Pay vs Performance Disclosure

|

12 Months Ended |

15 Months Ended |

33 Months Ended |

|

Dec. 26, 2023

USD ($)

$ / shares

|

Dec. 27, 2022

USD ($)

$ / shares

|

Dec. 28, 2021

USD ($)

$ / shares

|

Dec. 29, 2020

USD ($)

$ / shares

|

Mar. 17, 2021 |

Dec. 26, 2023 |

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

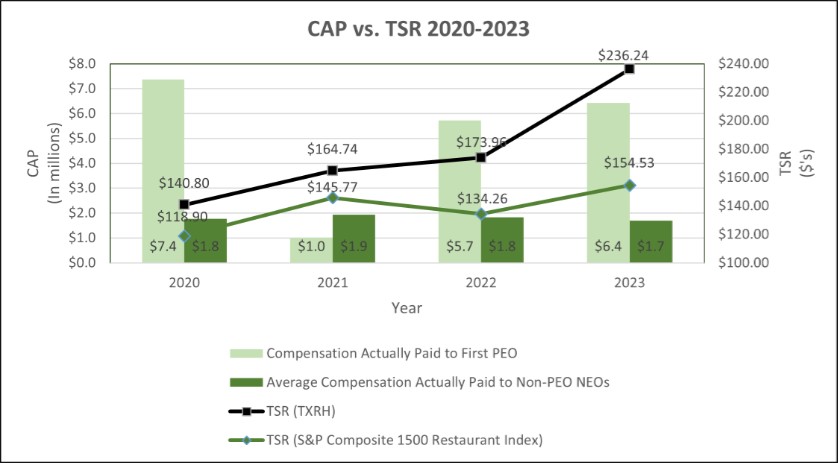

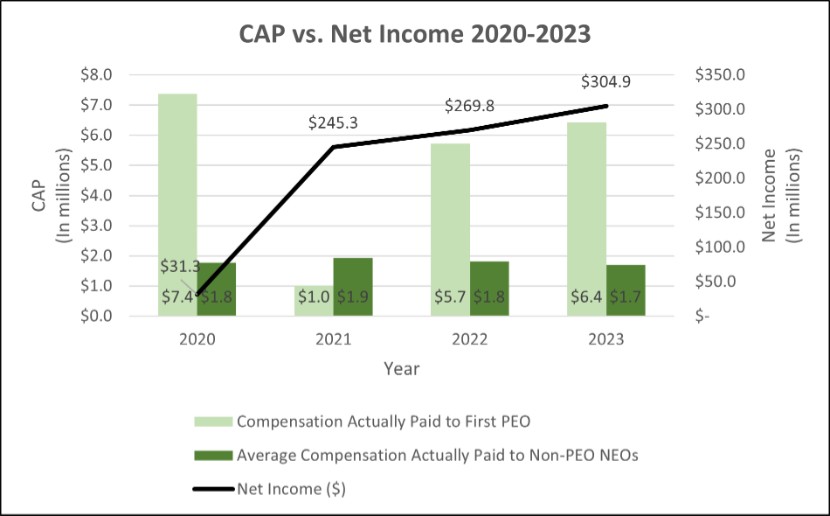

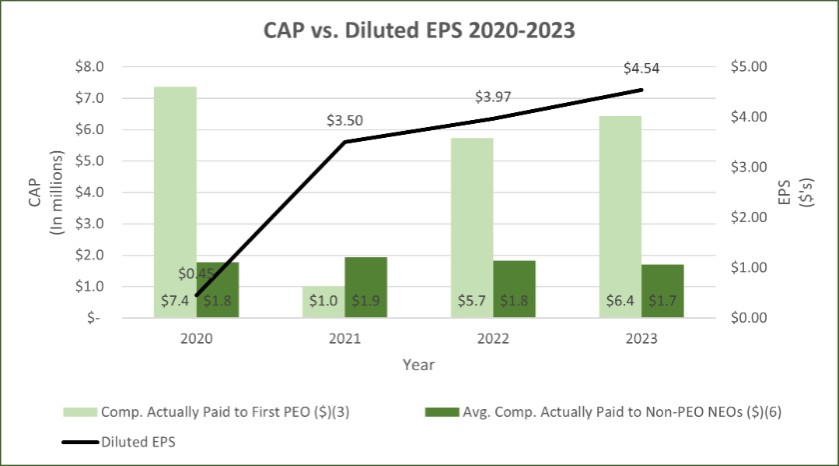

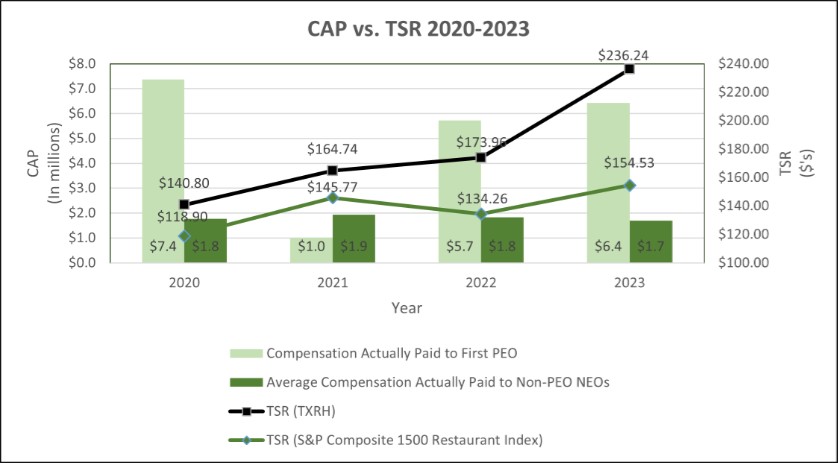

| | | | | | | | | | | Pay Versus Performance Table | | | | | | | | Value of Initial Fixed $100 Investment Based on: | | | Year | SCT Total Comp First PEO | SCT Total Comp for Second PEO | CAP to First PEO | CAP to Second PEO | Avg. SCT Total Comp for Non-PEO NEOs | Avg. CAP to Non-PEO NEOs | TSR | Peer Group TSR (S&P Index) | Net Income (in Millions) | Diluted EPS | | ($)(1) | ($)(2) | ($)(3) | ($)(4) | ($)(5) | ($)(6) | ($)(7) | ($)(8) | ($) | ($) | 2023 | 5,347,527 | N/A | 6,435,377 | N/A | 1,746,269 | 1,697,782 | 236.24 | 154.53 | 304.9 | 4.54 | 2022 | 4,421,989 | N/A | 5,725,465 | N/A | 1,662,319 | 1,823,561 | 173.96 | 134.26 | 269.8 | 3.97 | 2021 | 3,769,765 | 4,986,164 | 3,801,740 | (2,793,754) | 2,634,509 | 1,934,435 | 164.74 | 145.77 | 245.3 | 3.50 | 2020 | N/A | 3,620,939 | N/A | 7,366,061 | 1,207,262 | 1,773,284 | 140.80 | 118.90 | 31.3 | 0.45 |

(1) | For the purposes of this table, the First Principal Executive Officer refers to Gerald L. Morgan. On March 18, 2021, Mr. Morgan was named Chief Executive Officer of the Company following W. Kent Taylor’s passing. The amounts described in this column relate to amounts disclosed in the Summary Compensation Table of this proxy statement. Additionally, for the purposes of the 2021 fiscal year, the amounts also reflect compensation received by Mr. Morgan for positions within the Company before assuming the role of Chief Executive Officer on March 18, 2021. |

(2) | For the purposes of this table, the Second Principal Executive Officer refers to W. Kent Taylor. Mr. Taylor served as the Chief Executive Officer of the Company until his passing on March 18, 2021. The amounts described in this column relate to amounts disclosed in the Summary Compensation Table of this proxy statement. |

(3) | The dollar amounts reported in the “CAP to First PEO” column have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the First PEO. These amounts reflect the amount set forth in the “Total” column of the “Summary Compensation Table” for each fiscal year presented, with certain adjustments as described in the table below, in accordance with the requirements of Item 402(v) of Regulation S-K. Amounts in the below reconciliation table may not sum to total due to rounding: |

| | | | | | | | | CALCULATION OF FIRST PEO CAP | Year | SCT Total Comp | SCT Stock Awards | Value of Unvested Equity Awards Granted during CFY | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY | Value of Equity Awards Granted and Vested in CFY | Change in Value of Granted in Prior Years and Vested in CFY | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY | CAP to First PEO($) | | ($)(a) | ($)(b) | ($)(c) | ($)(d) | ($)(e) | ($)(f) | ($)(g)(i) | (a)-(b)+(c)+(d)+(e)+(f)-(g) | 2023 | 5,347,527 | 2,599,856 | 3,423,848 | -- | -- | 263,858 | -- | 6,435,377 | 2022 | 4,421,989 | 2,201,368 | 2,297,748 | -- | 4,996 | 1,202,100 | -- | 5,725,465 | 2021 | 3,769,765 | 2,394,513 | 2,352,525 | -- | -- | 73,963 | -- | 3,801,740 | 2020 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| (i) | For the purposes of determining the amount that should be included in column (g) of each footnote throughout the Company’s Pay Versus Performance disclosure, the Company has used (i) the value of the difference in the target amount of performance based restricted stock units that an applicable officer was granted for a particular fiscal year and the amount of performance based restricted stock units that actually vested to the extent the same is less than such target amount, and (ii) the value of the difference in the target amount of “retention” restricted stock units that an applicable officer was granted and the amount of “retention” restricted stock units that actually vested (as and if applicable). |

(4) | | | | | | | | | CALCULATION OF SECOND PEO CAP | Year | SCT Total Comp | SCT Stock Awards | Value of Unvested Equity Awards Granted during CFY | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY | Value of Equity Awards Granted and Vested in CFY | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY | CAP to Second PEO($) | | ($)(a) | ($)(b) | ($)(c) | ($)(d) | ($)(e) | ($)(f) | ($)(g) | (a)-(b)+(c)+(d)+(e)+(f)-(g) | 2023 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 2022 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 2021 | 4,986,164 | 4,753,200 | -- | -- | 1,909,885 | 880,222 | 5,816,825 | (2,793,754) | 2020 | 3,620,939 | 3,358,800 | 4,737,600 | 1,698,000 | -- | 668,322 | -- | 7,366,061 |

(5) | For the purposes of the 2020 fiscal year, the Non-Principal Executive Officers include Tonya R. Robinson, Doug W. Thompson, S. Chris Jacobsen, and Gerald L. Morgan. |

For the purposes of the 2021 fiscal year, the Non-Principal Executive Officers include Tonya R. Robinson, Doug W. Thompson, S. Chris Jacobsen, Christopher C. Colson, Hernan E. Mujica and Regina A. Tobin. For the purposes of the 2022 fiscal year, the Non-Principal Executive Officers include Tonya R. Robinson, S. Chris Jacobsen, Christopher C. Colson, Hernan E. Mujica and Regina A. Tobin. For the purposes of the 2023 fiscal year, the Non-Principal Executive Officers include Regina A. Tobin, D. Christopher Monroe, Keith V. Humpich, Tonya R. Robinson, Travis C. Doster, S. Chris Jacobsen, D. Christopher Monroe, Christopher C. Colson, and Hernan E. Mujica. (6) | | | | | | | | | CALCULATION OF 2020 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($) (c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Robinson | 920,732 | 671,760 | 947,520 | 226,400 | --- | (3,400) | --- | 1,419,492 | Thompson | 1,818,256 | 1,679,400 | 2,368,800 | 283,000 | --- | 265,278 | --- | 3,055,934 | Jacobsen | 924,889 | 671,760 | 947,520 | 226,400 | --- | 92,317 | --- | 1,519,366 | Morgan | 1,165,170 | 291,726 | 394,800 | --- | --- | (169,900) | --- | 1,098,344 | Average | 1,207,262 | 828,662 | 1,164,660 | 183,950 | --- | 46,074 | --- | 1,773,284 |

| | | | | | | | | CALCULATION OF 2021 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($) (c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Robinson | 1,788,492 | 998,855 | 1,120,250 | --- | --- | 5,234 | 147,497 | 1,767,624 | Thompson | 7,556,722 | 2,376,600 | --- | --- | --- | 6,192 | 1,475,289 | 3,711,025 | Jacobsen | 1,712,853 | 950,640 | 1,075,440 | --- | --- | 4,020 | 516,319 | 1,325,354 | Tobin | 1,395,079 | 822,315 | 761,770 | --- | --- | 56,190 | --- | 1,390,724 | Colson | 1,589,173 | 945,109 | 873,795 | --- | --- | 66,566 | --- | 1,584,425 | Mujica | 1,764,732 | 1,142,043 | 1,064,238 | --- | --- | 140,529 | --- | 1,827,456 | Average | 2,634,509 | 1,205,927 | 815,916 | --- | --- | 46,455 | 356,518 | 1,934,435 |

| | | | | | | | | CALCULATION OF 2022 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($) (c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Robinson | 1,755,123 | 893,178 | 932,283 | --- | --- | 205,623 | --- | 1,999,851 | Jacobsen | 1,787,674 | 793,936 | 828,696 | --- | --- | 403,536 | --- | 2,225,970 | Tobin | 1,788,904 | 795,166 | 913,449 | --- | --- | (11,380) | --- | 1,895,807 | Colson | 1,489,948 | 496,210 | 517,935 | --- | --- | (6,458) | --- | 1,505,215 | Mujica | 1,489,948 | 496,210 | 517,935 | --- | --- | (20,710) | --- | 1,490,963 | Average | 1,662,319 | 694,940 | 742,060 | --- | --- | 114,122 | --- | 1,823,561 |

| | | | | | | | | CALCULATION OF 2023 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($)(c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Tobin | 2,400,016 | 897,792 | 1,182,336 | --- | --- | 90,021 | --- | 2,774,581 | Monroe | 1,398,938 | 404,484 | 455,692 | --- | --- | --- | --- | 1,450,146 | Humpich | 1,148,979 | 364,629 | 421,946 | --- | --- | 48,696 | --- | 1,254,992 | Robinson | 2,021,333 | --- | --- | --- | --- | --- | 932,283 | 1,089,050 | Doster | 1,518,004 | 860,836 | 1,014,838 | --- | --- | 70,954 | --- | 1,742,960 | Jacobsen | 1,827,450 | 804,272 | --- | --- | --- | 95,188 | --- | 1,118,366 | Colson | 1,826,340 | 794,920 | 1,046,860 | --- | --- | (3,575) | --- | 2,074,705 | Mujica | 1,829,094 | 794,920 | 1,046,860 | --- | --- | (3,575) | --- | 2,077,459 | Average | 1,746,269 | 615,232 | 646,067 | --- | --- | 37,214 | 116,535 | 1,697,782 |

(7) | For the purposes of calculating the Company’s total shareholder return (“TSR”), the Company’s TSR increased 40.8% in fiscal year 2020, increased 17.0% in fiscal year 2021, increased 5.6% in fiscal year 2022, and increased 35.8% in fiscal year 2023. |

(8) | As more particularly shown in the Company’s Annual Report on Form 10-K for the year ended December 28, 2021, we presented a performance graph by comparing our cumulative TSR against the Russell 3000 Restaurant Index. In connection with our Annual Report on Form 10-K for the year ended December 28, 2021, December 27, 2022 and December 26, 2023, the Company presented a performance graph by comparing our cumulative TSR against the S&P Composite 1500 Restaurant Sub-Index (the “S&P Index”). For the purposes of the table above, we have shown the TSR for the Company’s peer companies using the S&P Index. In furtherance of the foregoing, using the S&P Composite 1500 Restaurant Sub-Index, the TSR of the Company’s peer companies increased 18.9% in fiscal year 2020, increased 22.6% in fiscal year 2021, decreased 7.9% in fiscal year 2022, and increased 15.1% in fiscal year 2023. |

|

|

|

|

|

|

| Company Selected Measure Name |

Diluted EPS

|

|

|

|

|

|

| Named Executive Officers, Footnote |

|

|

|

|

(2) | For the purposes of this table, the Second Principal Executive Officer refers to W. Kent Taylor. Mr. Taylor served as the Chief Executive Officer of the Company until his passing on March 18, 2021. The amounts described in this column relate to amounts disclosed in the Summary Compensation Table of this proxy statement. |

|

(1) | For the purposes of this table, the First Principal Executive Officer refers to Gerald L. Morgan. On March 18, 2021, Mr. Morgan was named Chief Executive Officer of the Company following W. Kent Taylor’s passing. The amounts described in this column relate to amounts disclosed in the Summary Compensation Table of this proxy statement. Additionally, for the purposes of the 2021 fiscal year, the amounts also reflect compensation received by Mr. Morgan for positions within the Company before assuming the role of Chief Executive Officer on March 18, 2021. |

|

| Peer Group Issuers, Footnote |

(8) | As more particularly shown in the Company’s Annual Report on Form 10-K for the year ended December 28, 2021, we presented a performance graph by comparing our cumulative TSR against the Russell 3000 Restaurant Index. In connection with our Annual Report on Form 10-K for the year ended December 28, 2021, December 27, 2022 and December 26, 2023, the Company presented a performance graph by comparing our cumulative TSR against the S&P Composite 1500 Restaurant Sub-Index (the “S&P Index”). For the purposes of the table above, we have shown the TSR for the Company’s peer companies using the S&P Index. In furtherance of the foregoing, using the S&P Composite 1500 Restaurant Sub-Index, the TSR of the Company’s peer companies increased 18.9% in fiscal year 2020, increased 22.6% in fiscal year 2021, decreased 7.9% in fiscal year 2022, and increased 15.1% in fiscal year 2023. |

|

|

|

|

|

|

| Adjustment To PEO Compensation, Footnote |

(3) | The dollar amounts reported in the “CAP to First PEO” column have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the First PEO. These amounts reflect the amount set forth in the “Total” column of the “Summary Compensation Table” for each fiscal year presented, with certain adjustments as described in the table below, in accordance with the requirements of Item 402(v) of Regulation S-K. Amounts in the below reconciliation table may not sum to total due to rounding: |

| | | | | | | | | CALCULATION OF FIRST PEO CAP | Year | SCT Total Comp | SCT Stock Awards | Value of Unvested Equity Awards Granted during CFY | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY | Value of Equity Awards Granted and Vested in CFY | Change in Value of Granted in Prior Years and Vested in CFY | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY | CAP to First PEO($) | | ($)(a) | ($)(b) | ($)(c) | ($)(d) | ($)(e) | ($)(f) | ($)(g)(i) | (a)-(b)+(c)+(d)+(e)+(f)-(g) | 2023 | 5,347,527 | 2,599,856 | 3,423,848 | -- | -- | 263,858 | -- | 6,435,377 | 2022 | 4,421,989 | 2,201,368 | 2,297,748 | -- | 4,996 | 1,202,100 | -- | 5,725,465 | 2021 | 3,769,765 | 2,394,513 | 2,352,525 | -- | -- | 73,963 | -- | 3,801,740 | 2020 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| (i) | For the purposes of determining the amount that should be included in column (g) of each footnote throughout the Company’s Pay Versus Performance disclosure, the Company has used (i) the value of the difference in the target amount of performance based restricted stock units that an applicable officer was granted for a particular fiscal year and the amount of performance based restricted stock units that actually vested to the extent the same is less than such target amount, and (ii) the value of the difference in the target amount of “retention” restricted stock units that an applicable officer was granted and the amount of “retention” restricted stock units that actually vested (as and if applicable). |

| | | | | | | | | CALCULATION OF SECOND PEO CAP | Year | SCT Total Comp | SCT Stock Awards | Value of Unvested Equity Awards Granted during CFY | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY | Value of Equity Awards Granted and Vested in CFY | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY | CAP to Second PEO($) | | ($)(a) | ($)(b) | ($)(c) | ($)(d) | ($)(e) | ($)(f) | ($)(g) | (a)-(b)+(c)+(d)+(e)+(f)-(g) | 2023 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 2022 | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 2021 | 4,986,164 | 4,753,200 | -- | -- | 1,909,885 | 880,222 | 5,816,825 | (2,793,754) | 2020 | 3,620,939 | 3,358,800 | 4,737,600 | 1,698,000 | -- | 668,322 | -- | 7,366,061 |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,746,269

|

$ 1,662,319

|

$ 2,634,509

|

$ 1,207,262

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 1,697,782

|

1,823,561

|

1,934,435

|

1,773,284

|

|

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | CALCULATION OF 2020 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($) (c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Robinson | 920,732 | 671,760 | 947,520 | 226,400 | --- | (3,400) | --- | 1,419,492 | Thompson | 1,818,256 | 1,679,400 | 2,368,800 | 283,000 | --- | 265,278 | --- | 3,055,934 | Jacobsen | 924,889 | 671,760 | 947,520 | 226,400 | --- | 92,317 | --- | 1,519,366 | Morgan | 1,165,170 | 291,726 | 394,800 | --- | --- | (169,900) | --- | 1,098,344 | Average | 1,207,262 | 828,662 | 1,164,660 | 183,950 | --- | 46,074 | --- | 1,773,284 |

| | | | | | | | | CALCULATION OF 2021 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($) (c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Robinson | 1,788,492 | 998,855 | 1,120,250 | --- | --- | 5,234 | 147,497 | 1,767,624 | Thompson | 7,556,722 | 2,376,600 | --- | --- | --- | 6,192 | 1,475,289 | 3,711,025 | Jacobsen | 1,712,853 | 950,640 | 1,075,440 | --- | --- | 4,020 | 516,319 | 1,325,354 | Tobin | 1,395,079 | 822,315 | 761,770 | --- | --- | 56,190 | --- | 1,390,724 | Colson | 1,589,173 | 945,109 | 873,795 | --- | --- | 66,566 | --- | 1,584,425 | Mujica | 1,764,732 | 1,142,043 | 1,064,238 | --- | --- | 140,529 | --- | 1,827,456 | Average | 2,634,509 | 1,205,927 | 815,916 | --- | --- | 46,455 | 356,518 | 1,934,435 |

| | | | | | | | | CALCULATION OF 2022 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($) (c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Robinson | 1,755,123 | 893,178 | 932,283 | --- | --- | 205,623 | --- | 1,999,851 | Jacobsen | 1,787,674 | 793,936 | 828,696 | --- | --- | 403,536 | --- | 2,225,970 | Tobin | 1,788,904 | 795,166 | 913,449 | --- | --- | (11,380) | --- | 1,895,807 | Colson | 1,489,948 | 496,210 | 517,935 | --- | --- | (6,458) | --- | 1,505,215 | Mujica | 1,489,948 | 496,210 | 517,935 | --- | --- | (20,710) | --- | 1,490,963 | Average | 1,662,319 | 694,940 | 742,060 | --- | --- | 114,122 | --- | 1,823,561 |

| | | | | | | | | CALCULATION OF 2023 NON-PEO CAP | Non PEO | SCT Total Comp ($)(a) | SCT Stock Awards ($)(b) | Value of Unvested Equity Awards Granted during CFY ($)(c) | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY ($)(d) | Value of Equity Awards Granted and Vested in CFY($)(e) | Change in Value of Equity Awards Granted in Prior Years and Vested in CFY ($)(f) | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY ($)(g) | CAP to Non-PEO($)

(a)-(b)+(c)+(d)+(e)+(f)-(g) | Tobin | 2,400,016 | 897,792 | 1,182,336 | --- | --- | 90,021 | --- | 2,774,581 | Monroe | 1,398,938 | 404,484 | 455,692 | --- | --- | --- | --- | 1,450,146 | Humpich | 1,148,979 | 364,629 | 421,946 | --- | --- | 48,696 | --- | 1,254,992 | Robinson | 2,021,333 | --- | --- | --- | --- | --- | 932,283 | 1,089,050 | Doster | 1,518,004 | 860,836 | 1,014,838 | --- | --- | 70,954 | --- | 1,742,960 | Jacobsen | 1,827,450 | 804,272 | --- | --- | --- | 95,188 | --- | 1,118,366 | Colson | 1,826,340 | 794,920 | 1,046,860 | --- | --- | (3,575) | --- | 2,074,705 | Mujica | 1,829,094 | 794,920 | 1,046,860 | --- | --- | (3,575) | --- | 2,077,459 | Average | 1,746,269 | 615,232 | 646,067 | --- | --- | 37,214 | 116,535 | 1,697,782 |

|

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

|

|

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

|

|

| Tabular List, Table |

The following table lists the three financial performance measures that we believe represent the most important financial measures to link compensation actually paid to our Named Executive Officers in 2023 to our performance. | Most Important Performance Measures | 1) Diluted Earnings Per Share Growth | | |

|

|

|

|

|

|

| Total Shareholder Return Amount |

$ 236.24

|

173.96

|

164.74

|

140.80

|

|

|

| Peer Group Total Shareholder Return Amount |

154.53

|

134.26

|

145.77

|

118.90

|

|

|

| Net Income (Loss) |

$ 304,900,000

|

$ 269,800,000

|

$ 245,300,000

|

$ 31,300,000

|

|

|

| Company Selected Measure Amount | $ / shares |

4.54

|

3.97

|

3.50

|

0.45

|

|

|

| PEO Name |

Gerald L. Morgan

|

|

|

|

|

|

| Change In Shareholder Rtn Percentage |

35.80%

|

5.60%

|

17.00%

|

40.80%

|

|

|

| Change In Peer Group 1 Rtn Percentage |

15.10%

|

7.90%

|

22.60%

|

18.90%

|

|

|

| Measure:: 1 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Name |

Diluted Earnings Per Share Growth

|

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Name |

Profit Growth

|

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Name |

Change in Stock Price

|

|

|

|

|

|

| Gerald L Morgan |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| PEO Total Compensation Amount |

$ 5,347,527

|

$ 4,421,989

|

$ 3,769,765

|

|

|

|

| PEO Actually Paid Compensation Amount |

6,435,377

|

5,725,465

|

3,801,740

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

|

|

|

$ 1,165,170

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

|

|

|

1,098,344

|

|

|

| Gerald L Morgan | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

2,599,856

|

2,201,368

|

2,394,513

|

|

|

|

| Gerald L Morgan | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

3,423,848

|

2,297,748

|

2,352,525

|

|

|

|

| Gerald L Morgan | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

263,858

|

1,202,100

|

73,963

|

|

|

|

| Gerald L Morgan | Value of Equity Awards Granted and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

4,996

|

|

|

|

|

| W Kent Taylor |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| PEO Total Compensation Amount |

|

|

4,986,164

|

3,620,939

|

|

|

| PEO Actually Paid Compensation Amount |

|

|

(2,793,754)

|

7,366,061

|

|

|

| W Kent Taylor | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

4,753,200

|

3,358,800

|

|

|

| W Kent Taylor | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

4,737,600

|

|

|

| W Kent Taylor | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

1,698,000

|

|

|

| W Kent Taylor | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

880,222

|

668,322

|

|

|

| W Kent Taylor | Value of Equity Awards Granted and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

1,909,885

|

|

|

|

| W Kent Taylor | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

5,816,825

|

|

|

|

| Tonya R Robinson |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

2,021,333

|

1,755,123

|

1,788,492

|

920,732

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

1,089,050

|

1,999,851

|

1,767,624

|

1,419,492

|

|

|

| Doug W Thompson |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

|

|

7,556,722

|

1,818,256

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

|

|

3,711,025

|

3,055,934

|

|

|

| S Chris Jacobsen |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

1,827,450

|

1,787,674

|

1,712,853

|

924,889

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

1,118,366

|

2,225,970

|

1,325,354

|

1,519,366

|

|

|

| Christopher C Colson |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

1,826,340

|

1,489,948

|

1,589,173

|

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

2,074,705

|

1,505,215

|

1,584,425

|

|

|

|

| Hernan E Mujica |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

1,829,094

|

1,489,948

|

1,764,732

|

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

2,077,459

|

1,490,963

|

1,827,456

|

|

|

|

| Regina A Tobin |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

2,400,016

|

1,788,904

|

1,395,079

|

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

2,774,581

|

1,895,807

|

1,390,724

|

|

|

|

| David Christopher Monroe |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

1,398,938

|

|

|

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

1,450,146

|

|

|

|

|

|

| Keith V. Humpich |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

1,148,979

|

|

|

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

1,254,992

|

|

|

|

|

|

| Travis C. Doster |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

1,518,004

|

|

|

|

|

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

1,742,960

|

|

|

|

|

|

| Non-PEO NEO | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(615,232)

|

(694,940)

|

(1,205,927)

|

(828,662)

|

|

|

| Non-PEO NEO | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

646,067

|

742,060

|

815,916

|

1,164,660

|

|

|

| Non-PEO NEO | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

183,950

|

|

|

| Non-PEO NEO | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

37,214

|

114,122

|

46,455

|

46,074

|

|

|

| Non-PEO NEO | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(116,535)

|

|

(356,518)

|

|

|

|

| Non-PEO NEO | Gerald L Morgan | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

(291,726)

|

|

|

| Non-PEO NEO | Gerald L Morgan | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

394,800

|

|

|

| Non-PEO NEO | Gerald L Morgan | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

(169,900)

|

|

|

| Non-PEO NEO | Tonya R Robinson | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

(893,178)

|

(998,855)

|

(671,760)

|

|

|

| Non-PEO NEO | Tonya R Robinson | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

932,283

|

1,120,250

|

947,520

|

|

|

| Non-PEO NEO | Tonya R Robinson | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

226,400

|

|

|

| Non-PEO NEO | Tonya R Robinson | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

205,623

|

5,234

|

(3,400)

|

|

|

| Non-PEO NEO | Tonya R Robinson | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(932,283)

|

|

(147,497)

|

|

|

|

| Non-PEO NEO | Doug W Thompson | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(2,376,600)

|

(1,679,400)

|

|

|

| Non-PEO NEO | Doug W Thompson | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

2,368,800

|

|

|

| Non-PEO NEO | Doug W Thompson | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

283,000

|

|

|

| Non-PEO NEO | Doug W Thompson | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

6,192

|

265,278

|

|

|

| Non-PEO NEO | Doug W Thompson | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(1,475,289)

|

|

|

|

| Non-PEO NEO | S Chris Jacobsen | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(804,272)

|

(793,936)

|

(950,640)

|

(671,760)

|

|

|

| Non-PEO NEO | S Chris Jacobsen | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

828,696

|

1,075,440

|

947,520

|

|

|

| Non-PEO NEO | S Chris Jacobsen | Change in Value of Equity Awards Granted in Prior Years and Unvested at end of CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

|

226,400

|

|

|

| Non-PEO NEO | S Chris Jacobsen | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

95,188

|

403,536

|

4,020

|

$ 92,317

|

|

|

| Non-PEO NEO | S Chris Jacobsen | Value of Equity Awards Previously Granted that Failed to Meet Conditions in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

|

|

(516,319)

|

|

|

|

| Non-PEO NEO | Christopher C Colson | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(794,920)

|

(496,210)

|

(945,109)

|

|

|

|

| Non-PEO NEO | Christopher C Colson | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,046,860

|

517,935

|

873,795

|

|

|

|

| Non-PEO NEO | Christopher C Colson | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(3,575)

|

(6,458)

|

66,566

|

|

|

|

| Non-PEO NEO | Hernan E Mujica | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(794,920)

|

(496,210)

|

(1,142,043)

|

|

|

|

| Non-PEO NEO | Hernan E Mujica | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,046,860

|

517,935

|

1,064,238

|

|

|

|

| Non-PEO NEO | Hernan E Mujica | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(3,575)

|

(20,710)

|

140,529

|

|

|

|

| Non-PEO NEO | Regina A Tobin | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(897,792)

|

(795,166)

|

(822,315)

|

|

|

|

| Non-PEO NEO | Regina A Tobin | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,182,336

|

913,449

|

761,770

|

|

|

|

| Non-PEO NEO | Regina A Tobin | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

90,021

|

$ (11,380)

|

$ 56,190

|

|

|

|

| Non-PEO NEO | David Christopher Monroe | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(404,484)

|

|

|

|

|

|

| Non-PEO NEO | David Christopher Monroe | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

455,692

|

|

|

|

|

|

| Non-PEO NEO | Keith V. Humpich | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(364,629)

|

|

|

|

|

|

| Non-PEO NEO | Keith V. Humpich | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

421,946

|

|

|

|

|

|

| Non-PEO NEO | Keith V. Humpich | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

48,696

|

|

|

|

|

|

| Non-PEO NEO | Travis C. Doster | SCT Stock Awards |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

(860,836)

|

|

|

|

|

|

| Non-PEO NEO | Travis C. Doster | Value of Unvested Equity Awards Granted during CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,014,838

|

|

|

|

|

|

| Non-PEO NEO | Travis C. Doster | Change in Value of Granted in Prior Years and Vested in CFY |

|

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 70,954

|

|

|

|

|

|