Franklin BSP Realty Trust, Inc. Announces Closing of a $1.024 Billion CRE CLO

27 September 2024 - 6:15AM

Business Wire

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) today announced the

closing of BSPRT 2024-FL11 (“FL11”), a $1.024 billion managed

Commercial Real Estate Collateralized Loan Obligation. FL11

features a 36-month reinvestment period and includes a $100

million, all multifamily 180-day ramp-up acquisition period. The

transaction has an initial advance rate of 86.5% and a weighted

average interest rate of 1M CME Term SOFR+1.99% before accounting

for discount and transaction costs.

Michael Comparato, President of FBRT, commented: “We are excited

to announce the successful closing of FL11. Year-to-date, FBRT has

been very active originating loans in the middle market, with a

meaningful amount of those originations included in the FL11

collateral pool. Strong investor interest led to significant

oversubscription across all bond classes, and we are very

appreciative of the continued support of our offerings by some of

the largest institutional investors in the world.”

Barclays Capital Inc. served as sole structuring agent. J.P.

Morgan Securities LLC and Wells Fargo Securities LLC served as

co-lead managers and joint bookrunners.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Franklin BSP Realty Trust, Inc.

Franklin BSP Realty Trust, Inc. is a real estate investment

trust that originates, acquires and manages a diversified portfolio

of commercial real estate debt secured by properties located in the

United States. As of June 30, 2024, FBRT had approximately $6.3

billion of assets. FBRT is externally managed by Benefit Street

Partners L.L.C., a wholly owned subsidiary of Franklin Resources,

Inc. For further information, please visit www.fbrtreit.com.

Forward-Looking Statements

Certain statements included in this press release are

forward-looking statements. Those statements include statements

regarding the intent, belief or current expectations of FBRT and

members of our management team, as well as the assumptions on which

such statements are based, and generally are identified by the use

of words such as "may," "will," "seeks," "anticipates," "believes,"

"estimates," "expects," "plans," "intends," "should" or similar

expressions. Actual results may differ materially from those

contemplated by such forward-looking statements. Further,

forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time, unless required by law.

FBRT’s forward-looking statements are subject to various risks

and uncertainties, including but not limited to the risks and

important factors contained and identified in FBRT’s filings with

the Securities and Exchange Commission (“SEC”), including its

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 and its subsequent filings with the SEC, any of which could

cause actual results to differ materially from the forward-looking

statements. The forward-looking statements included in this

communication are made only as of the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926367932/en/

Investor Relations Contact: Lindsey Crabbe

l.crabbe@benefitstreetpartners.com (214) 874-2339

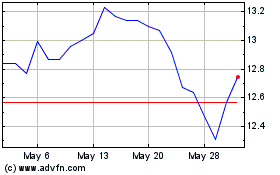

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

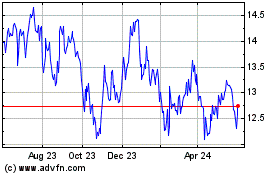

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Jan 2024 to Jan 2025