Vericel Corporation (NASDAQ:VCEL), a leader in advanced therapies

for the sports medicine and severe burn care markets, today

reported financial results and business highlights for the fourth

quarter and year ended December 31, 2021, and provided full-year

2022 financial guidance.

Fourth Quarter 2021 Financial Highlights

- Total net revenue of $47.6 million, compared to $45.2 million

in the fourth quarter of 2020

- MACI® net revenue of $37.3 million, Epicel® net revenue of $9.7

million, and NexoBrid® revenue of $0.5 million related to the U.S.

Biomedical Advanced Research and Development Authority (BARDA)

procurement for emergency response preparedness

- Gross margin of 72%, compared to 74% in the fourth quarter of

2020

- Net income of $4.5 million, or $0.09 per share, compared to

$12.2 million, or $0.25 per share, in the fourth quarter of

2020

- Non-GAAP adjusted EBITDA of $12.8 million, compared to $16.0

million in the fourth quarter of 2020

- Operating cash flow of $10.6 million

Full Year 2021 Financial Highlights

- Total net revenue of $156.2 million, compared to $124.2 million

in 2020

- MACI net revenue of $111.6 million, Epicel net revenue of $41.5

million, and NexoBrid revenue of $3.1 million related to BARDA

procurement for emergency response preparedness

- Gross margin of 68%, compared to gross margin of 68% in

2020

- Net loss of $7.5 million, or $0.16 per share, compared to net

income of $2.9 million, or $0.06 per share, in 2020

- Non-GAAP adjusted EBITDA of $29.5 million, compared to $18.6

million in 2020

- Operating cash flow of $29.0 million

- As of December 31, 2021, the Company had approximately $129

million in cash and investments, compared to $100 million as of

December 31, 2020, and no debt

Business Highlights and Updates

- Total net revenue growth of 26% for 2021, in line with the

Company’s compounded annual revenue growth rate since the launch of

MACI in 2017

- Full-year net revenue growth of 18% for MACI, achieving record

quarterly revenue in the fourth quarter

- Full-year net revenue growth of 51% for Epicel and the fifth

straight quarter with revenue over $9.5 million

- Achieved 20% growth in surgeons taking MACI biopsies and 30%

growth in MACI biopsies for the year, with a record quarterly high

in the number of biopsies and the number of surgeons taking

biopsies in the fourth quarter

- Achieved over 30% growth in Epicel biopsies and burn centers

treating patients with Epicel compared to 2020

- Announced plans for a new

state-of-the-art cell therapy manufacturing facility and corporate

headquarters to support long-term growth

“We delivered another strong year of revenue growth and

generated record adjusted EBITDA and operating cash flow to end the

year in a very strong financial position,” said Nick Colangelo,

President and CEO of Vericel. “The Company continues to execute

very well across all areas of the business, generating record

revenue and biopsies for MACI in the fourth quarter and driving

over 50% growth in Epicel revenue for the year. Looking forward,

given the significant market opportunities and the continued

progress across both of our franchises, we believe that we are

well-positioned for continued strong revenue and profitability

growth in 2022 and the years ahead.”

2022 Financial Guidance

- Total net revenue for 2022 expected

to be in the range of $178 to $189 million

- MACI revenue expected to be in the

range of $132 to $141 million

- Epicel revenue expected to be in the

range of $45.5 to $47.5 million

- Gross margin expected to be

approximately 70%

- Adjusted EBITDA margin expected to

be approximately 21%

Fourth Quarter 2021 ResultsTotal net revenue

for the quarter ended December 31, 2021 increased 5% to $47.6

million, compared to $45.2 million in the fourth quarter of 2020.

Total net product revenue for the quarter included $37.3 million of

MACI (autologous cultured chondrocytes on porcine collagen

membrane) net revenue and $9.7 million of Epicel (cultured

epidermal autografts) net revenue, compared to $34.7 million of

MACI net revenue and $9.6 million of Epicel net revenue,

respectively, in the fourth quarter of 2020. Total net revenue for

the quarter also included $0.5 million of revenue related to the

procurement of NexoBrid (concentrate of proteolytic enzymes

enriched in bromelain) by BARDA for emergency response

preparedness, compared to $1.0 million in the fourth quarter of

2020.

Gross profit for the quarter ended December 31, 2021 was $34.0

million, or 72% of net revenue, compared to $33.6 million, or 74%

of net revenue, for the fourth quarter of 2020.

Total operating expenses for the quarter ended December 31, 2021

were $29.9 million, compared to $21.4 million for the same period

in 2020. The increase in operating expenses was primarily due to an

increase in stock-based compensation expense driven by share price

appreciation.

Net income for the quarter ended December 31, 2021 was $4.5

million, or $0.09 per share, compared to net income of $12.2

million, or $0.25 per share, for the fourth quarter of 2020.

Non-GAAP adjusted EBITDA for the quarter ended December 31, 2021

was $12.8 million, or 27% of net revenue, compared to $16.0

million, or 35% of net revenue, for the fourth quarter of 2020. A

table reconciling non-GAAP measures is included in this press

release for reference.

Full-Year 2021 ResultsTotal net revenue for the

year ended December 31, 2021 increased 26% to $156.2 million,

compared to $124.2 million in 2020. Total net product revenue for

the year included $111.6 million of MACI net revenue and $41.5

million of Epicel net revenue, compared to $94.4 million of MACI

net revenue and $27.5 million of Epicel net revenue, respectively,

in 2020. Total net revenue in 2021 also included $3.1 million of

revenue related to the procurement of NexoBrid by BARDA for

emergency response preparedness, compared to $2.2 million of

revenue in 2020.

Gross profit for the year ended December 31, 2021 was $106.0

million, or 68% of net revenue, compared to $84.2 million, or 68%

of net revenue, in 2020.

Total operating expenses for the year ended December 31, 2021

were $113.9 million, compared to $81.9 million in 2020. The

increase in operating expenses was primarily due to an increase in

stock-based compensation expense driven by share price appreciation

and lower spend in 2020 due to COVID-19-related factors.

Net loss for the year ended December 31, 2021 was $7.5 million,

or $0.16 per share, compared to net income of $2.9 million, or

$0.06 per share, in 2020.

Non-GAAP adjusted EBITDA for the year ended December 31, 2021

was $29.5 million, or 19% of net revenue, compared to $18.6

million, or 15% of net revenue, in 2020. A table reconciling

non-GAAP measures is included in this press release for

reference.

As of December 31, 2021, the Company had approximately $129

million in cash and investments, compared to approximately $100

million as of December 31, 2020, and no debt.

Conference Call Information Today’s conference

call will be available live at 8:30am Eastern Time and can be

accessed through the Investor Relations section of the Vericel

website at http://investors.vcel.com/events-presentations. A slide

presentation with highlights from today’s conference call will be

available on the webcast and in the Investor Relations section of

the Vericel website. Please access the site at least 15 minutes

prior to the scheduled start time in order to download the required

audio software, if necessary. To participate in the live call by

telephone, please call (877) 312-5881 and reference Vericel

Corporation’s fourth quarter 2021 investor conference call. If

calling from outside the U.S., please use the international phone

number (253) 237-1173.

If you are unable to participate in the live call, the webcast

will be available at http://investors.vcel.com/events-presentations

until February 24, 2023. A replay of the call will also be

available until 11:30am (EDT) on February 28, 2022 by calling (855)

859-2056, or from outside the U.S. by calling (404) 537-3406. The

conference ID is 5795764.

About Vericel CorporationVericel is a leader in

advanced therapies for the sports medicine and severe burn care

markets. The Company markets two cell therapy products in the

United States. MACI (autologous cultured chondrocytes on porcine

collagen membrane) is an autologous cellularized scaffold product

indicated for the repair of symptomatic, single or multiple

full-thickness cartilage defects of the knee with or without bone

involvement in adults. Epicel (cultured epidermal autografts) is a

permanent skin replacement for the treatment of patients with

deep-dermal or full-thickness burns greater than or equal to 30% of

total body surface area. The Company also holds an exclusive

license for North American rights to NexoBrid, a registration-stage

biological orphan product for debridement of severe thermal

burns. For more information, please visit the Company’s

website at www.vcel.com.

GAAP v. Non-GAAP MeasuresVericel’s reported

earnings are prepared in accordance with generally accepted

accounting principles in the United States, or GAAP, and represent

earnings as reported to the Securities and Exchange Commission.

Vericel has provided in this release certain financial

information that has not been prepared in accordance with

GAAP. Vericel’s management believes that the non-GAAP

adjusted EBITDA described in the release, which includes

adjustments for specific items that are generally not indicative of

our core operations, provides additional information that is useful

to investors in understanding Vericel’s underlying performance,

business and performance trends, and helps facilitate

period-to-period comparisons and comparisons of its financial

measures with other companies in Vericel’s industry. However,

the non-GAAP financial measures that Vericel uses may differ from

measures that other companies may use. Non-GAAP financial

measures are not required to be uniformly applied, are not audited

and should not be considered in isolation or as substitutes for

results prepared in accordance with GAAP.

Epicel® and MACI® are registered trademarks of Vericel

Corporation. NexoBrid® is a registered trademark of MediWound Ltd.

(MediWound) and is used under license to Vericel Corporation. ©

2022 Vericel Corporation. All rights reserved.

Forward-Looking StatementsVericel cautions you

that all statements other than statements of historical fact

included in this press release that address activities, events or

developments that we expect, believe or anticipate will or may

occur in the future are forward-looking statements. Although we

believe that we have a reasonable basis for the forward-looking

statements contained herein, they are based on current expectations

about future events affecting us and are subject to risks,

assumptions, uncertainties and factors relating to our operations

and business environment, all of which are difficult to predict and

many of which are beyond our control. Our actual results may differ

materially from those expressed or implied by the forward-looking

statements in this press release. These statements are often, but

are not always, made through the use of words or phrases such as

“anticipates,” “intends,” “estimates,” “plans,” “expects,”

“continues,” “believe,” “guidance,” “outlook,” “target,” “future,”

“potential,” “goals” and similar words or phrases, or future or

conditional verbs such as “will,” “would,” “should,” “could,”

“may,” or similar expressions.

Among the factors that could cause actual results to differ

materially from those set forth in the forward-looking statements

include, but are not limited to, uncertainties associated with our

expectations regarding future revenue, growth in revenue, market

penetration for MACI and Epicel, growth in profit, gross margins

and operating margins, the ability to achieve or sustain

profitability, contributions to adjusted EBITDA, the expected

target surgeon audience, potential fluctuations in sales and

volumes and our results of operations over the course of the year,

timing and conduct of clinical trial and product development

activities, timing of the resubmission to the Food & Drug

Administration (FDA) of a Biologics License Application (BLA) for

NexoBrid seeking approval for the treatment of severe burns in the

United States following MediWound’s receipt of a complete response

letter on June 28, 2021, timing or likelihood of approval by the

FDA of the NexoBrid BLA resubmission, the estimate of the

commercial growth potential of our products and product candidates,

availability of funding from BARDA under its agreement with

MediWound for use in connection with NexoBrid development

activities, competitive developments, changes in third-party

coverage and reimbursement, our ability to supply or meet customer

demand for our products, and the ongoing impacts of the COVID-19

pandemic on our business or the economy generally.

With respect to COVID-19, we are currently unable to predict

whether the recent spread of the COVID-19 Delta and Omicron

variants or a future resurgence of COVID-19 infections that may

limit the effectiveness of approved vaccines will result in future

restrictions on the performance of elective surgical procedures or

affect the availability of physicians and/or their treatment

prioritizations, cause healthcare facility staffing shortages,

effect the willingness or ability of patients to seek treatment, or

heighten the impact of the outbreak on the overall healthcare

infrastructure. Other disruptions or potential disruptions include

restrictions on the ability of Company personnel to travel and

access customers for training, promotion and case support, delays

in product development efforts, and additional government-imposed

quarantines and requirements to “shelter at home” or other

incremental mitigation efforts or initiatives that may impact our

ability to source supplies for our operations or our ability or

capacity to manufacture, sell and support the use of our products.

With respect to NexoBrid, the COVID-19 pandemic may impact the

FDA’s response times to future regulatory submissions, its ability

to monitor our clinical trials, and/or conduct necessary reviews or

inspections of manufacturing facilities involved in the production

of NexoBrid, any or all of which may result in timelines being

materially delayed, which could affect the development and ultimate

commercialization of NexoBrid. The total impact of these

disruptions could have a material impact on the Company’s financial

condition, cash flows and results of operations.

These and other significant factors are discussed in greater

detail in Vericel’s Annual Report on Form 10-K for the year ended

December 31, 2021, filed with the Securities and Exchange

Commission (SEC) on February 24, 2022, and in other filings with

the SEC. These forward-looking statements reflect our

views as of the date hereof and Vericel does not assume and

specifically disclaims any obligation to update any of these

forward-looking statements to reflect a change in its views or

events or circumstances that occur after the date of this release

except as required by law.

Investor Contact: Eric Burnsir@vcel.com+1 (734)

418-4411

VERICEL

CORPORATIONCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited, amounts in thousands, except

per share amounts)

| |

|

Three Months Ended December 31, 2021 |

|

Twelve Months Ended December 31, 2021 |

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Product sales, net |

|

47,050 |

|

|

44,256 |

|

|

153,075 |

|

|

121,968 |

|

|

Other revenue |

|

541 |

|

|

973 |

|

|

3,109 |

|

|

2,211 |

|

| Total revenue |

|

47,591 |

|

|

45,229 |

|

|

156,184 |

|

|

124,179 |

|

|

Cost of product sales |

|

13,559 |

|

|

11,582 |

|

|

50,159 |

|

|

39,951 |

|

|

Gross profit |

|

34,032 |

|

|

33,647 |

|

|

106,025 |

|

|

84,228 |

|

|

Research and development |

|

3,924 |

|

|

3,118 |

|

|

16,287 |

|

|

13,020 |

|

|

Selling, general and administrative |

|

25,967 |

|

|

18,240 |

|

|

97,592 |

|

|

68,836 |

|

|

Total operating expenses |

|

29,891 |

|

|

21,358 |

|

|

113,879 |

|

|

81,856 |

|

| Income (loss) from

operations |

|

4,141 |

|

|

12,289 |

|

|

(7,854 |

) |

|

2,372 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

61 |

|

|

117 |

|

|

224 |

|

|

691 |

|

|

Interest expense |

|

(1 |

) |

|

(1 |

) |

|

(4 |

) |

|

(6 |

) |

|

Other income (expense) |

|

8 |

|

|

(5 |

) |

|

52 |

|

|

(13 |

) |

|

Total other income (expense) |

|

68 |

|

|

111 |

|

|

272 |

|

|

672 |

|

| Income (loss) before income

taxes |

|

4,209 |

|

|

12,400 |

|

|

(7,582 |

) |

|

3,044 |

|

|

Income tax (benefit) expense |

|

(326 |

) |

|

180 |

|

|

(111 |

) |

|

180 |

|

| Net income (loss) |

|

4,535 |

|

|

12,220 |

|

|

(7,471 |

) |

|

2,864 |

|

| Net income (loss) per common

share: |

|

|

|

|

|

|

|

|

| Basic |

|

0.10 |

|

|

0.27 |

|

|

(0.16 |

) |

|

0.06 |

|

| Diluted |

|

0.09 |

|

|

0.25 |

|

|

(0.16 |

) |

|

0.06 |

|

| Weighted-average common shares

outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

46,821 |

|

|

45,545 |

|

|

46,472 |

|

|

45,221 |

|

| Diluted |

|

49,939 |

|

|

48,101 |

|

|

46,472 |

|

|

47,282 |

|

|

RECONCILIATION OF REPORTED NET INCOME (LOSS)

(GAAP)TO ADJUSTED EBITDA (NON-GAAP MEASURE) -

UNAUDITED |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

(In thousands) |

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Net income (loss) |

|

$ |

4,535 |

|

|

$ |

12,220 |

|

|

$ |

(7,471 |

) |

|

$ |

2,864 |

|

|

Stock-based compensation expense |

|

|

7,841 |

|

|

|

3,024 |

|

|

|

34,322 |

|

|

|

13,843 |

|

|

Depreciation and amortization |

|

|

780 |

|

|

|

734 |

|

|

|

2,965 |

|

|

|

2,383 |

|

|

Net interest income |

|

|

(60 |

) |

|

|

(116 |

) |

|

|

(220 |

) |

|

|

(685 |

) |

|

Income tax (benefit) expense |

|

|

(326 |

) |

|

|

180 |

|

|

|

(111 |

) |

|

|

180 |

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

12,770 |

|

|

$ |

16,042 |

|

|

$ |

29,485 |

|

|

$ |

18,585 |

|

VERICEL

CORPORATIONCONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited, amounts in

thousands)

| |

|

December 31, |

|

|

|

|

2021 |

|

|

2020 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

68,330 |

|

$ |

33,620 |

|

Short-term investments |

|

|

35,068 |

|

|

42,187 |

|

Accounts receivable (net of allowance for doubtful accounts of $40

and $143, respectively) |

|

|

37,437 |

|

|

34,504 |

|

Inventory |

|

|

13,381 |

|

|

9,356 |

|

Other current assets |

|

|

4,246 |

|

|

3,893 |

|

Total current assets |

|

|

158,462 |

|

|

123,560 |

|

Property and equipment, net |

|

|

13,308 |

|

|

7,633 |

|

Restricted cash |

|

|

211 |

|

|

211 |

|

Right-of-use assets |

|

|

45,720 |

|

|

50,105 |

|

Long-term investments |

|

|

25,687 |

|

|

24,099 |

|

Other long-term assets |

|

|

317 |

|

|

— |

|

Total assets |

|

$ |

243,705 |

|

$ |

205,608 |

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

9,016 |

|

$ |

6,755 |

|

Accrued expenses |

|

|

14,045 |

|

|

11,293 |

|

Current portion of operating lease liabilities |

|

|

2,950 |

|

|

4,394 |

|

Other current liabilities |

|

|

41 |

|

|

41 |

|

Total current liabilities |

|

|

26,052 |

|

|

22,483 |

|

Operating lease liabilities |

|

|

47,147 |

|

|

48,789 |

|

Other long-term liabilities |

|

|

44 |

|

|

76 |

|

Total liabilities |

|

|

73,243 |

|

|

71,348 |

|

Total shareholders’ equity |

|

|

170,462 |

|

|

134,260 |

|

Total liabilities and shareholders’ equity |

|

$ |

243,705 |

|

$ |

205,608 |

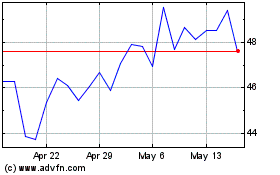

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

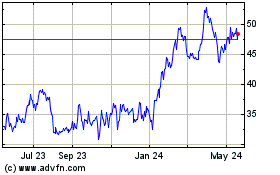

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Jul 2023 to Jul 2024