0001549084false00015490842023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

July 27, 2023

Date of Report (date of earliest event reported)

Ekso Bionics Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Nevada | 001-37854 | 99-0367049 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

101 Glacier Point, Suite A | San Rafael | California | 94901 |

(Address of Principal Executive Offices) | (Zip Code) |

(510) 984-1761

Registrant's telephone number, including area code

Not Applicable

________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | EKSO | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 2.02 Results of Operations and Financial Condition

On July 27, 2023 Ekso Bionics Holdings, Inc. (the “Company”) reported its financial results for the three and six months ended June 30, 2023. The full text of the press release announcing such results is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 2.02 of this Current Report on Form 8-K, including the information contained in Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of such section, and such information shall not be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

EKSO BIONICS HOLDINGS, INC.

By: /s/ Jerome Wong

Name: Jerome Wong

Title: Chief Financial Officer

Dated: July 27, 2023

Ekso Bionics Report Record Revenues of $4.7 Million in Second Quarter 2023

Record number of EksoHealth devices booked in second quarter 2023

SAN RAFAEL, Calif., July 27, 2023 -- Ekso Bionics Holdings, Inc. (Nasdaq: EKSO) (the “Company” or “Ekso Bionics”), an industry leader in exoskeleton technology for medical and industrial use, today reported financial results for the three and six months ended June 30, 2023.

Recent Highlights and Accomplishments

•Achieved record revenues of $4.7 million in the second quarter of 2023, an increase of 36% year-over-year

•Booked a total of 44 EksoHealth devices in the second quarter of 2023

•Gross profit of $2.3 million in the second quarter of 2023, compared to $1.6 million in the same period of last year

•Cash position of $13.3 million at June 30, 2023

“Our strong second quarter results reflect solid commercial execution and continued growth in bookings from our clinical and personal use device customers,” said Scott Davis, Chief Executive Officer of Ekso Bionics. “Highlighted by a record number of EksoHealth device bookings resulting in robust revenue growth of 36% year-over-year, more patients than ever are benefitting from our innovative portfolio of exoskeleton devices across the continuum of care. Looking ahead, we remain focused on securing more multi-unit orders with large network operators to drive sustainable, long-term growth.”

Second Quarter 2023 Financial Results

Revenue was $4.7 million for the quarter ended June 30, 2023, an increase of 36%, compared to $3.5 million for the same period in 2022. The Company booked a total of 44 EksoHealth devices in the second quarter of 2023.

Gross profit for the quarter ended June 30, 2023 was $2.3 million, an increase of 37% from the same period in 2022, representing a gross margin of approximately 48% in the second quarter of 2023, compared to a gross margin of 47% for the same period in 2022. The increase in gross margin was primarily due to lower device costs.

Sales and marketing expenses for the quarter ended June 30, 2023 were $2.3 million, compared to $1.8 million for the same period of 2022. The increase was primarily due to higher compensation costs associated with the acquisition of the Human Motion Control (“HMC”) business unit, severance expense and an increase in marketing activities.

Research and development expenses for the quarter ended June 30, 2023 were $1.4 million, compared to $0.9 million for the same period of 2022. The increase was primarily due to higher costs associated with the acquisition of HMC.

General and administrative expenses for the quarter ended June 30, 2023 were $2.8 million, compared to $2.2 million for the same period in 2022. The increase was primarily due to HMC-related audit and integration costs.

Net loss applicable to common stockholders for the quarter ended June 30, 2023 was $4.2 million, or $0.31 per basic and diluted share, compared to net loss of $3.0 million, or $0.23 per basic and diluted share, for the same period in 2022.

Six Months Ended June 30, 2023

Revenue was $8.8 million for the six months ended June 30, 2023, an increase of 46%, compared to $6.0 million for the same period in 2022. The Company booked a total of 67 EksoHealth devices in the first half of 2023.

Gross profit for the six months ended June 30, 2023 was $4.3 million, representing a gross margin of approximately 48%, compared to gross profit of $2.9 million for the same period in 2022, representing a gross margin of 47%. The overall increase in gross margin was primarily due to lower device costs.

Sales and marketing expenses for the six months ended June 30, 2023 were $4.4 million, compared to $3.5 million the same period in 2022. The increase was primarily due to higher compensation costs associated with the acquisition of HMC, an increase in marketing activities, and severance expense.

Research and development expenses for the six months ended June 30, 2023 were $2.6 million, compared to $1.8 million for the same period in 2022. The increase was primarily due to higher costs associated with the acquisition of HMC.

General and administrative expenses for the six months ended June 30, 2023 were $6.0 million, compared to $5.1 million for the same period in 2022. The increase was primarily due to HMC-related audit and integration costs.

Net loss applicable to common stockholders for the six months ended June 30, 2023 was $8.6 million, or $0.64 per basic and diluted share, compared to net loss of $7.6 million, or $0.59 per basic and diluted share, for the same period in 2022.

Cash on hand on June 30, 2023 was $13.3 million, compared to $20.5 million at December 31, 2022.

Conference Call

Management will host a conference call today beginning at 1:30 p.m. PT / 4:30 p.m. ET to discuss the Company’s financial results and recent business developments.

A live webcast of the event is available in the “Investors” section of the Company’s website at www.eksobionics.com, or by clicking here. Investors interested in listening to the conference call may do so by dialing 877-407-3036 for domestic callers or 201-378-4919 for international callers. The webcast will also be available on the Company’s website for one month following the completion of the call.

About Ekso Bionics®

Ekso Bionics® is a leading developer of exoskeleton solutions that amplify human potential by supporting or enhancing strength, endurance, and mobility across medical and industrial applications. Founded in 2005, the Company continues to build upon its industry-leading expertise to design some of the most cutting-edge, innovative wearable robots available on the market. Ekso Bionics is the only known exoskeleton company to offer technologies that range from helping those with paralysis to stand up and walk, to enhancing human capabilities on job sites across the globe. Ekso Bionics is headquartered in the San Francisco Bay Area and is listed on the Nasdaq Capital Market under the symbol “EKSO.” For more information, visit: www.eksobionics.com or follow @EksoBionics on Twitter.

Forward-Looking Statements

Any statements contained in this press release that do not describe historical facts may constitute forward-looking statements. Forward-looking statements may include, without limitation, statements regarding the plans, objectives and expectations of management with respect to the Company’s industry, growth and strategy, including the Company’s focus on securing more multi-unit orders with large network operators and its ability to obtain sustainable, long-term growth, the expected benefits of the acquisition of HMC, potential technological and operational improvements and the assumptions underlying or relating to the foregoing. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon the Company's current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which the Company has no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, the Company's inability to obtain adequate financing to fund and grow the Company's operations and necessary to develop or enhance the Company’s technology, the significant length of time and resources associated with the development of the Company's products, the Company's failure to achieve broad market acceptance of the Company's products, the failure of the Company’s sales and marketing efforts or of partners to market the Company’s products effectively, adverse results in future clinical studies of the Company's medical device products, the failure of the Company to obtain or maintain patent protection for the Company's technology, the failure of the Company to obtain or maintain regulatory approval to market the Company's medical devices, lack of product diversification, existing or increased competition, disruptions in the Company’s supply chain, the Company’s ability to successfully integrate the HMC business and its personnel, and the Company's failure to implement the Company's business plans or strategies. These and other factors are identified and described in more detail in the Company's filings with the SEC, including the Company’s most recently filed Annual Report on Form 10-K and its subsequently filed Quarterly Reports on Form 10-Q. To learn more about Ekso Bionics please visit the Company’s website at www.eksobionics.com or refer to the Company’s Twitter page at @EksoBionics. Any forward-looking statements made in this press release speak only as of the date of this press release. The Company does not undertake to update these forward-looking statements, except as required by law.

Contact:

David Carey

212-867-1768

investors@eksobionics.com

| | | | | | | | | | | | | | | | | |

| Ekso Bionics Holdings, Inc. |

| Condensed Consolidated Balance Sheets |

| (In thousands) |

| | | | | |

| | | June 30 | | December 31, |

| | | 2023 | | 2022 |

| Assets | | (Unaudited) | | |

| Current assets: | | | | |

| Cash and restricted cash | $ | 13,307 | | $ | 20,525 | |

| Accounts receivable, net | | 5,052 | | | 4,625 | |

| Inventories | | 5,602 | | | 5,187 | |

| Prepaid expenses and other current assets | | 759 | | | 700 | |

| Total current assets | | 24,720 | | | 31,037 | |

| Property and equipment, net | | 2,304 | | | 2,680 | |

| Right-of-use assets | | 1,146 | | | 1,307 | |

| Intangible assets, net | | 5,053 | | | 5,217 | |

| Goodwill | | 431 | | | 431 | |

| Other assets | | 332 | | | 231 | |

| Total assets | $ | 33,986 | | $ | 40,903 | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | $ | 3,155 | | $ | 3,151 | |

| Accrued liabilities | | 2,393 | | | 2,278 | |

| Deferred revenues, current | | 1,286 | | | 1,121 | |

| Note payable, current | | 2,937 | | | 2,310 | |

| Lease liabilities, current | | 358 | | | 341 | |

| Total current liabilities | | 10,129 | | | 9,201 | |

| Deferred revenue | | 1,632 | | | 1,032 | |

| Notes payable, net | | 3,301 | | | 3,767 | |

| Lease liabilities | | 907 | | | 1,087 | |

| Warrant liabilities | | 107 | | | 233 | |

| Other non-current liabilities | | 103 | | | 141 | |

| Total liabilities | | 16,179 | | | 15,461 | |

| Stockholders' equity: | | | | |

| Common stock | | 14 | | | 13 | |

| Additional paid-in capital | | 250,000 | | | 248,813 | |

| Accumulated other comprehensive income | | 359 | | | 563 | |

| Accumulated deficit | | (232,566) | | | (223,947) | |

| Total stockholders' equity | | 17,807 | | | 25,442 | |

| Total liabilities and stockholders' equity | $ | 33,986 | | $ | 40,903 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ekso Bionics Holdings, Inc. |

| Condensed Consolidated Statements of Operations |

(In thousands, except per share amounts)

(Unaudited) |

| | | | Three Months Ended

June 30, | | Six Months Ended June 30, |

| | | | |

| | | | | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | | |

| Revenue | | | | | | $ | 4,703 | | | $ | 3,465 | | | $ | 8,825 | | | $ | 6,032 | |

| Cost of revenue | | | | | | 2,449 | | | 1,824 | | | 4,571 | | | 3,182 | |

| Gross profit | | | | | | 2,254 | | | 1,641 | | | 4,254 | | | 2,850 | |

| | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | |

| Sales and marketing | | | | | | 2,349 | | | 1,841 | | | 4,437 | | | 3,470 | |

| Research and development | | | | | | 1,398 | | | 873 | | | 2,552 | | | 1,793 | |

| General and administrative | | | | | | 2,791 | | | 2,156 | | | 5,997 | | | 5,053 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total operating expenses | | | | | | 6,538 | | | 4,870 | | | 12,986 | | | 10,316 | |

| | | | | | | | | | | | |

| Loss from operations | | | | | | (4,284) | | | (3,229) | | | (8,732) | | | (7,466) | |

| | | | | | | | | | | | |

| Other (expense) income, net: | | | | | | | | | | | | |

| Interest expense, net | | | | | | (61) | | | (29) | | | (172) | | | (56) | |

| Gain on revaluation of warrant liabilities | | | | | | 152 | | | 999 | | | 126 | | | 899 | |

| Unrealized gain (loss) on foreign exchange | | | | | | (7) | | | (718) | | | 210 | | | (972) | |

| Other expense, net | | | | | | (30) | | | (1) | | | (51) | | | (3) | |

| Total other income (expense), net | | | | | | 54 | | | 251 | | | 113 | | | (132) | |

| Net loss | | | | | | $ | (4,230) | | | $ | (2,978) | | | $ | (8,619) | | $ | $ | (7,598) | |

| | | | | | | | | | | | |

| Net loss per share, basic and diluted | | | | | | $ | (0.31) | | | $ | (0.23) | | | $ | (0.64) | | $ | $ | (0.59) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Weighted average number of shares of common stock outstanding, basic and diluted | | | | | | 13,637 | | | 12,884 | | | 13,467 | | | 12,807 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Document and Entity Information Document

|

Jul. 27, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 27, 2023

|

| Entity Registrant Name |

Ekso Bionics Holdings, Inc.

|

| Entity Central Index Key |

0001549084

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-37854

|

| Entity Tax Identification Number |

99-0367049

|

| Entity Address, Address Line One |

101 Glacier Point, Suite A

|

| Entity Address, City or Town |

San Rafael

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94901

|

| City Area Code |

510

|

| Local Phone Number |

984-1761

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

EKSO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

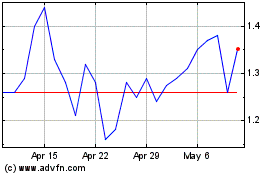

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2024 to May 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From May 2023 to May 2024