IZEA, Inc. (NASDAQ: IZEA), operator of IZEAx, the premier online

marketplace connecting brands and publishers with influential

content creators, reported its financial and operational results

for the fourth quarter and full year ended December 31, 2017.

The financial information presented here and in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2017

reflects restated financial information relating to our prior

period information. All comparisons are on an as-adjusted basis. We

determined that there were errors in our previously issued

financial statements related to our presentation of revenue related

to the self-service Content Workflow portion of our revenue and our

classification of cost of revenue related to our Managed Services.

The restatement had no impact on our previously reported loss from

operations, net loss, loss per share, or on any of the consolidated

balance sheets, statements of cash flows, and statements of

stockholders' equity.

For discussions of the restatement adjustments, see Item 1A.

“Risk Factors” and Item 8, “Financial Statements,” including Notes

2 and 14 of the Notes to the Consolidated Financial Statements in

our 10-K.

Q4 2017 Financial Summary Compared to Q4 2016

- Total revenue up 16% to $6.8 million,

compared to $5.9 million.

- Managed Services revenue increased 16%

to $6.6 million, compared to $5.7 million.

- Content Workflow revenue decreased 33%

to $77,000, compared to $116,000.

- Gross billings up 6% to $7.8 million,

compared to $7.4 million.

- Total costs and expenses were $7.5

million, compared to $7.7 million.

- Net loss was $(743,000), compared to a

net loss of $(1.83 million), an improvement of $1.1 million or

59%.

- Adjusted EBITDA was $103,000, compared

to $(1.1) million, an improvement of $1.2 million.

FY2017 Financial Summary Compared to FY2016

- Total revenue up 15% to $24.4 million,

compared to $21.2 million.

- Managed Services revenue increased 17%

to $23.8 million, compared to $20.4 million.

- Content Workflow revenue decreased 25%

to $351,000, compared to $465,000.

- Gross billings up 7% to $29.2 million,

compared to $27.3 million.

- Total costs and expenses were $29.9

million, compared to $28.7 million.

- Net loss was $(5.5) million, compared

to $(7.6) million, an improvement of $2.1 million.

- Adjusted EBITDA was $(2.5) million,

compared to $(5.1) million, an improvement of $2.6 million.

FY2017 Operational Highlights

- Launched IZEAx 2.0, including Promoted

Posts and IZEA Pay.

- Released ContentMine™ and

CurationEngine™ with integrated artificial intelligence.

- Partnered with CORT to launch first

Augmented Sponsorship™ campaign.

- Recognized as a 2017 Top 100 Company in

Central Florida by Orlando Sentinel.

Management Commentary

“IZEA has demonstrated meaningful improvement across the board

in 2017. We released an impressive array of new technologies,

delivered record revenue, record gross billings, and achieved our

goal of getting to our first Adjusted EBITDA positive quarter a

full year ahead of schedule,” said Ted Murphy, IZEA’s Chairman and

CEO. “The improvements we made throughout the year had a

significant impact on our efficiency and overall strength as an

organization.”

“Custom Content in particular played a meaningful role in our

growth last year. Revenue from Custom Content grew 47%, or $1.7

million over 2016, and the success is a reflection of our

investment in building out the infrastructure to support that line

of business. We continue to see great opportunity for Custom

Content, particularly when paired together with our Influencer

Marketing services.”

“As we look to 2018, a primary goal is the expansion of our

sales organization to provide the foundation for topline

re-acceleration in 2019 and beyond. We are expanding our recruiting

efforts with an emphasis on sales, and will continue to enhance our

technology platform. The company will add sales resources to our

core Managed Services team, as well as our newer SMB and

Partnership teams. Management continues to balance investment in

growth with expense management and an eye on profitability.”

Q4 2017 Financial Results

Revenue in the fourth quarter of 2017 increased 16% to $6.8

million compared to $5.9 million in the same year-ago quarter. The

increase was due to organic growth in both our Sponsored Social and

Custom Content Managed Service offerings. Cost of revenue

(exclusive of amortization) as a percentage of revenue decreased

from 49.1% to 47.5%, an improvement of 1.6%.

Total costs and expenses in the fourth quarter of 2017 were $7.5

million compared to $7.7 million in the same year-ago quarter. This

decrease was primarily due to decreased personnel-related costs as

well as lower public relations and marketing expenses.

Net loss in the fourth quarter of 2017 was $(743,000) or $(0.13)

per share, as compared to a net loss of $(1.8) million or $(0.34)

per share in the same year-ago quarter. The improvement was

primarily due to increased revenue as well as decreased

expenses.

Adjusted EBITDA (a non-GAAP metric management used as a proxy

for operating cash flow, as defined below) in the fourth quarter of

2017 was $103,000 compared to $(1.1) million in the same year-ago

quarter. The improvement in adjusted EBITDA was primarily due to

the increase in revenue as well as reduced expenses. Adjusted

EBITDA as a percentage of revenue in the fourth quarter of 2017 was

2% compared to (18%) in the year-ago quarter.

Revenue backlog, which includes unbilled bookings and unearned

revenue, was $8.2 million at the end of the quarter.

Cash and cash equivalents at December 31, 2017 totaled $3.9

million. At the end of the quarter the Company had accessed

approximately $500,000 of its $5.0 million credit line.

Full Year 2017 Financial Results

Revenue for the year increased 15% to $24.4 million compared to

$21.2 million in 2016. The increase was due to organic growth in

Managed Services. Cost of revenue (exclusive of amortization) as a

percentage of revenue decreased from 49.3% to 47.4%, an improvement

of 1.9%.

Total costs and expenses were $29.9 million in 2017 and 28.7

million in 2016. The decrease was primarily attributable to

decreased personnel costs and related overhead, as well as reduced

marketing spend.

Net loss in 2017 was $(5.5) million or $(0.96) per share,

compared to a net loss of $(7.6) million or $(1.41) per share in

2016. The improvement in net loss was primarily due to increased

revenue and profit margins, along with reduced operating

expenses.

Adjusted EBITDA was $(2.5) million compared to $(5.1) million in

2016. Adjusted EBITDA as a percentage of revenue was (10%) compared

to (24%) in 2016.

Conference Call

IZEA will hold a conference call to discuss its fourth quarter

and full year 2017 results on Thursday, April 19 at 5:00 p.m.

Eastern time. Management will host the call, followed by a question

and answer period.

Date: Thursday, April 19, 2018Time: 5:00 p.m. Eastern

timeToll-free dial-in number: 1-877-407-4018International dial-in

number: 1-201-689-8471

The conference call will be webcast live and available for

replay via the investors section of the company’s website at

https://izea.com/. Please call the conference telephone number five

minutes prior to the start time. An operator will register your

name and organization. A replay of the call will be available after

8:00 p.m. Eastern time on the same day through April 26, 2018.

Toll-free replay number: 1-844-512-2921International replay

number: 1-412-317-6671Replay ID: 13679060

About IZEA

IZEA operates IZEAx, the premier online marketplace that

connects marketers with content creators. IZEAx automates

influencer marketing and custom content development, allowing

brands and agencies to scale their marketing programs. IZEA

creators include celebrities and accredited journalists. Creators

are compensated for producing unique content such as long and short

form text, videos, photos, status updates, and illustrations for

marketers or distributing such content on behalf of marketers

through their personal websites, blogs, and social media channels.

Marketers receive influential consumer content and engaging,

shareable stories that drive awareness. For more information about

IZEA, visit https://izea.com.

Use of Non-GAAP Financial Measures

We define gross billings, a non-GAAP financial measure, as the

total dollar value of the amounts earned from our customers for the

services we performed, or the amounts charged to our customers for

their self-service purchase of goods and services on our platforms.

Gross billings for Content Workflow differs from revenue reported

in our consolidated statements of operations, which is presented

net of the amounts we pay to our third-party creators providing the

content or sponsorship services. Gross billings for all other

revenue equals the revenue reported in our consolidated statements

of operations.

We consider this metric to be an important indicator of our

performance as it measures the total dollar volume of transactions

generated through our marketplaces. Tracking gross billings allows

us to monitor the percentage of gross billings that we are able to

retain after payments to our creators. Because we invoice our

customers on a gross basis, tracking gross billings is critical as

it pertains to our credit risk and cash flow.

"EBITDA" is a non-GAAP financial measure under the rules of the

Securities and Exchange Commission. EBITDA is commonly defined as

"earnings before interest, taxes, depreciation and amortization."

IZEA defines “Adjusted EBITDA,” also a non-GAAP financial measure,

as earnings or loss before interest, taxes, depreciation and

amortization, non-cash stock related compensation, gain or loss on

asset disposals or impairment, changes in acquisition cost

estimates, and all other non-cash income and expense items such as

gains or losses on settlement of liabilities and exchanges, and

changes in fair value of derivatives, if applicable.

We believe that Adjusted EBITDA provides useful information to

investors as they exclude transactions not related to the core cash

operating business activities including non-cash transactions. We

believe that excluding these transactions allows investors to

meaningfully trend and analyze the performance of our core cash

operations.

All companies do not calculate Gross Billings and Adjusted

EBITDA in the same manner. These metrics as presented by IZEA may

not be comparable to those presented by other companies. Moreover,

these metrics have limitations as analytical tools, and you should

not consider them in isolation or as a substitute for an analysis

of our results of operations as reported under GAAP. A

reconciliation of GAAP to non-GAAP results is included in the

financial tables included in this press release.

Safe Harbor Statement

All statements in this release that are not based on historical

fact are “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended. Forward-looking

statements, which are based on certain assumptions and describe our

future plans, strategies and expectations, can generally be

identified by the use of forward-looking terms such as "believe,"

"expect," "may," "will," "should," "could," "seek," "intend,"

"plan," "goal," "estimate," "anticipate" or other comparable terms.

Examples of forward-looking statements include, among others,

statements we make regarding expectations concerning IZEA’s ability

to increase revenue and improve Adjusted EBITDA, expectations with

respect to operational efficiency, and expectations concerning

IZEA’s business strategy. Forward-looking statements involve

inherent risks and uncertainties which could cause actual results

to differ materially from those in the forward-looking statements,

as a result of various factors including, among others, the

following: competitive conditions in the content and social

sponsorship segment in which IZEA operates; failure to popularize

one or more of the marketplace platforms of IZEA; inability to

finance growth initiatives in a timely manner; our ability to

establish effective disclosure controls and procedures and internal

control over financial reporting; our ability to satisfy the

requirements for continued listing of our common stock on the

Nasdaq Capital Market; changing economic conditions that are less

favorable than expected; and other risks and uncertainties

described in IZEA’s periodic reports filed with the Securities and

Exchange Commission. The forward-looking statements made in this

release speak only as of the date of this release, and IZEA assumes

no obligation to update any such forward-looking statements to

reflect actual results or changes in expectations, except as

otherwise required by law.

IZEA, Inc. Consolidated Balance Sheets

December 31, December 31, 2017 2016 Assets

Current: Cash and cash equivalents $ 3,906,797 $ 5,949,004 Accounts

receivable, net 3,647,025 3,745,695 Prepaid expenses 389,104

322,377 Other current assets 9,140 11,940

Total current assets 7,952,066

10,029,016 Property and equipment, net 286,043

460,650 Goodwill 3,604,720 3,604,720 Intangible assets, net 667,909

1,662,536 Software development costs, net 967,927 1,103,959

Security deposits 148,638 161,736 Total

assets $ 13,627,303 $ 17,022,617

Liabilities and Stockholders’ Equity Current liabilities: Accounts

payable $ 1,756,841 $ 1,438,389 Accrued expenses 1,592,356

1,242,889 Unearned revenue 3,070,502 3,315,563 Line of credit

500,550 — Current portion of deferred rent 45,127 34,290 Current

portion of acquisition costs payable 741,155

1,252,885 Total current liabilities 7,706,531

7,284,016 Deferred rent, less current portion

17,419 62,547 Acquisition costs payable, less current portion

609,768 688,191 Warrant liability — —

Total liabilities 8,333,718 8,034,754

Commitments and Contingencies — — Stockholders’

equity: Preferred stock; $.0001 par value; 10,000,000 shares

authorized; no shares issued and outstanding — — Common stock,

$.0001 par value; 200,000,000 shares authorized; 5,733,981 and

5,456,118, respectively, issued and outstanding 573 545 Additional

paid-in capital 52,570,432 50,797,039 Accumulated deficit

(47,277,420 ) (41,809,721 ) Total stockholders’ equity

5,293,585 8,987,863 Total

liabilities and stockholders’ equity $ 13,627,303

$ 17,022,617 IZEA, Inc.

Consolidated Statements of Operations (Unaudited)

Three Months Ended Twelve Months Ended December 31,

December 31, (As Restated) (As Restated) 2017

2016 2017 2016 Revenue $ 6,800,385 $ 5,883,614

$ 24,437,649 $ 21,234,297 Costs and expenses: Cost of

revenue (exclusive of amortization) 3,230,931 2,888,292 11,585,316

10,474,769 Sales and marketing 1,584,671 2,061,786 7,593,197

7,989,590 General and administrative 2,292,976 2,358,702 9,218,565

8,946,431 Depreciation and amortization 420,976

364,788 1,516,807 1,299,851

Total costs and expenses 7,529,554

7,673,568 29,913,885 28,710,641

Loss from operations (729,169 ) (1,789,954 ) (5,476,236 )

(7,476,344 ) Other income (expense): Interest expense

(19,544 ) (24,683 ) (64,950 ) (82,944 ) Loss on exchange of

warrants — — Change in fair value of derivatives, net 3,147 (5,405

) 39,269 9,163 Other income (expense), net 2,490

(9,590 ) 34,218 (10,075 ) Total other

income (expense), net (13,907 ) (39,678 )

8,537 (83,856 ) Net loss $ (743,076 )

$ (1,829,632 ) $ (5,467,699 ) $ (7,560,200 )

Weighted average common shares outstanding – basic and

diluted 5,720,824 5,450,005

5,674,901 5,380,465 Basic and diluted loss per

common share $ (0.13 ) $ (0.34 ) $ (0.96 )

$ (1.41 )

IZEA, Inc.Non-GAAP

Reconciliations(Unaudited)

Reconciliation of GAAP Revenue to Non-GAAP Gross

Billings:

Three Months Ended Twelve Months Ended

(As Restated) (As Restated) December 31, December 31, December 31,

December 31, 2017 2016 2017 2016

Revenue $ 6,800,385 $ 5,883,614 $ 24,437,649 $ 21,234,297 Plus

payments made to third-party creators (1) 1,044,188

1,550,377 4,744,325 6,076,306 Gross

billings $ 7,844,573 $ 7,433,991 $

29,181,974 $ 27,310,603

(1) Payments made to third-party creators

for the Content Workflow portion of our revenue reported on a net

basis for GAAP.

Gross billings by revenue stream and the percentage of total

gross billings by stream:

Three Months Ended Twelve Months Ended (As

Restated) (As Restated) December 31, 2017 December 31, 2016

December 31, 2017 December 31, 2016 Managed Services $ 6,561,921

84 % $ 5,652,220 76 % $ 23,836,236 82 % $

20,393,757 75 % Content Workflow 1,121,687 14 % 1,666,447 22

% 5,094,973 17 % 6,541,684 24 % Service Fees & Other 160,965

2 % 115,324 2 % 250,765 1 % 375,162 1 %

Total Gross Billings by stream $ 7,844,573 100 % $ 7,433,991

100 % $ 29,181,974 100 % $ 27,310,603 100 %

Reconciliation of GAAP Net Loss to Non-GAAP Adjusted

EBITDA:

Three Months Ended Twelve Months Ended (As

Restated) (As Restated) December 31, December 31, December

31, December 31, 2017 2016 2017 2016

Net loss $ (743,076 ) $ (1,829,632 ) $ (5,467,699 ) $ (7,560,200 )

Non-cash stock-based compensation 125,785 171,948 635,427 748,092

Non-cash stock issued for payment of services 38,459 26,457 181,995

133,897 (Gain) loss on disposal of equipment (3,295 ) 9,919 (8,757

) 9,435 (Gain) loss on settlement of acquisition costs payable — —

(10,491 ) — Increase (decrease) in value of acquisition costs

payable 247,524 155,459 583,010 196,431 Depreciation and

amortization 420,976 364,788 1,516,807 1,299,851 Loss on exchange

of warrants — — Interest expense 19,544 24,683 64,950 82,944 Change

in fair value of derivatives (3,147 )

5,405 (39,269 ) (9,163 )

Adjusted EBITDA $ 102,770 $ (1,070,973

) $ (2,544,027 ) $ (5,098,713 )

Revenue 6,800,385

5,883,614 24,437,649 21,234,297

EBITDA as a % of Revenue 2% (18)%

(10)% (24)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180418005390/en/

IZEA, Inc.Justin Braun, 407-215-6218Manager, Corporate

Communicationsjustin.braun@izea.com

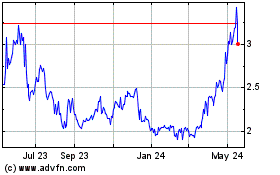

IZEA Worldwide (NASDAQ:IZEA)

Historical Stock Chart

From Mar 2024 to May 2024

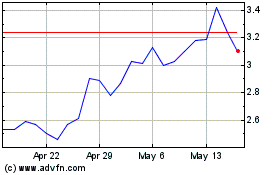

IZEA Worldwide (NASDAQ:IZEA)

Historical Stock Chart

From May 2023 to May 2024