicates historically has not matched that of

the larger Beazley syndicates. However, A.M. Best expects Syndicate

3623’s performance to improve over the medium term, as Beazley’s

admitted business in the United States attains scale, and remedial

actions in accident and health lines take effect.

Beazley Re reinsures 75% of the profit of Beazley’s Lloyd’s

corporate member after a deductible. Therefore, it shares in the

strong profile and combined profitability of syndicates 2623, 3623

and 3622. Beazley Re is viewed to be integrated and strategically

important to Beazley, reflecting its role as the group’s internal

reinsurer. In addition, Beazley Re is expected to obtain a license

to write third-party insurance business during 2017, which will

enable the group to offer non-Lloyd’s underwriting capacity in the

European Union in the future. The company’s risk-adjusted

capitalisation is supportive of the ratings.

BICI’s role as an expanding admitted U.S. carrier is

strategically important to Beazley Re and to the Beazley group.

A.M. Best expects BICI’s importance to increase over the medium

term, as the company’s premium and earnings base become more

material to the overall group.

This press release relates to Credit Ratings that have been

published on A.M. Best’s website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please see A.M.

Best’s Recent Rating Activity web page. For additional

information regarding the use and limitations of Credit Rating

opinions, please view Understanding Best’s Credit

Ratings.

A.M. Best is the world’s oldest and most authoritative

insurance rating and information source. For more information,

visit www.ambest.com.

Copyright © 2017 by A.M. Best Rating

Services, Inc. and/or its subsidiaries. ALL RIGHTS

RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170407005495/en/

A.M. BestMyles Gould, +44 20 7397 0267Senior Financial

Analystmyles.gould@ambest.comorEdin Imsirovic,

+1-908-439-2200, ext. 5740Senior Financial

Analystedin.imsirovic@ambest.comorChristopher

Sharkey, +1-908-439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy,

+1-908-439-2200, ext. 5644Director, Public

Relationsjames.peavy@ambest.com

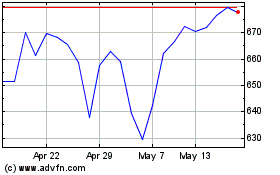

Beazley (LSE:BEZ)

Historical Stock Chart

From Apr 2024 to May 2024

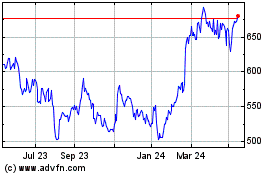

Beazley (LSE:BEZ)

Historical Stock Chart

From May 2023 to May 2024