UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13E-3

RULE

13E-3 TRANSACTION STATEMENT UNDER SECTION 13(E)

OF

THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT

NO. 5)

Thoughtworks Holding, Inc.

(Name of the Issuer)

Thoughtworks

Holding, Inc.

Turing EquityCo II L.P.

Apax IX GP Co. Limited

Apax

IX EUR GP L.P. Inc.

Apax

IX EUR L.P.

Apax

IX - AIV EUR L.P.

Apax

IX EUR Co-Investment L.P.

Apax

IX USD GP L.P. Inc.

Apax

IX USD L.P.

Apax

IX - AIV USD L.P.

Apax

IX USD Co-Investment L.P.

Apax

XI GP Co. Limited

Apax

XI EUR GP L.P. Inc.

Apax

XI USD GP L.P. Inc.

Apax

XI (Guernsey) USD AIV L.P.

Apax

XI EUR L.P.

Apax

XI EUR 1 L.P.

Apax

XI EUR SCSp

Apax

XI USD L.P.

Apax

XI USD 2 L.P.

Apax

XI USD SCSp

Apax

XI GP SARL

Tasmania

Midco, LLC

Tasmania

Parent, Inc.

Tasmania

Holdco, Inc.

Tasmania

GP Co. Limited

Hobart

Equity Holdco, LP

Erin

Cummins

Rachel

Laycock

Ramona

Mateiu

Christopher

Murphy

Michael

Sutcliff

Sudhir

Tiwari

(Name

of Persons Filing Statement)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

88546E105

(CUSIP

Number of Class of Securities)

Thoughtworks

Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

Salim

Nathoo

Rohan

Haldea

c/o

Apax Partners LLP

1

Knightsbridge

London

SW1X

7LX

United

Kingdom

+44-20-7872-6300

|

|

Erin

Cummins

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

Rachel

Laycock

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000

|

|

Ramona

Mateiu

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000

|

|

Christopher

Murphy

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000

|

Michael

Sutcliff

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

Sudhir

Tiwari

c/o

Thoughtworks Holding, Inc.

200

East Randolph Street, 25th Floor

Chicago,

Illinois 60601

(312)

373-1000 |

|

|

(Name, Address, and Telephone Numbers of Person

Authorized to Receive Notices and Communications on Behalf of the Persons Filing Statement)

With

copies to:

Eduardo

Gallardo

Paul

Hastings LLP

200

Park Avenue

New

York, NY 10166

(212)

318-6000 |

Srinivas

S. Kaushik, P.C.

Joshua

N. Korff, P.C.

Kirkland

& Ellis LLP

601

Lexington Avenue

New

York, NY 10022

(212)

446-4800 |

This

statement is filed in connection with (check the appropriate box): ☐

| a. |

☒ |

The filing of solicitation

materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act

of 1934. |

| b. |

☐ |

The filing of a registration

statement under the Securities Act of 1933. |

| c. |

☐ |

A tender offer. |

| d. |

☐ |

None of the above. |

Check

the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies:

☐

Check

the following box if the filing is a final amendment reporting the results of the transaction: ☒

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of this transaction, passed upon

the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this transaction statement on

Schedule 13E-3. Any representation to the contrary is a criminal offense.

INTRODUCTION

This Amendment No. 5 (“Final

Amendment”) to the Transaction Statement on Schedule 13E-3 (as amended, the “Transaction Statement”) is being filed

with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), jointly by the following persons (each, a “Filing Person,” and collectively,

the “Filing Persons”): (1) Thoughtworks Holding, Inc., a Delaware corporation (“Thoughtworks” or the “Company”)

and the issuer of the Common Stock, par value $0.001 per share (the “Company Common Stock”) that is the subject of the Rule

13e-3 transaction; (2) Turing EquityCo II L.P., a Guernsey limited partnership; (3) Apax IX GP Co. Limited, a Guernsey limited company;

(4) Apax IX EUR GP L.P. Inc., a Guernsey incorporated limited partnership; (5) Apax IX EUR L.P., a Guernsey limited partnership (6) Apax

IX - AIV EUR L.P, a Delaware limited partnership.; (7) Apax IX EUR Co-Investment L.P., a Guernsey limited partnership; (8) Apax IX USD

GP L.P. Inc., a Guernsey incorporated limited partnership; (9) Apax IX USD L.P., a Guernsey limited partnership; (10) Apax IX - AIV USD

L.P., a Delaware limited partnership; (11) Apax IX USD Co-Investment L.P., a Guernsey limited partnership; (12) Apax XI GP Co. Limited,

a Guernsey limited company; (13) Apax XI EUR GP L.P. Inc., a Guernsey incorporated limited partnership; (14) Apax XI USD GP L.P. Inc.,

a Guernsey incorporated limited partnership; (15) Apax XI (Guernsey) USD AIV L.P., a Guernsey limited partnership; (16) Apax XI EUR L.P.,

a Guernsey limited partnership; (17) Apax XI EUR 1 L.P., a Guernsey limited partnership; (18) Apax XI EUR SCSp, a Luxembourg special

limited partnership; (19) Apax XI USD L.P., a Guernsey limited partnership; (20) Apax XI USD 2 L.P., a Guernsey limited partnership;

(21) Apax XI USD SCSp, a Luxembourg special limited partnership; (22) Apax XI GP SARL, a Luxembourg limited liability company; (23) Tasmania

Midco, LLC, a Delaware limited liability company; (24) Tasmania Parent, Inc., a Delaware corporation; (25) Tasmania Holdco, Inc., a Delaware

corporation; (26) Tasmania GP Co. Limited, a Guernsey limited company; (27) Hobart Equity Holdco, LP, a Guernsey limited partnership,

((2) through (27), the “Apax Filing Persons”); (28) Erin Cummins; (29) Rachel Laycock; (30) Ramona Mateiu; (31) Christopher

Murphy; (32) Michael Sutcliff; and (33) Sudhir Tiwari.

This Transaction Statement,

including this Final Amendment, relates to the Agreement and Plan of Merger, dated as of August 5, 2024 (as amended or otherwise modified

in accordance with its terms, the “Merger Agreement”), by and among the Company, Tasmania Midco, LLC, a Delaware limited

liability company (“Parent”) and Tasmania Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent

(“Merger Sub”). Pursuant to the Merger Agreement, on November 13, 2024, Merger Sub merged with and into the Company, with

the Company surviving such merger as a wholly owned subsidiary of Parent (the “Merger”). As a result of the Merger, Merger

Sub ceased to exist as an independent entity and, therefore, is no longer a filing person.

This Final Amendment is

being filed pursuant to Rule 13e-3(d)(3) under the Exchange Act to report the results of the Merger and to reflect certain updates as

detailed below. Except as otherwise set forth herein, the information set forth in the Transaction Statement remains unchanged and is

incorporated by reference into this Final Amendment. All information set forth in this Final Amendment should be read together with the

information contained in or incorporated by reference into the Transaction Statement.

On October 21, 2024, Thoughtworks

filed a notice of written consent and appraisal rights and definitive information statement (the “Information Statement”)

under Regulation 14C of the Exchange Act and the accompanying Amendment No. 4 to the Transaction Statement on Schedule 13E-3 with the

SEC. A copy of the Information Statement is attached hereto as Exhibit (a)(1). A copy of the Merger Agreement is attached to the Information

Statement as Annex A. Terms used but not defined in this Transaction Statement have the meanings assigned to them in the Information

Statement.

Pursuant to General Instruction

F to Schedule 13E-3, the information contained in the Information Statement, including all annexes thereto, is expressly incorporated

by reference herein in its entirety, and responses to each item herein are qualified in their entirety by the information contained in

the Information Statement and the annexes thereto. The cross-references below are being supplied pursuant to General Instruction G to

Schedule 13E-3 and show the location in the Information Statement of the information required to be included in response to the items

of Schedule 13E-3.

The information concerning

Thoughtworks contained in, or incorporated by reference into, this Transaction Statement and the Information Statement was supplied by

Thoughtworks. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference into, this Transaction

Statement and the Information Statement was supplied by such Filing Person. No Filing Person, including Thoughtworks, is responsible

for the accuracy of any information supplied by any other Filing Person.

| ITEM 15. |

ADDITIONAL INFORMATION |

(c) Other Material Information. Item 15(c) is hereby amended

and supplemented by adding the following language:

On November 13, 2024, the Company filed a

Certificate of Merger with the Secretary of State of the State of Delaware, pursuant to which the Merger became effective (such time,

the “Effective Time”). As a result of the Merger, the Company became a wholly owned subsidiary of Parent.

Upon the consummation of the Merger,

pursuant to the terms and subject to the conditions of the Merger Agreement, each share of Company Common Stock issued and

outstanding as of immediately prior to the Effective Time (other than such shares (a) owned directly or indirectly by Parent or

Merger Sub or (b) held by all holders of Company Common Stock who have neither voted in favor of the Merger nor consented thereto in

writing and who have properly and validly exercised (and not withdrawn) their statutory right of appraisal in respect of such shares

in accordance with the General Corporation Law of the State of Delaware) was cancelled and extinguished and automatically converted into the

right to receive cash in an amount equal to $4.40, without interest thereon (the “Per Share Price”), less any applicable

tax withholdings.

Pursuant to the Merger Agreement, except as

otherwise explicitly agreed in writing by the parties to the Merger Agreement or between Parent and the holder of the applicable Company

equity award, at the Effective Time, the Company’s outstanding equity awards were treated as follows:

| ● | Each

option to purchase shares of Company Common Stock (a “Company Option”) that was

vested, outstanding and unexercised immediately prior to the Effective Time (a “Vested

Company Option”) was cancelled, with the holder of such Company Option becoming entitled

to receive an amount in cash, less any applicable tax withholdings, equal to the product

obtained by multiplying (a) the excess of the Per Share Price over the per share exercise

price of such Vested Company Option, by (b) the number of shares of Company Common Stock

covered by such Vested Company Option immediately prior to the Effective Time. |

| ● | Each

outstanding Company Option that was not a Vested Company Option (an “Unvested Company

Option”) was cancelled and converted into the contingent right to receive an aggregate

amount in cash, without interest and less any applicable tax withholdings, equal to the product

obtained by multiplying (a) the excess, if any, of the Per Share Price over the per share

exercise price of such Unvested Company Option, by (b) the number of shares of Company Common

Stock covered by such Unvested Company Option immediately prior to the Effective Time, which

cash amount will generally remain subject to the same vesting schedule applicable to the

related Unvested Company Option, including any acceleration of vesting provisions. |

| ● | Each

outstanding Company Option with a per share exercise price equal to or greater than the Per

Share Price, whether vested or not, was cancelled for no consideration as of the Effective

Time. |

| ● | Each

award of Company restricted stock units (a “Company RSU Award”) that was vested

and outstanding immediately prior to the Effective Time but not yet settled, and each outstanding

and unvested Company RSU Award that was scheduled to vest on or before November 18, 2024

(the “November 2024 RSUs”), was cancelled, with the holder of such Company RSU

Award becoming entitled to receive an amount in cash, less any applicable tax withholdings,

equal to the product obtained by multiplying (a) the Per Share Price by (b) the number of

shares of Company Common Stock covered by such Company RSU Award. |

| ● | Each

Company RSU Award and each award of Company performance stock units (a “Company PSU

Award”), in each case, that was outstanding immediately prior to the Effective

Time and that did not vest upon the occurrence of the Effective Time by its terms or as set

forth above, was assumed by Parent and converted into the contingent right to receive an

amount in cash, without interest and less any applicable tax withholdings (a “Converted

Stock Unit Cash Award”), equal to the product obtained by multiplying (a) the Per Share

Price, by (b) the number of shares of Company Common Stock covered by such Company equity

award immediately prior to the Effective Time (with the number of shares of Company Common

Stock subject to any Company PSU Award determined assuming achievement of target-level performance).

After giving effect to the accelerated vesting of November 2024 RSUs described above, the

vesting conditions applicable to the Converted Stock Unit Cash Awards converted from Company

RSU Awards were modified so that 50% of such Converted Stock Unit Cash Awards (on an individual-by-individual

basis) will vest on each of the first and second anniversaries of the date of the closing

of the Merger. The Converted Stock Unit Cash Award will otherwise continue to vest on the

same schedule and conditions as applied to the applicable Company equity award and will otherwise

remain subject to the same terms and conditions as applied to the corresponding Company equity

award, as applicable, immediately prior to the Effective Time, including any acceleration

of vesting provisions and any performance-based vesting conditions (as may be adjusted or

modified by Parent in connection with the transactions), and including payment above target

for performance above the target performance-level consistent with the terms of the applicable

Company equity award (provided, that, each Converted Stock Unit Cash Award that was a Company

PSU Award subject to relative TSR vesting conditions will instead be treated as set forth

in the disclosure letter delivered by the Company to Parent and Merger Sub concurrently with

the execution and delivery of the Merger Agreement). |

In connection with the completion of the Merger, the Company notified

the Nasdaq Global Select Market (“Nasdaq”) that the Merger had been completed and requested that Nasdaq suspend trading of

the Company Common Stock on Nasdaq prior to the opening of trading on November 13, 2024. In addition, the Company requested that Nasdaq

file with the SEC a Notification of Removal from Listing and/or Registration under Section 12(b) of the Exchange Act on Form 25 to delist

and deregister the Company Common Stock from Nasdaq. After the effectiveness of the Form 25, the Company intends to file with the SEC

a Form 15 under the Exchange Act requesting the deregistration of the Company Common Stock under Section 12(g) of the Exchange Act and

suspension of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act.

In addition, on November 13, 2024, the Company

issued a press release announcing the closing of the Merger. The press release is attached as Exhibit 99.1 to the Form 8-K, filed concurrently

with the SEC, and is incorporated by reference herein as Exhibit (a)(iii) hereto.

The

following exhibits are filed herewith:

| Exhibit No. |

|

|

| (a)(i) |

|

Definitive

Information Statement of Thoughtworks Holding, Inc, incorporated herein by reference to the Information Statement. |

| (a)(ii) |

|

Notice of Written Consent and Appraisal Rights (included in the Information Statement and incorporated herein by reference). |

| (a)(iii) |

|

Press Release, dated November 13, 2024, (included as Exhibit 99.1 to Thoughtworks Holdings, Inc. Current Report on Form 8-K filed on November 13, 2024 and incorporated herein by reference). |

| (b)(i) |

|

Equity Commitment Letter, dated as of August 5, 2024 by and among Apax XI EUR L.P., Apax XI EUR 1 L.P., APAX XI EUR SCSp, Apax XI USD L.P., Apax XI USD 2 L.P., APAX XI USD SCSp and Tasmania Midco, LLC. |

| (c)(i) |

|

Opinion of Lazard Frères & Co. LLC, dated August 4, 2024 (included as Annex C to the Information Statement and incorporated herein by reference). |

| (c)(ii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 10, 2023. |

| (c)(iii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 26, 2023. |

| (c)(iv) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 30, 2023. |

| (c)(v) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 15, 2023. |

| (c)(vi) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 30, 2023. |

| (c)(vii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated April 26, 2024. |

| (c)(viii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 8, 2024. |

| (c)(ix) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 13, 2024. |

| (c)(x) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 16, 2024. |

| (c)(xi) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated May 30, 2024. |

| (c)(xii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 4, 2024. |

| (c)(xiii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 10, 2024 (regarding a discounted cash flow analysis). |

| (c)(xiv) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., June 10, 2024 (regarding sensitivity analyses). |

| (c)(xv) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 18, 2024. |

| (c)(xvi) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated June 19, 2024. |

| (c)(xvii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated July 1, 2024. |

| (c)(xviii) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated August 1, 2024. |

| (c)(xix) |

|

Confidential discussion materials prepared by Lazard Frères & Co. LLC for the Special Committee of the Board of Directors of Thoughtworks Holdings, Inc., dated August 4, 2024. |

| (c)(xx) |

|

Confidential discussion materials prepared by Goldman Sachs & Co. LLC for certain representatives of the Apax Filing Persons, dated March 21, 2024. |

| (c)(xxi) |

|

Confidential discussion materials prepared by Goldman Sachs & Co. LLC for certain representatives of the Apax Filing Persons, dated May 9, 2024. |

| (c)(xxii) |

|

Confidential discussion materials prepared by Goldman Sachs & Co. LLC for certain representatives of the Apax Filing Persons, dated May 14, 2024. |

| (d)(i) |

|

Agreement and Plan of Merger, dated August 5, 2024, by and among, Tasmania Midco, LLC, Tasmania Merger Sub, Inc. and Thoughtworks Holding, Inc. (included as Annex A to the Information Statement and incorporated herein by reference). |

| (d)(ii) |

|

Turing Rollover Agreement (included as Annex E to the Information Statement and incorporated herein by reference). |

| (d)(iii)* |

|

Form of Rollover and Reinvestment Agreement (included as Annex F to the Information Statement and incorporated herein by reference). |

| (d)(iv) |

|

Amendment to Thoughtworks Inc. Employment Agreement, dated as of July 31, 2024, by and between Thoughtworks Inc. and Michael R. Sutcliff. |

| (d)(v)* |

|

Investment Agreement, dated as of August 5, 2024, by and between Tasmania Parent, Inc. and Michael Sutcliff. |

| (d)(vi) |

|

Director Nomination Agreement, dated as of September 17, 2021, by and among the Company and the other signatories party thereto, incorporated herein by reference to Exhibit 10.10 in the quarterly report on Form 10-Q of Thoughtworks Holding, Inc. filed with the SEC on November 15, 2021. |

| (d)(vii) |

|

Thoughtworks Inc. Employment Agreement, dated as of May 2, 2024, by and between Thoughtworks Inc. and Michael R. Sutcliff, incorporated herein by reference to Exhibit 10.1 in the quarterly report on Form 10-Q of Thoughtworks Holding, Inc. filed with the SEC on August 6, 2024. |

| (f) |

|

Section 262 of the General Corporation Law of the State of Delaware (included as Annex G to the Information Statement and incorporated herein by reference). |

| (g) |

|

None. |

| 107 |

|

Filing Fee Table. |

| * | Schedule

or exhibit omitted pursuant to Item 1016 of Regulation M-A. The Company agrees to furnish supplementally a copy of any omitted schedule

or exhibit to the SEC upon request. |

SIGNATURES

After

due inquiry and to the best of each of the undersigned’s knowledge and belief, each of the undersigned certifies that the information

set forth in this statement is true, complete and correct.

Dated as of November 13, 2024

| THOUGHTWORKS

HOLDING, INC. |

|

| |

|

|

|

| By: |

/s/

Michael Sutcliff |

|

| |

Name: |

Michael

Sutcliff |

|

| |

Title: |

Chief

Executive Officer |

|

| |

|

|

|

| TURING

EQUITYCO II L.P. |

|

| |

|

|

|

| By: |

Turing

GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

| By: |

/s/

Mark Babbe |

|

| |

Name: |

Mark

Babbe |

|

| |

Title: |

Director |

|

| APAX

IX GP CO. LIMITED |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/

Victoria Merrien |

|

|

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

| APAX

IX EUR GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/

Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

[Signature Page to SC

13E-3]

| APAX

IX EUR L.P. |

|

| |

|

|

|

| By: |

Apax

IX EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/

Victoria Merrien |

|

|

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory

for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

| APAX

IX – AIV EUR L.P. |

|

| |

|

|

|

| By: |

Apax

IX EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/

Victoria Merrien |

|

|

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised Signatory

for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX

IX EUR CO-INVESTMENT L.P. |

|

| |

|

|

|

| By: |

Apax

IX EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

| APAX

IX USD GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

| APAX

IX USD L.P. |

|

| |

|

|

|

| By: |

Apax

IX USD GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX

IX – AIV USD L.P. |

|

| |

|

|

|

| By: |

Apax

IX USD GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy Latham |

|

| |

Title: |

Director |

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

| APAX

IX USD CO-INVESTMENT L.P. |

|

| |

|

|

|

| By: |

Apax

IX USD GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

IX GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Jeremy Latham |

|

| |

Name: |

Jeremy

Latham |

|

| |

Title: |

Director |

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax IX GP Co. Limited |

|

| APAX

XI GP CO. LIMITED |

|

| |

|

|

|

| By: |

/s/ Simon Cresswell |

|

| |

Name: |

Simon

Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX

XI EUR GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

| Its: |

General

Partner |

| |

|

|

|

| By: |

/s/

Simon Cresswell |

|

| |

Name: |

Simon Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners

Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX

XI USD GP L.P. INC. |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

| Its: |

General

Partner |

| |

|

|

|

| By: |

/s/

Simon Cresswell |

|

| |

Name: |

Simon Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

|

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners

Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX

XI (GUERNSEY) USD AIV L.P. |

|

| |

|

|

|

| By: |

Apax

XI USD GP L.P. Inc. |

| Its: |

General

Partner |

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

| Its: |

General

Partner |

| |

|

|

|

| By: |

/s/

Simon Cresswell |

|

| |

Name: |

Simon Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised Signatory for and on behalf of Apax Partners

Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX

XI EUR L.P. |

|

| |

|

|

|

| By: |

Apax

XI EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Simon Cresswell |

|

| |

Name: |

Simon

Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX

XI EUR 1 L.P. |

|

| |

|

|

|

| By: |

Apax

XI EUR GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/

Simon Cresswell |

|

| |

Name: |

Simon

Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/

Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

| APAX

XI EUR SCSP |

|

| |

|

|

|

| By: |

Apax

XI GP SARL |

|

| Its: |

Managing

General Partner |

|

| |

|

|

|

| By: |

/s/ Geoffrey Limpach |

|

| |

Name: |

Geoffrey

Limpach |

|

| |

Title: |

Manager |

|

| |

|

|

|

| By: |

/s/ Pedro Gouveia Fernandes

Das Neves |

|

| |

Name: |

Pedro Gouveia Fernandes Das Neves |

|

| |

Title: |

Manager |

|

[Signature

Page to SC 13E-3]

| APAX

XI USD L.P. |

|

| |

|

|

|

| By: |

Apax

XI USD GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| By: |

Apax

XI GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Simon Cresswell |

|

| |

Name: |

Simon Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

| |

|

|

|

| APAX

XI USD 2 L.P. |

|

| |

|

|

|

| By: |

Apax

XI USD GP L.P. Inc. |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

Apax

XI GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Simon Cresswell |

|

| |

Name: |

Simon

Cresswell |

|

| |

Title: |

Director |

|

| |

|

|

|

| By: |

/s/ Victoria Merrien |

|

| |

Name: |

Victoria

Merrien |

|

| |

Title: |

Authorised

Signatory for and on behalf of Apax Partners Guernsey Limited as Company Secretary to Apax XI GP Co. Limited |

|

[Signature

Page to SC 13E-3]

| APAX

XI USD SCSP |

|

| |

|

|

|

| By: |

Apax

XI GP SARL |

|

| Its: |

Managing

General Partner |

|

| |

|

|

|

| By: |

/s/ Geoffrey Limpach |

|

| |

Name: |

Geoffrey Limpach |

|

| |

Title: |

Manager |

|

| |

|

|

|

| By: |

/s/ Pedro Gouveia Fernandes

Das Neves |

|

| |

Name: |

Pedro Gouveia Fernandes Das Neves |

|

| |

Title: |

Manager |

|

| |

|

|

|

| Apax

XI GP SARL |

|

| |

|

|

|

| By: |

/s/ Geoffrey Limpach |

|

| |

Name: |

Geoffrey Limpach |

|

| |

Title: |

Manager |

|

| |

|

|

|

| By: |

/s/ Pedro Gouveia Fernandes

Das Neves |

|

| |

Name: |

Pedro Gouveia Fernandes Das Neves |

|

| |

Title: |

Manager |

|

| |

|

|

|

| TASMANIA

MIDCO, LLC |

|

| |

|

|

|

| By: |

/s/ Marc Henckel |

|

| |

Name: |

Marc Henckel |

|

| |

Title: |

President and Secretary |

|

| |

|

|

|

| TASMANIA

HOLDCO, INC. |

|

| |

|

|

|

| By: |

/s/ Marc Henckel |

|

| |

Name: |

Marc Henckel |

|

| |

Title: |

President |

|

[Signature

Page to SC 13E-3]

| TASMANIA

PARENT, INC. |

|

| |

|

|

|

| By: |

/s/ Marc Henckel |

|

| |

Name: |

Marc Henckel |

|

| |

Title: |

Vice President and Secretary |

|

| TASMANIA

GP CO. LIMITED |

|

| |

|

|

|

| By: |

/s/ Mark Babbe |

|

| |

Name: |

Mark Babbe |

|

| |

Title: |

Director |

|

| |

|

|

|

| HOBART

EQUITY HOLDCO, LP |

|

| |

|

|

|

| By: |

Tasmania

GP Co. Limited |

|

| Its: |

General

Partner |

|

| |

|

|

|

| By: |

/s/ Mark Babbe |

|

| |

Name: |

Mark Babbe |

|

| |

Title: |

Director |

|

| ERIN

CUMMINS |

|

| |

|

|

| /s/

Erin Cummins |

|

| Name: |

Erin

Cummins |

|

| |

|

|

| RACHEL

LAYCOCK |

|

| |

|

|

| /s/

Rachel Laycock |

|

| Name: |

Rachel

Laycock |

|

| |

|

|

| RAMONA

MATEIU |

|

| |

|

|

| /s/

Ramona Mateiu |

|

| Name: |

Ramona

Mateiu |

|

| |

|

|

| CHRISTOPHER

MURPHY |

|

| |

|

|

| /s/

Christopher Murphy |

|

| Name: |

Christopher

Murphy |

|

| |

|

|

| MICHAEL

SUTCLIFF |

|

| |

|

|

| /s/

Michael Sutcliff |

|

| Name: |

Michael

Sutcliff |

|

| |

|

|

| SUDHIR

TIWARI |

|

| |

|

|

| /s/

Sudhir Tiwari |

|

| Name: |

Sudhir

Tiwari |

|

[Signature

Page to SC 13E-3]

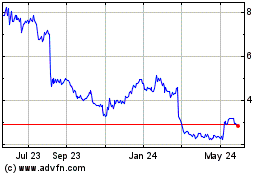

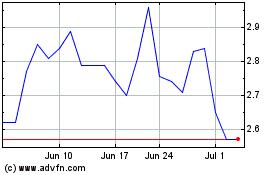

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Mar 2024 to Mar 2025