0001859035

false

0001859035

2023-09-13

2023-09-13

0001859035

us-gaap:CommonStockMember

2023-09-13

2023-09-13

0001859035

us-gaap:RightsMember

2023-09-13

2023-09-13

0001859035

MCAG:UnitsMember

2023-09-13

2023-09-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 13, 2023

Date of Report (Date of earliest event reported)

Mountain Crest Acquisition Corp. V

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-40418 |

|

85-2412613 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

311 West 43rd Street, 12th Floor

New York, NY |

|

10036 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (646) 493-6558

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

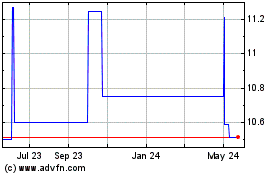

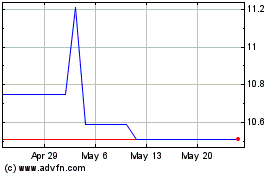

| Common Stock |

|

MCAG |

|

The Nasdaq Stock Market LLC |

| Rights |

|

MCAGR |

|

The Nasdaq Stock Market LLC |

| Units |

|

MCAGU |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into

a Material Definitive Agreement

On

September 13, 2023, Mountain Crest Acquisition Corp. V (the “Company”) entered into four separate

vendor liability conversion agreements (the “Vendor Liability Conversion Agreements”) with four of

the Company’s vendors. Pursuant to the Vendor Liability Conversion Agreements, an aggregate of $1,800,000 of the service

fees due to the vendors have been converted into an aggregate of 450,000 shares Company’s common

stock, par value $0.0001 per share (the “Common Stock”) based upon a conversion price

of $4.00 per share. Accordingly, the Company satisfied aggregate vendor liabilities of $1,800,000 in exchange

for the issuance of 450,000 shares of Common Stock.

As

previously disclosed, on February 15, 2023, the Company issued a non-interest bearing, unsecured promissory note in the aggregate principal

amount of $300,000 (the “Note”) to Mountain Crest Global Holdings LLC, a Delaware limited liability company and the Company’s

sponsor (the “Sponsor”). Pursuant to the Note, the Sponsor loaned the Company an aggregate amount of $300,000 that is due

and payable upon the Company’s consummation of an initial business combination with a target business. The Note would either be

paid upon consummation of the Company’s initial business combination, or, at the Sponsor’s discretion, converted into private

units at a price of $10.00 per unit. On September 13, 2023, as approved by the Company’s audit committee, the Company entered into

a note conversion agreement (the “Note Conversion Agreement”) with the Sponsor, to convert the Note into 75,000 shares of

the Company’s Common Stock. Accordingly, the Company satisfied the Note in exchange for the issuance

of 75,000 shares of Common Stock.

Pursuant

to the Vendor Liability Conversion Agreements and the Note Conversion Agreement, the vendors and the Sponsor have (i) one demand registration

of the sale of such shares at the Company’s expense, and (ii) unlimited “piggyback” registration rights, both for a

period of five (5) years after the closing of the Company’s initial business combination at the Company’s expense.

The

foregoing descriptions of the Vendor Liability Conversion Agreements and the Note Conversion Agreement do not purport to be complete and

are qualified in their entirety by reference to the Vendor Liability Conversion Agreements and the Note Conversion Agreement, which filed

as Exhibits 10.1 to 10.4 and 10.5, respectively, to this Current Report on Form 8-K, and which are incorporated herein by reference.

Item 3.02 Unregistered

Sales of Equity Securities

The information

set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. On

September 18, 2023, an aggregate of 525,000 shares of the Company’s Common Stock has been

issued pursuant to the Vendor Liability Conversion Agreements and the Note Conversion Agreement, in full

payment and satisfaction of aggregate vendor liabilities of $1,800,000 and the Note in the principal amount of $300,000. The Company

has relied upon Sections 4(a)(2) and/or Regulation D of the Securities Act of 1933, as amended (the

“Securities Act”), in connection with the conversion, as the shares were issued to sophisticated investors without a view

to distribution, and were not issued through any general solicitation or advertisement.

No Offer or Solicitation

This Current Report on Form

8-K is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation of a proxy,

consent or authorization with respect to any securities or in respect of an initial business combination or PIPE financing and is not

intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy

or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction.

Item 9.01. Financial Statements and Exhibits.

| EXHIBIT NO. |

|

DESCRIPTION |

| 10.1* |

|

Vendor Liability Conversion Agreement entered by and between Mountain Crest Acquisition Corp. V and Vendor No. 1, dated September 13, 2023 |

| 10.2* |

|

Vendor Liability Conversion Agreement entered by and between Mountain Crest Acquisition Corp. V and Vendor No. 2, dated September 13, 2023 |

| 10.3* |

|

Vendor

Liability Conversion Agreement entered by and between Mountain Crest Acquisition Corp. V and Vendor No. 3, dated September 13,

2023 |

| 10.4* |

|

Vendor Liability Conversion Agreement entered by and between Mountain Crest Acquisition Corp. V and Vendor No. 4, dated September 13, 2023 |

| 10.5* |

|

Note Conversion Agreement entered by and between Mountain Crest Acquisition Corp. V and Mountain Crest Global Holdings LLC, dated September 13, 2023 |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * | Certain terms have been omitted pursuant to Item 601(b)(10)(iv)

of Regulation S-K. The Registrant hereby undertakes to furnish copies of any of the terms upon request by the SEC. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: September 19, 2023 |

|

| |

|

| MOUNTAIN CREST ACQUISITION CORP. V |

|

| |

|

| By: |

/s/ Suying Liu |

|

| Name: |

Suying Liu |

|

| Title: |

Chief Executive Officer |

|

Exhibit

10.1

[Pursuant to Item 601(b)(10)(iv) of Regulation

S-K, certain term to this exhibit have been omitted as they are both not material and of the type that the registrant treats as private

or confidential. A copy of unredacted copy of the exhibit will be furnished supplementally to the SEC upon request.]

LIABILITY

CONVERSION AGREEMENT

This LIABILITY CONVERSION AGREEMENT

(this “Agreement”) is made as of September 13, 2023 by and between Mountain Crest Acquisition Corp. V, a Delaware corporation

(the “Company”), and XXX, a People's Republic of China limited company (the “Holder”).

R

E C I T A L S

WHEREAS, the Company

is liable to the Holder for services rendered to date by the Holder for the Company in the aggregate amount of $450,000, as evidenced

by Invoice(s) IN23515 issued by the Holder to the Company (the “Liability”);

WHEREAS,

the Company and the Holder desire to convert the outstanding balance due under the Liability to shares of the Company’s common

stock, par value $0.0001 per share (the “Common Stock”) with a conversion price of $4.00 per share;

WHEREAS, the Company

wishes to convert the Liability into 112,500 shares of Common Stock (the “Shares”);

WHEREAS,

upon the conversion of the Liability to the Common Stock, all obligations of the Company under the Liability shall be extinguished; and

WHEREAS,

the Company and the Holder are executing and delivering this Agreement in reliance upon an exemption from securities registration afforded

by the provisions of Section 4(2), Section 4(6) and/or Regulation D as promulgated by the United States Securities and Exchange Commission

under the Securities Act of 1933, as amended.

NOW,

THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants, agreements and conditions set

forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties

hereby agree as follows:

1.

Conversion of the Liability into the Shares. The Company and the Holder acknowledge, agree, represent, warrant and covenant to

each other as follows:

a.

The Liability shall be converted into 112,500 shares of Common Stock (the “Shares”). Within three (3) business days

of the execution of this Agreement, the Company shall issue the Shares to the Holder in book-entry form and no certificate shall be issued

therefor.

b.

The Liability and the debt shall be fully and wholly satisfied and extinguished, and the Liability shall be canceled and of no further

force or effect, and neither Holder, nor any person or entity claiming under, through or by right of Holder, nor any successor, assignee

or other party, shall make any further claim against the Company relating to or arising out of the Liability.

2.

Registration Rights. The Company represents, warrants and agrees that with respect to the Shares, the Holder or its assignee or

transferee will have the following registration rights: (i) one demand registration of the sale of the Shares at the Company’s

expense, and (ii) unlimited “piggyback” registration rights, both for a period of five (5) years after the closing of the

Company’s initial business combination at the Company’s expense.

3.

Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company as follows:

(a)

The Holder has full power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement constitutes

the Holder’s valid and legally binding obligation, enforceable in accordance with its terms.

(b)

The Holder is the sole owner of the Liability being delivered to the Company as consideration for the issuance of the Shares. The Liability

is being delivered to the Company free and clear of any and all liens, charges, encumbrances, security agreements, pledge agreements,

conditional sales agreements or other obligations relating to the sale or transfer thereof.

(c)

Own Investment. Holder confirms that the Common Stock will be acquired for investment for such Holder’s own account, not

as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that such Holder has no present intention

of selling, granting any participation in, or otherwise distributing the same.

(d)

Accredited Investor. The Holder understands that the Shares to be issued to the Holder have not been registered under the Securities

Act of 1933, as amended (the “Securities Act”), by reason of a specific exemption from the registration provisions

of the Securities Act. The Holder is an “accredited investor” as that term is defined under the Securities Act.

(e)

Knowledge and Experience. Holder has such knowledge and experience in financial and business matters that Holder is capable of

evaluating the merits and risks of the investment in the Common Stock, and Holder can bear the economic risk of such investment and is

able, without impairing Holder’s financial condition, to hold the Common Stock for an indefinite period of time and to suffer a

complete loss of such investment.

(f)

Information. The Holder hereby represents that it has conducted its own due diligence and received all the information it considers

necessary or appropriate for deciding whether to engage in the Note Conversion. The Holder further represents that it has had an opportunity

to ask questions and receive answers from the Company regarding the terms and conditions of the Note Conversion and the business, properties,

prospects and financial condition of the Company and to obtain any additional information necessary to verify the accuracy of the information

furnished.

(g)

Reliance. The Holder acknowledges it has been encouraged to rely solely upon the advice of its legal counsel and accountants or

other financial advisers with respect to the legal, tax, business, financial, and other aspects relating to the purchase of the Common

Stock. Each has relied only on the information contained in this Agreement in determining to make this Note Conversion and in basing

his decision to invest in the Common Stock. The Holder further acknowledges that it has relied upon no other representations, promises,

or information written or verbal by any person with respect to the considerations relating to the purchase of the Common Stock. The Holder

recognizes that an investment in the Common Stock involves substantial risk and is fully cognizant of and understands all of the risk

factors the Common Stock;

(h)

No Advice. The Holder understands and acknowledges that this Agreement, and any other additional information provided in connection

hereto has been prepared by the Company. Accordingly, the Holder understands and acknowledges that no independent legal counsel, accountant,

financial advisor, or investment banking firm has passed upon, independently verified or investigated, or assumed any responsibility

for the accuracy, completeness, or fairness of the information contained in any such materials. No information furnished by the Company

constitutes investment, accounting, legal or tax advice and the Holder is relying on professional advisers for such advice.

(i)

Economic Risk. The Holder can bear, and is willing to accept, the economic risk of losing the entire investment in the Company

and can bear such risk for an indefinite period of time. The Holder’s overall commitment to investments which are not readily marketable

is not disproportionate to his net worth, and the investment in the Common Stock will not cause such overall commitment to become excessive,

and the investment is suitable for the Holder when viewed in light of the Holder’s other securities holdings and financial situation

and needs. The Holder has adequate means of providing for current needs and personal contingencies.

(j)

Restrictions on Resale.

(i)

Legend. The Holder acknowledges that until registered under the Securities Act, the certificates representing the Shares shall

bear the following or similar legend:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THESE SECURITIES MAY

NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH SECURITIES ACT

OR ANY APPLICABLE STATE SECURITIES LAW OR AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT

REQUIRED.”

(ii)

Stop Order. The Holder further acknowledges that the Company reserves the right to place a stop order against the instruments

representing the Shares and to refuse to effect any transfers thereof in the absence of an effective registration statement with respect

to the Shares or in the absence of an opinion of counsel to the Company that such transfer is exempt from registration under the Securities

Act and under applicable state securities laws.

4.

Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder as follows:

(a)

The Company has full corporate power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement

constitutes the Company’s valid and legally binding obligation, enforceable in accordance with its terms.

(b)

The issuance of the Shares has been duly authorized by the Company and the Shares, when issued upon conversion of the Notes in accordance

with the terms hereof, will be validly issued and outstanding, fully paid and nonassessable.

5.

General.

(a)

The parties agree that if changes to any terms of this Agreement are necessary to comply with applicable federal securities laws or regulations,

or requirements of The Nasdaq Stock Market, LLC, or other national securities exchange, or over the counter market on which the Common

Stock of the Corporation is listed, quoted and/or traded, the parties hereby agree to negotiate in good faith to amend this Agreement

accordingly to be in compliance with such laws and regulations.

(b)

This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, regardless of the laws that

might otherwise govern under applicable principles of conflicts of law.

(c)

The provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, assigns, transferees, heirs, legatees,

executors, administrators and personal representatives of the parties hereto.

(d)

This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof, and this Agreement

supersedes and renders null and void any and all other prior oral or written agreements, understandings or commitments pertaining to

the subject matter hereof.

(e)

This Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original and all of which taken together,

shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature) or other transmission method, and any counterpart so delivered shall be deemed to have been duly and validly delivered and

be valid and effective for all purposes.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the parties have executed this Liability Conversion Agreement as of the date first written above.

| |

MOUNTAIN

CREST ACQUISITION CORP. V |

| |

|

| |

By: |

/s/

Suying Liu |

| |

|

Name: |

Suying

Liu |

| |

|

Title: |

Chief

Executive Officer |

| |

|

|

|

| |

HOLDER: |

| |

|

| |

XXX |

| |

|

|

|

| |

By: |

/s/

XXX |

| |

|

Name: |

XXX |

| |

|

Title: |

CEO |

Exhibit

10.2

[Pursuant to Item 601(b)(10)(iv) of Regulation

S-K, certain term to this exhibit have been omitted as they are both not material and of the type that the registrant treats as private

or confidential. A copy of unredacted copy of the exhibit will be furnished supplementally to the SEC upon request.]

LIABILITY CONVERSION

AGREEMENT

This LIABILITY CONVERSION AGREEMENT

(this “Agreement”) is made as of September 13, 2023 by and between Mountain Crest Acquisition Corp. V, a Delaware corporation

(the “Company”), and XXX, a People’s Republic of China limited company (the “Holder”).

R

E C I T A L S

WHEREAS,

the Company is liable to the Holder for services rendered to date by the Holder for the Company in the aggregate amount of $470,000,

as evidenced by Invoice(s) 256-001 issued by the Holder to the Company (the “Liability”);

WHEREAS,

the Company and the Holder desire to convert the outstanding balance due under the Liability to shares of the Company’s common

stock, par value $0.0001 per share (the “Common Stock”) with a conversion price of $4.00 per share;

WHEREAS,

the Company wishes to convert the Liability into 117,500 shares of Common Stock (the “Shares”);

WHEREAS,

upon the conversion of the Liability to the Common Stock, all obligations of the Company under the Liability shall be extinguished; and

WHEREAS,

the Company and the Holder are executing and delivering this Agreement in reliance upon an exemption from securities registration afforded

by the provisions of Section 4(2), Section 4(6) and/or Regulation D as promulgated by the United States Securities and Exchange Commission

under the Securities Act of 1933, as amended.

NOW,

THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants, agreements and conditions set

forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties

hereby agree as follows:

1.

Conversion of the Liability into the Shares. The Company and the Holder acknowledge, agree, represent, warrant and covenant to each other

as follows:

a.

The Liability shall be converted into 117,500 shares of Common Stock (the “Shares”). Within three (3) business days of

the execution of this Agreement, the Company shall issue the Shares to the Holder in book-entry form and no certificate shall be

issued therefor.

b.

The Liability and the debt shall be fully and wholly satisfied and extinguished, and the Liability

shall be canceled and of no further force or effect, and neither Holder, nor any person or entity claiming under, through or by right

of Holder, nor any successor, assignee or other party, shall make any further claim against the Company relating to or arising out of

the Liability.

2. Registration

Rights. The Company represents, warrants and agrees that with respect to the Shares, the Holder or its assignee or transferee

will have the following registration rights: (i) one demand registration of the sale of the Shares at the Company’s expense,

and (ii) unlimited “piggyback” registration rights, both for a period of five (5) years after the closing of the

Company’s initial business combination at the Company’s expense.

3.

Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company as follows:

(a)

The Holder has full power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement constitutes

the Holder’s valid and legally binding obligation, enforceable in accordance with its terms.

(b) The

Holder is the sole owner of the Liability being delivered to the Company as consideration for the issuance of the Shares. The

Liability is being delivered to the Company free and clear of any and all liens, charges, encumbrances, security agreements, pledge

agreements, conditional sales agreements or other obligations relating to the sale or transfer thereof.

(c) Own

Investment. Holder confirms that the Common Stock will be acquired for investment for such Holder’s own account, not as a

nominee or agent, and not with a view to the resale or distribution of any part thereof, and that such Holder has no present

intention of selling, granting any participation in, or otherwise distributing the same.

(d) Accredited

Investor. The Holder understands that the Shares to be issued to the Holder have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), by reason of a specific exemption from the registration provisions of

the Securities Act. The Holder is an “accredited investor” as that term is defined under the Securities Act.

(e) Knowledge

and Experience. Holder has such knowledge and experience in financial and business matters that Holder is capable of evaluating the

merits and risks of the investment in the Common Stock, and Holder can bear the economic risk of such investment and is able, without

impairing Holder’s financial condition, to hold the Common Stock for an indefinite period of time and to suffer a complete loss

of such investment.

(f) Information.

The Holder hereby represents that it has conducted its own due diligence and received all the information it considers necessary or

appropriate for deciding whether to engage in the Note Conversion. The Holder further represents that it has had an opportunity to

ask questions and receive answers from the Company regarding the terms and conditions of the Note Conversion and the business,

properties, prospects and financial condition of the Company and to obtain any additional information necessary to verify the

accuracy of the information furnished.

(g) Reliance.

The Holder acknowledges it has been encouraged to rely solely upon the advice of its legal counsel and accountants or other

financial advisers with respect to the legal, tax, business, financial, and other aspects relating to the purchase of the Common

Stock. Each has relied only on the information contained in this Agreement in determining to make this Note Conversion and in basing

his decision to invest in the Common Stock. The Holder further acknowledges that it has relied upon no other representations,

promises, or information written or verbal by any person with respect to the considerations relating to the purchase of the Common

Stock. The Holder recognizes that an investment in the Common Stock involves substantial risk and is fully cognizant of and

understands all of the risk factors the Common Stock;

(h) No

Advice. The Holder understands and acknowledges that this Agreement, and any other additional information provided in connection hereto

has been prepared by the Company. Accordingly, the Holder understands and acknowledges that no independent legal counsel, accountant,

financial advisor, or investment banking firm has passed upon, independently verified or investigated, or assumed any responsibility for

the accuracy, completeness, or fairness of the information contained in any such materials. No information furnished by the Company constitutes

investment, accounting, legal or tax advice and the Holder is relying on professional advisers for such advice.

(i) Economic

Risk. The Holder can bear, and is willing to accept, the economic risk of losing the entire investment in the Company and can

bear such risk for an indefinite period of time. The Holder’s overall commitment to investments which are not readily

marketable is not disproportionate to his net worth, and the investment in the Common Stock will not cause such overall commitment

to become excessive, and the investment is suitable for the Holder when viewed in light of the Holder’s other securities

holdings and financial situation and needs. The Holder has adequate means of providing for current needs and personal

contingencies.

(j) Restrictions

on Resale.

(i) Legend.

The Holder acknowledges that until registered under the Securities Act, the certificates representing the Shares shall bear the following

or similar legend:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THESE SECURITIES MAY

NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH SECURITIES ACT

OR ANY APPLICABLE STATE SECURITIES LAW OR AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT

REQUIRED.”

(ii)

Stop Order. The Holder further acknowledges that the Company reserves the right to place a stop order against the instruments

representing the Shares and to refuse to effect any transfers thereof in the absence of an effective registration statement with respect

to the Shares or in the absence of an opinion of counsel to the Company that such transfer is exempt from registration under the Securities

Act and under applicable state securities laws.

4.

Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder as follows:

(a) The

Company has full corporate power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement

constitutes the Company’s valid and legally binding obligation, enforceable in accordance with its terms.

(b)

The issuance of the Shares has been duly authorized by the Company and the Shares, when issued upon conversion of the Notes in accordance

with the terms hereof, will be validly issued and outstanding, fully paid and nonassessable.

5. General.

(a) The

parties agree that if changes to any terms of this Agreement are necessary to comply with applicable federal securities laws or regulations,

or requirements of The Nasdaq Stock Market, LLC, or other national securities exchange, or over the counter market on which the Common

Stock of the Corporation is listed, quoted and/or traded, the parties hereby agree to negotiate in good faith to amend this Agreement

accordingly to be in compliance with such laws and regulations.

(b)

This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, regardless of the laws that

might otherwise govern under applicable principles of conflicts of law.

(c) The

provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, assigns, transferees, heirs, legatees,

executors, administrators and personal representatives of the parties hereto.

(d)

This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof, and this Agreement

supersedes and renders null and void any and all other prior oral or written agreements, understandings or commitments pertaining to

the subject matter hereof.

(e) This

Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original and all of which taken together,

shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature) or other transmission method, and any counterpart so delivered shall be deemed to have been duly and validly delivered and

be valid and effective for all purposes.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the parties have executed this Liability Conversion Agreement as of the date first written above.

| |

MOUNTAIN

CREST ACQUISITION CORP. V |

| |

|

| |

By: |

/s/

Suying Liu |

| |

|

Name: |

Suying

Liu |

| |

|

Title: |

Chief

Executive Officer |

| |

HOLDER: |

| |

|

| |

XXX |

| |

|

| |

By: |

/s/ XXX

|

| |

|

Name: |

XXX |

| |

|

Title: |

Chief Executive Officer |

Exhibit

10.3

[Pursuant to Item 601(b)(10)(iv) of Regulation

S-K, certain term to this exhibit have been omitted as they are both not material and of the type that the registrant treats as private

or confidential. A copy of unredacted copy of the exhibit will be furnished supplementally to the SEC upon request.]

LIABILITY CONVERSION

AGREEMENT

This LIABILITY CONVERSION AGREEMENT

(this “Agreement”) is made as of September 13, 2023 by and between Mountain Crest Acquisition Corp. V, a Delaware corporation

(the “Company”), and XXX, a People’s Republic of China limited company (the “Holder”).

R

E C I T A L S

WHEREAS,

the Company is liable to the Holder for services rendered to date by the Holder for the Company in the aggregate amount of $600,000,

as evidenced by Invoice(s) 256-001 issued by the Holder to the Company (the “Liability”);

WHEREAS,

the Company and the Holder desire to convert the outstanding balance due under the Liability to shares of the Company’s common

stock, par value $0.0001 per share (the “Common Stock”) with a conversion price of $4.00 per share;

WHEREAS,

the Company wishes to convert the Liability into 150,000 shares of Common Stock (the “Shares”);

WHEREAS,

upon the conversion of the Liability to the Common Stock, all obligations of the Company under the Liability shall be extinguished; and

WHEREAS,

the Company and the Holder are executing and delivering this Agreement in reliance upon an exemption from securities registration afforded

by the provisions of Section 4(2), Section 4(6) and/or Regulation D as promulgated by the United States Securities and Exchange Commission

under the Securities Act of 1933, as amended.

NOW,

THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants, agreements and conditions set

forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties

hereby agree as follows:

1.

Conversion of the Liability into the Shares. The Company and the Holder acknowledge, agree, represent, warrant and covenant to each other

as follows:

a.

The Liability shall be converted into 150,000 shares of Common Stock (the “Shares”). Within three (3) business days of

the execution of this Agreement, the Company shall issue the Shares to the Holder in book-entry form and no certificate shall be

issued therefor.

b.

The Liability and the debt shall be fully and wholly satisfied and extinguished, and the Liability

shall be canceled and of no further force or effect, and neither Holder, nor any person or entity claiming under, through or by right

of Holder, nor any successor, assignee or other party, shall make any further claim against the Company relating to or arising out of

the Liability.

2. Registration

Rights. The Company represents, warrants and agrees that with respect to the Shares, the Holder or its assignee or transferee

will have the following registration rights: (i) one demand registration of the sale of the Shares at the Company’s expense,

and (ii) unlimited “piggyback” registration rights, both for a period of five (5) years after the closing of the

Company’s initial business combination at the Company’s expense.

3.

Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company as follows:

(a)

The Holder has full power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement constitutes

the Holder’s valid and legally binding obligation, enforceable in accordance with its terms.

(b) The

Holder is the sole owner of the Liability being delivered to the Company as consideration for the issuance of the Shares. The

Liability is being delivered to the Company free and clear of any and all liens, charges, encumbrances, security agreements, pledge

agreements, conditional sales agreements or other obligations relating to the sale or transfer thereof.

(c) Own

Investment. Holder confirms that the Common Stock will be acquired for investment for such Holder’s own account, not as a

nominee or agent, and not with a view to the resale or distribution of any part thereof, and that such Holder has no present

intention of selling, granting any participation in, or otherwise distributing the same.

(d) Accredited

Investor. The Holder understands that the Shares to be issued to the Holder have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), by reason of a specific exemption from the registration provisions of

the Securities Act. The Holder is an “accredited investor” as that term is defined under the Securities Act.

(e) Knowledge

and Experience. Holder has such knowledge and experience in financial and business matters that Holder is capable of evaluating the

merits and risks of the investment in the Common Stock, and Holder can bear the economic risk of such investment and is able, without

impairing Holder’s financial condition, to hold the Common Stock for an indefinite period of time and to suffer a complete loss

of such investment.

(f) Information.

The Holder hereby represents that it has conducted its own due diligence and received all the information it considers necessary or

appropriate for deciding whether to engage in the Note Conversion. The Holder further represents that it has had an opportunity to

ask questions and receive answers from the Company regarding the terms and conditions of the Note Conversion and the business,

properties, prospects and financial condition of the Company and to obtain any additional information necessary to verify the

accuracy of the information furnished.

(g) Reliance.

The Holder acknowledges it has been encouraged to rely solely upon the advice of its legal counsel and accountants or other

financial advisers with respect to the legal, tax, business, financial, and other aspects relating to the purchase of the Common

Stock. Each has relied only on the information contained in this Agreement in determining to make this Note Conversion and in basing

his decision to invest in the Common Stock. The Holder further acknowledges that it has relied upon no other representations,

promises, or information written or verbal by any person with respect to the considerations relating to the purchase of the Common

Stock. The Holder recognizes that an investment in the Common Stock involves substantial risk and is fully cognizant of and

understands all of the risk factors the Common Stock;

(h) No

Advice. The Holder understands and acknowledges that this Agreement, and any other additional information provided in connection hereto

has been prepared by the Company. Accordingly, the Holder understands and acknowledges that no independent legal counsel, accountant,

financial advisor, or investment banking firm has passed upon, independently verified or investigated, or assumed any responsibility for

the accuracy, completeness, or fairness of the information contained in any such materials. No information furnished by the Company constitutes

investment, accounting, legal or tax advice and the Holder is relying on professional advisers for such advice.

(i) Economic

Risk. The Holder can bear, and is willing to accept, the economic risk of losing the entire investment in the Company and can

bear such risk for an indefinite period of time. The Holder’s overall commitment to investments which are not readily

marketable is not disproportionate to his net worth, and the investment in the Common Stock will not cause such overall commitment

to become excessive, and the investment is suitable for the Holder when viewed in light of the Holder’s other securities

holdings and financial situation and needs. The Holder has adequate means of providing for current needs and personal

contingencies.

(j) Restrictions

on Resale.

(i) Legend.

The Holder acknowledges that until registered under the Securities Act, the certificates representing the Shares shall bear the following

or similar legend:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THESE SECURITIES MAY

NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH SECURITIES ACT

OR ANY APPLICABLE STATE SECURITIES LAW OR AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT

REQUIRED.”

(ii)

Stop Order. The Holder further acknowledges that the Company reserves the right to place a stop order against the instruments

representing the Shares and to refuse to effect any transfers thereof in the absence of an effective registration statement with respect

to the Shares or in the absence of an opinion of counsel to the Company that such transfer is exempt from registration under the Securities

Act and under applicable state securities laws.

4.

Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder as follows:

(a) The

Company has full corporate power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement

constitutes the Company’s valid and legally binding obligation, enforceable in accordance with its terms.

(b)

The issuance of the Shares has been duly authorized by the Company and the Shares, when issued upon conversion of the Notes in accordance

with the terms hereof, will be validly issued and outstanding, fully paid and nonassessable.

5. General.

(a) The

parties agree that if changes to any terms of this Agreement are necessary to comply with applicable federal securities laws or regulations,

or requirements of The Nasdaq Stock Market, LLC, or other national securities exchange, or over the counter market on which the Common

Stock of the Corporation is listed, quoted and/or traded, the parties hereby agree to negotiate in good faith to amend this Agreement

accordingly to be in compliance with such laws and regulations.

(b)

This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, regardless of the laws that

might otherwise govern under applicable principles of conflicts of law.

(c) The

provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, assigns, transferees, heirs, legatees,

executors, administrators and personal representatives of the parties hereto.

(d)

This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof, and this Agreement

supersedes and renders null and void any and all other prior oral or written agreements, understandings or commitments pertaining to

the subject matter hereof.

(e) This

Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original and all of which taken together,

shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature) or other transmission method, and any counterpart so delivered shall be deemed to have been duly and validly delivered and

be valid and effective for all purposes.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the parties have executed this Liability Conversion Agreement as of the date first written above.

| |

MOUNTAIN

CREST ACQUISITION CORP. V |

| |

|

| |

By: |

/s/

Suying Liu |

| |

|

Name: |

Suying

Liu |

| |

|

Title: |

Chief

Executive Officer |

| |

HOLDER: |

| |

|

| |

XXX |

| |

|

| |

By: |

/s/ XXX |

| |

|

Name: |

XXX |

| |

|

Title: |

Managing Partner |

Exhibit

10.4

[Pursuant to Item 601(b)(10)(iv) of Regulation

S-K, certain term to this exhibit have been omitted as they are both not material and of the type that the registrant treats as private

or confidential. A copy of unredacted copy of the exhibit will be furnished supplementally to the SEC upon request.]

LIABILITY CONVERSION

AGREEMENT

This LIABILITY CONVERSION AGREEMENT

(this “Agreement”) is made as of September 13, 2023 by and between Mountain Crest Acquisition Corp. V, a Delaware corporation

(the “Company”), and XXX, a Wyoming limited liability company (the “Holder”).

R

E C I T A L S

WHEREAS,

the Company is liable to the Holder for services rendered to date by the Holder for the Company in the aggregate amount of $280,000,

as evidenced by Invoice(s) 256-001 issued by the Holder to the Company (the “Liability”);

WHEREAS,

the Company and the Holder desire to convert the outstanding balance due under the Liability to shares of the Company’s common

stock, par value $0.0001 per share (the “Common Stock”) with a conversion price of $4.00 per share;

WHEREAS,

the Company wishes to convert the Liability into 70,000 shares of Common Stock (the “Shares”);

WHEREAS,

upon the conversion of the Liability to the Common Stock, all obligations of the Company under the Liability shall be extinguished; and

WHEREAS,

the Company and the Holder are executing and delivering this Agreement in reliance upon an exemption from securities registration afforded

by the provisions of Section 4(2), Section 4(6) and/or Regulation D as promulgated by the United States Securities and Exchange Commission

under the Securities Act of 1933, as amended.

NOW,

THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants, agreements and conditions set

forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties

hereby agree as follows:

1.

Conversion of the Liability into the Shares. The Company and the Holder acknowledge, agree, represent, warrant and covenant to each other

as follows:

a.

The Liability shall be converted into 70,000 shares of Common Stock (the “Shares”). Within three (3) business days of

the execution of this Agreement, the Company shall issue the Shares to the Holder in book-entry form and no certificate shall be

issued therefor.

b.

The Liability and the debt shall be fully and wholly satisfied and extinguished, and the Liability

shall be canceled and of no further force or effect, and neither Holder, nor any person or entity claiming under, through or by right

of Holder, nor any successor, assignee or other party, shall make any further claim against the Company relating to or arising out of

the Liability.

2. Registration

Rights. The Company represents, warrants and agrees that with respect to the Shares, the Holder or its assignee or transferee

will have the following registration rights: (i) one demand registration of the sale of the Shares at the Company’s expense,

and (ii) unlimited “piggyback” registration rights, both for a period of five (5) years after the closing of the

Company’s initial business combination at the Company’s expense.

3.

Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company as follows:

(a)

The Holder has full power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement constitutes

the Holder’s valid and legally binding obligation, enforceable in accordance with its terms.

(b) The

Holder is the sole owner of the Liability being delivered to the Company as consideration for the issuance of the Shares. The

Liability is being delivered to the Company free and clear of any and all liens, charges, encumbrances, security agreements, pledge

agreements, conditional sales agreements or other obligations relating to the sale or transfer thereof.

(c) Own

Investment. Holder confirms that the Common Stock will be acquired for investment for such Holder’s own account, not as a

nominee or agent, and not with a view to the resale or distribution of any part thereof, and that such Holder has no present

intention of selling, granting any participation in, or otherwise distributing the same.

(d) Accredited

Investor. The Holder understands that the Shares to be issued to the Holder have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), by reason of a specific exemption from the registration provisions of

the Securities Act. The Holder is an “accredited investor” as that term is defined under the Securities Act.

(e) Knowledge

and Experience. Holder has such knowledge and experience in financial and business matters that Holder is capable of evaluating the

merits and risks of the investment in the Common Stock, and Holder can bear the economic risk of such investment and is able, without

impairing Holder’s financial condition, to hold the Common Stock for an indefinite period of time and to suffer a complete loss

of such investment.

(f) Information.

The Holder hereby represents that it has conducted its own due diligence and received all the information it considers necessary or

appropriate for deciding whether to engage in the Note Conversion. The Holder further represents that it has had an opportunity to

ask questions and receive answers from the Company regarding the terms and conditions of the Note Conversion and the business,

properties, prospects and financial condition of the Company and to obtain any additional information necessary to verify the

accuracy of the information furnished.

(g) Reliance.

The Holder acknowledges it has been encouraged to rely solely upon the advice of its legal counsel and accountants or other

financial advisers with respect to the legal, tax, business, financial, and other aspects relating to the purchase of the Common

Stock. Each has relied only on the information contained in this Agreement in determining to make this Note Conversion and in basing

his decision to invest in the Common Stock. The Holder further acknowledges that it has relied upon no other representations,

promises, or information written or verbal by any person with respect to the considerations relating to the purchase of the Common

Stock. The Holder recognizes that an investment in the Common Stock involves substantial risk and is fully cognizant of and

understands all of the risk factors the Common Stock;

(h) No

Advice. The Holder understands and acknowledges that this Agreement, and any other additional information provided in connection hereto

has been prepared by the Company. Accordingly, the Holder understands and acknowledges that no independent legal counsel, accountant,

financial advisor, or investment banking firm has passed upon, independently verified or investigated, or assumed any responsibility for

the accuracy, completeness, or fairness of the information contained in any such materials. No information furnished by the Company constitutes

investment, accounting, legal or tax advice and the Holder is relying on professional advisers for such advice.

(i) Economic

Risk. The Holder can bear, and is willing to accept, the economic risk of losing the entire investment in the Company and can

bear such risk for an indefinite period of time. The Holder’s overall commitment to investments which are not readily

marketable is not disproportionate to his net worth, and the investment in the Common Stock will not cause such overall commitment

to become excessive, and the investment is suitable for the Holder when viewed in light of the Holder’s other securities

holdings and financial situation and needs. The Holder has adequate means of providing for current needs and personal

contingencies.

(j) Restrictions

on Resale.

(i) Legend.

The Holder acknowledges that until registered under the Securities Act, the certificates representing the Shares shall bear the following

or similar legend:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THESE SECURITIES MAY

NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH SECURITIES ACT

OR ANY APPLICABLE STATE SECURITIES LAW OR AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT

REQUIRED.”

(ii)

Stop Order. The Holder further acknowledges that the Company reserves the right to place a stop order against the instruments

representing the Shares and to refuse to effect any transfers thereof in the absence of an effective registration statement with respect

to the Shares or in the absence of an opinion of counsel to the Company that such transfer is exempt from registration under the Securities

Act and under applicable state securities laws.

4.

Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder as follows:

(a) The

Company has full corporate power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement

constitutes the Company’s valid and legally binding obligation, enforceable in accordance with its terms.

(b)

The issuance of the Shares has been duly authorized by the Company and the Shares, when issued upon conversion of the Notes in accordance

with the terms hereof, will be validly issued and outstanding, fully paid and nonassessable.

5. General.

(a) The

parties agree that if changes to any terms of this Agreement are necessary to comply with applicable federal securities laws or regulations,

or requirements of The Nasdaq Stock Market, LLC, or other national securities exchange, or over the counter market on which the Common

Stock of the Corporation is listed, quoted and/or traded, the parties hereby agree to negotiate in good faith to amend this Agreement

accordingly to be in compliance with such laws and regulations.

(b)

This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, regardless of the laws that

might otherwise govern under applicable principles of conflicts of law.

(c) The

provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, assigns, transferees, heirs, legatees,

executors, administrators and personal representatives of the parties hereto.

(d)

This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof, and this Agreement

supersedes and renders null and void any and all other prior oral or written agreements, understandings or commitments pertaining to

the subject matter hereof.

(e) This

Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original and all of which taken together,

shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature) or other transmission method, and any counterpart so delivered shall be deemed to have been duly and validly delivered and

be valid and effective for all purposes.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the parties have executed this Liability Conversion Agreement as of the date first written above.

| |

MOUNTAIN

CREST ACQUISITION CORP. V |

| |

|

| |

By: |

/s/

Suying Liu |

| |

|

Name: |

Suying

Liu |

| |

|

Title: |

Chief

Executive Officer |

| |

HOLDER: |

| |

|

| |

XXX |

| |

|

| |

By: |

/s/ XXX |

| |

|

Name: |

XXX |

| |

|

Title: |

Chief Executive Officer |

Exhibit

10.5

NOTE

CONVERSION AGREEMENT

This

NOTE CONVERSION AGREEMENT (this “Agreement”) is made as of September 13, 2023 by and between Mountain Crest Acquisition Corp.

V, a Delaware corporation (the “Company”), and Mountain Crest Global Holdings, LLC, a Delaware limited liability company

(the “Holder”).

R

E C I T A L S

WHEREAS,

the Company issued the Holder a non-interest bearing promissory note in the aggregate principal amount of $300,000, dated February 15,

2023, and as amended May 16, 2023 (the “Note”);

WHEREAS,

the Company and the Holder desire to convert the outstanding principal amount due under the Note to shares of the Company’s common

stock, par value $0.0001 per share (the “Common Stock”) with a conversion price of $4.00 per share;

WHEREAS,

the Company wishes to convert the Note into 75,000 shares of Common Stock (the “Shares”);

WHEREAS,

upon the conversion of the Note to the Common Stock, all obligations of the Company under the Note shall be extinguished; and

WHEREAS,

the Company and the Holder are executing and delivering this Agreement in reliance upon an exemption from securities registration afforded

by the provisions of Section 4(2), Section 4(6) and/or Regulation D as promulgated by the United States Securities and Exchange Commission

under the Securities Act of 1933, as amended.

NOW,

THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants, agreements and conditions set

forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties

hereby agree as follows:

1.

Conversion of Note into the Shares. The Company and the Holder acknowledge, agree, represent, warrant and covenant to each other

as follows:

a.

The Note shall be converted into 75,000 shares of Common Stock (the “Shares”). Within three (3) business days of the execution

of this Agreement, the Company shall issue the Shares to the Holder in book-entry form and no certificate shall be issued therefor.

b.

The Note is hereby amended to provide for the immediate conversion of the Note (in full satisfaction of the Note).

c.

The Note and the debt shall be fully and wholly satisfied and extinguished, and the Note shall be canceled and of no further force or

effect, and neither Holder, nor any person or entity claiming under, through or by right of Holder, nor any successor, assignee or other

party, shall make any further claim against the Company relating to or arising out of the Note. A failure by Holder to deliver the original

Note to the Company on or after the date of this Agreement shall not have the effect of giving the Holder, or any person or entity claiming

under, through or by right of Holder, nor any successor, assignee or other party, any rights therein or thereto, and Holder shall indemnify

and hold harmless the Company, and their respective employees, officers, directors and agents, from any and all losses which arise directly

or indirectly as a result of Holder’s breach of the representations made in this Agreement and/or a failure to deliver the original

Note to the Company which results in claims made therein, thereto or thereunder.

2.

Registration Rights. The Company represents, warrants and agrees that with respect to the Shares, the Holder will have the following

registration rights: (i) one demand registration of the sale of the Shares at the Company’s expense, and (ii) unlimited “piggyback”

registration rights for a period of five (5) years after the closing of the Company’s initial business combination at the Company’s

expense.

3.

Representations and Warranties of the Holder. The Holder hereby represents and warrants to the Company as follows:

(a)

The Holder has full power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement constitutes

the Holder’s valid and legally binding obligation, enforceable in accordance with its terms.

(b)

The Holder is the sole owner of the Note being delivered to the Company as consideration for the issuance of the Shares. The Note is

being delivered to the Company free and clear of any and all liens, charges, encumbrances, security agreements, pledge agreements, conditional

sales agreements or other obligations relating to the sale or transfer thereof.

(c) The

Holder is acquiring the Shares for investment for the Holder’s own account and not with a view to, or for resale in connection

with, any distribution thereof, and the Holder has no present intention of selling or distributing the Shares. The Holder understands

that the Shares to be issued to the Holder have not been registered under the Securities Act of 1933, as amended (the “Securities

Act”), by reason of a specific exemption from the registration provisions of the Securities Act. The Holder is an “accredited

investor” as that term is defined under the Securities Act.

(d)

Restrictions on Resale.

(i) Legend.

The Holder acknowledges that until registered under the Securities Act, the certificates representing the Shares shall bear the following

or similar legend:

“THE

SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED. THESE SECURITIES MAY

NOT BE SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH SECURITIES ACT

OR ANY APPLICABLE STATE SECURITIES LAW OR AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT

REQUIRED.”

(ii)

Stop Order. The Holder further acknowledges that the Company reserves the right to place a stop order against the instruments

representing the Shares and to refuse to effect any transfers thereof in the absence of an effective registration statement with respect

to the Shares or in the absence of an opinion of counsel to the Company that such transfer is exempt from registration under the Securities

Act and under applicable state securities laws.

4.

Representations and Warranties of the Company. The Company hereby represents and warrants to the Holder as follows:

(a) The

Company has full corporate power and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement

constitutes the Company’s valid and legally binding obligation, enforceable in accordance with its terms.

(b)

The issuance of the Shares has been duly authorized by the Company and the Shares, when issued upon conversion of the Notes in accordance

with the terms hereof, will be validly issued and outstanding, fully paid and nonassessable.

5. General.

(a) The

parties agree that if changes to any terms of this Agreement are necessary to comply with applicable federal securities laws or regulations,

or requirements of The Nasdaq Stock Market, LLC, or other national securities exchange, or over the counter market on which the Common

Stock of the Corporation is listed, quoted and/or traded, the parties hereby agree to negotiate in good faith to amend this Agreement

accordingly to be in compliance with such laws and regulations.

(b)

This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York, regardless of the laws that

might otherwise govern under applicable principles of conflicts of law.

(c) The

provisions of this Agreement shall inure to the benefit of, and be binding upon, the successors, assigns, transferees, heirs, legatees,

executors, administrators and personal representatives of the parties hereto.

(d)

This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof, and this Agreement

supersedes and renders null and void any and all other prior oral or written agreements, understandings or commitments pertaining to

the subject matter hereof.

(e) This

Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original and all of which taken together,

shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic

signature) or other transmission method, and any counterpart so delivered shall be deemed to have been duly and validly delivered and

be valid and effective for all purposes.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the parties have executed this Note Conversion Agreement as of the date first written above.

| |

MOUNTAIN

CREST ACQUISITION CORP. V |

| |

|

| |

By: |

/s/

Suying Liu |

| |

|

Name: |

Suying

Liu |

| |

|

Title: |

Chief

Executive Officer |

| |

HOLDER: |

| |

|

| |

MOUNTAIN

CREST GLOBAL HOLDINGS LLC |

| |

|

| |

By: |

/s/

Dong Liu |

| |

|

Name: |

Dong

Liu |

| |

|

Title: |

Manager |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |