Smith & Nephew Buys Extremity Orthopedics for $240 Million

29 September 2020 - 10:50PM

Dow Jones News

By Ian Walker

Smith & Nephew PLC said Tuesday that it is buying the

Extremity Orthopedics business of Integra LifeSciences Holdings

Corporation for $240 million, and that the purchase be funded from

existing cash and debt.

The global medical-technology company said the portfolio being

bought is highly complementary to its existing orthopedics

offering, and provides entry into the shoulder replacement and foot

and ankle segments.

"This strategic acquisition represents a significant opportunity

to strengthen Smith+Nephew's position in a high-value area and

allows us to offer a leading extremities portfolio to customers,"

S&N's President of Global Orthopaedics Skip Kiil said.

The business being bought generated revenue of $90 million and

posted a small loss in 2019. It is expected to deliver double-digit

revenue growth and be slightly dilutive to trading profit in 2021

and 2022, S&N said.

The acquisition is expected to complete around the end of this

year.

Shares at 1210 GMT were down 7.50 pence, or 0.5%, at 1472

pence.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

September 29, 2020 08:35 ET (12:35 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

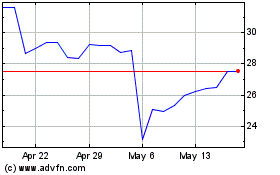

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From Mar 2024 to May 2024

Integra LifeSciences (NASDAQ:IART)

Historical Stock Chart

From May 2023 to May 2024