ASML Holding Expects Long-Term Demand, Growth as It Kicks off EUR12 Billion Buyback

11 November 2022 - 4:15AM

Dow Jones News

By Joe Hoppe

ASML Holding NV said Thursday that it sees longer-term wafer

demand and capacity showing healthy growth despite

macroeconomic-driven near-term uncertainties, and announced a new

12.0 billion euro ($12.02 billion) share buyback.

Speaking ahead of its investor day meeting on Friday, the Dutch

semiconductor-equipment maker said expanding application space and

industry innovation are expected to keep fueling growth across

semiconductor markets, and it plans to adjust its capacity to meet

future demand.

The company said it expects a substantial growth opportunity to

achieve annual revenue of between around EUR30 billion and EUR40

billion in 2025, with a gross margin of between 54% and 56%. It

further expects annual revenue to be between around EUR44 billion

and EUR60 billion in 2030.

ASML said it expects to continue to return significant cash to

shareholders through a combination of growing dividends and share

buybacks, and announced a new buyback program, effective from

Friday and to be carried out by the end of 2025.

It said it intends to repurchase up to EUR12 billion of shares.

Repurchased shares will either be used to cover employee share

plans, or cancelled.

Write to Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

November 10, 2022 12:00 ET (17:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

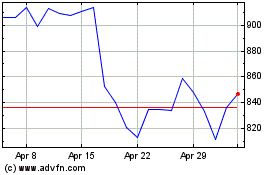

ASML Holding NV (EU:ASML)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASML Holding NV (EU:ASML)

Historical Stock Chart

From Apr 2023 to Apr 2024