Benefit Street Partners L.L.C. Announces Closing of Three Senior Loans Aggregating $265 Million on a Multifamily Portfolio

11 September 2024 - 6:15AM

Business Wire

Benefit Street Partners L.L.C. (“BSP” or the “Company”) today

announced the closing of three floating-rate, cross-collateralized

senior loans aggregating $265 million on a multifamily portfolio.

The portfolio comprises 1,262 units of class A multifamily product

across three properties located in Saint John’s County, Florida.

Electra Capital Advisors, LLC provided three co-terminus mezzanine

loans aggregating $60 million. The loan’s sponsor, Gatlin

Development, is a repeat borrower of BSP. BSP was the original

construction lender for all three assets, which were completed in

2023 and 2024.

BSP allocated the loan across its commercial real estate

platform, including $136.4 million to Franklin BSP Realty Trust,

Inc. (NYSE: FBRT).

Michael Comparato, Head of Commercial Real Estate for BSP,

commented: “This transaction is another example of the high-quality

multifamily loans we're adding across our real estate platform. The

properties are some of the highest quality assets delivered in the

Jacksonville MSA and lease up continues to be strong. We are

pleased to continue our relationship with Gatlin Development and

look forward to future opportunities.”

About Benefit Street Partners

BSP-Alcentra is a leading global alternative credit asset

manager offering clients investment solutions across a broad range

of complementary credit strategies, including direct lending,

special situations, structured credit, high yield bonds, leveraged

loans and commercial real estate debt. As of June 30, 2024,

BSP-Alcentra has $76 billion of assets under management, with over

400 employees operating across North America, Europe and Asia

Pacific. BSP is a wholly owned subsidiary of Franklin Templeton.

For further information, please visit

www.benefitstreetpartners.com.

About Franklin BSP Realty Trust, Inc.

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) is a real estate

investment trust that originates, acquires and manages a

diversified portfolio of commercial real estate debt secured by

properties located in the United States. As of June 30, 2024, FBRT

had approximately $6.3 billion of assets. FBRT is externally

managed by Benefit Street Partners L.L.C., a wholly owned

subsidiary of Franklin Resources, Inc. For further information,

please visit www.fbrtreit.com.

Forward-Looking Statements

This communication includes forward-looking statements. These

forward-looking statements generally can be identified by phrases

such as “will,” “should,” “expects,” “anticipates,” “foresees,”

“forecasts,” “estimates” or other words or phrases of similar

import. Similarly, any statements herein that describe beliefs,

intentions or goals also are forward-looking statements. It is

uncertain whether any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do, what impact they will have on the results of operations

and financial condition of FBRT. These forward-looking statements

involve certain risks and uncertainties, many of which are beyond

our control, that could cause actual results to differ materially

from those indicated in such forward-looking statements. Further,

forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time, unless required by law.

Our forward-looking statements are subject to various risks and

uncertainties, including but not limited to the risks and important

factors contained and identified in FBRT’s filings with the

Securities and Exchange Commission (“SEC”), including its Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

its subsequent filings with the SEC, any of which could cause

actual results to differ materially from the forward-looking

statements. The forward-looking statements included in this

communication are made only as of the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910604904/en/

Investor Relations Contact: Lindsey Crabbe

l.crabbe@benefitstreetpartners.com (214) 874-2339

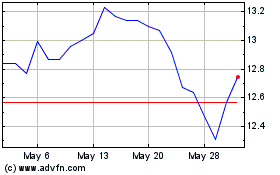

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

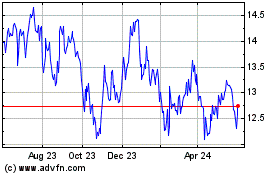

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Feb 2024 to Feb 2025