Omnicell delivers strong fourth quarter

financial results

Results exceed previously issued full year

guidance for bookings, total revenues, and non-GAAP EBITDA

Omnicell, Inc. (NASDAQ:OMCL) (“Omnicell,” “we,” “our,” “us,”

“management,” or the “Company”), a leader in transforming the

pharmacy and nursing care delivery model, today announced results

for its fiscal year and fourth quarter ended December 31, 2024.

“We delivered solid financial results for the fourth quarter of

2024, including returning to year-over-year revenue growth. We are

pleased with the improved execution of the business throughout

2024, including strong free cash flows achieved in the year,”

stated Randall Lipps, chairman, president, chief executive officer,

and founder of Omnicell. “As we progress through 2025, we remain

focused on successfully executing on our strategic priorities,

which include driving long-term revenue growth, achieving

consistent GAAP profitability, and continuing to raise the bar in

medication management and adherence through innovation and bringing

new products and services to market.”

Financial Results

Total revenues for the fourth quarter of 2024 were $307 million,

up $48 million, or 19%, from the fourth quarter of 2023. The

quarter-over-quarter increase in total revenues reflects the

improvement of the macroeconomic environment and the timing of

implementation of XT Series systems, as well as continued growth in

our SaaS and Expert Services (formerly known as Advanced Services),

including an increase in revenues from our Specialty Pharmacy

Services offering. Total revenues for the year ended December 31,

2024 were $1.112 billion, down $35 million, or 3%, from the year

ended December 31, 2023. The year-over-year decrease in total

revenues reflects the impact of a challenging environment through a

significant portion of 2024 for some of our health system customers

and the timing of our XT Series systems lifecycle, as we are

largely through the replacement cycle.

Total GAAP net income for the fourth quarter of 2024 was $16

million, or $0.34 per diluted share. This compares to GAAP net loss

of $14 million, or $0.32 per diluted share, for the fourth quarter

of 2023. Total GAAP net income for the year ended December 31, 2024

was $13 million, or $0.27 per diluted share. This compares to GAAP

net loss of $20 million, or $0.45 per diluted share, for the year

ended December 31, 2023.

Total non-GAAP net income for the fourth quarter of 2024 was $28

million, or $0.60 per diluted share. This compares to non-GAAP net

income of $15 million, or $0.33 per diluted share, for the fourth

quarter of 2023. Total non-GAAP net income for the year ended

December 31, 2024 was $79 million, or $1.71 per diluted share. This

compares to non-GAAP net income of $87 million, or $1.91 per

diluted share, for the year ended December 31, 2023.

Total non-GAAP EBITDA for the fourth quarter of 2024 was $46

million. This compares to non-GAAP EBITDA of $24 million for the

fourth quarter of 2023. Total non-GAAP EBITDA for the year ended

December 31, 2024 was $136 million. This compares to non-GAAP

EBITDA of $138 million for the year ended December 31, 2023.

Bookings and Backlog - Historical Metric

Total bookings(1) for the year ended December 31, 2024 were $923

million compared to $854 million for the year ended December 31,

2023, or an increase of 8% year-over-year, primarily driven by XT

Series upgrades as we complete the XT Series upgrade cycle, as well

as better than expected bookings of XTExtend, a core component of

the multi-year XT Amplify innovation program.

The chart below summarizes our total backlog(2) under the

definition of bookings in use for the years ended December 31, 2024

and 2023:

December 31,

2024

2023

(In thousands)

Total backlog

$

1,201,296

$

1,142,686

By type:

Product backlog

$

646,508

$

610,832

SaaS and Expert Services backlog (3)

$

554,788

$

531,854

By duration and type:

Short-term product backlog

$

447,412

$

377,936

Long-term product backlog

$

199,096

$

232,896

Short-term SaaS and Expert Services

backlog (3)

$

93,113

$

72,455

Long-term SaaS and Expert Services backlog

(3)

$

461,675

$

459,399

____________________________

(1)

We utilize bookings as an

indicator of the success of our business. During 2024, we defined

bookings generally as: (i) the value of non-cancelable contracts

for our connected devices, software products, and SaaS and Expert

Services (although, for those SaaS and Expert Services contracts

without a minimum commitment, bookings only include the amount of

revenue that has been recognized once the services have been

provided); and (ii) for our consumables, the value of orders placed

through our Omnicell Storefront online platform or through written

or telephonic orders. We typically exclude technical services and

other less significant items ancillary to our products and

services, such as freight revenue, from bookings. In addition,

dependent upon counterparty or credit risk, which is evaluated at

the time of contract signing, for a given multi-year subscription

contract we may reduce the portion of the contractual commitment

booked at a given time. Connected devices and software license

bookings are recorded as revenue upon customer acceptance of the

installation or receipt of goods. Revenues from SaaS and Expert

Services bookings are recorded over the contractual term.

(2)

Backlog is the dollar amount of

bookings that have not yet been recognized as revenue. Bookings for

those SaaS and Expert Services contracts without a minimum

commitment are not included in backlog. In addition, dependent upon

counterparty or credit risk, which is evaluated at the time of

contract signing, for a given multi-year subscription contract we

may reduce the portion of the contractual commitment booked at a

given time, and these excluded amounts are not included in backlog.

A majority of our connected devices and software license products

are installable and recognized as revenues within twelve months of

booking, while service revenues from SaaS and Expert Services are

recorded over the contractual term. Larger or more complex

implementations such as software-enabled connected devices for

Central Pharmacy, including but not limited to our Central Pharmacy

Dispensing Service and IV Compounding Service, are often installed

and recognized as revenue between 12 and 24 months after booking.

We consider backlog that is expected to be converted to revenues in

more than twelve months to be long-term backlog. We believe a

majority of long-term product backlog will be convertible into

revenues in 12 to 24 months. Long-term SaaS and Expert Services

backlog typically represents multi-year subscription agreements

(usually with contractual terms of 2 to 7 years, some of which have

not yet been implemented) that will be converted to revenue over

the contractual term. Due to industry practice that allows

customers to change order configurations with limited advance

notice prior to shipment and as customer installation schedules may

change, backlog as of any particular date may not necessarily

indicate the timing of future revenue. However, we do believe that

backlog is an indication of a customer’s willingness to install our

solutions and revenue we expect to generate over time.

(3)

Includes only the value of SaaS

and Expert Services non-cancelable contracts with minimum

commitments.

Product Bookings, Product Backlog and Annual Recurring

Revenue - New Metrics

Starting in 2025, we will utilize product bookings(1) as a key

performance metric for our business. Under the new definition,

product bookings as of December 31, 2024 were $558 million. In

addition, going forward, we will no longer be reporting SaaS and

Expert Services backlog information, as these revenue streams will

be captured by the new Annual Recurring Revenue (“ARR”) metric,

which we will begin utilizing as a key performance metric for our

business. For comparative purposes, the table below summarizes our

product backlog and ARR for December 31, 2024 under the new

definitions of product bookings and ARR:

December 31,

2024

(In thousands)

Total product backlog(2)

$

646,440

By duration:

Short-term product backlog

$

447,344

Long-term product backlog

199,096

Annual Recurring Revenue(3)

$

580,025

____________________________

(1)

We define product bookings

generally as the value of non-cancelable contracts for our

connected devices and software licenses. We typically exclude

freight revenue and other less significant items ancillary to our

products from product bookings. In addition, dependent upon

counterparty or credit risk, which is evaluated at the time of

contract signing, for a given multi-year subscription contract we

may reduce the value of the contractual commitment booked at a

given time. Connected devices and software license bookings are

recorded as revenue upon customer acceptance of the installation or

receipt of goods. We utilize product bookings as an indicator of

the success of certain portions of our business that generate

non-recurring revenue.

(2)

Product backlog is the dollar

amount of product bookings that have not yet been recognized as

revenue. A majority of our connected devices and software license

products are installable and recognized as revenues within twelve

months of booking. Larger or more complex implementations such as

software-enabled connected devices for Central Pharmacy, including,

but not limited to, our Central Pharmacy Dispensing Service and IV

Compounding Service, are often installed and recognized as revenue

between 12 and 24 months after booking. Due to industry practice

that allows customers to change order configurations with limited

advance notice prior to shipment and as customer installation

schedules may change, backlog as of any particular date may not

necessarily indicate the timing of future revenue. However, we do

believe that backlog is an indication of a customer’s willingness

to install our solutions and revenue we expect to generate over

time. We consider backlog that is expected to be converted to

revenues in more than twelve months to be long-term backlog. We

believe a majority of long-term product backlog will be convertible

into revenues in 12-24 months.

(3)

We consider revenues generated

from our consumables, technical services, and SaaS and Expert

Services to be recurring revenues. For the portions of our business

which generate recurring revenues, we utilize ARR as a key metric

to measure our progress in growing our recurring revenue business.

We define ARR at a measurement date as the revenue we expect to

receive from our customers over the course of the following year

for providing them with products or services. ARR includes expected

revenue from all customers who are using our products or services

at the reported date. For technical services and SaaS and Expert

Services, solutions are generally on a contractual basis, typically

with contracts for a period of 12 months or more, with a high

probability of renewal. Probability of renewal is based on historic

renewal experience of the individual revenue streams or

management’s best estimates if historical renewal experience is not

available. Consumables orders are placed by customers through our

Omnicell Storefront online platform or through written or

telephonic orders and are sold to a customer base who utilize the

consumable product and place recurring orders when customer

inventory is depleted. ARR is generally calculated based on

revenues received in the most recent quarter and changes to

expected revenues where solutions were added to or removed from the

install or customer base in the quarter. Revenues from technical

services and SaaS and Expert Services are recorded ratably over the

service term. Revenue from consumables are recorded when the

product has shipped and title has passed. Our measure of ARR may be

different than that used by other companies. Because ARR is based

on expected future revenue, it does not represent revenue

recognized during a particular reporting period or revenue to be

recognized in future reporting periods. ARR should not be viewed as

a substitute for GAAP revenues.

Balance Sheet

As of December 31, 2024, Omnicell’s balance sheet reflected cash

and cash equivalents of $369 million, total debt (net of

unamortized debt issuance costs) of $341 million, and total assets

of $2.12 billion. Cash flows provided by operating activities in

the fourth quarter of 2024 totaled $56 million. This compares to

cash flows provided by operating activities totaling $38 million in

the fourth quarter of 2023.

As of December 31, 2024, the Company had $350 million of

availability under its revolving credit facility with no

outstanding balance.

Business Highlights

OmniSphere

The Company announced OmniSphere, a next-generation, cloud

native, software workflow engine and data platform that is intended

to seamlessly integrate enterprise-wide robotics and smart devices

to support more secure, data-driven, medication management across

the continuum of care. OmniSphere is designed to provide customers

state-of-the-art security, improved productivity, enterprise-wide

visibility, and streamlined upgrades, that is meant to deliver

optimal end-to-end medication management.

ASHP Midyear

More than 1,600 pharmacy and industry leaders had the

opportunity to explore Omnicell’s portfolio of outcomes-centric

solutions and learn best practices from peers as part of the

American Society of Health System Pharmacists (ASHP) Midyear 2024

Clinical Meeting and Exhibition. This annual event is the largest

gathering of pharmacy professionals in the world.

HITRUST Data Security

Certification

Omnicell’s medication management solutions powered by the

OmniCenter platform once again received HITRUST Common Security

Framework (CSF) certification, which we believe demonstrates the

Company’s ongoing commitment to high standards for cybersecurity

and data protection within the organization and for business

partners and customers.

Omnicell Issues New Convertible Senior

Notes

In late November, Omnicell issued $172.5 million aggregate

principal amount of 1.00% convertible senior notes due 2029. In

addition, Omnicell completed a partial repurchase of $400.0 million

aggregate principal amount of 0.25% convertible senior notes due

2025 for approximately $391.2 million in cash.

2025 Guidance

The table below summarizes Omnicell’s first quarter and full

year 2025 guidance:

Q1 2025

2025

Product Bookings (2025

Definition)

Not provided

$500 million - $550 million

ARR

Not Provided

$610 million - $630 million

Total Revenues

$255 million - $265 million

$1.105 billion - $1.155

billion

Product Revenues

$137 million - $142 million

$610 million - $640 million

Service Revenues

$118 million - $123 million

$495 million - $515 million

Technical Services Revenues

Not provided

$235 million - $245 million

SaaS and Expert Service Revenue

(formerly Advanced Services)

Not provided

$260 million - $270 million

Non-GAAP EBITDA

$19 million - $25 million

$140 million - $155 million

Non-GAAP Earnings Per Share

$0.15 - $0.25

$1.65 - $1.85

The Company does not provide guidance for GAAP net income or

GAAP earnings per share, nor a reconciliation of any

forward-looking non-GAAP financial measures to the most directly

comparable GAAP financial measures on a forward-looking basis

because it is unable to predict certain items contained in the GAAP

measures without unreasonable efforts. These forward-looking

non-GAAP financial measures do not include certain items, which may

be significant, including, but not limited to, unusual gains and

losses, costs associated with future restructurings,

acquisition-related expenses, and certain tax and litigation

outcomes.

Omnicell Conference Call Information

Omnicell will hold a conference call today, Thursday, February

6, 2025 at 8:30 a.m. ET to discuss fourth quarter and year end 2024

financial results. The conference call can be monitored by dialing

(800) 715-9871 in the U.S. or (646) 307-1963 in international

locations. The Conference ID is 2515873. A link to the live and

archived webcast will also be available on the Investor Relations

section of Omnicell’s website at

https://ir.omnicell.com/events-and-presentations/.

About Omnicell

Since 1992, Omnicell has been committed to transforming pharmacy

and nursing care through outcomes-centric solutions designed to

deliver clinical and business outcomes across all settings of care.

Through a comprehensive portfolio of robotics and smart devices,

intelligent software workflows, and data and analytics, all

optimized by expert services, Omnicell solutions are helping

healthcare facilities worldwide to uncover cost savings, improve

labor efficiency, establish new revenue streams, enhance supply

chain control, support compliance, and move closer to the

industry-defined vision of the Autonomous Pharmacy. To learn more,

visit omnicell.com.

From time to time, Omnicell may use the Company’s investor

relations website and other online social media channels, including

its LinkedIn page www.linkedin.com/company/omnicell, and Facebook

page www.facebook.com/omnicellinc, to disclose material non-public

information and comply with its disclosure obligations under

Regulation Fair Disclosure (“Reg FD”).

OMNICELL, the Omnicell logo, and ENLIVENHEALTH are registered

trademarks of Omnicell, Inc. or one of its subsidiaries. This press

release may also include the trademarks and service marks of other

companies. Such trademarks and service marks are the marks of their

respective owners.

Forward-Looking Statements

To the extent any statements contained in this press release

deal with information that is not historical, these statements are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Without limiting the

foregoing, statements including the words “expect,” “intend,”

“may,” “will,” “should,” “would,” “could,” “plan,” “potential,”

“anticipate,” “believe,” “forecast,” “guidance,” “outlook,”

“goals,” “target,” “estimate,” “seek,” “predict,” “project,” and

similar expressions are intended to identify forward-looking

statements. Forward-looking statements are subject to the

occurrence of many events outside Omnicell’s control. Such

statements include, but are not limited to, Omnicell’s projected

product bookings, revenues, including product, service, technical

services and SaaS and Expert Services revenues, annual recurring

revenue, non-GAAP EBITDA, and non-GAAP earnings per share;

expectations regarding our products and services and developing new

or enhancing existing products and solutions and the related

objectives and expected benefits (and any implied financial

impact); our ability to drive long-term growth and consistent GAAP

profitability; and statements about Omnicell’s strategy, plans,

objectives, promise and purpose, goals, opportunities, and market

or Company outlook. Actual results and other events may differ

significantly from those contemplated by forward-looking statements

due to numerous factors that involve substantial known and unknown

risks and uncertainties. These risks and uncertainties include,

among other things, (i) unfavorable general economic and market

conditions, including the impact and duration of inflationary

pressures, (ii) Omnicell’s ability to take advantage of growth

opportunities and develop and commercialize new solutions and

enhance existing solutions, (iii) reduction in demand in the

capital equipment market or reduction in the demand for or adoption

of our solutions, systems, or services, (iv) delays in

installations of our medication management solutions or our more

complex medication packaging systems, (v) risks related to

Omnicell’s investments in new business strategies or initiatives,

including its transition to selling more products and services on a

subscription basis, and its ability to acquire companies,

businesses, or technologies and successfully integrate such

acquisitions, (vi) ability to realize the benefits of our expense

containment initiatives, (vii) risks related to failing to maintain

expected service levels when providing our SaaS and Expert Services

or retaining our SaaS and Expert Services customers, (viii)

Omnicell’s ability to meet the demands of, or maintain

relationships with, its institutional, retail, and specialty

pharmacy customers, (ix) risks related to climate change, legal,

regulatory or market measures to address climate change and related

emphasis on ESG matters by various stakeholders, (x) changes to the

340B Program, (xi) risks related to the incorporation of artificial

intelligence technologies into our products, services and processes

or our vendors' offerings, (xii) Omnicell’s substantial debt, which

could impair its financial flexibility and access to capital,

(xiii) covenants in our credit agreement could restrict our

business and operations, (xiv) continued and increased competition

from current and future competitors in the medication management

automation solutions market and the medication adherence solutions

market, (xv) risks presented by government regulations, legislative

changes, fraud and anti-kickback statues, products liability

claims, the outcome of legal proceedings, and other legal

obligations related to healthcare, privacy, data protection, and

information security, and the costs of compliance with, and

potential liability associated with, our actual or perceived

failure to comply with such obligations, including any potential

governmental investigations and enforcement actions, litigation,

fines and penalties, exposure to indemnification obligations or

other liabilities, and adverse publicity related to the same; (xvi)

any disruption in Omnicell’s information technology systems and

breaches of data security or cyber-attacks on its systems or

solutions, including the previously disclosed ransomware incident

and any potential adverse legal, reputational, and financial

effects that may result from it and/or additional cybersecurity

incidents, as well as the effectiveness of business continuity

plans during any future cybersecurity incidents, (xvii) risks

associated with operating in foreign countries, (xviii) Omnicell’s

ability to recruit and retain skilled and motivated personnel,

(xix) Omnicell’s ability to protect its intellectual property, (xx)

risks related to the availability and sources of raw materials and

components or price fluctuations, shortages, or interruptions of

supply, (xxi) Omnicell’s dependence on a limited number of

suppliers for certain components, equipment, and raw materials, as

well as technologies provided by third-party vendors, (xxii)

fluctuations in quarterly and annual operating results may make our

future operating results difficult to predict, (xxiii) failing to

meet (or significantly exceeding) our publicly announced financial

guidance, and (xxiv) other risks and uncertainties further

described in the “Risk Factors” section of Omnicell’s most recent

Annual Report on Form 10-K, as well as in Omnicell’s other reports

filed with or furnished to the United States Securities and

Exchange Commission (“SEC”), available at www.sec.gov.

Forward-looking statements should be considered in light of these

risks and uncertainties. Investors and others are cautioned not to

place undue reliance on forward-looking statements. All

forward-looking statements contained in this press release speak

only as of the date of this press release. Omnicell assumes no

obligation to update any such statements publicly, or to update the

reasons actual results could differ materially from those expressed

or implied in any forward-looking statements, whether as a result

of changed circumstances, new information, future events, or

otherwise, except as required by law.

Use of Non-GAAP Financial Information

This press release contains financial measures that are not

calculated in accordance with U.S. Generally Accepted Accounting

Principles (“GAAP”). Management evaluates and makes operating

decisions using various performance measures. In addition to

Omnicell’s GAAP results, we also consider non-GAAP gross profit,

non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income

from operations, non-GAAP operating margin, non-GAAP net income,

non-GAAP net income per diluted share, non-GAAP diluted shares,

non-GAAP EBITDA, non-GAAP EBITDA margin, and non-GAAP free cash

flow. These non-GAAP results and metrics should not be considered

as an alternative to revenues, gross profit, operating expenses,

income from operations, net income, net income per diluted share,

diluted shares, net cash provided by operating activities, or any

other performance measure derived in accordance with GAAP. We

present these non-GAAP results and metrics because management

considers them to be important supplemental measures of Omnicell’s

performance and refers to such measures when analyzing Omnicell’s

strategy and operations.

Our non-GAAP gross profit, non-GAAP gross margin, non-GAAP

operating expenses, non-GAAP income from operations, non-GAAP

operating margin, non-GAAP net income, non-GAAP net income per

diluted share, non-GAAP EBITDA, and non-GAAP EBITDA margin are

exclusive of certain items to facilitate management’s review of the

comparability of Omnicell’s core operating results on a

period-to-period basis because such items are not related to

Omnicell’s ongoing core operating results as viewed by management.

We define our “core operating results” as those revenues recorded

in a particular period and the expenses incurred within such period

that directly drive operating income in such period. Management

uses these non-GAAP financial measures in making operating

decisions because, in addition to meaningful supplemental

information regarding operating performance, the measures give us a

better understanding of how we believe we should invest in research

and development, fund infrastructure growth, and evaluate the

effectiveness of marketing strategies. In calculating the above

non-GAAP results: non-GAAP gross profit and non-GAAP gross margin

exclude from their GAAP equivalents items a), b), e), and g) below;

non-GAAP operating expenses excludes from its GAAP equivalents

items a), b), c), d), e), g), h), i), j) and k) below; non-GAAP

income from operations and non-GAAP operating margin exclude from

their GAAP equivalents items a), b), c), d), e), g), h),i), j) and

k) below; and non-GAAP net income and non-GAAP net income per

diluted share exclude from their GAAP equivalents items a) through

l) below. Non-GAAP EBITDA is defined as earnings before interest

income and expense, taxes, depreciation, amortization, and

share-based compensation, as well as excluding certain other

non-GAAP adjustments. Non-GAAP EBITDA and non-GAAP EBITDA margin

exclude from their GAAP equivalents items a), c), d), e), f), g),

h), i), j), k) and l) below:

a)

Share-based compensation expense.

We excluded from our non-GAAP results the expense related to

equity-based compensation plans as it represents expenses that do

not require cash settlement from Omnicell.

b)

Amortization of acquired

intangible assets. We excluded from our non-GAAP results the

intangible assets amortization expense resulting from our past

acquisitions. These non-cash charges are not considered by

management to reflect the core cash-generating performance of the

business and therefore are excluded from our non-GAAP results.

c)

Acquisition-related expenses. We

excluded from our non-GAAP results the expenses related to recent

acquisitions, including amortization of representations and

warranties insurance. These expenses are unrelated to our ongoing

operations, vary in size and frequency, and are subject to

significant fluctuations from period to period due to varying

levels of acquisition activity. We believe that excluding these

expenses provides more meaningful comparisons of the financial

results to our historical operations and forward-looking guidance,

and to the financial results of peer companies.

d)

Impairment and abandonment of

operating lease right-of-use and other assets related to

facilities. We excluded from our non-GAAP results the impairment

and abandonment of certain operating lease right-of-use assets, as

well as property and equipment, incurred in connection with

restructuring activities for optimization of certain leased

facilities. These non-cash charges are not considered by management

to reflect the core cash-generating performance of the business and

therefore are excluded from our non-GAAP results.

e)

Severance-related expenses. We

excluded from our non-GAAP results the expenses related to

restructuring events, partially offset by reversals of previously

recognized severance expenses in subsequent periods. These expenses

are unrelated to our ongoing operations, vary in size and

frequency, and are subject to significant fluctuations from period

to period due to varying levels of restructuring activity. We

believe that excluding these expenses provides more meaningful

comparisons of the financial results to our historical operations

and forward-looking guidance, and to the financial results of peer

companies.

f)

Amortization of debt issuance

costs. Debt issuance costs represent costs associated with the

issuance of revolving credit facilities and convertible senior

notes. The costs include underwriting fees, original issue

discount, ticking fees, and legal fees. These non-cash expenses are

not considered by management to reflect the core cash-generating

performance of the business and therefore are excluded from our

non-GAAP results.

g)

RDS restructuring. We excluded

from our non-GAAP results the nonrecurring restructuring charges

related to the wind down of the Company’s Medimat Robotic

Dispensing System (“RDS”) product line, partially offset by

reversals of previously recognized expenses in subsequent periods.

For the period ended December 31, 2024, those charges consisted

primarily of inventory write-down, severance and other related

expenses. These expenses are unrelated to our ongoing operations

and we believe that excluding these expenses provides more

meaningful comparisons of the financial results to our historical

operations and forward-looking guidance, and to the financial

results of peer companies.

h)

Executives transition costs. We

excluded from our non-GAAP results the executives transition costs

associated with the departure of certain executive officers,

primarily consisting of severance expenses. These expenses are

unrelated to our ongoing operations and we do not expect them to

occur in the ordinary course of business. We believe that excluding

these expenses provides more meaningful comparisons of the

financial results to our historical operations and forward-looking

guidance, and to the financial results of peer companies.

i)

Ransomware-related insurance

recoveries. We excluded from our non-GAAP results the insurance

recoveries related to the previously disclosed ransomware incident

identified by the Company on May 4, 2022. These recoveries are

unrelated to our ongoing operations and would not have otherwise

been received by us in the normal course of business. We believe

that excluding these recoveries provides more meaningful

comparisons of the financial results to our historical operations

and forward-looking guidance, and to the financial results of peer

companies.

j)

Legal and regulatory expenses. We

excluded from our non-GAAP results certain non-recurring legal and

regulatory expenses, representing potential settlement amounts,

related to certain claims of non-compliance with our government

contracts that are outside of the ordinary course of our business.

We believe that excluding these amounts provides more meaningful

comparisons of the financial results to our historical operations

and forward-looking guidance, and to the financial results of peer

companies.

k)

Management severance costs. We

excluded from our non-GAAP results the severance expense of certain

senior management associated with the restructuring of our senior

leadership team. We believe that excluding these expenses provides

more meaningful comparisons of the financial results to our

historical operations and forward-looking guidance, and to the

financial results of peer companies.

l)

Gain on extinguishment of

convertible senior notes, net. We excluded from our non-GAAP

results the gain on the partial repurchase of the Company’s Senior

Convertible Notes due 2025 as well as the related unwinding of the

convertible note hedge and warrants. We believe that excluding this

gain provides more meaningful comparisons of the financial results

to our historical operations and forward-looking guidance, and to

the financial results of peer companies.

Management adjusts for the above items because management

believes that, in general, these items possess one or more of the

following characteristics: their magnitude and timing is largely

outside of Omnicell’s control; they are unrelated to the ongoing

operation of the business in the ordinary course; they are unusual

and we do not expect them to occur in the ordinary course of

business; or they are non-operational or non-cash expenses

involving stock compensation plans or other items.

We believe that the presentation of non-GAAP gross profit,

non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income

from operations, non-GAAP operating margin, non-GAAP net income,

non-GAAP net income per diluted share, non-GAAP EBITDA, and

non-GAAP EBITDA margin is warranted for several reasons:

a)

Such non-GAAP financial measures

provide an additional analytical tool for understanding Omnicell’s

financial performance by excluding the impact of items which may

obscure trends in the core operating results of the business.

b)

Since we have historically

reported non-GAAP results to the investment community, we believe

the inclusion of non-GAAP numbers provides consistency and enhances

investors’ ability to compare our performance across financial

reporting periods.

c)

These non-GAAP financial measures

are employed by management in its own evaluation of performance and

are utilized in financial and operational decision-making

processes, such as budget planning and forecasting.

d)

These non-GAAP financial measures

facilitate comparisons to the operating results of other companies

in our industry, which also use non-GAAP financial measures to

supplement their GAAP results (although these companies may

calculate non-GAAP financial measures differently than Omnicell

does), thus enhancing the perspective of investors who wish to

utilize such comparisons in their analysis of our performance.

Set forth below are additional reasons why share-based

compensation expense is excluded from our non-GAAP financial

measures:

i)

While share-based compensation

calculated in accordance with Accounting Standards Codification

(“ASC”) 718 constitutes an ongoing and recurring expense of

Omnicell, it is not an expense that requires cash settlement by

Omnicell. We therefore exclude these charges for purposes of

evaluating core operating results. Thus, our non-GAAP measurements

are presented exclusive of share-based compensation expense to

assist management and investors in evaluating our core operating

results.

ii)

We present ASC 718 share-based

payment compensation expense in our reconciliation of non-GAAP

financial measures on a pre-tax basis because the exact tax

differences related to the timing and deductibility of share-based

compensation under ASC 718 are dependent upon the trading price of

Omnicell’s common stock and the timing and exercise by employees of

their stock options. As a result of these timing and market

uncertainties, the tax effect related to share-based compensation

expense would be inconsistent in amount and frequency and is

therefore excluded from our non-GAAP results.

Non-GAAP diluted shares is defined as our GAAP diluted shares,

excluding the impact of dilutive convertible senior notes for which

the Company is economically hedged through its anti-dilutive

convertible note hedge transaction. We believe non-GAAP diluted

shares is a useful non-GAAP metric because it provides insight into

the offsetting economic effect of the hedge transaction against

potential conversion of the convertible senior notes.

Non-GAAP free cash flow is defined as net cash provided by

operating activities less cash used for software development for

external use and purchases of property and equipment. We believe

free cash flow is important to enable investors to better

understand and evaluate our ongoing operating results and allows

for greater transparency in the review and understanding of our

overall financial, operational, and economic performance, because

free cash flow takes into account certain capital expenditures and

cash used for software development necessary to operate our

business.

As stated above, we present non-GAAP financial measures because

we consider them to be important supplemental measures of

performance. However, non-GAAP financial measures have limitations

as an analytical tool and should not be considered in isolation or

as a substitute for Omnicell’s GAAP results. In the future, we

expect to incur expenses similar to certain of the non-GAAP

adjustments described above and expect to continue reporting

non-GAAP financial measures excluding such items. Some of the

limitations in relying on non-GAAP financial measures are:

a)

Omnicell’s equity incentive plans

and stock purchase plans are important components of incentive

compensation arrangements and will be reflected as expenses in

Omnicell’s GAAP results for the foreseeable future under ASC

718.

b)

Other companies, including

companies in Omnicell’s industry, may calculate non-GAAP financial

measures differently than Omnicell, limiting their usefulness as a

comparative measure.

c)

A limitation of the utility of

free cash flow as a measure of financial performance is that it

does not represent the total increase or decrease in Omnicell’s

cash balance for the period.

A detailed reconciliation between Omnicell’s non-GAAP and GAAP

financial results is set forth in the financial tables at the end

of this press release. Investors are advised to carefully review

and consider this information strictly as a supplement to the GAAP

results that are contained in this press release as well as in

Omnicell’s other reports filed with or furnished to the SEC.

Omnicell, Inc.

Condensed Consolidated

Statements of Operations

(Unaudited, in thousands,

except per share data)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Revenues:

Product revenues

$

182,271

$

145,655

$

630,507

$

708,561

Service revenues

124,608

113,192

481,731

438,551

Total revenues

306,879

258,847

1,112,238

1,147,112

Cost of revenues:

Cost of product revenues

96,755

90,306

383,025

414,106

Cost of service revenues

68,363

63,137

258,210

236,166

Total cost of revenues

165,118

153,443

641,235

650,272

Gross profit

141,761

105,404

471,003

496,840

Operating expenses:

Research and development

26,040

26,819

90,412

97,115

Selling, general, and administrative

103,325

101,950

380,254

434,593

Total operating expenses

129,365

128,769

470,666

531,708

Income (loss) from operations

12,396

(23,365

)

337

(34,868

)

Interest and other income (expense),

net

11,204

4,848

25,256

14,760

Income (loss) before income taxes

23,600

(18,517

)

25,593

(20,108

)

Provision for (benefit from) income

taxes

7,758

(4,142

)

13,062

263

Net income (loss)

$

15,842

$

(14,375

)

$

12,531

$

(20,371

)

Net income (loss) per share:

Basic

$

0.34

$

(0.32

)

$

0.27

$

(0.45

)

Diluted

$

0.34

$

(0.32

)

$

0.27

$

(0.45

)

Weighted-average shares

outstanding:

Basic

46,345

45,495

46,047

45,212

Diluted

46,854

45,495

46,255

45,212

Omnicell, Inc.

Condensed Consolidated Balance

Sheets

(Unaudited, in

thousands)

December 31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

369,201

$

467,972

Accounts receivable and unbilled

receivables, net

256,398

252,025

Inventories

88,659

110,099

Prepaid expenses

25,942

25,966

Other current assets

75,293

71,509

Total current assets

815,493

927,571

Property and equipment, net

112,692

108,601

Long-term investment in sales-type leases,

net

52,744

42,954

Operating lease right-of-use assets

25,607

24,988

Goodwill

734,727

735,810

Intangible assets, net

188,266

211,173

Long-term deferred tax assets

57,469

32,901

Prepaid commissions

54,656

52,414

Other long-term assets

79,306

90,466

Total assets

$

2,120,960

$

2,226,878

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

51,782

$

45,028

Accrued compensation

60,307

51,754

Accrued liabilities

167,895

149,276

Deferred revenues

141,370

121,734

Convertible senior notes, net

174,324

—

Total current liabilities

595,678

367,792

Long-term deferred revenues

76,123

58,622

Long-term deferred tax liabilities

1,108

1,620

Long-term operating lease liabilities

31,123

33,910

Other long-term liabilities

7,218

6,318

Convertible senior notes, net

166,397

569,662

Total liabilities

877,647

1,037,924

Total stockholders’ equity

1,243,313

1,188,954

Total liabilities and stockholders’

equity

$

2,120,960

$

2,226,878

Omnicell, Inc.

Condensed Consolidated

Statements of Cash Flows

(Unaudited, in

thousands)

Year Ended December

31,

2024

2023

Operating Activities

Net income (loss)

$

12,531

$

(20,371

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

82,232

87,319

Loss on disposal of assets

978

2,572

Share-based compensation expense

39,316

55,300

Deferred income taxes

(14,855

)

(11,047

)

Amortization of operating lease

right-of-use assets

7,523

8,239

Impairment and abandonment of operating

lease right-of-use assets related to facilities

—

9,998

Inventory write-down

5,393

—

Impairment of certain long-lived

assets

—

1,014

Amortization of debt issuance costs

3,788

4,397

Gain on extinguishment of convertible

senior notes, net

(7,517

)

—

Changes in operating assets and

liabilities:

Accounts receivable and unbilled

receivables

(5,002

)

49,150

Inventories

15,633

38,016

Prepaid expenses

24

1,149

Other current assets

9,337

(6,821

)

Investment in sales-type leases

(10,398

)

(10,411

)

Prepaid commissions

(2,242

)

7,069

Other long-term assets

2,161

2,111

Accounts payable

7,210

(17,525

)

Accrued compensation

8,553

(21,461

)

Accrued liabilities

13,942

(10,343

)

Deferred revenues

28,952

24,058

Operating lease liabilities

(10,737

)

(10,918

)

Other long-term liabilities

900

(401

)

Net cash provided by operating

activities

187,722

181,094

Investing Activities

External-use software development

costs

(16,330

)

(13,542

)

Purchases of property and equipment

(36,463

)

(41,474

)

Net cash used in investing activities

(52,793

)

(55,016

)

Financing Activities

Payments for debt issuance costs for

revolving credit facility

—

(2,967

)

Proceeds from issuance of convertible

senior notes, net of issuance costs

166,272

—

Partial repurchase of convertible senior

notes

(391,000

)

—

Purchase of convertible note hedge

(40,279

)

—

Proceeds from sale of warrants

25,168

—

Partial unwind of convertible note hedge

and warrants

(727

)

—

Proceeds from issuances under stock-based

compensation plans

13,411

23,216

Employees’ taxes paid related to

restricted stock units

(4,827

)

(7,366

)

Change in customer funds, net

(3,596

)

10,537

Net cash provided by (used in) financing

activities

(235,578

)

23,420

Effect of exchange rate changes on cash

and cash equivalents

(1,716

)

(1,354

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

(102,365

)

148,144

Cash, cash equivalents, and restricted

cash at beginning of period

500,979

352,835

Cash, cash equivalents, and restricted

cash at end of period

$

398,614

$

500,979

Reconciliation of cash, cash

equivalents, and restricted cash to the Condensed Consolidated

Balance Sheets:

Cash and cash equivalents

$

369,201

$

467,972

Restricted cash included in other current

assets

29,413

33,007

Cash, cash equivalents, and restricted

cash at end of period

$

398,614

$

500,979

Omnicell, Inc.

Reconciliation of GAAP to

Non-GAAP

(Unaudited, in thousands,

except per share data and percentage)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of GAAP gross profit to

non-GAAP gross profit:

GAAP gross profit

$

141,761

$

105,404

$

471,003

$

496,840

GAAP gross margin

46.2

%

40.7

%

42.3

%

43.3

%

Share-based compensation expense

1,489

1,799

6,373

8,288

Amortization of acquired intangibles

1,017

2,607

4,131

11,165

RDS restructuring, net of reversals

1,211

—

9,897

—

Severance-related expenses, net of

reversals

—

2,987

—

3,089

Non-GAAP gross profit

$

145,478

$

112,797

$

491,404

$

519,382

Non-GAAP gross margin

47.4

%

43.6

%

44.2

%

45.3

%

Reconciliation of GAAP operating

expenses to non-GAAP operating expenses:

GAAP operating expenses

$

129,365

$

128,769

$

470,666

$

531,708

GAAP operating expenses % to total

revenues

42.2

%

49.7

%

42.3

%

46.4

%

Share-based compensation expense

(7,550

)

(10,388

)

(32,943

)

(47,012

)

Amortization of acquired intangibles

(4,480

)

(5,007

)

(18,578

)

(20,409

)

Acquisition-related expenses

(182

)

(244

)

(898

)

(982

)

Impairment and abandonment of operating

lease right-of-use and other assets related to facilities (a)

—

(1,587

)

—

(10,007

)

RDS restructuring, net of reversals

(1,223

)

(1,610

)

(2,056

)

(1,610

)

Ransomware-related insurance

recoveries

—

624

—

808

Legal and regulatory expenses

(2,000

)

—

(2,000

)

—

Management severance costs

(911

)

—

(911

)

—

Executives transition costs

—

—

—

(2,189

)

Severance-related expenses, net of

reversals

—

(7,098

)

—

(12,450

)

Non-GAAP operating expenses

$

113,019

$

103,459

$

413,280

$

437,857

Non-GAAP operating expenses as a % of

total revenues

36.8

%

40.0

%

37.2

%

38.2

%

Reconciliation of GAAP income (loss)

from operations to non-GAAP income from operations:

GAAP income (loss) from operations

$

12,396

$

(23,365

)

$

337

$

(34,868

)

GAAP operating income (loss) % to total

revenues

4.0

%

(9.0

)%

0.0

%

(3.0

)%

Share-based compensation expense

9,039

12,187

39,316

55,300

Amortization of acquired intangibles

5,497

7,614

22,709

31,574

Acquisition-related expenses

182

244

898

982

Impairment and abandonment of operating

lease right-of-use and other assets related to facilities (a)

—

1,587

—

10,007

RDS restructuring, net of reversals

2,434

1,610

11,953

1,610

Ransomware-related insurance

recoveries

—

(624

)

—

(808

)

Legal and regulatory expenses

2,000

—

2,000

—

Management severance costs

911

—

911

—

Executives transition costs

—

—

—

2,189

Severance-related expenses, net of

reversals

—

10,085

—

15,539

Non-GAAP income from operations

$

32,459

$

9,338

$

78,124

$

81,525

Non-GAAP operating margin (non-GAAP

operating income as a % of total revenues)

10.6

%

3.6

%

7.0

%

7.1

%

Omnicell, Inc.

Reconciliation of GAAP to

Non-GAAP

(Unaudited, in thousands,

except per share data and percentage)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of GAAP net income

(loss) to non-GAAP net income:

GAAP net income (loss)

$

15,842

$

(14,375

)

$

12,531

$

(20,371

)

Share-based compensation expense

9,039

12,187

39,316

55,300

Amortization of acquired intangibles

5,497

7,614

22,709

31,574

Acquisition-related expenses

182

244

898

982

Impairment and abandonment of operating

lease right-of-use and other assets related to facilities (a)

—

1,587

—

10,007

RDS restructuring, net of reversals

2,434

1,610

11,953

1,610

Ransomware-related insurance

recoveries

—

(624

)

—

(808

)

Legal and regulatory expenses

2,000

—

2,000

—

Management severance costs

911

—

911

—

Executives transition costs

—

—

—

2,189

Severance-related expenses, net of

reversals

—

10,085

—

15,539

Amortization of debt issuance costs

871

1,258

3,788

4,397

Gain on extinguishment of convertible

senior notes, net

(7,517

)

—

(7,517

)

—

Tax effect of the adjustments above

(b)

(919

)

(4,573

)

(7,295

)

(13,754

)

Non-GAAP net income

$

28,340

$

15,013

$

79,294

$

86,665

Reconciliation of GAAP net income

(loss) per share - diluted to non-GAAP net income per share -

diluted:

Shares - diluted GAAP

46,854

45,495

46,255

45,212

Shares - diluted non-GAAP

46,854

45,532

46,255

45,439

GAAP net income (loss) per share -

diluted

$

0.34

$

(0.32

)

$

0.27

$

(0.45

)

Share-based compensation expense

0.19

0.26

0.85

1.22

Amortization of acquired intangibles

0.12

0.17

0.49

0.69

Acquisition-related expenses

0.00

0.01

0.02

0.02

Impairment and abandonment of operating

lease right-of-use and other assets related to facilities (a)

—

0.03

—

0.22

RDS restructuring, net of reversals

0.05

0.04

0.26

0.04

Ransomware-related insurance

recoveries

—

(0.01

)

—

(0.02

)

Legal and regulatory expenses

0.04

—

0.04

—

Management severance costs

0.02

—

0.02

—

Executives transition costs

—

—

—

0.05

Severance-related expenses, net of

reversals

—

0.22

—

0.34

Amortization of debt issuance costs

0.02

0.03

0.08

0.10

Gain on extinguishment of convertible

senior notes, net

(0.16

)

—

(0.16

)

—

Tax effect of the adjustments above

(b)

(0.02

)

(0.10

)

(0.16

)

(0.30

)

Non-GAAP net income per share -

diluted

$

0.60

$

0.33

$

1.71

$

1.91

Omnicell, Inc.

Reconciliation of GAAP to

Non-GAAP

(Unaudited, in thousands,

except per share data and percentage)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of GAAP net income

(loss) to non-GAAP EBITDA (c):

GAAP net income (loss)

$

15,842

$

(14,375

)

$

12,531

$

(20,371

)

Share-based compensation expense

9,039

12,187

39,316

55,300

Interest (income) and expense, net

(5,062

)

(5,811

)

(23,399

)

(18,542

)

Depreciation and amortization expense

19,966

21,723

82,232

87,319

Acquisition-related expenses

182

244

898

982

Impairment and abandonment of operating

lease right-of-use and other assets related to facilities (a)

—

1,587

—

10,007

RDS restructuring, net of reversals

2,434

1,610

11,953

1,610

Ransomware-related insurance

recoveries

—

(624

)

—

(808

)

Legal and regulatory expenses

2,000

—

2,000

—

Management severance costs

911

—

911

—

Executives transition costs

—

—

—

2,189

Severance-related expenses, net of

reversals

—

10,085

—

15,539

Amortization of debt issuance costs

871

1,258

3,788

4,397

Gain on extinguishment of convertible

senior notes, net

(7,517

)

—

(7,517

)

—

Provision for (benefit from) income

taxes

7,758

(4,142

)

13,062

263

Non-GAAP EBITDA

$

46,424

$

23,742

$

135,775

$

137,885

Non-GAAP EBITDA margin (non-GAAP EBITDA as

a % of total revenues)

15.1

%

9.2

%

12.2

%

12.0

%

Reconciliation of GAAP net cash

provided by operating activities to non-GAAP free cash

flow:

GAAP net cash provided by operating

activities

$

56,315

$

38,414

$

187,722

$

181,094

External-use software development

costs

(4,481

)

(3,302

)

(16,330

)

(13,542

)

Purchases of property and equipment

(9,087

)

(9,070

)

(36,463

)

(41,474

)

Non-GAAP free cash flow

$

42,747

$

26,042

$

134,929

$

126,078

____________________________

(a)

For the year ended December 31,

2023, impairment charges of other assets were approximately $0.6

million related to property and equipment in connection with

restructuring activities for optimization of certain leased

facilities.

(b)

Tax effects calculated for all

adjustments except share-based compensation expense, using an

estimated annual effective tax rate of 21% for both fiscal years

2024 and 2023.

(c)

Defined as earnings before

interest income and expense, taxes, depreciation, amortization, and

share-based compensation, as well as excluding certain other

non-GAAP adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206336508/en/

Kathleen Nemeth Senior Vice President, Investor Relations

650-435-3318 Kathleen.Nemeth@Omnicell.com

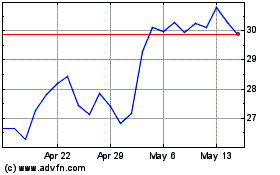

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Mar 2025 to Apr 2025

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Apr 2024 to Apr 2025