Benefit Street Partners L.L.C. Announces Closing of a $135 Million Loan Package on The Empire Hotel

18 January 2025 - 12:30AM

Business Wire

Benefit Street Partners L.L.C. (“BSP” or the “Company”) today

announced the closing of a $120 million senior loan and a $15

million mezzanine loan, together aggregating a $135 million loan

package, facilitating the refinancing of the Empire Hotel. The

Empire Hotel is a 427-key hotel located in the Upper West Side

neighborhood of Manhattan, NY. The property was built in 1901 and

underwent a comprehensive renovation in 2013.

BSP allocated the loans across its commercial real estate

platform, including a portion to Franklin BSP Realty Trust, Inc.

(NYSE: FBRT).

Michael Comparato, Head of Commercial Real Estate for BSP,

commented: “The Empire Hotel represents a strategic addition to our

commercial real estate portfolio, showcasing the flexibility and

value that our platform delivers to borrowers. We look forward to

capitalizing on additional unique opportunities within the real

estate market throughout 2025.”

Further commenting, Brian Buffone, Head of Real Estate

Operations at BSP, added: “The borrower signed our application on

December 17, 2024. We successfully funded this complicated

transaction in 18 business days, further demonstrating the

flexibility and responsiveness of the BSP platform.”

About Benefit Street Partners

BSP-Alcentra is a leading global alternative credit asset

manager offering clients investment solutions across a broad range

of complementary credit strategies, including direct lending,

special situations, structured credit, high yield bonds, leveraged

loans and commercial real estate debt and equity. As of September

30, 2024, BSP-Alcentra has $77 billion of assets under management,

with over 400 employees operating across North America, Europe and

Asia Pacific. BSP is a wholly owned subsidiary of Franklin

Templeton. For further information, please visit

www.benefitstreetpartners.com.

About Franklin BSP Realty Trust, Inc.

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) is a real estate

investment trust that originates, acquires and manages a

diversified portfolio of commercial real estate debt secured by

properties located in the United States. As of September 30, 2024,

FBRT had approximately $6.3 billion of assets. FBRT is externally

managed by Benefit Street Partners L.L.C., a wholly owned

subsidiary of Franklin Resources, Inc. For further information,

please visit www.fbrtreit.com.

Forward-Looking Statements

This communication includes forward-looking statements. These

forward-looking statements generally can be identified by phrases

such as “will,” “should,” “expects,” “anticipates,” “foresees,”

“forecasts,” “estimates” or other words or phrases of similar

import. Similarly, any statements herein that describe beliefs,

intentions or goals also are forward-looking statements. It is

uncertain whether any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do, what impact they will have on the results of operations

and financial condition of FBRT. These forward-looking statements

involve certain risks and uncertainties, many of which are beyond

our control, that could cause actual results to differ materially

from those indicated in such forward-looking statements. Further,

forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time, unless required by law.

Our forward-looking statements are subject to various risks and

uncertainties, including but not limited to the risks and important

factors contained and identified in FBRT’s filings with the

Securities and Exchange Commission (“SEC”), including its Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

its subsequent filings with the SEC, any of which could cause

actual results to differ materially from the forward-looking

statements. The forward-looking statements included in this

communication are made only as of the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250117468487/en/

Investor Relations Contact: Lindsey Crabbe

l.crabbe@benefitstreetpartners.com (214) 874-2339

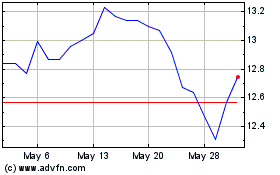

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

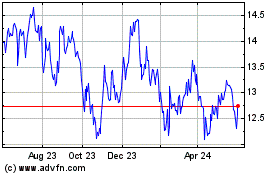

Franklin BSP Realty (NYSE:FBRT)

Historical Stock Chart

From Jan 2024 to Jan 2025