SurgePays, Inc. (Nasdaq: SURG) (“SurgePays” or the “Company”), a

technology and telecom company focused on the underbanked and

underserved, today announced its financial results for the third

quarter ended September 30, 2023.

Third quarter 2023 Financial

Highlights

-

Net income of $7.1 million in the third quarter 2023, compared to a

net loss of $(1.5) million in the third quarter 2022.

-

Third quarter 2023 EBITDA of $7.5 million compared to a third

quarter 2022 EBITDA loss of $(0.8) million.

-

Revenue of $34.2 million in the third quarter 2023, compared to

$36.2 million third quarter 2022.

-

Gross profit of $10.5 million in the third quarter 2023, an

increase of $8.6 million over the third quarter 2022. Gross profit

margin expanded to 30.7% in the third quarter 2023.

Management Commentary

Commenting on the quarterly results, Chairman

and CEO Brian Cox said, “We delivered the Company’s highest ever

net income during a period where we made some tough but necessary

decisions to accomplish our long-term objectives. Year to date, we

have achieved over $17 million of net income and our profitability

margins have continued to expand. Sales and profitability in our

core business is growing. At the end of the third quarter, we had

over $12 million of cash on the balance sheet and minimal

debt.”

Mr. Cox continued, “Becoming profitable and

self-reliant enables us to make disciplined but aggressive business

decisions based on long term goals and growth objectives. The

Company’s core competency is to bring financial and wireless

services to the underbanked and underserved populations in the

United States, where they live and shop. Our goal is to build

the largest direct distribution network of underbanked products and

services to convenience stores. Our product suite gives us a

competitive advantage in offering owner-operated and chain stores

compelling reasons to utilize our technology-layered software

platform. We are gaining strength and momentum by developing new

products and services while growing our nationwide network of

stores. For example, we partnered with ClearLine Mobile to

integrate point of sale customer-facing LCD screens at the register

to promote our products, activate wireless subscribers and create

customer engagement. This next step advancement is part of our

strategy to solidify SurgePays as an innovative market leader in

providing wireless and fintech products to the underbanked and

underserved where they live and shop.”

Management Discussion &

Analysis

SurgePays is a technology and telecom company

focused on the underbanked and underserved communities. SurgePhone

and Torch Wireless provide subsidized mobile broadband to over

250,000 low-income subscribers nationwide. The SurgePays fintech

platform empowers clerks at thousands of convenience stores to

offer a suite of prepaid wireless and financial products to

underbanked customers.

During the third quarter ending September 30,

2023, the overall revenue was $34.2 million compared to $36.2

million in the third quarter ending September 30, 2022. The

decrease was primarily due to management's decision to streamline

the company's focus and messaging by winding down the LogicsIQ

subsidiary operations, and all legacy business outside the core

business model. LogicsIQ, the mass-tort lead generation subsidiary,

decreased by $4.1 million in the third quarter, while revenues

related to the company's core business objectives, providing

wireless and financial services to the underbanked, increased by

$2.1 million.

Operating income improved overall to $7.1

million in the third quarter of 2023, compared to a loss of $(1.8)

million in the third quarter of 2022.

Net income in the third quarter of 2023 was $7.1

million, compared to a net loss of $(1.5) million in the third

quarter of 2022. EBITDA increased to $7.5 million in the third

quarter compared to ($0.5) million in the third quarter of

2022.

Third Quarter 2023 Results Conference

Call

SurgePays management will host a webcast at 5

p.m. ET / 2 p.m. PT to discuss these results.

The live webcast of the call can be accessed at

3Q23 Webcast Link and on the company’s investor relations website

at ir.surgepays.com.

Telephone access to the call will be available

at 1-844-825-9789 (in the U.S.) or by dialing 1-412-317-5180

(outside U.S.).

A telephone replay will be available

approximately one hour following completion of the call through

Thursday, November 28, 2023. To access the replay, please dial

844-512-2921 (in the U.S.) or 412-317-6671 (outside U.S.). Enter

Conference ID #10183975.

About SurgePays, Inc.

SurgePays, Inc. is a technology and telecom

company focused on the underbanked and underserved communities.

SurgePhone and Torch Wireless provide subsidized mobile broadband

to over 250,000 low-income subscribers nationwide. SurgePays

fintech platform empowers clerks at over 8,000 convenience stores

to provide a suite of prepaid wireless and financial products to

underbanked customers. Please visit SurgePays.com for more

information.

About Non-GAAP Financial

Measures

The Company believes that EBITDA (earnings

before interest, taxes, depreciation and amortization) is useful to

investors because it is commonly used to evaluate companies on the

basis of operating performance and leverage.

EBITDA is not intended to represent cash flows

for the periods presented, nor have they been presented as an

alternative to operating income or as an indicator of operating

performance and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”). In accordance with SEC Regulation G, the non-GAAP

measurements in this press release have been reconciled to the

nearest GAAP measurement, which can be viewed under the heading

“Reconciliation of Net Income (loss) from Operations to EBITDA” in

the financial tables included in this press release.

Cautionary Note Regarding

Forward-Looking Statements

This press release includes express or implied

statements that are not historical facts and are considered

forward-looking within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act. Forward-looking

statements involve substantial risks and uncertainties.

Forward-looking statements generally relate to future events or our

future financial or operating performance and may contain

projections of our future results of operations or of our financial

information or state other forward-looking information. In some

cases, you can identify forward-looking statements by the following

words: “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing,” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words.

Although we believe that the expectations

reflected in these forward-looking statements such as regarding our

market potential along with the statements under the heading

Business Outlook are reasonable, these statements relate to future

events or our future operational or financial performance and

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by these forward-looking

statements. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a variety of risks and factors that are beyond our

control, including, without limitation, statements about our future

financial performance, including our revenue, cash flows, costs of

revenue and operating expenses; our anticipated growth; and our

predictions about our industry. The forward-looking statements

contained in this release are also subject to other risks and

uncertainties, including those more fully described in our filings

with the Securities and Exchange Commission (“SEC”), including in

our Annual Report on Form 10-K for the fiscal year ended December

31, 2022. The forward-looking statements in this press release

speak only as of the date on which the statements are made. We

undertake no obligation to update, and expressly disclaim the

obligation to update, any forward-looking statements made in this

press release to reflect events or circumstances after the date of

this press release or to reflect new information or the occurrence

of unanticipated events, except as required by law.

Investor RelationsBrian M. Prenoveau, CFAMZ

Group – MZ North AmericaSURG@mzgroup.us 561 489 5315

|

Consolidated Balance Sheets |

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

| |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

12,731,449 |

|

|

$ |

7,035,654 |

|

| Accounts receivable - net |

|

|

9,774,428 |

|

|

|

9,230,365 |

|

| Inventory |

|

|

14,549,407 |

|

|

|

11,186,242 |

|

| Prepaids |

|

|

197,879 |

|

|

|

111,524 |

|

| Total Current

Assets |

|

|

37,253,163 |

|

|

|

27,563,785 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment

- net |

|

|

432,224 |

|

|

|

643,373 |

|

| |

|

|

|

|

|

|

|

|

| Other

Assets |

|

|

|

|

|

|

|

|

| Note receivable |

|

|

176,851 |

|

|

|

176,851 |

|

| Intangibles - net |

|

|

2,289,847 |

|

|

|

2,779,977 |

|

| Internal use software

development costs - net |

|

|

571,689 |

|

|

|

387,180 |

|

| Goodwill |

|

|

1,666,782 |

|

|

|

1,666,782 |

|

| Investment in CenterCom |

|

|

449,843 |

|

|

|

354,206 |

|

| Operating lease - right of use

asset - net |

|

|

398,926 |

|

|

|

431,352 |

|

| Total Other

Assets |

|

|

5,553,938 |

|

|

|

5,796,348 |

|

| |

|

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

43,239,325 |

|

|

$ |

34,003,506 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable and accrued

expenses |

|

$ |

6,833,124 |

|

|

$ |

5,784,374 |

|

| Accounts payable and accrued

expenses - related party |

|

|

1,002,558 |

|

|

|

1,728,721 |

|

| |

|

|

|

|

|

|

|

|

| Installment sale

liability |

|

|

5,920,346 |

|

|

|

13,018,184 |

|

| Deferred revenue |

|

|

118,000 |

|

|

|

243,110 |

|

| Operating lease liability |

|

|

42,208 |

|

|

|

39,490 |

|

| Notes payable - related

parties |

|

|

558,150 |

|

|

|

1,108,150 |

|

| Notes payable |

|

|

10,554 |

|

|

|

1,542,033 |

|

| Total Current

Liabilities |

|

|

14,484,940 |

|

|

|

23,464,062 |

|

| |

|

|

|

|

|

|

|

|

| Long Term

Liabilities |

|

|

|

|

|

|

|

|

| Note payable |

|

|

53,135 |

|

|

|

53,134 |

|

| Notes payable - related

parties |

|

|

4,026,413 |

|

|

|

4,493,798 |

|

| Notes payable - SBA

government |

|

|

463,870 |

|

|

|

474,846 |

|

| |

|

|

|

|

|

|

|

|

| Operating lease liability |

|

|

367,465 |

|

|

|

399,413 |

|

| Total Long Term

Liabilities |

|

|

4,910,883 |

|

|

|

5,421,191 |

|

| |

|

|

|

|

|

|

|

|

| Total

Liabilities |

|

|

19,395,823 |

|

|

|

28,885,253 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies (Note 8) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par

value, 500,000,000 shares authorized 14,343,261 and 14,116,832

shares issued and outstanding, respectively |

|

|

14,344 |

|

|

|

14,117 |

|

| Additional paid-in

capital |

|

|

41,889,886 |

|

|

|

40,780,707 |

|

| Accumulated deficit |

|

|

(18,207,472 |

) |

|

|

(35,804,106 |

) |

| Stockholders’ equity |

|

|

23,696,758 |

|

|

|

4,990,718 |

|

|

Non-controlling interest |

|

|

146,744 |

|

|

|

127,535 |

|

| Total Stockholders’

Equity |

|

|

23,843,502 |

|

|

|

5,118,253 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

43,239,325 |

|

|

$ |

34,003,506 |

|

| |

|

SurgePays, Inc. and SubsidiariesConsolidated

Statements of Operations(Unaudited) |

| |

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

34,160,834 |

|

|

$ |

36,171,345 |

|

|

$ |

104,823,710 |

|

|

$ |

85,317,860 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

23,680,247 |

|

|

|

34,250,541 |

|

|

|

76,622,912 |

|

|

|

78,572,421 |

|

| General and administrative

expenses |

|

|

3,389,015 |

|

|

|

2,933,204 |

|

|

|

10,201,663 |

|

|

|

9,655,529 |

|

| Total costs and

expenses |

|

|

27,069,262 |

|

|

|

37,183,745 |

|

|

|

86,824,575 |

|

|

|

88,227,950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

|

7,091,572 |

|

|

|

(1,012,400 |

) |

|

|

17,999,135 |

|

|

|

(2,910,090 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(130,335 |

) |

|

|

(633,593 |

) |

|

|

(478,928 |

) |

|

|

(1,370,236 |

) |

| Gain (loss) on investment in

CenterCom |

|

|

51,894 |

|

|

|

(52,435 |

) |

|

|

95,636 |

|

|

|

(42,099 |

) |

| Amortization of debt

discount |

|

|

- |

|

|

|

(57,933 |

) |

|

|

- |

|

|

|

(95,001 |

) |

| Gain on forgiveness of PPP

loan - government |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

524,143 |

|

| Total other income

(expense) - net |

|

|

(78,441 |

) |

|

|

(743,961 |

) |

|

|

(383,292 |

) |

|

|

(983,193 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

including non-controlling interest |

|

|

7,013,131 |

|

|

|

(1,756,361 |

) |

|

|

17,615,843 |

|

|

|

(3,893,283 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling

interest |

|

|

(71,170 |

) |

|

|

(216,163 |

) |

|

|

19,209 |

|

|

|

(167,714 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss)

available to common stockholders |

|

$ |

7,084,301 |

|

|

$ |

(1,540,198 |

) |

|

$ |

17,596,634 |

|

|

$ |

(3,725,569 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per

share - attributable to common stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.50 |

|

|

$ |

(0.12 |

) |

|

$ |

1.24 |

|

|

$ |

(0.30 |

) |

|

Diluted |

|

$ |

0.49 |

|

|

$ |

(0.12 |

) |

|

$ |

1.19 |

|

|

$ |

(0.30 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares outstanding - attributable to common

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

14,291,263 |

|

|

|

12,443,052 |

|

|

|

14,205,127 |

|

|

|

12,259,907 |

|

|

Diluted |

|

|

14,507,984 |

|

|

|

12,443,052 |

|

|

|

14,740,201 |

|

|

|

12,259,907 |

|

|

|

|

Reconciliation of Net Income (loss) from Operations to

EBITDA |

|

|

|

|

|

|

|

|

|

|

Three months ended |

Three months ended |

Nine months ended |

Nine months ended |

|

|

|

September 30, 2023 |

September 30, 2022 |

September 30, 2023 |

September 30, 2022 |

|

|

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

|

Revenue |

|

$ |

34,160,834 |

|

|

$ |

36,171,345 |

|

|

$ |

104,823,710 |

|

|

$ |

85,317,860 |

|

|

Cost of revenue (exclusive of depreciation and amortization) |

|

|

23,680,247 |

|

|

|

34,250,541 |

|

|

|

76,622,912 |

|

|

|

78,572,421 |

|

|

General and administrative expenses |

|

|

3,389,015 |

|

|

|

2,933,204 |

|

|

|

10,201,663 |

|

|

|

9,655,529 |

|

|

Gain (loss) from operations |

|

$ |

7,091,572 |

|

|

$ |

(1,012,400 |

) |

|

$ |

17,999,135 |

|

|

$ |

(2,910,090 |

) |

|

Net gain (loss) to common stockholders |

|

|

7,084,301 |

|

|

|

(1,540,198 |

) |

|

|

17,596,634 |

|

|

|

(3,725,569 |

) |

|

Interest expense |

|

|

130,335 |

|

|

|

633,593 |

|

|

|

478,928 |

|

|

|

1,370,236 |

|

|

Depreciation and Amortization |

|

|

266,025 |

|

|

|

361,628 |

|

|

|

830,500 |

|

|

|

832,164 |

|

|

EBITDA |

|

$ |

7,480,661 |

|

|

|

(544,977 |

) |

|

$ |

18,906,062 |

|

|

|

(1,523,169 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

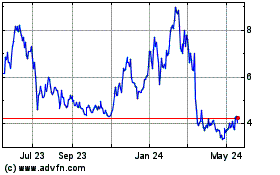

SurgePays (NASDAQ:SURG)

Historical Stock Chart

From Mar 2025 to Apr 2025

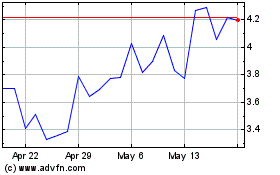

SurgePays (NASDAQ:SURG)

Historical Stock Chart

From Apr 2024 to Apr 2025