Great Elm Capital Corp. (“we”, “us”, “our” or “GECC”),

(NASDAQ:GECC), today announced its financial results for the

quarter ended March 31, 2017 and filed its quarterly report on Form

10-Q with the U.S. Securities and Exchange Commission.

FINANCIAL HIGHLIGHTS

- Net investment income (“NII”) for the quarter ended March 31,

2017 was approximately $4.1 million, or $0.32 per share, which was

in excess of our declared distribution of $0.083 per share per

month for the same period (approximately 1.3x distribution

coverage).

- In May, the Board of Directors declared a monthly distribution

of $0.083 per share for the third quarter of 2017.

- Net assets on March 31, 2017 were approximately $170.4 million.

Net asset value (“NAV”) per share on March 31, 2017 was $13.59, as

compared to $13.52 per share on December 31, 2016. The increase in

NAV per share is primarily driven by our net investment income

exceeding our distribution during the quarter. We had approximately

$2.0 million of net realized gains on portfolio investments that

were monetized during the quarter ended March 31, 2017, or

approximately $0.16 per share, and net unrealized depreciation of

investments of approximately $2.7 million, or approximately ($0.21)

per share.

- During the quarter ended March 31, 2017, we purchased an

aggregate of 245,729 shares through our stock buyback program at an

average price of $11.35, utilizing $2.8 million of our $15.0

million 10b5-1 program and our overall $50 million stock repurchase

program.

- From the commencement of the stock buyback program through May

10, 2017, we have purchased an aggregate of 378,301 shares at a

weighted average price of $11.17 per share, resulting in $4.2

million of cumulative cash paid to repurchase shares.

- Additionally, through the self-tender that we conducted, we

purchased 869,565 shares, representing approximately 6.9% of our

outstanding shares, at a price of $11.50 per share on a pro rata

basis for a total cost of approximately $10 million, excluding fees

and expenses relating to the self-tender offer. The purchase

price of properly tendered shares represented approximately 85% of

our net asset value per share as of March 31, 2017.

- During the quarter ended March 31, 2017, we invested

approximately $75.9 million across eight portfolio companies (1),

including two new portfolio investments. During the quarter ended

March 31, 2017, we monetized approximately $78.8 million across 17

portfolio companies (in part or in full). (2)

“We continue to be pleased at the pace of

monetization of the legacy Full Circle portfolio, as well as with a

number of names from the MAST-contributed portfolio and more

recently acquired positions, as catalysts have resulted in a

quicker repricing of these opportunities than we had anticipated.

With that backdrop, we have a healthy amount of dry powder to

deploy as the market presents compelling total return

opportunities,” said Peter A. Reed, Chief Executive Officer of

GECC.

PORTFOLIO AND INVESTMENT ACTIVITY

As of March 31, 2017, we held 23 debt

investments across 20 companies, totaling approximately $149.6

million. Debt investments represented 98% of invested capital, as

of March 31, 2017, with 94% of invested capital allocated to first

lien and/or senior secured debt instruments and 4% of invested

capital in unsecured debt obligations. We also had equity

investments in seven companies, totaling approximately $2.6

million.

As of March 31, 2017, the weighted average

current yield on our debt portfolio was approximately 12.63% with

approximately 47% of invested debt capital in floating rate debt

instruments.

During the quarter ended March 31, 2017, we

deployed approximately $75.9 million (1) into new and existing

investments across eight companies (two new, six existing). The

weighted average price of the new debt investments was $0.98,

carrying a weighted average current yield of 12.29%. Nearly all of

these investments are first lien and / or senior secured

investments with potential catalysts to unlock value.

During the quarter ended March 31, 2017, we

monetized 17 investments, in part or in full, for approximately

$78.8 million (2), at a weighted average current yield of 13.34%,

including the complete exit of one investment acquired from Full

Circle, at a slight gain. Our weighted average realization price

was $0.99.

CONSOLIDATED RESULTS OF OPERATIONS

Total investment income for the quarter ended

March 31, 2017 was approximately $7.3 million, or $0.58 per share.

Net expenses for the period ended March 31, 2017 were approximately

$3.2 million, or $0.26 per share.

Net realized gains for the quarter ended March

31, 2017 were approximately $2.0 million, or $0.16 per share. Net

unrealized depreciation from investments for the quarter ended

March 31, 2017 was approximately $2.7 million, or ($0.21) per

share.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2017, available liquidity from

cash and cash equivalents was approximately $66.8 million,

comprised of cash and cash equivalents, including investments in

money market mutual funds.

Total debt outstanding as of March 31, 2017 was

approximately $33.7 million, comprised entirely of the 8.25% notes

due June 30, 2020 (NASDAQ:FULLL).

RECENT DEVELOPMENTS

Distributions:

Our board of directors declared the monthly

distributions for the third quarter of 2017 at $0.083 per share.

The schedule of distribution payments is as follows:

|

Month |

Rate |

Record Date |

Payable Date |

|

July |

$ |

0.083 |

July 31, 2017 |

August 15, 2017 |

|

August |

$ |

0.083 |

August 31, 2017 |

September 15, 2017 |

|

September |

$ |

0.083 |

September 29, 2017 |

October 16, 2017 |

Our distribution policy has been designed to set

a base distribution rate that is well-covered by NII that will be

supplemented by special distributions from NII in excess of the

declared distribution and as catalyst-driven investments are

realized.

Portfolio Investments:

During April 2017, we sold our position in

Chester Downs & Marina LLC for approximately $6.3 million,

including accrued interest. We realized approximately $0.3

million of gains on the disposition of the investment.

During April and May 2017, we sold the remaining

$6.3 million of our position in Everi Payments, Inc. for

approximately $6.8 million, including accrued interest. We

realized approximately $0.6 million of gains on the disposition of

the investment.

During May 2017, we received approximately $2.8

million in proceeds from the disposition of the primary asset of

Double Deuce Lodging, LLC.

Capitalization:

The Company’s $10 million self-tender offer

expired at 5:00 p.m., New York City time, on May 5, 2017. The

Company purchased 869,565 shares, representing approximately 6.94%

of its outstanding shares, at a price of $11.50 per share on a pro

rata basis for a total cost of approximately $10 million, excluding

fees and expenses relating to the self-tender offer. The

purchase price represented approximately 85% of net asset value per

share as of March 31, 2017.

CONFERENCE CALL AND WEBCAST

Great Elm Capital Corp. will host a conference

call and webcast on Monday, May 15, 2017 at 10:00 a.m. New York

City time to discuss its first quarter financial results. All

interested parties are invited to participate in the conference

call by dialing (844) 820-8297; international

callers should dial (661) 378-9758. Participants

should enter the Conference ID 20957666 when asked. For a copy of

the slide presentation that will be referenced during the course of

our conference call, please visit http://www.greatelmcc.com/ under

Investor Relations. Additionally, the conference call with be

webcast simultaneously at

http://edge.media-server.com/m/p/quvzyvm2.

About Great Elm Capital

Corp.

Great Elm Capital Corp. is an externally

managed, specialty finance company focused on investing in debt

instruments of middle market companies. GECC elected to be

regulated as a business development company under the Investment

Company Act of 1940, as amended. GECC’s investment objective is to

generate both current income and capital appreciation, while

seeking to protect against risk of permanent capital loss. GECC

focuses on special situations and catalyst-driven investments as it

seeks to generate attractive risk-adjusted returns.

Cautionary Statement Regarding

Forward-Looking Statements

Statements in this communication that are not

historical facts are “forward-looking” statements within the

meaning of the federal securities laws. These statements are often,

but not always, made through the use of words or phrases such as

“expect,” “anticipate,” “should,” “will,” “estimate,” “designed,”

“seek,” “potential,” “continue,” “upside,” and “potential,” and

similar expressions. All such forward-looking statements involve

estimates and assumptions that are subject to risks, uncertainties

and other factors that could cause actual results to differ

materially from the results expressed in the statements. Among the

key factors that could cause actual results to differ materially

from those projected in the forward-looking statements are the

following: conditions in the credit markets, the price of GECC

common stock, performance of GECC’s portfolio and investment

manager. Information concerning these and other factors can be

found in GECC’s Form 10-K and other reports filed with the SEC.

GECC assumes no obligation to, and expressly disclaims any duty to,

update any forward-looking statements contained in this

communication or to conform prior statements to actual results or

revised expectations except as required by law. Readers are

cautioned not to place undue reliance on these forward-looking

statements that speak only as of the date hereof.

Media & Investor

Contact:

Meaghan K. Mahoney Senior Vice President +1

(617) 375-3006 investorrelations@greatelmcap.com

Endnotes:

1) This includes new deals, additional fundings

(inclusive of those on revolving credit facilities), refinancings

and payment in kind “PIK” interest.

2) This includes scheduled principal payments,

prepayments, sales and repayments (inclusive of those on revolving

credit facilities).

| |

|

| GREAT ELM CAPITAL CORP. |

|

| CONSOLIDATED STATEMENT OF ASSETS AND

LIABILITIES |

|

| MARCH 31, 2017 |

|

| Dollar amounts in thousands (except per share

amounts) |

|

| |

|

| |

|

March 31,

2017 |

|

|

December 31,

2016 |

|

|

Assets |

|

(unaudited) |

|

|

|

|

|

| Investments, at fair

value (amortized cost of $168,384 and $168,132,

respectively) |

|

$ |

152,234 |

|

|

$ |

154,677 |

|

| Cash and cash

equivalents |

|

|

66,763 |

|

|

|

66,782 |

|

| Receivable for

investments sold |

|

|

1,764 |

|

|

|

9,406 |

|

| Interest

receivable |

|

|

4,261 |

|

|

|

4,338 |

|

| Dividends

receivable |

|

|

12 |

|

|

|

— |

|

| Principal

receivable |

|

|

— |

|

|

|

786 |

|

| Due from portfolio

company |

|

|

188 |

|

|

|

312 |

|

| Deposit at broker |

|

|

63 |

|

|

|

56 |

|

| Due from

affiliates |

|

|

75 |

|

|

|

80 |

|

| Prepaid expenses and

other assets |

|

|

88 |

|

|

|

107 |

|

| Total

assets |

|

$ |

225,448 |

|

|

$ |

236,544 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

| Notes payable 8.25% due

June 30, 2020 (including unamortized premium of $826 and $888

at March 31, 2017 and December 31, 2016; respectively) |

|

$ |

34,471 |

|

|

$ |

34,534 |

|

| Payable for investments

purchased |

|

|

14,973 |

|

|

|

21,817 |

|

| Distributions

payable |

|

|

1,041 |

|

|

|

2,123 |

|

| Due to affiliates |

|

|

3,749 |

|

|

|

3,423 |

|

| Accrued expenses and

other liabilities |

|

|

777 |

|

|

|

1,663 |

|

| Total

liabilities |

|

$ |

55,011 |

|

|

$ |

63,560 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and

contingencies (Note 6) |

|

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

| Net

Assets |

|

|

|

|

|

|

|

|

| Common stock, par value

$0.01 per share (100,000,000 shares authorized, 12,545,151

and 12,790,880 shares issued and outstanding at March

31, 2017 and December 31, 2016; respectively) |

|

$ |

125 |

|

|

$ |

128 |

|

| Additional paid-in

capital |

|

|

216,531 |

|

|

|

219,317 |

|

| Accumulated net

realized losses |

|

|

(32,361 |

) |

|

|

(34,341 |

) |

| Undistributed net

investment income |

|

|

2,292 |

|

|

|

1,335 |

|

| Net unrealized

depreciation on investments |

|

|

(16,150 |

) |

|

|

(13,455 |

) |

| Total net

assets |

|

$ |

170,437 |

|

|

$ |

172,984 |

|

| Total

liabilities and net assets |

|

$ |

225,448 |

|

|

$ |

236,544 |

|

| Net asset value

per share |

|

$ |

13.59 |

|

|

$ |

13.52 |

|

| |

|

| |

|

|

GREAT ELM CAPITAL CORP. |

|

|

CONSOLIDATED STATEMENT OF OPERATIONS

(unaudited) |

|

|

THREE MONTHS ENDED MARCH 31, 2017 |

|

|

Dollar amounts in thousands (except per share

amounts) |

|

| |

|

| Investment

Income: |

|

|

|

|

| Interest income |

|

$ |

6,826 |

|

| Dividend income |

|

|

46 |

|

| Other income |

|

|

443 |

|

|

Total investment income |

|

|

7,315 |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

| Management fees |

|

|

593 |

|

| Incentive fees |

|

|

1,023 |

|

| Administration

fees |

|

|

495 |

|

| Custody fees |

|

|

13 |

|

| Directors’ fees |

|

|

27 |

|

| Professional

services |

|

|

331 |

|

| Interest and credit

facility expenses |

|

|

631 |

|

| Other expenses |

|

|

113 |

|

| Total

expenses |

|

|

3,226 |

|

| Accrued

administration fees waiver |

|

|

(5 |

) |

| Net expenses |

|

|

3,221 |

|

| Net investment

income |

|

|

4,094 |

|

| |

|

|

|

|

| Net realized

and unrealized gains (losses) on investment transactions:

|

|

|

|

|

| Net realized

gain/(loss) from: |

|

|

|

|

|

Investments |

|

|

1,980 |

|

| Net change in

unrealized appreciation (depreciation) from: |

|

|

|

|

|

Investments |

|

|

(2,695 |

) |

| Net realized and

unrealized gains (losses) |

|

|

(715 |

) |

| Net increase in

net assets resulting from operations |

|

$ |

3,379 |

|

| |

|

|

|

|

| Net investment income

per share (basic and diluted): |

|

$ |

0.32 |

|

| Earnings per share

(basic and diluted): |

|

$ |

0.27 |

|

| Weighted average shares

outstanding: |

|

|

12,636,477 |

|

| |

|

| |

|

| GREAT ELM CAPITAL CORP. |

|

| PER SHARE DATA |

|

| |

|

|

|

|

For the Three Months Ended

March 31, |

|

|

|

|

2017 |

|

| Per Share

Data:(1) |

|

|

|

|

| Net asset value,

beginning of period |

|

$ |

13.52 |

|

| Net investment

income |

|

|

0.32 |

|

| Net realized gains |

|

|

0.16 |

|

| Net unrealized

losses |

|

|

(0.21 |

) |

| Net decrease in net

assets resulting from operations |

|

|

0.27 |

|

| Accretion from share

buybacks |

|

|

0.05 |

|

| Distributions declared

from net investment income(2) |

|

|

(0.25 |

) |

| Distributions declared

from net realized gains(2) |

|

|

0.00 |

|

| Net decrease resulting

from distributions to common stockholders |

|

|

(0.25 |

) |

| Net asset value, end of

period |

|

$ |

13.59 |

|

(1) The per share data was derived by using

the weighted average shares outstanding during the period.

(2) The per share data for distributions

declared reflects the actual amount of distributions of record per

share for the period.

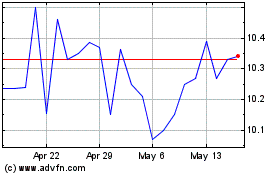

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Mar 2024 to May 2024

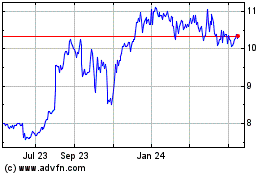

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From May 2023 to May 2024