Bitcoin’s 60-Day CDD Spikes: A Warning Sign or Buying Opportunity?

28 February 2025 - 8:30PM

NEWSBTC

Bitcoin remains under pressure, with its price dropping below

$85,000. At the time of writing, Bitcoin is valued at $84,397,

representing a 2.4% decline in the past 24 hours and a significant

13.7% drop over the past week. These market conditions have sparked

a range of analyses, with various on-chain indicators offering

insights into current investor behavior. Related Reading: Bitcoin

Retail Demand Levels Return to Neutral Zone—What Next? Bitcoin

Latest CDD Spike Could Signal A Market Shift One of the key

indicators highlighted recently by a CryptoQuant analyst known as

Banker is the Coin Days Destroyed (CDD) metric. According to

Banker, the Coin Days Destroyed (CDD) metric—a measure of economic

activity weighted by the age of coins being moved—has seen a

substantial surge. The 60-day CDD indicator, which aggregates these

destroyed coin days over two months, indicates that coins held for

extended periods are now being spent at a much higher rate. This

trend, observed from November 2024 to February 2025, suggests that

long-term holders are increasingly active in the market,

potentially signaling a pivotal moment for Bitcoin. Banker explains

that elevated CDD values often correlate with significant market

events. In this case, the sustained uptick in long-term holder

activity may hint at profit-taking, asset reallocation, or

anticipation of heightened market volatility. While it is not

unusual for Bitcoin long-term holders to move coins during

periods of major price shifts, the current trend represents the

strongest CDD signal since 2021. Historically, such patterns have

preceded market turning points, making this metric a critical one

to watch. Why CDD Matters Notably, the Coin Days Destroyed metric

differs from typical transaction volume as it gives more weight to

coins that have remained untouched for longer periods. Each unspent

day accumulates “coin days,” and when the holder finally moves

those coins, these days are “destroyed.” The 60-day CDD effectively

tracks long-term holder sentiment by revealing when these seasoned

participants decide to act. As earlier mentioned, a consistent

increase in CDD often reflects a growing willingness among

long-term holders to take profits or reposition their

portfolios—moves that can influence broader market sentiment.

Related Reading: Bitcoin Crashes: Experts Warn Of 6-Month Slump To

$73,000 Banker points out that this uptick may signal more than

just a Bitcoin price correction. With long-term holders moving

their coins at a steady pace, the market could be heading toward a

“healthier reset.” This kind of activity often sets the stage for

new entrants to step in, potentially stabilizing the market and

creating opportunities for fresh capital inflows. However, the

implications depend heavily on the broader market context,

including macroeconomic factors and investor confidence. Featured

image created with DALL-E, Chart from TradingView

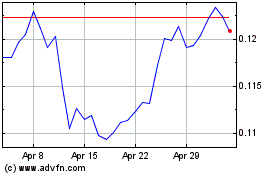

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Mar 2025