UPDATE:Merck Cholesterol Drug Prescriptions Dropped Last Week

25 November 2009 - 7:23AM

Dow Jones News

U.S. prescription volumes for Merck & Co.'s (MRK)

cholesterol drugs Zetia and Vytorin took a hit last week, while

Abbott Laboratories' (ABT) Niaspan got a boost from clinical trial

results that favored Niaspan over Zetia, according to a market

research firm.

Some users of Merck's drugs appeared to be switching to Niaspan,

and Niaspan trends among brand new patients were more favorable

than those for the Merck drugs, according to numbers provided to

Dow Jones Newswires on Tuesday by health-data tracker SDI, of

Plymouth Meeting, Pa.

"There's a lot of switching taking place," said Timothy McGee,

associate director of client solutions and syndicated analytics at

SDI.

Researchers in the Abbott-funded "Arbiter 6" study announced

Nov. 15 at a cardiology conference that Niaspan helped reverse

narrowing of the arteries in heart patients, while Zetia users saw

no significant changes. The data reinforced doubts about the

efficacy of the Merck drugs--doubts that have hurt their sales

since early 2008. Merck has defended the drugs' efficacy and

safety.

The effect of the study on prescription trends was swift,

according to the SDI data. Total U.S. Zetia prescriptions for the

week ended Nov. 20 declined 8.5% from the previous week to about

151,100, while Vytorin was down 5.2% at about 163,600. Vytorin is a

single-pill combination of Zetia and the drug simvastatin.

In contrast, total Niaspan prescriptions last week rose 2.6%

from the previous week to about 107,360, SDI said.

Total U.S. prescription volumes for all cholesterol drugs

contracted 2.6% for the week ended Nov. 20, versus the week before.

Such week-to-week fluctuations are common.

The differences between Niaspan and the Merck drugs were even

more pronounced among two subsets of patients: those who got a

brand new prescription last week and hadn't taken any other

cholesterol drug in the previous 12 months; and those who got a new

prescription last week but had taken a different cholesterol drug

in the previous 12 months.

SDI said these breakdowns of the data can help show whether a

specific event, such as the presentation of new clinical-trial

results, is causing switches among brands for existing patients or

shifting trends among new patients.

Niaspan prescriptions among new patients who hadn't taken any

cholesterol drug in the previous 12 months rose 33.8% from the

previous week, while prescriptions on that basis for Zetia dropped

24% and were down 16.8% for Vytorin. New Niaspan prescriptions

among people who had taken a different cholesterol drug in the

previous 12 months rose 45.6% from the week before, while Zetia

declined 27.4% and Vytorin dropped 23.7% on similar bases.

Merck spokesman Ron Rogers said the company isn't familiar with

the SDI data, and that it would be "premature" to gauge the impact

of the Arbiter 6 study on market trends. He noted that Merck

executives said in October that U.S. prescription market-share

declines for the company's cholesterol drugs appeared to be

stabilizing. He said Merck believes its drugs are valuable

treatment options for helping patients reduce bad cholesterol

levels.

Abbott spokeswoman Laureen Cassidy said the company was

"encouraged" that doctors seem to be recognizing the importance of

going beyond reducing bad cholesterol to treat heart patients.

Niaspan works primarily by raising good cholesterol while Zetia

primarily lowers bad cholesterol.

Abbott's Niaspan sales rose 6.4% to $601 million for the first

nine months of 2009. Merck reported combined Zetia and Vytorin

sales for that period of $3 billion, down 13.8% from a year

earlier.

Merck shares were off 27 cents to $36.15 in recent trading.

Abbott was up $1.29 to $54.42.

-Peter Loftus; Dow Jones Newswires; 215-656-8289;

peter.loftus@dowjones.com

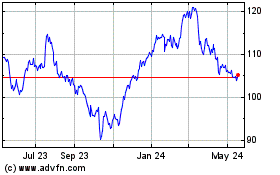

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to May 2024

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From May 2023 to May 2024