Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

16 November 2024 - 8:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Thoughtworks Holding, Inc.

(Name of Issuer)

Common Stock, $0.001 par value

(Title of Class of Securities)

88546E105

(CUSIP Number)

Ramona Mateiu

c/o Thoughtworks Holding, Inc.

200 East Randolph Street, 25th Floor

Chicago, Illinois 60601

Tel. (312) 373-1000

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

November 13, 2024

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on

Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-l(e),

240.13d-l(f) or 240.13d-l(g), check the following box. ☐

| Note: | Schedules filed in paper format shall include a signed original and five copies of the schedule, including all

exhibits. See §240 13d-7 for other parties to whom copies are to be sent. |

| 1 | The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures

provided in a prior cover page. |

| * | The information required on the remainder of this cover page shall not be deemed to be “filed” for

the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section

of the Act but shall be subject to all other provisions of the Act (however, see the Notes). |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Christopher Murphy |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Australia and United Kingdom

|

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.0% |

| 14. |

Type of Reporting Person (See Instructions)

IN |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Erin Cummins |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

United States |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.0% |

| 14. |

Type of Reporting Person (See Instructions)

IN |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Sudhir Tiwari |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

India |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.0% |

| 14. |

Type of Reporting Person (See Instructions)

IN |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Ramona Mateiu |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

United States |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0 |

| 14. |

Type of Reporting Person (See Instructions)

IN |

CUSIP No. 88546E105

| 1. |

Names of Reporting Persons

Rachel Laycock |

| 2. |

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☐ (b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if disclosure of legal proceedings is required pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

United Kingdom |

| Number of Shares Beneficially Owned By Each Reporting Person With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

0 |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

0 |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

0.0% |

| 14. |

Type of Reporting Person (See Instructions)

IN |

Explanatory Note

This Amendment No. 2 amends and supplements the statement on Schedule

13D filed by Christopher Murphy, Erin Cummins, Sudhir Tiwari, Ramona Mateiu and Rachel Laycock (each, a “Reporting Person”

and collectively, the “Reporting Persons”) with the Securities and Exchange Commission on August 12, 2024 and amended

on September 3, 2024 (as amended, the “Schedule 13D”) relating to shares of Common Stock, $0.001 par value (“Common

Stock”) of Thoughtworks Holding, Inc., a Delaware corporation (the “Company”). Capitalized terms used but

not defined herein shall have the meaning ascribed thereto in the Schedule 13D.

Item 4. Purpose of Transaction

The response to Item 4 of the

Schedule 13D is hereby amended and supplemented as follows:

Merger Closing

On November 13, 2024, at the effective

time of the Merger (the “Effective Time”), each share of Common Stock that was issued and outstanding as of immediately

prior to the Effective Time (other than such shares (a) owned directly or indirectly by Parent or Merger Sub or (b) held by any holders

of shares of Common Stock who have neither voted in favor of the Merger nor consented thereto in writing and who have properly and validly

exercised (and not withdrawn) their statutory right of appraisal in respect of such shares in accordance with the General Corporation

Law of the State of Delaware) was cancelled and extinguished and automatically converted into the right to receive the Per Share Price.

Additionally, on November 13, 2024, prior to the Effective Time (the “Exchange Time”), all shares of Common Stock

held by the Significant Company Stockholder and certain shares of Common Stock held by the Reporting Persons (each, a “Rollover

Share”) were contributed to Topco in exchange for a number of newly issued shares of Topco having an aggregate value equal to

the Per Share Price multiplied by the aggregate number of Rollover Shares.

The Common Stock was suspended from

trading on the Nasdaq Global Select Market (“Nasdaq”) prior to the opening of trading on November 13, 2024. In addition,

Nasdaq has filed with the SEC a Notification of Removal from Listing and/or Registration under Section 12(b) of the Act on Form 25 to

delist and deregister the Company Common Stock from Nasdaq. As a result, the Common Stock will no longer be listed on Nasdaq.

The foregoing descriptions of

the Merger Agreement and the Rollover Shares of the Reporting Persons, and the transactions contemplated thereby, are qualified in their

entirety by reference to the Merger Agreement and the form of the Rollover Agreements of the Reporting Persons, copies of which were

filed as Exhibit 1 and Exhibit 2, respectively, to Amendment No. 1 to this Schedule 13D filed by the Reporting Persons

on September 3, 2024 and are incorporated by reference herein.

Item 5. Interest in Securities of the Issuer

The responses to Sections (a)-(b) and (e) of Item

5 of the Schedule 13D are hereby amended and restated in their entirety as follows:

(a)-(b) The information contained on

the cover pages of this Schedule 13D and the information set forth in Item 4 of this Schedule 13D are incorporated herein by reference.

As a result of the closing of the Merger

as described in Item 4, the Reporting Persons ceased to beneficially own any shares of Common Stock or to have voting or dispositive

power with respect to any shares of Common Stock. In connection with the closing of the Merger, to the extent the Reporting Persons,

together with other securityholders of the Company, previously comprised a “group” within the meaning of Section 13(d)(3)

of the Act, any such group dissolved.

(e) The

Reporting Persons ceased to be the beneficial owners of more than five percent of the Common Stock on November 13, 2024.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 15, 2024

| |

By: |

/s/ Christopher Murphy |

| |

Name: |

Christopher Murphy |

| |

By: |

/s/ Erin Cummins |

| |

Name: |

Erin Cummins |

| |

By: |

/s/ Sudhir Tiwari |

| |

Name: |

Sudhir Tiwari |

| |

By: |

/s/ Ramona Mateiu |

| |

Name: |

Ramona Mateiu |

| |

By: |

/s/ Rachel Laycock |

| |

Name: |

Rachel Laycock |

9

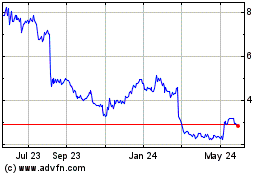

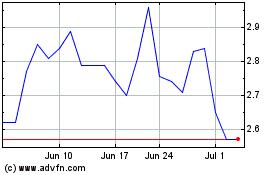

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Thoughtworks (NASDAQ:TWKS)

Historical Stock Chart

From Mar 2024 to Mar 2025