discoverIE Group plc (LSE:DSCV) announced its preliminary results for the fiscal year ending March 31, 2025, demonstrating resilient performance amid industry-wide inventory corrections that caused a 3% decline in sales. The company achieved record earnings, with adjusted operating profits rising 8% on a constant currency basis, supported by a notable increase in cash flow. The adjusted operating margin surpassed expectations, reaching 14.3%, prompting the company to raise its medium-term operating margin target to 17% by fiscal year 2029/30.

Orders showed organic growth of 2%, reflecting a positive market trend. discoverIE also completed two bolt-on acquisitions during the year, strengthening its market presence and expanding its product offerings. With a robust pipeline of opportunities and a strategic focus on high-growth markets, the group is well-positioned to sustain growth and operational resilience.

Financial and Strategic Outlook

discoverIE maintains a strong financial foundation with effective cash flow management despite revenue challenges and margin pressures. Strategic acquisitions and ongoing corporate developments underpin a positive outlook. However, cautious optimism is advised due to technical indicators and a relatively high price-to-earnings ratio. Continued emphasis on revenue expansion and margin improvement will be key to future success.

About discoverIE Group plc

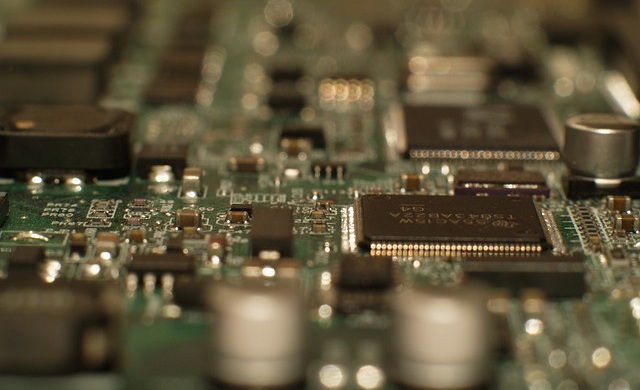

discoverIE Group plc is a global designer and manufacturer of innovative electronic components tailored for industrial applications. Operating through two divisions—Magnetics & Controls and Sensing & Connectivity—the company serves original equipment manufacturers worldwide. This business model supports a steady stream of recurring revenues and long-term customer partnerships, focusing on structurally growing markets.

Hot Features

Hot Features