Hong Kong Wins More Listings of U.S.-Traded Chinese Firms -- Update

10 September 2020 - 7:28PM

Dow Jones News

By Joanne Chiu

The tally of U.S.-listed Chinese companies securing alternative

listings in Hong Kong grew, as stock in China's largest restaurant

group started trading in the city and a major hotel chain began

taking orders for its own offering.

Yum China Holdings Inc., which runs KFC and Pizza Hut on the

mainland, made a lackluster debut days after it had raised the

equivalent of $2.2 billion by selling new stock.

Separately, Nasdaq-listed hotelier Huazhu Group Ltd., which

counts Accor SA and Trip.com Group Ltd. as shareholders, began

taking orders for a $970 million stock sale ahead of its planned

secondary listing in Hong Kong on Sept. 22.

The new deals follow a string of sizable stock sales in Hong

Kong by big Chinese technology companies whose securities already

trade in New York, such as Alibaba Group Holding Ltd., JD.com Inc.

and NetEase Inc.--and show such secondary listings also hold appeal

for companies outside the tech industry.

A Hong Kong listing means a company's stock can be traded during

the Asian day and is likely to broaden its investor base. If shares

are later added to Hong Kong's so-called stock connect program,

they could also become accessible to investors in mainland

China.

At the same time, American lawmakers have sought to step up

financial scrutiny of U.S.-listed Chinese companies, raising the

risk of potential delistings. And Hong Kong's stock exchange has

also revamped its rules to allow some Chinese companies whose

shares already trade on other exchanges to list in the city.

Yum China's stock fell 5.3% from its offer price on Thursday to

close at 390.20 Hong Kong dollars, the equivalent of $50.34. Its

New York-traded stock closed Wednesday at $53.20.

The lukewarm market reception came even though Yum China's stock

sale generated solid demand. Individual investors placed more than

52 times the stock offered to them, while institutions ordered

nearly nine times more shares than they were offered.

Paul Pong, managing director at Pegasus Fund Managers Ltd., said

investors liked Yum China's growth prospects and saw the company,

which was spun off from Yum Brands Inc. in 2016, as

well-managed.

"China's market is far from saturated for Yum China, giving it a

lot of growth potential for new store openings," he said. However,

Mr. Pong said any resurgence of coronavirus infections in the

winter could slow Yum China's recovery, even if its long-term

potential remained intact.

Lockdowns and social-distancing measures forced the company to

close about a third of its restaurants earlier this year. Yum China

has since reopened most stores but said sales and profits were

trending unevenly. Net income fell 26% to $132 million in the

second quarter and its sales fell 11% from a year earlier to $1.9

billion.

P.R. Venkat contributed to this article.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

September 10, 2020 05:13 ET (09:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

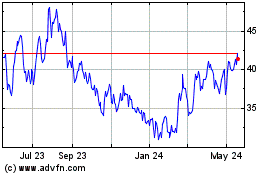

H World (NASDAQ:HTHT)

Historical Stock Chart

From Jun 2024 to Jul 2024

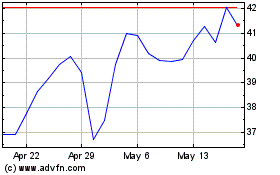

H World (NASDAQ:HTHT)

Historical Stock Chart

From Jul 2023 to Jul 2024