BlackRock Establishes Preeminent Private Markets, Technology, and Data Provider with Close of Preqin Acquisition

03 March 2025 - 10:52PM

Business Wire

BlackRock Inc. (NYSE:BLK) today announced the successful

completion of its acquisition of Preqin, a premier independent

provider of private markets data. This strategic transaction

strengthens BlackRock’s ability to serve clients’ whole portfolios

— across public and private markets — by combining investment,

technology, and data solutions in one platform.

Private markets are the fastest-growing segment of global

investing, with alternative assets projected to reach $30 trillion

by the end of the decade, according to Preqin data. As capital

markets evolve, private markets are playing an increasingly

important role in financing global growth. Institutional and wealth

investors continue to increase allocations to these markets as they

seek to optimize returns and diversify their long-term capital, yet

these allocations have been artificially limited by a lack of

transparency. With Preqin, BlackRock takes a major step forward to

address this need, positioning its private markets platform to

deliver investments, technology, and data holistically to power

next-generation investment solutions for clients.

Rob Goldstein, BlackRock’s Chief Operating Officer, said,

“BlackRock is a perpetual reinvention machine, evolving

continuously to stay ahead of our clients’ rapidly changing needs.

Today, clients are seeking a ‘common language’ for investing that

requires better data to drive investment decisions, manage risk,

and construct portfolios. With Preqin, a part of BlackRock, we will

seek to meet this need, accelerating clients’ ability to allocate

to the growth of private markets and furthering our aspirations to

deliver greater value across their whole portfolios.”

Mark O’Hare, Founder of Preqin, said, “For decades, investors in

private markets have lacked the robust data they need to make fully

informed decisions and incorporate private assets into their

portfolios at scale. By marrying Preqin with BlackRock’s technology

offering, we are even better placed to tackle this challenge and

help clients build more diverse, resilient portfolios by delivering

the transparency and insights they seek.”

Preqin, a part of BlackRock

From the outset, Preqin will extend BlackRock’s suite of

technology offerings, with clients continuing to use Preqin with

the same level of expert service. Preqin will remain available as a

standalone solution, while joint customers will benefit immediately

from product integrations, such as access to Preqin benchmarks

within Aladdin. Over time, BlackRock will integrate Preqin’s

proprietary data and research tools with Aladdin and eFront. This

unification of data, research, and investment processes will

transform private markets investing across fundraising, deal

sourcing, portfolio management, accounting, and performance

reporting.

Sudhir Nair, Global Head of Aladdin, commented, “We are on a

journey to make private markets more accessible and transparent for

clients through data and technology. We accelerated this ambition

in 2019 with our acquisition of eFront, enhancing private markets

investment technology and, in combination with Aladdin, enabling

the whole portfolio across public and private assets. Today, this

ambition takes another leap forward with the addition of Preqin’s

data, benchmarks, and analytics capabilities.”

The acquisition significantly enhances BlackRock’s investment

technology capabilities, marking a strategic expansion into the

rapidly growing private markets data segment, which is expected to

grow to an $18 billion total addressable market by 2030.

With a history spanning over 20 years, Preqin is an

industry-recognised independent data solutions provider in private

markets, empowering investors to make informed decisions by

providing data and insights that enhance transparency and access

across the global alternatives market. Its platform covers 210,000

funds and has over 220,000 users, including asset managers,

insurers, pensions, wealth managers, banks, and other service

providers.

Following the transaction, Preqin founder Mark O’Hare has joined

BlackRock as a Vice Chair.

Barclays served as lead financial advisor to BlackRock, with

Skadden, Arps, Slate, Meagher & Flom acting as legal

counsel.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a provider of

financial technology, we help millions of people build savings that

serve them throughout their lives by making investing easier and

more affordable. For additional information on BlackRock, please

visit www.blackrock.com/corporate

About Preqin, a part of BlackRock

Preqin empowers financial professionals who invest in or

allocate to private markets with essential data and insight to make

confident decisions. It supports them throughout the entire

investment lifecycle with critical information and leading

analytics solutions. Preqin has pioneered rigorous methods of

collecting private data for over 20 years, enabling more than

200,000 professionals globally to streamline how they raise

capital, source deals and investments, understand performance, and

stay informed. Acquired by BlackRock in 2025, Preqin complements

the existing Aladdin technology platform to provide investment

solutions for the whole portfolio. For more information visit

www.preqin.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250228261104/en/

Bart Nash bart.nash@blackrock.com

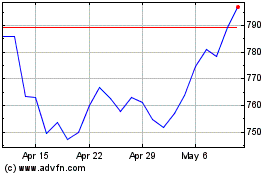

BlackRock (NYSE:BLK)

Historical Stock Chart

From Feb 2025 to Mar 2025

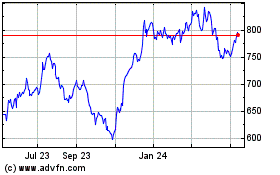

BlackRock (NYSE:BLK)

Historical Stock Chart

From Mar 2024 to Mar 2025