Form 8-K - Current report

07 December 2023 - 8:01AM

Edgar (US Regulatory)

false

0001854583

0001854583

2023-12-01

2023-12-01

0001854583

CAUD:CommonStockParValue0.0001PerShareMember

2023-12-01

2023-12-01

0001854583

CAUD:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2023-12-01

2023-12-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 8-K

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

December 1, 2023

Date

of Report (Date of earliest event reported)

COLLECTIVE

AUDIENCE, INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-40723 |

|

86-2861807 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

85

Broad Street 16-079

New York, NY 10004

(Address

of Principal Executive Offices and Zip Code)

Registrant’s

telephone number, including area code:

(808) 829-1057

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ | | Written communications

pursuant to Rule 425 under the Securities Act |

| ☐ | | Soliciting material

pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| |

|

|

|

|

| Common Stock, par value $0.0001 per share |

|

CAUD |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

CAUDW |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 4.01 Changes in Registrant’s Certifying Accountant.

On December 1, 2023, BDO

USA, LLP (“BDO”), Collective Audience, Inc.’s (f.k.a. Abri SPAC I, Inc., a Delaware corporation) (the “Company”)

independent registered public accounting firm prior to the Business Combination (as defined below), was informed that it would be dismissed

as the Company’s independent registered public accounting firm, as a result of the completion of the Quarterly Report on Form 10-Q

for quarter ended September 30, 2023, which financial statements (as defined below) consist only of the accounts of the pre-Business Combination

Company, Abri SPAC I, Inc.

As a result of the consummation

of the business combination involving the Company, Abri Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of the Company,

Logiq, Inc., a Delaware corporation, whose common stock is quoted on OTCQX Market under the ticker symbol “LGIQ” and, DLQ,

Inc., a Nevada corporation and then wholly owned subsidiary of Logiq, Inc. (“DLQ”) (collectively the “Business Combination”),

the Company approved the engagement of Frazier & Deeter, LLC (“FD”) as the Company’s independent registered

public accounting firm to audit the Company’s consolidated financial statements for the remainder of year ending December 31,

2023. FD served as the independent registered public accounting firm of DLQ prior to the Business Combination.

BDO’s report on the Company’s

consolidated balance sheets as of December 31, 2022 and 2021, the related consolidated statements of operations, stockholders’

equity and cash flows for the years ended December 31, 2022 and 2021 and the related notes to the financial statements (collectively,

the “financial statements”) did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified

as to uncertainty, audit scope or accounting principles, except for the substantial doubt about the Company’s ability to continue

as a going concern.

During the period from March

18, 2021 (inception) through December 31, 2022 and the subsequent interim period through December 1, 2023, there were no: (i) “disagreements”

(as defined in Item 304(a)(1)(iv) of Regulation S-K under the Exchange Act) with BDO on any

matter of accounting principles or practices, financial statement disclosures or audited scope or procedures, which disagreements if not

resolved to BDO’s satisfaction would have caused BDO to make reference to the subject matter of the disagreement in connection with

its report or (ii) “reportable events” (as defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act).

During the period from March

18, 2021 (inception) through December 31, 2022, and the interim period through December 1, 2023, the Company did not consult FD

with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed; or

the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was

provided to the Company by FD that FD concluded was an important factor considered by the Company in reaching a decision as to the accounting,

auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as that term is described

in Item 304(a)(1)(iv) of Regulation S-K under the Exchange Act and the related instructions to Item 304 of Regulation S-K under the

Exchange Act, or a reportable event, as that term is defined in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act.

The Company has provided BDO

with a copy of the disclosures made by the Company in response to this Item 4.01 and has requested that BDO furnish the Company with a

letter addressed to the SEC stating whether it agrees with the statements made by the Company in response to this Item 4.01 and, if not,

stating the respects in which it does not agree, as required under Item 304(a)(3) under regulation S-K. A copy of BDO’s letter will

be filed at a later date.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Dated: December 6, 2023 |

COLLECTIVE AUDIENCE, INC. |

| |

|

| |

By: |

/s/ Robb Billy |

| |

Name: |

Robb Billy |

| |

Title: |

Chief Financial Officer |

v3.23.3

Cover

|

Dec. 01, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 01, 2023

|

| Entity File Number |

001-40723

|

| Entity Registrant Name |

COLLECTIVE

AUDIENCE, INC.

|

| Entity Central Index Key |

0001854583

|

| Entity Tax Identification Number |

86-2861807

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

85

Broad Street 16-079

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10004

|

| City Area Code |

808

|

| Local Phone Number |

829-1057

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CAUD

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

CAUDW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CAUD_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CAUD_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

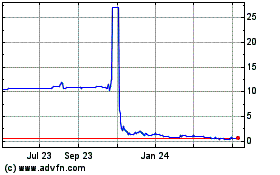

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Apr 2024 to May 2024

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From May 2023 to May 2024