Franklin BSP Realty Trust, Inc. (NYSE: FBRT) (“FBRT” or the

“Company”) today announced financial results for the quarter ended

September 30, 2024.

Reported GAAP net income (loss) of $30.2 million for the three

months ended September 30, 2024, compared to $(3.8) million for the

three months ended June 30, 2024. Reported diluted earnings per

share ("EPS") to common stockholders of $0.30 for the three months

ended September 30, 2024, compared to $(0.11) for the three months

ended June 30, 2024.

Reported Distributable Earnings (a non-GAAP financial measure)

of $(4.0) million, or $(0.10) per diluted common share on a fully

converted basis(1), for the three months ended September 30, 2024,

compared to $32.4 million, or $0.31 per diluted common share on a

fully converted basis(1), for the three months ended June 30,

2024.

Third Quarter 2024 Summary

- Core portfolio principal balance as of September 30, 2024 of

$5.2 billion:

- Portfolio consisted of 157 loans with an average loan size of

$33 million

- 99% of the Company's portfolio is in senior mortgage loans and

approximately 95% is floating rate

- 74% of the portfolio is collateralized by multifamily

properties and only 4% is collateralized by office properties

- Closed $380 million of new loan commitments at a weighted

average spread of 421 basis points, bringing total commitments for

the first three quarters of 2024 to $1.6 billion

- Funded $325 million of principal balance including future

funding on existing loans and received loan repayments of $510

million

- Total liquidity of $1.1 billion, which includes $346 million in

cash and cash equivalents

- Produced a third quarter GAAP and Distributable Earnings return

on equity (a non-GAAP financial measure) of 7.9% and (2.6)%,

respectively

- Declared third quarter common stock cash dividend of $0.355,

representing an annualized 9.3% yield on book value per share,

fully converted(1)

- GAAP and Distributable Earnings dividend coverage of 85% and

(28)%, respectively

- Book value of $15.24 per diluted common share on a fully

converted basis(1)

- Closed BSPRT 2024-FL11 ("FL11 CRE CLO"), a $1.024 billion

managed Commercial Real Estate Collateralized Loan Obligation

("CLO"), resulting in financing of $886.2 million, with a 36 month

re-investment period, advance rate of 86.5% and a weighted average

interest rate of 1M Term SOFR+199 before accounting for discount

and transaction costs

- During the quarter, sold 16 of the 21 remaining retail

properties in the Walgreens Portfolio for a sale price of $60.9

million. The transaction was financed by the Company

Richard Byrne, Chairman and Chief Executive Officer of FBRT,

said, “FBRT has originated over $1.6 billion in total commitments

year-to-date in 2024. These new loans are some of the most

attractive in our portfolio. We continue to make rapid progress

turning over our book into loans underwritten at current cap rates.

In all, 40% of our book has been underwritten since January

2023."

Further commenting on the Company's results, Michael Comparato,

President of FBRT, added, “We are encouraged by paydowns on our

legacy portfolio this quarter, receiving $510 million in

repayments. Payoffs are a blessing and a curse, but in the current

market environment we are pleased to see the liquidity of our

portfolio. Equally as encouraging is the progress the team has made

in our watchlist loans and REO portfolio. We continue to positively

resolve positions, modify loans, sell REO and clean up what we

believe is overall a very healthy, multifamily-heavy loan

portfolio."

Portfolio and Investment Activity

Core Portfolio: For the quarter ended September 30, 2024, the

Company closed $380 million of new loan commitments, funded $325

million of principal balance on new and existing loans, and

received loan repayments of $510 million. As of September 30, 2024,

the Company had three loans on its watch list, two of which are

risk rated a five and one risk rated a four.

Conduit: For the quarter ended September 30, 2024, the Company

originated $70 million of fixed rate conduit loans and sold $132

million of conduit loans for a gain of $6.2 million, gross of

related derivatives.

Real Estate Owned: During the third quarter, the Company sold 16

of the 21 remaining retail properties in the Walgreens Portfolio

for a sale price of $60.9 million. The transaction was financed by

the Company. The Company recorded an additional third quarter loss

of $0.1 million, net of minority interest, related to the sale. In

addition, the Company recorded a third quarter $3.5 million write

down, net of minority interest, on the remaining five properties

held within the Walgreens Portfolio. Both of these losses have been

realized in GAAP Net Income and Distributable Earnings.

Allowance for Credit Losses: During the quarter, the Company

recognized a net benefit for credit losses of $0.3 million,

comprised of a $0.5 million asset-specific provision and a $0.8

million general allowance benefit.

Financing: On September 26, 2024, the Company closed the $1.024

billion FL11 CRE CLO, resulting in financing of $886.2 million,

with a 36 month re-investment period, advance rate of 86.5% and a

weighted average interest rate of 1M Term SOFR+199 before

accounting for discount and transaction costs.

Book Value

As of September 30, 2024, book value was $15.24 per diluted

common share on a fully converted basis(1).

Share Repurchase Program

On October 31, 2024, the Company's Board of Directors extended

the Company's $65 million share repurchase program through December

31, 2025. As of October 30, 2024, $31.1 million remains available

under the $65 million share repurchase program.

Distributable Earnings and Distributable Earnings to

Common

Distributable Earnings is a non-GAAP measure, which the Company

defines as GAAP net income (loss), adjusted for (i) non-cash CLO

amortization acceleration and amortization over the expected useful

life of the Company's CLOs, (ii) unrealized gains and losses on

loans and derivatives, including CECL reserves and impairments, net

of realized gains and losses, as described further below, (iii)

non-cash equity compensation expense, (iv) depreciation and

amortization, (v) subordinated performance fee accruals/(reversal),

(vi) realized gains and losses on debt extinguishment and CLO

calls, and (vii) certain other non-cash items. Further,

Distributable Earnings to Common, a non-GAAP measure, presents

Distributable Earnings net of (i) perpetual preferred stock

dividend payments and (ii) non-controlling interests in joint

ventures.

As noted in (ii) above, we exclude unrealized gains and losses

on loans and other investments, including CECL reserves and

impairments, from our calculation of Distributable Earnings and

include realized gains and losses. The nature of these adjustments

is described more fully in the footnotes to our reconciliation

tables. GAAP loan loss reserves and any property impairment losses

have been excluded from Distributable Earnings consistent with

other unrealized losses pursuant to our existing definition of

Distributable Earnings. We expect to only recognize such potential

credit or property impairment losses in Distributable Earnings if

and when such amounts are deemed nonrecoverable upon a realization

event. This is generally at the time a loan is repaid, or in the

case of a foreclosure or other property, when the underlying asset

is sold. Amounts may also be deemed non-recoverable if, in our

determination, it is nearly certain the carrying amounts will not

be collected or realized. The realized loss amount reflected in

Distributable Earnings will generally equal the difference between

the cash received and the Distributable Earnings basis of the

asset. The timing of any such loss realization in our Distributable

Earnings may differ materially from the timing of the corresponding

loss reserves, charge-offs or impairments in our consolidated

financial statements prepared in accordance with GAAP.

The Company believes that Distributable Earnings and

Distributable Earnings to Common provide meaningful information to

consider in addition to the disclosed GAAP results. The Company

believes Distributable Earnings and Distributable Earnings to

Common are useful financial metrics for existing and potential

future holders of its common stock as historically, over time,

Distributable Earnings to Common has been an indicator of common

dividends per share. As a REIT, the Company generally must

distribute annually at least 90% of its taxable income, subject to

certain adjustments, and therefore believes dividends are one of

the principal reasons stockholders may invest in its common stock.

Further, Distributable Earnings to Common helps investors evaluate

performance excluding the effects of certain transactions and GAAP

adjustments that the Company does not believe are necessarily

indicative of current loan portfolio performance and the Company's

operations and is one of the performance metrics the Company's

board of directors considers when dividends are declared.

Distributable Earnings and Distributable Earnings to Common do

not represent net income (loss) and should not be considered as an

alternative to GAAP net income (loss). The methodology for

calculating Distributable Earnings and Distributable Earnings to

Common may differ from the methodologies employed by other

companies and thus may not be comparable to the Distributable

Earnings reported by other companies.

Please refer to the financial statements and reconciliation of

GAAP Net Income to Distributable Earnings and Distributable

Earnings to Common included at the end of this release for further

information.

1 Fully converted per share information in

this press release assumes applicable conversion of our series of

outstanding convertible preferred stock into common stock and the

vesting of our outstanding equity compensation awards.

Supplemental Information

The Company published a supplemental earnings presentation for

the quarter ended September 30, 2024 on its website to provide

additional disclosure and financial information. These materials

can be found on the Company’s website at http://www.fbrtreit.com

under the Presentations tab.

Conference Call and Webcast

The Company will host a conference call and live audio webcast

to discuss its financial results on Tuesday, November 5, 2024, at

9:00 a.m. ET. Participants are encouraged to pre-register for the

call and webcast at

https://dpregister.com/sreg/10193610/fdb52ca66a. If you are unable

to pre-register, the conference call may be accessed by dialing

(844) 701-1166 (Domestic) or (412) 317-5795 (International). Ask to

join the Franklin BSP Realty Trust conference call. Participants

should call in at least five minutes prior to the start of the

call.

The call will also be accessible via live webcast at

https://ccmediaframe.com?id=aTncCfPs. Please allow extra time prior

to the call to download and install audio software, if needed. A

slide presentation containing supplemental information may also be

accessed through the Company’s website in advance of the call.

An audio replay of the live broadcast will be available

approximately one hour after the end of the conference call on

FBRT’s website. The replay will be available for 90 days on the

Company’s website.

About Franklin BSP Realty Trust, Inc.

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) is a real estate

investment trust that originates, acquires and manages a

diversified portfolio of commercial real estate debt secured by

properties located in the United States. As of September 30, 2024,

FBRT had approximately $6.3 billion of assets. FBRT is externally

managed by Benefit Street Partners L.L.C., a wholly owned

subsidiary of Franklin Resources, Inc. For further information,

please visit www.fbrtreit.com.

Forward-Looking Statements

Certain statements included in this press release are

forward-looking statements. Those statements include statements

regarding the intent, belief or current expectations of the Company

and members of our management team, as well as the assumptions on

which such statements are based, and generally are identified by

the use of words such as "may," "will," "seeks," "anticipates,"

"believes," "estimates," "expects," "plans," "intends," "should" or

similar expressions. Actual results may differ materially from

those contemplated by such forward-looking statements. Further,

forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time, unless required by law.

The Company's forward-looking statements are subject to various

risks and uncertainties. Factors that could cause actual outcomes

to differ materially from our forward-looking statements include

macroeconomic factors in the United States including inflation,

changing interest rates and economic contraction, impairments in

the value of real estate property securing our loans or that we

own, the extent of any recoveries on delinquent loans, the

financial stability of our borrowers and the other risks and

important factors contained and identified in the Company’s filings

with the Securities and Exchange Commission (“SEC”), including its

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 and its subsequent filings with the SEC, any of which could

cause actual results to differ materially from the forward-looking

statements. The forward-looking statements included in this

communication are made only as of the date hereof.

FRANKLIN BSP REALTY TRUST,

INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

(Unaudited)

September 30, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

346,153

$

337,595

Restricted cash

7,720

6,092

Commercial mortgage loans, held for

investment, net of allowance for credit losses of $76,640 and

$47,175 as of September 30, 2024 and December 31, 2023,

respectively

5,077,476

4,989,767

Real estate securities, available for

sale, measured at fair value, amortized cost of $210,256 and

$243,272 as of September 30, 2024 and December 31, 2023,

respectively (includes pledged assets of $210,656 and $167,948 as

of September 30, 2024 and December 31, 2023, respectively)

210,656

242,569

Receivable for loan repayment(1)

196,314

55,174

Accrued interest receivable

37,517

42,490

Prepaid expenses and other assets

20,315

19,213

Intangible lease asset, net of

amortization

40,554

42,793

Real estate owned, net of depreciation

113,848

115,830

Real estate owned, held for sale

284,423

103,657

Total assets

$

6,334,976

$

5,955,180

LIABILITIES AND STOCKHOLDERS'

EQUITY

Collateralized loan obligations

$

4,097,668

$

3,567,166

Repurchase agreements and revolving credit

facilities - commercial mortgage loans

183,761

299,707

Repurchase agreements - real estate

securities

241,266

174,055

Mortgage note payable

23,998

23,998

Other financings

12,865

36,534

Unsecured debt

81,370

81,295

Interest payable

12,378

15,383

Distributions payable

36,240

36,133

Accounts payable and accrued expenses

14,013

13,339

Due to affiliates

15,630

19,316

Intangible lease liability, held for

sale

1,805

12,297

Total liabilities

$

4,720,994

$

4,279,223

Commitments and Contingencies

Redeemable convertible preferred

stock:

Redeemable convertible preferred stock

Series H, $0.01 par value, 20,000 authorized and 17,950 issued and

outstanding as of September 30, 2024 and December 31, 2023

$

89,748

$

89,748

Total redeemable convertible preferred

stock

$

89,748

$

89,748

Equity:

Preferred stock, $0.01 par value;

100,000,000 shares authorized, 7.5% Cumulative Redeemable Preferred

Stock, Series E, 10,329,039 shares issued and outstanding as of

September 30, 2024 and December 31, 2023

$

258,742

$

258,742

Common stock, $0.01 par value, 900,000,000

shares authorized, 83,066,789 and 82,751,913 shares issued and

outstanding as of September 30, 2024 and December 31, 2023,

respectively

818

820

Additional paid-in capital

1,598,844

1,599,197

Accumulated other comprehensive

income/(loss)

400

(703

)

Accumulated deficit

(342,355

)

(298,942

)

Total stockholders' equity

$

1,516,449

$

1,559,114

Non-controlling interest

7,785

27,095

Total equity

$

1,524,234

$

1,586,209

Total liabilities, redeemable

convertible preferred stock and equity

$

6,334,976

$

5,955,180

(1) Includes $196.1 million and $55.1

million of cash held by servicer related to the CLOs as of

September 30, 2024 and December 31, 2023, respectively.

FRANKLIN BSP REALTY TRUST,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except share

and per share data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Income

Interest income

$

134,142

$

137,042

$

398,253

$

420,470

Less: Interest expense

89,884

77,973

257,942

224,347

Net interest income

44,258

59,069

140,311

196,123

Revenue from real estate owned

5,412

3,317

14,196

13,067

Total income

$

49,670

$

62,386

$

154,507

$

209,190

Expenses

Asset management and subordinated

performance fee

$

4,906

$

7,908

$

19,023

$

24,893

Acquisition expenses

255

316

688

977

Administrative services expenses

3,801

3,566

7,365

10,993

Professional fees

3,588

4,153

11,536

11,761

Share-based compensation

2,134

1,255

6,020

3,505

Depreciation and amortization

1,387

1,513

4,221

5,514

Other expenses

5,709

2,856

11,274

9,323

Total expenses

$

21,780

$

21,567

$

60,127

$

66,966

Other income/(loss)

(Provision)/benefit for credit losses

$

268

$

(2,379

)

$

(34,790

)

$

(28,363

)

Realized gain/(loss) on extinguishment of

debt

—

(2,836

)

—

2,201

Realized gain/(loss) on real estate

securities, available for sale

55

(486

)

143

110

Realized gain/(loss) on sale of commercial

mortgage loans, held for sale, measured at fair value

6,228

933

13,125

3,027

Unrealized gain/(loss) on commercial

mortgage loans, held for sale, measured at fair value

(615

)

—

—

44

Gain/(loss) on other real estate

investments

(2,193

)

(4,112

)

(8,436

)

(7,142

)

Trading gain/(loss)

—

(2,627

)

—

(605

)

Unrealized gain/(loss) on derivatives

322

(183

)

1

(110

)

Realized gain/(loss) on derivatives

(1,573

)

67

(1,261

)

684

Total other income/(loss)

$

2,492

$

(11,623

)

$

(31,218

)

$

(30,154

)

Income/(loss) before taxes

30,382

29,196

63,162

112,070

(Provision)/benefit for income tax

(209

)

1,799

(927

)

2,408

Net income/(loss)

$

30,173

$

30,995

$

62,235

$

114,478

Net (income)/loss attributable to

non-controlling interest

1,441

772

3,124

722

Net income/(loss) attributable to

Franklin BSP Realty Trust, Inc.

$

31,614

$

31,767

$

65,359

$

115,200

Less: Preferred stock dividends

6,749

6,748

20,245

20,245

Net income/(loss) applicable to common

stock

$

24,865

$

25,019

$

45,114

$

94,955

Basic earnings per share

$

0.30

$

0.30

$

0.53

$

1.14

Diluted earnings per share

$

0.30

$

0.30

$

0.53

$

1.14

Basic weighted average shares

outstanding

81,788,091

82,210,624

81,865,672

82,410,725

Diluted weighted average shares

outstanding

81,788,091

82,210,624

81,865,672

82,410,725

FRANKLIN BSP REALTY TRUST,

INC.

RECONCILIATION OF GAAP NET

INCOME TO DISTRIBUTABLE EARNINGS

(In thousands, except share

and per share data)

(Unaudited)

The following table provides a

reconciliation of GAAP net income to Distributable Earnings and

Distributable Earnings to Common as of the three and nine months

ended September 30, 2024 and 2023 (amounts in thousands, except

share and per share data):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP Net Income (Loss)

$

30,173

$

30,995

$

62,235

$

114,478

Adjustments:

CLO amortization acceleration(1)

—

(1,294

)

—

(3,959

)

Unrealized (gain)/loss on financial

instruments(2)

2,486

4,295

8,435

7,208

Unrealized (gain)/loss - ARMs

—

—

—

415

(Reversal of)/Provision for credit

losses

(268

)

2,379

34,790

28,363

Non-Cash Compensation Expense

2,134

1,256

6,020

3,506

Depreciation and amortization

1,387

1,513

4,221

5,514

Subordinated performance fee(3)

(3,438

)

1,579

(6,150

)

3,599

Realized (gain)/loss on debt

extinguishment / CLO call

—

2,836

—

(2,201

)

Realized Cash Gain/(Loss) Adjustment on

REO(4)

(36,433

)

(1,571

)

(40,113

)

(1,571

)

Loan workout charges/(loan workout

recoveries)(5)

—

—

—

(5,105

)

Distributable Earnings

$

(3,959

)

$

41,988

$

69,438

$

150,247

7.5% Series E Cumulative Redeemable

Preferred Stock Dividend

(4,842

)

(4,842

)

(14,526

)

(14,525

)

Noncontrolling Interests in Joint Ventures

Net (Income) / Loss

1,441

(276

)

3,124

(326

)

Noncontrolling Interests in Joint Ventures

Adjusted Net (Income) / Loss DE Adjustments

(1,403

)

772

(3,355

)

(15

)

Distributable Earnings to

Common

$

(8,763

)

$

37,642

$

54,681

$

135,381

Average Common Stock & Common Stock

Equivalents(6)

1,349,076

1,402,370

1,370,048

1,406,481

GAAP Net Income/(Loss) ROE

7.9

%

7.7

%

4.9

%

7.1

%

Distributable Earnings ROE

(2.6

)%

10.7

%

5.3

%

9.6

%

GAAP Net Income/(Loss) Per Share,

Diluted

$

0.30

$

0.30

$

0.53

$

1.14

GAAP Net Income/(Loss) Per Share, Fully

Converted(7)

$

0.30

$

0.30

$

0.57

$

1.12

Distributable Earnings Per Share, Fully

Converted(7)

$

(0.10

)

$

0.43

$

0.62

$

1.53

________________________

(1)

Before Q1 2024, we adjusted GAAP income

for non-cash CLO amortization acceleration to effectively amortize

the issuance costs of our CLOs over the expected lifetime of the

CLOs. We assume our CLOs will be outstanding for approximately four

years and amortized the financing costs over approximately four

years in our distributable earnings as compared to effective yield

methodology in our GAAP earnings. Starting in Q1 2024, we amortized

the issuance costs incurred on our CLOs over the expected lifetime

of the CLOs in our GAAP presentation, making our previous

adjustment no longer necessary.

(2)

Represents unrealized gains and losses on

(i) commercial mortgage loans, held for sale, measured at fair

value, (ii) other real estate investments, measured at fair value

and (iii) derivatives.

(3)

Represents accrued and unpaid subordinated

performance fee. In addition, reversal of subordinated performance

fee represents cash payment obligations in the quarter.

(4)

Represents amounts deemed nonrecoverable

upon a realization event, which is generally at the time a loan is

repaid, or in the case of a foreclosure or other property, when the

underlying asset is sold. Amounts may also be deemed

non-recoverable if, in our determination, it is nearly certain the

carrying amounts will not be collected or realized upon sale.

Amount may be different than the GAAP basis. As of September 30,

2024, the Company has $11.9 million of GAAP loss adjustments that

would run through distributable earnings if and when cash losses

are realized.

(5)

Represents loan workout charges the

Company incurred, which the Company deemed likely to be recovered.

Reversal of loan workout charges represent recoveries received.

During the second quarter of 2023, the Company recovered $5.1

million of loan workout charges, in aggregate, related to the loan

workout charges incurred in the first, second, and third quarters

of 2022 amounting to $1.9 million, $3.0 million, and $0.2 million,

respectively.

(6)

Represents the average of all classes of

equity except the Series E Preferred Stock.

(7)

Fully Converted assumes conversion of our

series of convertible preferred stock and full vesting of our

outstanding equity compensation awards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104781880/en/

Investor Relations Contact: Lindsey Crabbe

l.crabbe@benefitstreetpartners.com (214) 874-2339

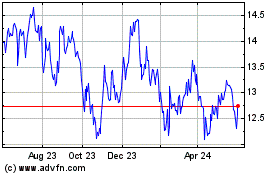

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

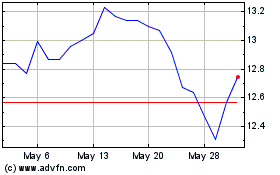

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Feb 2024 to Feb 2025