0001435064

false

0001435064

2023-07-25

2023-07-25

0001435064

us-gaap:CommonStockMember

2023-07-25

2023-07-25

0001435064

CETX:Series1PreferredStockMember

2023-07-25

2023-07-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 25, 2023

Cemtrex

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

001-37464 |

30-0399914 |

(State

or other jurisdiction

of

incorporation) |

(Commission

File

Number) |

(I.R.S.

Employer

Identification

No.) |

276

Greenpoint Ave Bld. 8 Suite 208

Brooklyn,

NY |

11101 |

| (Address

of principal executive offices) |

(Zip

Code) |

Registrant’s

telephone number, including area code: (631) 756-9116

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Common

Stock |

|

CETX |

|

Nasdaq

Capital Market |

| Series

1 Preferred Stock |

|

CETXP |

|

Nasdaq

Capital Market |

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

July 25, 2023, the Company received a Notice of Staff Determination from the Listing Qualifications Department of Nasdaq notifying the

Company that its Series 1 Preferred Stock had not gained compliance and would be suspended from trading at the opening of business on

August 3, 2023. The Company has requested a hearing regarding the delisting which will stay the suspension and filing of Form 25-NSE

with the Securities and Exchange Commission (the “SEC”).

On

July 25, 2023, the Company received notification that it had been granted a hearing on September 14, 2023.

The

Company intends to continue actively monitoring the bid price for its Series 1 preferred stock between now and the hearing date and will

consider available options to resolve the deficiency and regain compliance with the Minimum Bid Price Requirement.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CEMTREX,

INC. |

| |

|

| Date:

August 4, 2023 |

By: |

/s/

Saagar Govil |

| |

|

Saagar

Govil |

| |

|

Chairman,

President and Chief Executive Officer |

EXHIBIT 99.1

Sent via electronic delivery

July 25, 2023

Saagar Govil

CEO/Cemtrex, Inc.

Cemtrex Inc.

135 Fell Ct

Hauppauge, NY 11788

RE: Cemtrex Inc. (Symbol: CETX)

Nasdaq Listing Qualifications Hearings Docket No.

NQ 6651C-23

Dear Saagar Govil,

We have received your request on behalf of Cemtrex

Inc.(the “Company”), to appeal the Nasdaq Listing Qualification Staff determination to delist the Company’s securities

from The Nasdaq Stock Market LLC. Accordingly, the delisting action referenced in the Nasdaq Staff’s determination letter has been

stayed, pending a final written decision by the Nasdaq Hearings Panel.

This letter provides formal notice that the Panel

will consider your appeal at an oral hearing. It also provides information to assist you in preparing for the hearing, including deadlines

for submission of materials to the Panel for review.

The Hearing. The hearing will be held

on September 14, 2023 at 1:00 p.m. 1 via video conference. Dial-in information will be provided by Hearing Staff prior

to the hearing date.

Expedited Review Process. The

Company currently has no deficiencies with respect to the listing standards other than its failure to maintain compliance with Listing

Rule 5555(a)(1) (“Bid Price Rule”). As such, the Panel is providing the Company with the option to participate in an

expedited review process by completing the attached questionnaire regarding the Company’s compliance plan and returning it to the

Panel by email to hearings@nasdaq.com no later than August 1, 2023

Based on its review of the Company’s responses

to the questionnaire, the Panel may determine that an oral hearing is not necessary in order to grant the Company an exception to regain

compliance in this matter. In this event, no hearing will be necessary and the Panel will issue a decision describing the terms of the

exception, including the compliance deadline and any milestones the Company must meet, based on the Company’s responses to the questionnaire

and the written record. If the Panel is unable to conclude that an exception is appropriate based on the Company’s responses to

the questionnaire and the written record, there would be no prejudice against the company and the hearing will proceed as scheduled.

1 In accordance with Nasdaq policy, companies

requesting hearings are scheduled for the next available hearing date. Requests for specific hearing dates or continuances will not be

honored.

Hearing Instructions. If this matter

is not addressed through the expedited review process described above, the Hearing will proceed as scheduled. At the hearing, the Company

must demonstrate its ability to regain compliance with the particular deficiencies cited by Staff, as well as its ability to sustain long-term

compliance with all applicable maintenance criteria. If the Company is currently subject to a Listing Rule compliance period for a deficiency

distinct from those that are bases for the Staff’s determination to delist the Company, it must also address its plan for regaining

compliance with that particular standard within the applicable compliance period. The Company will be notified if the Staff identifies

new deficiencies either before or after the hearing, and will be provided an opportunity to respond.

If at any point before the hearing the Company believes

it has regained compliance with all criteria for continued listing and can evidence an ability to sustain compliance with those requirements

over the long term, the Company should notify its Listing Analyst and also inform the Hearings Department. If the Listing Analyst determines

that the Company has regained compliance, the Hearings Department will advise the Company by letter that the hearing is cancelled.

Record on Review. Nasdaq Market Place

Rule 5840(a) requires that you be provided with a list of documents in the written record, and copies of any that are not in your possession,

at least three days in advance of the deadline for your submission to the Panel. Currently, the written record consists of the following

documents, each of which is already in your possession:

(1) Staff Determination Letter

to the Company. Staff determination letter to the Company dated July 25, 2023;

(2) All correspondence between

Staff and Company related to the deficiency;

(3) Hearing Request. Company’s

request for a hearing dated July 25, 2023. The record will be supplemented with the documents outlined below as they are created:

(4) Submissions from the Company

to the Panel. Pursuant to Listing Rule 5815,2 the Company must provide for the Panel’s review a written submission

(“Written Submission”), to which Staff may respond in writing, stating with specificity the grounds upon which the Company

is seeking review of Staff’s determination letter. Additionally, the Company’s Written Submission should include (a) an updated

plan of compliance; and (b) a chronological list (in reverse chronological order) of all Form 8-K or 6-K filings made by the Company since

the date of its most recent annual filing, with filing dates and a brief summary for each filing of the event reported. Do not submit

actual Form 8-K or 6-K filings. The Company’s Written Submission must include all legal arguments on which it intends to rely.3

Moreover, if applicable, the updated plan of compliance should address the events leading to the Company’s deficiency, how the Company

is addressing the deficiency, and a specific timeline within which the Company will cure its deficiency. As noted below, the Company may

supplement its Written Submission by providing a written update to the Panel (“Written Update”) no later than two business

days in advance of the hearing.

2 See Securities Exchange Act Release

No. 90201 (October 15, 2020), 85 FR 67024 (October 21, 2020) (SR- NASDAQ-2020-002).

3 As provided in Listing Rule 5815(a)(6),

“[t]he Company will not be permitted to introduce any legal argument not raised by the Company with specificity in the Written Submission.”

(5) Participant and Panel Information.

Please submit the full name and a brief biography of each person that will appear before the Panel at the hearing. The biography should

contain, at a minimum, the information that is required to be included in the Company’s proxy statement. Please submit this information

at the same time you submit your plan of compliance and list of Form 8-K or 6-K filings. Individuals for whom we have not received full

names and biographical information at least five days before the hearing may be precluded from attending the hearing. We will also send

you copies of the names and biographical information of the panel members expected to hear your matter. You will receive this information

at least five days before the hearing, and we ask you to notify us immediately if you are aware of any conflicts of interest.

Items (4) and (5) above should be submitted as

one document.

All submissions should be submitted

electronically through the Listing Center at Nasdaq Listing Center.4

Company submissions to the Panel (i.e.,

the Written Submission with the plan of compliance, the list of Form 8-K or 6-K filings, and participant biographies) must be submitted

through the Listing Center by noon Eastern Time on Friday, August 25, 2023. Extensions will not be granted.

(6) The Hearing Memorandum.

Nasdaq Staff will receive copies of all documents submitted by the Company for the Panel’s review, and will prepare a written response,

in the form of a Hearing Memorandum, for inclusion in the hearing record. A copy of this Hearing Memorandum will be provided to the Company

at least three calendar days before the hearing, in accordance with Listing Rule 5840(a). The Company may respond to the Hearing Memorandum

with a written submission of its own, which shall be submitted to the Panel pursuant to the provisions in Listing Rule 5815.

(7) The Written Update.

The Company may provide a Written Update, no later than two business days in advance of the hearing, briefing the Panel on any new material

information that has transpired since its Written Submission. The Written Update may not include legal arguments not raised by the Company

with specificity in the Written Submission. The Written Update should be submitted electronically through the Listing Center.

4

To utilize the electronic submission process via the Listing Center, please create a user account, if you have not already done

so. Once you create a user account, you can begin completing the Hearing Request Form. At any time, you may save your work and complete

it at a later time. Upon submission, you will receive a confirmation email. Please note that prior to starting you will need the following

company information: current trading symbol, Central Index Key (CIK) code or CUSIP.

(8) Hearing Presentation.

If the Company uses written materials for its presentation to the Panel at the hearing, the Company should also submit these through the

Listing Center. Notice that, absent solicitation from the Panel, the Company will not be permitted to introduce any material information

at the Hearing that was not raised with specificity in the Written Submission or Written Update, unless the Company shows (a) that the

material information did not exist at the time the Company was permitted to submit a Written Update or (b) the Company shows that exceptional

or unusual circumstances exist that warrant consideration of the newly raised material information.

If, as described above, the Panel permits the Company

to enter new material information at the oral hearing, Staff shall have up to three business days from the oral hearing (or such shorter

time as indicated by the Panel) to respond in writing to the Company’s newly raised material information. The Company may respond

to Staff’s submission only if requested by the Panel.

For your convenience, information relating to the

Nasdaq Listing Rules and the hearing process may be found on our website at:

Nasdaq Listing Center

The answers to Frequently Asked Questions regarding

the Hearings Process can be found at:

Nasdaq Listing Center Hearings FAQs

Communications. Listing Rule 5835(a)

prohibits communications relevant to the merits of a proceeding before the Panel between the Nasdaq Staff and the Hearings Department,

unless the Company or its designated representative has been provided notice and an opportunity to participate. Listing Rule 5835(a) also

prohibits communications relevant to the merits of the proceeding between the Company and the Hearings Department, unless Staff is provided

with notice and an opportunity to participate. In this case, however, Staff has notified the Hearings Department that it will waive its

right to participate in any communications between the Company and the Hearings Department.

Consequently, the Company should contact the Hearings

Department directly should it require clarification of any issues that relate to the hearing. Should Staff revoke its waiver, the Company

will be notified and the requirements of Listing Rule 5835(a) will apply.

Confidentiality. Should the Company

appeal this matter to the Nasdaq Listing and Hearing Review Council, the Listing Council’s decision will be filed with the Securities

and Exchange Commission as required by SEC Rule 19d-1. Nasdaq may also make a summary of the Listing Council decision available on Nasdaq’s

public website. Should the Listing Council’s decision be appealed to the SEC, Nasdaq will certify and file a copy of the entire

record in this matter with the SEC as required by SEC Rule 19d-3. In addition, information provided to Nasdaq or FINRA may be subject

to disclosure in response to a subpoena or other request for access from a court or federal, state or self-regulatory body. As a result,

special requests for confidential treatment of information cannot be granted; however, the Company should note that Nasdaq does not intend

to publicly disseminate any of the information submitted to the Panel except as noted directly above.

I’m happy to speak with you about this process

and any questions you may have regarding this matter. You may contact me at (202) 912-3058.

Sincerely,

Aravind Menon

Hearings Advisor

The Nasdaq Stock Market LLC

Office of the General Counsel

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CETX_Series1PreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Cemtrex (NASDAQ:CETXP)

Historical Stock Chart

From Apr 2024 to May 2024

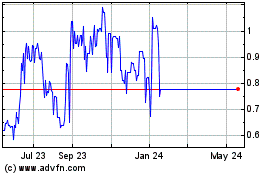

Cemtrex (NASDAQ:CETXP)

Historical Stock Chart

From May 2023 to May 2024