Major Shareholder of DG FastChannel Announces Intent to Vote Against Proposed Merger With Enliven

22 August 2008 - 12:12AM

Marketwired

Costa Brava Partnership III L.P., a long-term shareholder of DG

FastChannel, Inc. (NASDAQ: DGIT), intends to vote against DG

FastChannel's proposed merger with Enliven Marketing Technologies

Corporation (NASDAQ: ENLV). In making this announcement, Costa

Brava first stresses that it thinks highly of DG FastChannel's

senior managers and has been satisfied with the Company's strategic

acquisitions since becoming a shareholder in the fall of 2006.

Costa Brava has been happy with DG FastChannel's performance.

Two years ago management promised to take advantage of the February

2009 deadline for FCC mandated implementation of digital

broadcasting. And they kept their promise. To date, the company's

strategic acquisitions have fueled growth, with management taking

advantage of operational synergies quickly and efficiently. The

company's operating income and cash generation over the past two

quarters are proof of management's success in this area.

Costa Brava's satisfaction with DG FastChannel and its prior

acquisitions does not flow to the Enliven transaction. "The

recently proposed Enliven transaction is not like prior strategic

acquisitions. Costa Brava will be voting our 973,000 shares against

the Enliven acquisition," commented Costa Brava's Seth Hamot.

DG FastChannel provides electronic delivery of advertisements,

syndicated programs and video news releases to traditional

broadcasters and other media throughout the nation. The company's

past acquisitions of Vivx, GTN, Pathfire, Point 360 and FastChannel

took advantage of "network effects" to bring greater benefits to

delivery of digital content. This is the strategy in which Costa

Brava invested.

Enliven is different. Enliven provides marketers with the tools

and consultation necessary for the creation of internet

advertising. The acquisition and integration of Enliven will have

no "network effects" and limited synergies because they don't do

what DG FastChannel does. Costa Brava believes the Enliven deal is

a dangerous detour from the deliberate growth initiatives the

company has implemented over the past few years. If the transaction

is consummated, the company would enter a new business and, in one

fell swoop, become a "content provider" in addition to a "content

deliverer."

And the price of this detour is dear. Enliven will cost the

company more than $100 million. What exactly will DG FastChannel

get for such an astronomical sum? To help answer this question, and

mindful of the lack of strategic synergies between the two

companies, a brief review of Enliven's performance is

warranted.

-- Enliven has a history of dismal and increasing operating losses, with

$12.078 million in operating losses over the last twelve months. The

pace of losses has accelerated over the last six months, increasing by

50% for the January through June period. In reviewing the quarters

since the first quarter of 2004, Costa Brava was able to identify only

one quarter when the company generated an operating profit. And that

profit was under $100,000.

-- Revenue and expenses resulting from the "search" segment of Enliven's

business have been removed from the table below. The "search" segment

of Enliven's business is governed by a contract with Yahoo which

terminates in early 2010. The number of downloads of the "viewpoint

toolbar" has been declining for the past several years, and the

revenue from the "search" segment is down sharply in 2008. Costa Brava

believes this "search" segment of Enliven's business has almost no

value except to generate the meager cash flow to sustain the

unprofitable advertising business.

-- Private company competitor Eyeblaster has maintained 90% margins as

their business has grown almost 250% over the past few years. The

tables below demonstrate that Enliven's performance, without including

the "search" segment, has been much less profitable, with much lower

margins.

Enliven's Business (other than the "search" segment)

(All amounts in thousands)

2006 2007 YTD 2008

Revenue $ 10,870 $ 12,649 $ 8,337

Cost of Revenues $ 6,521 $ 8,940 $ 5,242

Gross Profit $ 4,349 $ 3,709 $ 3,095

Gross Margin % 41% 29% 37%

Eyeblaster's Business

(All amounts in thousands)

2006 2007 YTD 2008

Revenue $ 18,829 $ 27,659 $ 44,737

Cost of Revenues $ 1,907 $ 2,700 $ 3,243

Gross Profit $ 16,922 $ 24,959 $ 41,494

Gross Margin % 90% 90% 93%

(Source: Eyeblaster, Inc. Form S-1/A filed with the SEC on

May 22, 2008.)

Noteworthy, though Eyeblaster is now ten times larger than Enliven, its

margins have always been about 90% -- even three years ago when

Eyeblaster had smaller, comparable revenues.

-- The balance sheet does not support a price of $100 million for Enliven.

Tangible book value is less than zero and cash and short term

investments total to less than $2 million. The latter number is down

from over $7 million at the end of last year. Losses since the business

was formed are $300 million, and there has been almost nothing of value

created for such a waste of capital.

-- The most recent 10Q for Enliven, filed with the SEC on August 11, 2008,

contains the following warning, "We have limited capital resources as

well as recurring operating losses and negative cash flows that are

expected to continue for the foreseeable future. The conditions

combined with the possibility of the accelerated payment of a

$3.4 million subordinated note in the event our common stock is

delisted raises substantial doubt about our ability to continue as a

going concern."

-- A few days ago, DG FastChannel disclosed that, "based on Enliven's

first six months performance, as of August 2008, DG FastChannel now

expects full year 2008 revenue of Enliven of approximately

$25.5 million, a reduction of approximately 14% from the full year 2008

estimates provided by Enliven management prior to the execution of the

merger agreement." (DG FastChannel Amendment No. 2 to Form S-4, filed

on August 18, 2008, page 19.)

-- DG FastChannel also disclosed that, in the days leading up to the

execution of the merger agreement, Enliven twice revised its financial

projections downward but did not share these new projections to

DG FastChannel. It is unclear whether DG FastChannel's financial

advisor possessed Enliven's revised lower projections when it issued

a fairness opinion on May 7, 2008. (DG FastChannel Amendment No. 2 to

Form S-4, filed on August 18, 2008, pages 38 and 39.)

-- Finally, doing a "sum of the parts" analysis of Enliven only highlights

Costa Brava's concerns about paying $100 million for the business. The

late 2007 Springbox acquisition is now driving the year over year

increases in Enliven's quarterly revenues. Enliven paid $5.5 million

for Springbox. The 2005 acquisition of Unicast was a stock transaction

including some debt assumption by Enliven. The apparent value on the

deal completion date was under $8 million. Costa Brava believes the

search business is worth less than $15 million today. How could the

whole company be worth $100 million?

Importantly, there is nothing at Enliven to "bolt on" to any DG

FastChannel business. There are no "network effects." Any benefits

from the transaction will occur only because there is a new

management team directing Enliven's efforts. But such benefits are

not synergies that enhance Enliven's value to DG FastChannel's

shareholders. Actually, the opposite is true.

Essentially, DG FastChannel's shareholders are paying $100

million in exchange for an opportunity to distract senior

management from the tremendously successful organization they've

created. Costa Brava's Seth Hamot concluded that, "We don't want

the company to pay $100 million for a strategic distraction. The

deal certainly doesn't 'pencil out,' and it's too much money to

purchase what looks to be more of a problem rather than an

opportunity."

Contact: Costa Brava Partnership III L.P. Seth Hamot

617-595-4405

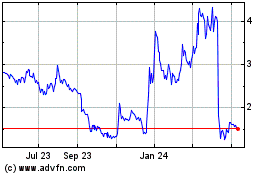

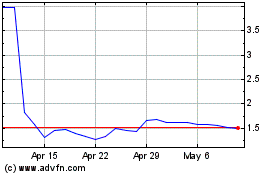

Enlivex Therapeutics (NASDAQ:ENLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Enlivex Therapeutics (NASDAQ:ENLV)

Historical Stock Chart

From Jul 2023 to Jul 2024