- Free Writing Prospectus - Filing under Securities Act Rules 163/433 (FWP)

18 December 2010 - 1:45AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus dated December 17, 2010

Registration No. 333-168312

TERM SHEET

|

|

|

|

|

Issuer:

|

|

ValueVision Media, Inc.

|

|

|

|

|

|

Nasdaq Global Market Symbol:

|

|

VVTV

|

|

|

|

|

|

Securities offered by

ValueVision:

|

|

4,900,000 shares of our common stock

|

|

|

|

|

|

Price to public:

|

|

$3.75 per share

|

|

|

|

|

|

Underwriting discount and

commissions per share:

|

|

$0.225

|

|

|

|

|

|

Estimated net proceeds to

ValueVision (after underwriting

discounts and commissions and

estimated offering expenses):

|

|

$17,022,500

|

|

|

|

|

|

Trade date:

|

|

December 17, 2010

|

|

|

|

|

|

Closing date:

|

|

December 22, 2010

|

|

|

|

|

|

Common stock outstanding after

the offering*:

|

|

37,712,201

|

|

|

|

|

|

Over-allotment option:

|

|

None

|

|

|

|

|

|

Underwriter:

|

|

Piper Jaffray & Co.

|

|

|

|

|

|

Use of proceeds:

|

|

We intend to use the net proceeds from this offering for working capital and general corporate purposes, which may include capital expenditures, as well as payment to the holder of our Series B Preferred Stock in connection with the cash sweep payment obligations under the terms of our Series B Preferred Stock. In addition, we may pay $2.5 million to the holder of our Series B Preferred Stock to obtain their consent to the issuance of shares to NBCU in May 2011. See the section titled "Use of Proceeds" beginning on page S-7 of the prospectus supplement.

|

|

|

|

|

|

*

|

|

Based on 32,812,201 shares of common stock outstanding as of the close of

business on December 15, 2010 and excludes, as of the close of business on

December 15, 2010:

|

|

|

|

•

|

|

2,491,195 shares of common stock issuable upon the exercise of outstanding

options under our 2004 Omnibus Stock Plan, with a weighted average exercise price of $5.75

per share;

|

|

|

|

•

|

|

1,696,325 shares of common stock issuable upon the exercise of outstanding

options under our 2001 Omnibus Stock Plan, with a weighted average exercise price of $6.03;

|

|

|

|

•

|

|

525,000 shares of common stock issuable upon the exercise of outstanding stock

options issued to certain employees outside the Omnibus Stock Plans, with a weighted

average exercise price of $3.58; and

|

|

|

|

•

|

|

warrants to purchase up to 6,000,000 shares of common stock and warrants to

purchase up to 14,744 shares of common stock issued to issued to GE Capital Equity

Investments, Inc. (“GE Equity”) and NBC Universal, Inc.

(“NBCU”), respectively, in connection with our strategic

alliance with GE Equity and NBCU; and

|

|

|

|

•

|

|

$4 million of our common stock to be issued to NBCU on May 15, 2011.

|

The issuer has filed a registration statement (including a prospectus) with the SEC for

the offering to which this communication relates. Before you invest, you should read the prospectus

in that registration statement and other documents the issuer has filed with the SEC for more

complete information about the issuer and this offering. You may get these documents for free by

visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, you may obtain a copy of the

prospectus by contacting Piper Jaffray & Co. at 800 Nicollet Mall, Suite 800, Minneapolis,

Minnesota 55402, or by calling 1-800-747-3924.

Capitalization

The following table sets forth our consolidated capitalization as of October 30, 2010:

|

|

•

|

|

on an actual basis; and

|

|

|

|

|

•

|

|

on an as adjusted basis to give effect to our sale of 4,900,000 shares

of common stock at an offering price of $3.75 per share, after

deducting an assumed underwriting discount and estimated offering

expenses of $250,000 payable by us ($125,000 of which constitute fees

and expenses of the underwriter that we have agreed to pay).

|

The information set forth in the following table should be read in conjunction with and is

qualified in its entirety by reference to the audited and unaudited financial statements and notes

thereto incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of October 30, 2010

|

|

|

|

|

Actual

|

|

|

As

|

|

|

|

|

|

|

|

Adjusted

|

|

|

|

|

(In thousands)

|

|

|

Cash and cash equivalents

|

|

$

|

15,674

|

|

|

$

|

32,697

|

|

Restricted cash and investments

|

|

|

4,961

|

|

|

|

4,961

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term payable

|

|

$

|

1,937

|

|

|

$

|

1,937

|

|

|

Accrued dividends — Series B Preferred Stock

|

|

|

8,903

|

|

|

|

8,903

|

|

|

Series B Mandatory Redeemable Preferred Stock, $.01 per share par

value, 4,929,266 shares authorized; 4,929,266 shares issued and

outstanding

|

|

|

12,531

|

|

|

|

12,531

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.01 per share par value; 100,000,000 shares authorized

Actual — 32,796,077 shares outstanding

As adjusted — 37,696,077 shares outstanding

|

|

$

|

328

|

|

|

$

|

377

|

|

Warrants to purchase 6,022,115 shares of common stock

|

|

|

637

|

|

|

|

637

|

|

|

Additional paid-in capital

|

|

|

318,932

|

|

|

|

335,906

|

|

|

|

Accumulated deficit

|

|

|

(253,859

|

)

|

|

|

(253,859

|

)

|

|

Total shareholders’ equity

|

|

$

|

66,038

|

|

|

$

|

83,061

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

89,409

|

|

|

$

|

106,432

|

|

Dilution

If you invest in our common stock in this offering, your ownership interest will be diluted to the

extent of the difference between the public offering price per share of our common stock and the as

adjusted net tangible book value per share of our common stock upon completion of this offering.

Historical net tangible book value per share is determined by dividing our total tangible assets

(total assets less intangible assets) less total liabilities, by the number of outstanding shares

of our common stock. The historical net tangible book value of our common stock as

of October 30, 2010 was approximately $64.3 million, or approximately $1.96 per share of common stock, based on

the number of shares of common stock outstanding as of October 30, 2010.

Investors participating in this offering will incur immediate and substantial dilution. After

giving effect to the sale of common stock offered by us in this offering at the public offering

price of $ per share, and after deducting the underwriting discounts and commissions and

the estimated expenses of $250,000 payable by us ($125,000 of which constitute fees and expenses of

the underwriter that we have agreed to pay), our as adjusted net tangible book value as of October

30, 2010 would have been approximately $81.3 million, or

approximately $2.16 per share of

common stock. This represents an immediate increase in as adjusted

net tangible book value of $0.20

per share to existing common shareholders, and an immediate dilution

of $1.59 per share to

investors participating in this offering. The following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share

|

|

|

|

|

|

$

|

3.75

|

|

|

Historical net

tangible book value

per share as of

October 30, 2010

|

|

|

1.96

|

|

|

|

|

|

|

Increase in historical

net tangible book

value per share

attributable to

investors

participating in this

offering

|

|

|

0.20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As adjusted historical net tangible

book value per share after this

offering

|

|

|

|

|

|

2.16

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to investors

participating in this offering

|

|

|

|

|

|

$1.59

|

|

|

|

|

|

|

|

|

|

|

|

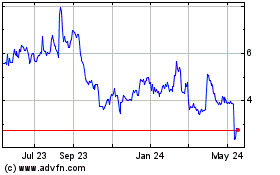

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Evolv Technologies (NASDAQ:EVLV)

Historical Stock Chart

From Jul 2023 to Jul 2024