Power REIT (NYSE-AMEX: PW and PW.PRA) (“Power REIT” or the

“Trust”), with a focused “Triple Bottom Line” strategy and a

commitment to people, planet, and profit, today announced that it

is providing an update that includes highlights of the Trust’s

financial and operating results for the three and twelve months

ended December 31, 2021.

FINANCIAL HIGHLIGHTS

| |

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

1,785,809 |

|

|

$ |

1,394,613 |

|

|

$ |

8,457,914 |

|

|

$ |

4,272,709 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income Attributable to Common Shareholders |

|

$ |

670,730 |

|

|

$ |

863,970 |

|

|

$ |

4,491,656 |

|

|

$ |

1,891,644 |

|

| Net Income per Common Share (basic) |

|

|

0.21 |

|

|

|

0.42 |

|

|

|

1.41 |

|

|

|

0.99 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core FFO Available to Common Shareholders |

|

$ |

1,115,079 |

|

|

$ |

973,578 |

|

|

$ |

6,139,903 |

|

|

$ |

2,560,225 |

|

| Core FFO per Common Share |

|

|

0.35 |

|

|

|

0.51 |

|

|

|

1.93 |

|

|

|

1.34 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Growth Rates: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

|

28 |

% |

|

|

|

|

|

|

98 |

% |

|

|

|

|

| Net Income Attributable to Common Shareholders |

|

|

-22 |

% |

|

|

|

|

|

|

137 |

% |

|

|

|

|

| Net Income per Common Share (basic) |

|

|

-49 |

% |

|

|

|

|

|

|

42 |

% |

|

|

|

|

| Core FFO Available to Common Shareholders |

|

|

15 |

% |

|

|

|

|

|

|

140 |

% |

|

|

|

|

| Core FFO per Common Share |

|

|

-31 |

% |

|

|

|

|

|

|

44 |

% |

|

|

|

|

During the year, Power REIT deployed all of the

approximately $37 million of the capital raised in the Rights

Offering which was completed in February 2021. During the fourth

quarter of 2021, the Trust reported a Quarterly FFO Per Share of

$0.35. During the fourth quarter, the Trust recorded two one-time

write-offs for the termination of leases with Cloud Nine LLC and

The Grail Project LLC. Additionally, straight-line rent for the

Michigan property starting in Q4 2021 was omitted from

straight-line rent and created a one-time write-off to adjust for

the straight-line that was recorded during the third quarter of

2021. These three one-time adjustments combined reduced FFO by

$0.16 per share. We anticipate resuming straight-line rent for the

Michigan property once there is a clearer sense of timing with

respect to licensing and commencement of operations. Had the

straight-lined rent for the Michigan property been included in the

fourth quarter 2021 calculation, the incremental FFO would add

approximately $0.38 per share per quarter. On an adjusted basis, if

we did not make these three one-time adjustments, and did not omit

straight-line rent from the Michigan property in Q4, our Quarterly

FFO Per Share for the fourth quarter of 2021 would have been

$0.89.

Commenting on the Trust’s financial and

operating results, David Lesser, Chief Executive Officer

stated, “We are pleased with our external growth activity

last year. We invested approximately $48 million in 9 greenhouse

properties primarily from the funds generated through our

non-dilutive rights offering completed in February of 2021. These

acquisitions are consistent with our business strategy that we

commenced in 2019, positioning ourselves as an emerging technology

company that focuses on real estate for greenhouse plant

cultivation. With a focus on environmental sustainability across

our entire platform, greenhouses provide superior sustainable

farming alternatives for the future. Our goal moving into 2022 and

beyond is to continue our growth efforts and generate long-term

cash flow from our portfolio.”

Mr. Lesser concluded, “From an

earnings perspective, we increased our Core FFO per common share by

44% year over year. We remain confident in our long-term strategy

that greenhouses provide the most economically and environmentally

sustainable path for cultivation and focused on managing our

existing portfolio in lockstep with accretive acquisitions.”

PORTFOLIO

Power REIT’s portfolio currently comprises:

- 21 Controlled Environment

Agriculture (CEA) properties (greenhouses) totaling more than

1,000,000 square feet;

- 7 solar farm ground leases totaling

601 acres; and

- 112 miles of railroad

property.

During 2021 the Trust acquired 9 greenhouse

properties at an average unlevered yield of approximately 18%. This

is indicative of the current market conditions where the Trust

seeks to acquire and expand its greenhouse portfolio.

LEASING ACTIVITY

PSP – Tamarack 13 and 14On

August 11, 2021, our wholly owned subsidiary, PW CO CanRe MF LLC

(“CanRe MF”), filed a breach of contract claim against PSP

Management LLC (“PSP”) related to the lease (the “PSP Lease”) for

property (the MF Property) owned by CanRe MF. As a result, PSP was

evicted on November 1, 2021. Currently, this space is being

marketed to a variety of prospective tenants.

Golden Leaf Lane – Maverick 5On

November 5, 2021, our wholly owned subsidiary, PW CO CanRe Mav 5

LLC (“CanRe Mav 5”), terminated its lease (the “OCG Lease”) with

Original Cannabis Growers of Ordway LLC (“OCG”) which was executed

on March 19, 2020. On November 5, 2021, Green Leaf Lane LLC (“Green

Leaf”) signed a 20-year lease with 2, 5-year renewal options at an

Unleveraged FFO Yield of 18.5%. Construction was complete at the

property and Green Leaf was able to commence cultivation

immediately.

The Sandlot – Tamarack 4 and

5On December 8, 2021, our wholly owned subsidiary, PW CO

CanRE Grail, LLC (“CanRE Grail”), terminated its lease (the “Grail

Lease”) with The Grail Project LLC (“Grail”) which was executed on

January 1, 2021. On January 1, 2022, The Sandlot LLC (“Sandlot”)

signed a 20-year lease with 4, 5-year renewal options at an

Unleveraged FFO Yield of 18.6%. Sandlot will complete the remaining

construction and improvements at the property.

STRATEGIC ALLIANCE

In 2021, Power REIT embarked on a strategic

alliance with Millennium Sustainable Ventures Corp. (“MILC”)

(ticker: MILC). The goal of the strategic alliance was to create a

more scalable operating and acquisition platform between the two

public companies of which David Lesser is CEO. The Trust’s

Declaration permits this type of business relationship, and going

forward, a majority of the members of the Special Committee –

Related Party Transactions, which is comprised entirely of

independent trustees must approve Power REIT’s involvement in any

transactions related to MILC to address any inherent conflicts of

interest between Power REIT, MILC, and their CEO, Mr. Lesser or his

affiliates. The Trust believes that this alleviates any unilateral

decisions made by Mr. Lesser and/or his affiliates. These potential

risk factors, or conflicts of interest are outlined in detail in

both companies’ public filings. Further, both companies also have

favorable governance structures with a non-insider ratio of 4:1 at

Power REIT and a 3:1 ratio at MILC.

CAPITAL MARKETS ACTIVITY

Cash and Cash Equivalents totaled approximately

$3.2 million as of December 31, 2021, a decrease of approximately

2.4 million from December 31, 2020. The primary use of cash was for

working capital requirements and investment activities including

$30.9 million paid for land and greenhouse cultivation facilities

with $11.2 paid for construction and improvements for these

facilities.

On December 21, 2021, Power REIT obtained a $20

million debt facility which has a 12-month draw period before

converting to a five-year term loan. The interest rate on the debt

facility is 5.42%, which creates a meaningful investment spread

based on the yields Power REIT is investing at.

On June 21, 2021, the SEC declared Power REIT’s

shelf registration effective. Power REIT continues to focus on

non-dilutive capital to fund its growth including debt alternatives

and potentially the issuance of Preferred Stock.

On February 5, 2021, Power REIT closed on its

Rights Offering, generating proceeds of approximately $37 million

and issued an additional 1,383,394 common shares. Through this

investor friendly, shareholders of record as of December 28, 2020,

were offered the opportunity to purchase additional shares at

$26.50 per share

On February 3, 2021, Power REIT issued 192,308

additional shares of Power REIT’s Series A Preferred Stock (ticker:

PW.PRA) as part of a transaction to acquire a property located in

Riverside County, CA (the “Canndescent Property”) through a newly

formed wholly owned subsidiary (“PW Canndescent”).

DISTRIBUTIONS

During the twelve months ended December 31,

2021, the Trust paid quarterly dividends of approximately $653,000

($0.484375 per share) on Power REIT’s 7.75% Series A Cumulative

Redeemable Perpetual Preferred Stock.

UPDATED INVESTMENT

PRESENTATION

Power REIT has posted an updated investor

presentation which is available using the following link:

https://www.pwreit.com/investors

STATEMENT ON SUSTAINABILITY

Power REIT owns real estate related to

infrastructure assets including properties for Controlled

Environment Agriculture facilities with a focus on greenhouses,

Renewable Energy and Transportation.

CEA facilities in the form of greenhouses,

provide an extremely environmentally friendly solution, which

consume approximately 70% less energy than indoor growing

operations that do not benefit from “free” sunlight. greenhouses

use 90% less water than field grown plants, and all of Power REIT’s

greenhouse properties operate without the use of pesticides and

avoid agricultural runoff of fertilizers and pesticides. These

facilities cultivate medical Cannabis, which has been recommended

to help manage a myriad of medical symptoms, including seizures and

spasms, multiple sclerosis, post-traumatic stress disorder,

migraines, arthritis, Parkinson's disease, and Alzheimer’s.

Renewable Energy assets are

comprised of land and infrastructure associated with utility scale

solar farms. These projects produce power without the use of fossil

fuels thereby lowering carbon emissions. The solar farms produce

approximately 50,000,000 kWh of electricity annually which is

enough to power approximately 4,600 homes on a carbon free

basis.

Transportation assets are

comprised of land associated with a railroad, an environmentally

friendly mode of bulk transportation.

ABOUT POWER REITPower REIT,

with a focus on the “Triple Bottom Line” and a commitment to

people, planet and profit, is a specialized real estate investment

trust (REIT) that owns sustainable real estate related to

infrastructure assets including properties for Controlled

Environment Agriculture, Renewable Energy and Transportation. Power

REIT is actively seeking to expand its real estate portfolio

related to Controlled Environment Agriculture in the form of

greenhouses for the cultivation of food and cannabis.

Additional information about Power REIT can be

found on its website: www.pwreit.com

Cautionary Statement About

Forward-Looking StatementsThis document includes

forward-looking statements within the meaning of the U.S.

securities laws. Forward-looking statements are those that predict

or describe future events or trends and that do not relate solely

to historical matters. You can generally identify forward-looking

statements as statements containing the words "believe," "expect,"

"will," "anticipate," "intend," "estimate," "project," "plan,"

"assume", "seek" or other similar expressions, or negatives of

those expressions, although not all forward-looking statements

contain these identifying words. All statements contained in this

document regarding our future strategy, future operations, future

prospects, the future of our industries and results that might be

obtained by pursuing management's current or future plans and

objectives are forward-looking statements. You should not place

undue reliance on any forward-looking statements because the

matters they describe are subject to known and unknown risks,

uncertainties and other unpredictable factors, many of which are

beyond our control. Our forward-looking statements are based on the

information currently available to us and speak only as of the date

of the filing of this document. Over time, our actual results,

performance, financial condition or achievements may differ from

the anticipated results, performance, financial condition or

achievements that are expressed or implied by our forward-looking

statements, and such differences may be significant and materially

adverse to our security holders.

Contact:

|

David H. Lesser, Chairman & CEO |

Mary Jensen, Investor Relations |

|

dlesser@pwreit.com |

mary@irrealized.com |

|

917-881-3142 |

310-526-1707 |

|

|

|

| 301 Winding RoadOld Bethpage, NY

11804 |

|

| www.pwreit.com |

|

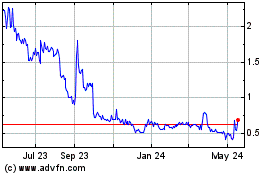

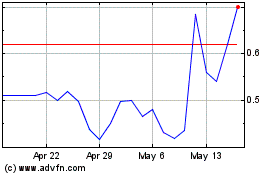

Power REIT (AMEX:PW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Power REIT (AMEX:PW)

Historical Stock Chart

From Jul 2023 to Jul 2024