Credit Bureaus Get Scolding -- WSJ

27 February 2019 - 7:02PM

Dow Jones News

Lawmakers call for tougher rules forcing firms such as Equifax

to fix inaccuracies

By Yuka Hayashi

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 27, 2019).

WASHINGTON -- Lawmakers on Tuesday launched a new attack on

consumer credit-reporting companies, a year and a half after the

data breach at Equifax Inc. exposed personal financial details of

millions of Americans.

A hearing before a Democratic-led House panel resulted in calls

for new legislation to impose tougher requirements on companies to

fix inaccuracies in consumers' credit reports. Several House

Democrats said errors are pervasive and boost costs of mortgage and

auto loans for millions of consumers.

Tuesday's hearing before the House Financial Services Committee

brought together chief executives of the nation's top three

credit-reporting companies with some of Congress's toughest critics

of their industry. Those included Rep. Maxine Waters, the

committee's head, and Rep. Alexandria Ocasio-Cortez (D., N.Y.), one

of the panel's new members who has called credit reporting a

"broken system."

Summoned to the hearing were Mark Begor of Equifax, James Peck

of TransUnion LLC and Craig Boundy of Experian PLC's North America

unit.

Some committee Republicans also said consumers needed more

protection. Rep. Patrick McHenry (R., N.C.), the committee's most

senior Republican, said Tuesday's hearing was long overdue. "The

credit-reporting system is broken," he said.

The industry has escaped tougher oversight in the wake of the

Equifax breach, but that might change under the

Democratic-controlled House. Some key Senate Republicans, whose

support is needed for passing any legislation, have expressed

interest in changing credit-reporting companies' practices.

"So consumers own their data but credit bureaus collect their

information without their consent," said Ms. Ocasio-Cortez as she

questioned the executives. "There is no way they can prevent you

from collecting it."

Ahead of Tuesday's hearing, Ms. Waters, a longtime industry

critic, introduced a 199-page bill calling for wide-ranging

measures to overhaul the industry. Among them are a new right for

consumers to challenge errors in their credit reports, bars on

employers using credit reports to screen job applicants and greater

power for the Consumer Financial Protection Bureau to regulate the

industry.

"While these are all critical reforms to the existing system, I

believe that we need to ask whether the system is so beyond repair

that we need to completely rebuild the entire consumer

credit-reporting sector to truly put consumers first," Ms. Waters

said at the hearing.

The industry executives pushed back against the need for new

legislation, saying they have made significant improvements to

their systems and practices in recent years.

Equifax's Mr. Begor said since the hack at his company, it has

increased technology spending by $1.2 billion, including hiring

nearly 1,000 technology and security staff. The company is

investing more to help consumers access their data and fix errors

more easily.

"Our culture is shifting," Mr. Begor said. "One credit-reporting

error is one too many."

As a result of 2018 legislation, consumers can now freeze and

unfreeze their credit reports free of charge, including those for

children.

Analysts say some of the steps proposed by Ms. Waters have a

chance of becoming law eventually. That will depend on whether

Democrats, who have a majority in the House, can get the support of

Republicans in the Senate, where Sen. Mike Crapo (R., Idaho),

chairman of the Senate banking panel, has expressed interest in

legislation to change industry practices.

Jaret Seiberg, an analyst for Cowen Washington Research Group,

said Tuesday's hearing confirmed there is bipartisan support for

legislation to overhaul the industry. "While there may not be

agreement on exactly what should change, there was broad support to

giving consumers more power to fix mistakes and to control the

data," he said in a research note.

While lawmakers renew their interest in the sector, regulators

are continuing their efforts to investigate the Equifax breach. The

company disclosed in a securities filing last week that the Federal

Trade Commission and the Consumer Financial Protection Bureau

intended to seek legal remedies, including civil penalties in the

case of the CFPB. The company said it is cooperating with

investigations, adding that these may lead to charges that affect

its financial results.

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

February 27, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

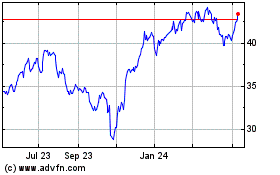

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From Apr 2024 to May 2024

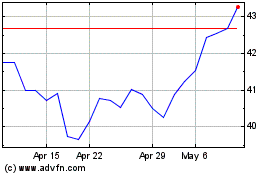

Experian (QX) (USOTC:EXPGY)

Historical Stock Chart

From May 2023 to May 2024