Is Solana In A Macro Trend Move? Charts Show Potential Shift

01 March 2025 - 5:30AM

NEWSBTC

Solana (SOL) is trading at its lowest price level since September

2024, as the entire crypto market struggles with fear and intense

selling pressure. Solana has lost over 55% of its value in less

than six weeks, erasing the gains from its post-election rally and

raising concerns among investors about a potential prolonged

downtrend. Related Reading: Dogecoin Open Interest Declines 67% In

Three Months – Can Meme Coins Recover? Panic has taken over the

market, and traders are growing fearful that Solana’s correction

may continue into lower price levels. Despite multiple attempts to

reclaim momentum, bulls have been unable to defend key demand

zones, allowing bears to maintain control. Top analyst Ali Martinez

shared a technical analysis on X, stating that Solana appears to be

experiencing a macro trend shift from bullish to bearish. If SOL

fails to recover key levels soon, it could signal a deeper

downtrend and further selling pressure in the coming weeks. For

now, investors are closely watching Solana’s next move. If SOL can

reclaim key resistance levels, it could stabilize and possibly

trigger a recovery. However, failure to hold above current prices

could lead to an extended bearish phase, increasing the risk of

further declines. Solana Facing Serious Selling Pressure Solana is

trading below crucial daily support levels, invalidating the

bullish structure thesis that many traders were holding onto. The

price action has been weak, with Solana now caught in a high time

frame range between $120 and $220. If bulls fail to defend the

lower end of this range, Solana could face the risk of a prolonged

bear market. Related Reading: Litecoin Holds Solid Structure Amid

Market Breakdown – Analyst Forecasts A Big Move The current price

breakdown suggests that bears remain in control as selling pressure

continues to mount. Solana has struggled to reclaim momentum, and

the once-strong uptrend that started in July 2023 is at risk of

collapsing. Analysts are now monitoring whether SOL can hold above

the $120 support level, as a failure to do so could trigger a

deeper correction. Martinez’s technical analysis states that Solana

appears to be experiencing a macro trend shift. Martinez explains

that the bullish trend that started in mid-2023 is on the verge of

breaking, and if SOL continues to lose key demand levels, it could

confirm a long-term bearish phase. Investors are now waiting for a

confirmation move. If Solana can reclaim key resistance levels,

bullish momentum could be reestablished. However, if the price

fails to hold support and breaks below $120, it may indicate the

start of a bear market for Solana. Price Testing Long-Term Demand

Solana is trading at $130 after experiencing a 33% drop in less

than two weeks. The market is in panic mode, with selling pressure

overwhelming bullish attempts to reclaim key levels. Bulls have

lost control of the price action, and Solana is struggling to find

strong support. At this stage, the most crucial level to hold is

$120. If SOL falls below this mark, it could trigger a deeper

correction and push the price into uncharted bearish territory.

However, if buyers step in and defend this level, Solana could

stabilize and prepare for a potential recovery rally. For a trend

reversal, SOL must reclaim the $160 level as soon as possible. This

would help restore bullish momentum and shift market sentiment back

toward optimism. However, this process could take time, especially

given the current uncertainty and broader market weakness. Related

Reading: Long-Term Dogecoin Holders Are In “Denial” – On-Chain

Metrics Expose Weakness A consolidation phase around the $120–$140

range is possible before any meaningful recovery takes place. If

Solana holds above support and demand starts increasing, a strong

bounce could follow. However, failure to hold these levels could

confirm a bearish trend, extending the correction even further.

Featured image from Dall-E, chart from TradingView

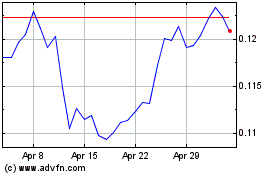

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Mar 2025