UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT

OF 1934

For the month of December 2021.

Commission File Number: 001-38857

AGM

GROUP HOLDINGS INC.

(Translation

of registrant’s name into English)

c/o Creative Consultants (Hong Kong) Limited

Room 1502-3 15/F., Connaught Commercial Building,

185 Wanchai Road

Wanchai, Hong Kong

+86-010-65020507 – telephone

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Registered Direct Offering and Concurrent

Private Placement

On December 10, 2021, AGM Group Holdings Inc.

(the “Company”) entered into a certain securities purchase agreement (the “Purchase Agreement”) with certain institutional

investors (the “Purchasers”) pursuant to which the Company agreed to sell 2,898,552 of its Class A ordinary shares (the “Shares”),

par value US$0.001 per share, in a registered direct offering, and, in a concurrent private placement, the Company has agreed to sell

warrants to purchase up to 1,449,276 Class A ordinary shares (the “Investor Warrants”), for gross proceeds of approximately

US$20 million. The purchase price for each Share and the corresponding half Warrant is US$6.90. The Investor Warrants will be exercisable

immediately from the date of issuance and have an exercise price of US$8.30 per share. The Investor Warrants will expire 3.5 years from

the date of issuance. Each Investor Warrant contains anti-dilution provisions to reflect share dividends and splits or other similar transactions,

as described in the Investor Warrants.

Pursuant to the Purchase Agreement, the Shares will

be issued to the Purchasers in a registered direct offering (the “Registered Direct Offering”) and registered under the Securities

Act of 1933, as amended (the “Securities Act”), pursuant to a prospectus supplement to the Company’s currently effective

registration statement on Form F-3 (File No. 333-236897), which was initially filed with the U.S. Securities and Exchange Commission (the

“SEC”) on March 5, 2020 and declared effective by the SEC on May 28, 2020 (the “Shelf Registration Statement”).

The Company plans to file the prospectus supplement for the Registered Direct Offering by December 14, 2021.

The Company will issue the Investor Warrants to

the Purchasers in a concurrent private placement pursuant to an exemption from the registration requirements of the Securities Act

contained in Section 4(a)(2) thereof and/or Regulation D thereunder (the “Private Placement,” and together with the Registered

Direct Offering, the “Offering”).

FT Global Capital, Inc. (the “Placement

Agent”) acted as the exclusive placement agent in connection with the Offering under the terms of the Placement Agency Agreement,

dated December 10, 2021 between it and the Company (the “Placement Agency Agreement”) and, at closing of the Offering, will

receive a cash fee equal to 7.5% of the aggregate gross proceeds raised in the Offering as well as reimbursement of certain costs and

expenses of up to US$80,000. Additionally, the Company has agreed to issue to the Placement Agent or its designees warrants (the “Placement

Agent Warrants,” and together with the Investor Warrants, the “Warrants”) for the purchase of 202,899 Class A ordinary

shares with an exercise price of US$8.30 per share, and with a term expiring 3.5 years from the date of issuance. The Placement Agent

Warrants shall have the same registration rights as the Warrants issued to the Purchasers in the Offering. The Placement Agent is also

entitled to additional tail compensation for any financings consummated by the Company within the 12-month period following the termination

of the Placement Agency Agreement, to the extent such financing is provided to the Company by investors that the Placement Agent had “wall-crossed”

on behalf of the Company in connection with the Offering.

The Company has agreed to file and maintain with

the SEC a registration statement (the “Registration Statement”) to register the Warrants and the Class A ordinary shares underlying

the Warrants (the “Warrant Shares”) within 30 calendar days from the closing of the Offering and to use its best efforts to

cause such registration statement to become effective within 60 calendar days following the closing of the Offering (or, in the event

of a review by the SEC, within 120 calendar days).

The Company agreed in the Purchase Agreement that

it would not issue any ordinary shares or ordinary share equivalents for sixty (60) days following the closing of the Offering subject

to certain exceptions. The Company agreed in the Placement Agency Agreement that it would not issue any ordinary shares or ordinary share

equivalents for one hundred twenty (120) days following the closing of the Offering without the consent of the Placement Agent, subject

to certain exceptions.

The Company agreed in the Purchase Agreement that it will not issue

any ordinary shares or ordinary share equivalents involve in a Variable Rate Transaction (as defined in the Purchase Agreement) until

the earlier of (x) the date the initial Registration Statement is declared effective by the SEC and (y) the date as of which all of the

holders of Investor Warrants may sell all of the Investor Warrant Shares without restriction pursuant to Rule 144 (including, without

limitation, volume restrictions) and without the need for current public information required by Rule 144(c)(1) (or Rule 144(i)(2), if

applicable). The Company further agreed that until the first anniversary of the earlier of (x) or (y) above, it would not issue or enter

into any agreement to issue any ordinary shares or ordinary share equivalents unless the Purchasers are offered a participation right,

subject to certain terms and conditions as set forth in the Purchase Agreement, to subscribe, on a pro rata basis, for up to 50% of the

securities offered in such offering.

Concurrently with the execution of the Purchase

Agreement, the officers and directors of the Company and shareholders of the Company holding 5% or more of the Company’s Class A

ordinary shares entered into lock-up agreements (the “Lock-Up Agreements”) pursuant to which they have agreed, among other

things, not to sell or dispose of any ordinary shares which are or will be beneficially owned by them for one hundred twenty (120) days

following the closing of the Offering, as well as similar lock-up agreements pursuant to the Placement Agency Agreement restricting sales

of ordinary shares for ninety (90) days after the closing of the Offering.

The Company expects the Offering to close on or

about December 14, 2021, subject to the satisfaction of customary closing conditions in the Purchase Agreement. The Purchase Agreement

contains customary representations, warranties and agreements of the Company and the Purchasers and customary indemnification rights and

obligations of the parties thereto.

The foregoing descriptions of the Placement

Agency Agreement, the Purchase Agreement, the Registration Rights Agreement, the Lock-Up Agreements, the Investor Warrants and the Placement

Agent Warrants are qualified in their entirety by reference to the full texts of such documents, the forms of which are attached as Exhibits

10.1, 10.2, 10.3, 10.4, 4.1 and 4.2, respectively, to this report on Form 6-K, and which are incorporated herein in their entirety by

reference. The Company is filing the opinion of its British Virgin Islands counsel, Mourant Ozannes, relating to the legality of the

issuance and sale of the Shares as Exhibit 5.1 hereto. Exhibit 5.1 is incorporated herein by reference and into the Shelf Registration

Statement.

This Form 6-K contains forward-looking statements.

Forward-looking statements include, but are not limited to, statements that express the Company’s intentions, beliefs, expectations,

strategies, predictions or any other statements related to the Company’s future activities, or future events or conditions. These

statements are based on current expectations, estimates and projections about the Company’s business based, in part, on assumptions

made by its management. These statements are not guarantees of future performances and involve risks, uncertainties and assumptions that

are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in the forward-looking

statements due to numerous factors, including those risks discussed in the Company’s Annual Report on Form 20-F, and in other documents

that the Company files from time to time with the SEC. Any forward-looking statements speak only as of the date on which they are made,

and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of

this Form 6-K, except as required by law.

On December 10, 2021, the Company issued a

press release announcing the pricing of the Offering. A copy of the press release is attached hereto as Exhibit 99.1 and

incorporated herein by reference.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

|

Date: December 13, 2021

|

AGM GROUP HOLDINGS INC.

|

|

|

|

|

|

|

By:

|

/s/ Wenjie Tang

|

|

|

Name:

|

Wenjie Tang

|

|

|

Title:

|

Co-Chief Executive Officer

|

3

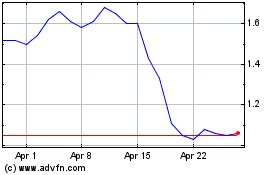

AGM (NASDAQ:AGMH)

Historical Stock Chart

From Mar 2024 to Apr 2024

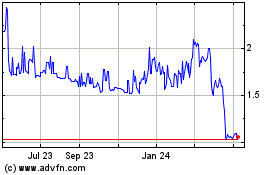

AGM (NASDAQ:AGMH)

Historical Stock Chart

From Apr 2023 to Apr 2024