0001897245

false

0001897245

2023-08-01

2023-08-01

0001897245

ACAX:UnitsEachConsistingOfOneShareOfClassCommonStockOnehalfOfOneRedeemableWarrantAndOneRightMember

2023-08-01

2023-08-01

0001897245

ACAX:ClassCommonStockParValue0.0001PerShareMember

2023-08-01

2023-08-01

0001897245

ACAX:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2023-08-01

2023-08-01

0001897245

ACAX:RightsEachEntitlingHolderToReceiveOnetenthOfOneShareOfClassCommonStockMember

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

August

1, 2023

Date

of Report (Date of earliest event reported)

ALSET

CAPITAL ACQUISITION CORP.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41254 |

|

87-3296100 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

4800

Montgomery Lane, Suite 210

Bethesda,

MD |

|

20814 |

| (Address of Principal Executive

Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (301) 971-3955

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each consisting

of one share of Class A Common Stock, one-half of one Redeemable Warrant and one Right |

|

ACAXU |

|

The

Nasdaq Global Market |

| Class A Common Stock,

par value $0.0001 per share |

|

ACAX |

|

The

Nasdaq Global Market |

| Redeemable warrants,

each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

ACAXW |

|

The

Nasdaq Global Market |

| Rights, each entitling

the holder to receive one-tenth of one share of Class A Common Stock |

|

ACAXR |

|

The

Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.07. Submission of Matters to a Vote of Security Holders.

On

August 1, 2023, Alset Capital Acquisition Corp. (referred to herein as “Alset” or the “Company”) held

a special meeting of the stockholders of the Company (the “Special Meeting”). On July 7, 2023, the record date for the Special

Meeting (the “Record Date”), there were 4,606,036 shares of the Company’s Class A and Class B common stock issued

and outstanding, par value 0.0001; holders of our Class A and Class B common stock are entitled to one vote per share (“Class B

Common Stock”, and collectively with the Class A Common Stock, “Common Stock”).

At

the Special Meeting held on August 1, 2023, 3,899,797 shares of Common Stock, representing approximately 84.66% of the

issued and outstanding shares of Common Stock as of the Record Date, were present in person (by virtual attendance) or by proxy.

At

the Special Meeting, the Company’s stockholders approved the following items: (i) approve and adopt the Agreement and Plan of Merger

(the “Merger Agreement”), dated as of September 9, 2022, among Alset, HWH Merger Sub, Inc., a Nevada corporation and newly

formed, wholly owned, direct subsidiary of Alset (“Merger Sub”), and HWH International, Inc., a Nevada corporation (“HWH”);

(ii) a proposal to amend the Company’s amended and restated certificate of incorporation (the “Charter”), in the

form set forth as Annex B to the Proxy Statement (as defined below) for the Special Meeting (the “Charter Amendment”), to

change the name of Alset to HWH International Inc.; establish that the board of directors (the “Board”) of Alset following

the closing of the business combination (the “Alset Board”) will not be divided into classes (with the number of directors

of the Alset Board being initially fixed at seven pursuant to the Merger Agreement and in accordance with the initial appointment

rights provided therein; prohibiting stockholder actions by written consent; and removing various provisions applicable to special purpose

acquisition corporations; (iii) to vote upon, on a non-binding advisory basis, certain governance provisions in the Proposed Charter,

presented separately in accordance with SEC requirements, which we refer to as the “Advisory Charter Amendments Proposals; (iv)

to vote on a proposal to approve, for purposes of complying with applicable listing rules of Nasdaq, the issuance of more than 20% of

the total issued and outstanding Common Stock in connection with the Business Combination, which we refer to as the “Nasdaq Proposal”;

and (v) to vote upon a proposal to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of one or more

proposals at the special meeting, which we refer to as the “Adjournment Proposal”.

The

final proposal, set forth as the “Adjournment Proposal” in the definitive proxy statement related to the Special Meeting

filed by the Company with the Securities and Exchange Commission (the “SEC”) on July 11, 2023 (the “Proxy Statement”),

was not presented to the Company’s stockholders.

These

Advisory Charter Amendments Proposals require the affirmative vote of a majority of the votes cast by stockholders present in person

or represented by proxy and entitled to vote thereon at the Special Meeting (which would include presence by virtual attendance at the

Special Meeting). An abstention will be counted towards the quorum requirement but will not count as a vote cast at the Special Meeting.

A broker non-vote will neither be counted towards the quorum requirement (as the Proposals we believe will be considered as non-discretionary)

nor count as a vote cast in the Special Meeting.

Set

forth below are the final voting results for each of the proposals presented at the Special Meeting:

Business

Combination Proposal

The

Business Combination Proposal was approved. The voting results of the shares of Common Stock were as follows:

| For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 3,889,615 |

|

182 |

|

0 |

|

0 |

Charter

Amendment Proposals

The

Charter Amendment Proposals was approved. The voting results of the shares of Common Stock were as follows:

| For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 3,710,652 |

|

189,145 |

|

0 |

|

0 |

Advisory

Charter Amendment Proposals

The

Advisory Charter Amendment Proposals was approved. The voting results of the shares of Common Stock were as follows:

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 3,710,615 | |

189,145 | |

0 | |

0 |

Nasdaq

Stock Issuance Proposals

The

Nasdaq Stock Issuance Proposal was approved. The voting results of the shares of Common Stock were as follows:

| For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 3,889,615 |

|

182 |

|

0 |

|

0 |

Adjournment

Proposal

The

Adjournment Proposal was approved. The voting results of the shares of Common Stock were as follows:

| For |

|

Against |

|

Abstain |

|

Broker

Non-Votes |

| 3,889,615 |

|

182 |

|

0 |

|

0 |

Forward

Looking Statements

This

Current Report on Form 8-K includes “forward-looking statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995. Certain of these forward-looking statements can be identified by the

use of words such as “believes,” “expects,” “intends,” “plans,”

“estimates,” “assumes,” “may,” “should,” “will,” “seeks,” or

other similar expressions. These statements are based on current expectations on the date of this Current Report on Form 8-K and

involve a number of risks and uncertainties that may cause actual results to differ significantly, including those risks set forth

in the Proxy Statement, the Company’s most recent Annual Report on Form 10-K and other documents filed with the SEC. Copies of

such filings are available on the SEC’s website at www.sec.gov. The Company does not assume any obligation to update or revise

any such forward-looking statements, whether as the result of new developments or otherwise. Readers are cautioned not to put undue

reliance on forward-looking statements.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

No. |

|

Description |

|

|

|

| 104 |

|

Cover Page Interactive

Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Alset Capital Acquisition Corp. |

| |

|

|

| |

By: |

/s/

Heng Fai Ambrose Chan |

| |

Name: |

Heng

Fai Ambrose Chan |

| |

Title: |

Chief

Executive Officer |

| |

Dated: |

August 1, 2023 |

v3.23.2

Cover

|

Aug. 01, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 01, 2023

|

| Entity File Number |

001-41254

|

| Entity Registrant Name |

ALSET

CAPITAL ACQUISITION CORP.

|

| Entity Central Index Key |

0001897245

|

| Entity Tax Identification Number |

87-3296100

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4800

Montgomery Lane

|

| Entity Address, Address Line Two |

Suite 210

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

(301)

|

| Local Phone Number |

971-3955

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Class A Common Stock, one-half of one Redeemable Warrant and one Right |

|

| Title of 12(b) Security |

Units, each consisting

of one share of Class A Common Stock, one-half of one Redeemable Warrant and one Right

|

| Trading Symbol |

ACAXU

|

| Security Exchange Name |

NASDAQ

|

| Class A Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A Common Stock,

par value $0.0001 per share

|

| Trading Symbol |

ACAX

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants,

each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

ACAXW

|

| Security Exchange Name |

NASDAQ

|

| Rights, each entitling the holder to receive one-tenth of one share of Class A Common Stock |

|

| Title of 12(b) Security |

Rights, each entitling

the holder to receive one-tenth of one share of Class A Common Stock

|

| Trading Symbol |

ACAXR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACAX_UnitsEachConsistingOfOneShareOfClassCommonStockOnehalfOfOneRedeemableWarrantAndOneRightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACAX_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACAX_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACAX_RightsEachEntitlingHolderToReceiveOnetenthOfOneShareOfClassCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

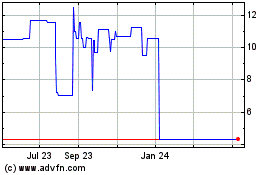

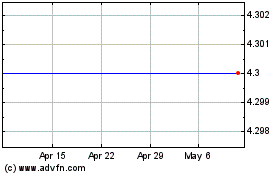

Alset Capital Acquisition (NASDAQ:ACAXU)

Historical Stock Chart

From Apr 2024 to May 2024

Alset Capital Acquisition (NASDAQ:ACAXU)

Historical Stock Chart

From May 2023 to May 2024