KCR Residential REIT PLC Exchange of contracts to acquire 17 apartments (5365J)

03 April 2018 - 4:01PM

UK Regulatory

TIDMKCR

RNS Number : 5365J

KCR Residential REIT PLC

03 April 2018

This announcement contains information which, prior to its

disclosure, was inside information for the purpose of the Market

Abuse Regulation

3 April 2018

KCR Residential REIT plc

Exchange of binding contracts to acquire 17 apartments in West

London

Highlights

-- Total consideration of GBP5.35 million

-- Gross annual yield on consideration of 4.8 per cent

-- Transaction will significantly increase Net Asset Value ("NAV") per share.

KCR Residential REIT plc ("KCR" or the "Company") is pleased to

announce that it has exchanged binding contracts to acquire three

freehold blocks containing 16 studio, one- and two-bedroom

apartments in Ladbroke Grove and a two-bedroom apartment in Harrow

for a total consideration of GBP5.35 million excluding costs,

payable in cash. KCR is acquiring the entire share capital of the

SPV that owns the freehold properties. The transaction is

contracted to complete no later than 29 June 2018.

The apartments are fully let to private tenants. The total

rental income is over GBP0.25 million, generating a gross annual

yield on consideration of 4.8 per cent. The average unit value of

the acquired properties is GBP314,700 and average monthly rent is

approximately GBP1,250 (GBP32 per sq. ft. per annum).

There is strong demand from tenants in this area (in particular

in the lower rental price bracket in which KCR focuses) with a

limited supply of such properties, as many are being converted back

to single family homes.

This transaction is in line with KCR's acquisition strategy:

-- blocks of studio, one- and two-bed apartments

-- lower rental price bracket where there is high tenant demand

-- generating immediate income

-- close to transport and shopping / leisure facilities

-- asset management potential to enhance rental and capital values

-- focus on acquiring SPVs that own property to realise benefits

afforded to REIT structures.

Dominic White, Chief Executive of KCR, said: "This is a highly

accretive transaction for KCR that has a significant positive

impact on revenue. We estimate that NAV per share will increase by

more than 20 per cent as a result of the acquisition.

We are currently working on a number of similar acquisitions in

the south and south-east of the UK that would mark a step-change in

the size and growth of KCR. We will update the market when

appropriate."

Contacts:

KCR Residential REIT plc info@kcrreit.com

Dominic White, Chief executive +44 20 3793

5236

Arden Partners plc

Steve Douglas +44 20 7614 5917

Notes to Editors:

KCR's objective is to build a substantial UK residential

property portfolio that generates both secure income flow and

increasing net asset value for shareholders. KCR acquires blocks of

studio, one- and two-bed apartments that are close to transport

links, shopping and leisure. As a Real Estate Investment Trust, KCR

predominantly acquires buildings owned by Special Purpose Vehicles

("SPVs") with inherent historical capital gains since this

acquisition structure can often deliver tax advantages to the REIT

and its shareholders.

This information is provided by RNS

The company news service from the London Stock Exchange

END

CNTDGGDSCSGBGID

(END) Dow Jones Newswires

April 03, 2018 02:01 ET (06:01 GMT)

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From Apr 2024 to May 2024

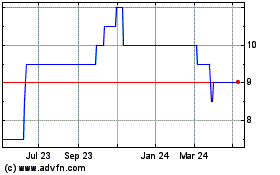

Kcr Residential Reit (LSE:KCR)

Historical Stock Chart

From May 2023 to May 2024