SPRINGFIELD, Ill., Feb. 8 /PRNewswire-FirstCall/ -- Horace Mann

Educators Corporation (NYSE:HMN) today reported net income of $16.1

million (35 cents per share) and $77.3 million ($1.67 per share),

respectively, for the three and twelve months ended December 31,

2005, compared to $28.3 million (61 cents per share) and $56.3

million ($1.25 per share) for the same periods in 2004. Included in

net income were net realized gains on securities of $0.7 million

($0.4 million after tax, or 1 cent per share) and $9.8 million

($6.4 million after tax, or 13 cents per share) for the three and

twelve months ended December 31, 2005, respectively, compared to

net realized gains of $2.9 million ($1.9 million after tax, or 4

cents per share) and $12.2 million ($7.9 million after tax, or 17

cents per share) for the three and twelve months ended December 31,

2004, respectively. All per-share amounts are stated on a diluted

basis. "As previously announced, Horace Mann's fourth quarter 2005

earnings reflected a significant level of catastrophe costs for the

company -- $13.2 million after tax, or 28 cents per share, for the

quarter. Looking beyond the catastrophe costs, property and

casualty non-catastrophe loss ratios continued to be favorable in

the fourth quarter, although somewhat higher than prior year due to

the severe winter weather that impacted several key states in the

first half of December," said Louis G. Lower II, President and

Chief Executive Officer. "Our underlying auto and homeowners

results continued to benefit from tightened underwriting standards

and pricing actions taken in recent years, ongoing improvements in

claims processes, cost containment initiatives, and generally low

non-catastrophe claim frequencies. Property and casualty earnings

for the quarter also benefited by $3.4 million after tax from

continued favorable development of prior years' claim reserves,"

Lower added. For full year 2005, the company's federal income tax

expense reflected a reduction of $9.1 million from the closing of

six prior tax years. Federal income tax expense for the third

quarter was reduced by $6.4 million as a result of closing tax

years 1998 through 2001 with favorable resolution of the contingent

tax liabilities related to those four years. In the second quarter

of 2005, resolution of tax years 1996 and 1997 reduced federal

income tax expense by $2.7 million, and interest on the tax refund

amounts of $1.4 million was received and recorded as pretax income.

"Our underlying 2005 results support a preliminary estimate of full

year 2006 net income before realized investment gains and losses of

between $1.65 and $1.80 per share," said Lower. "This projection

anticipates favorable underlying property and casualty underwriting

results -- with a combined ratio in the low 90s -- and also

reflects additional costs of approximately 16 cents per share

associated with an enhanced catastrophe reinsurance program. The

2006 reinsurance program includes increased coverage for a single

event to a maximum of $110 million as well as a new aggregate

excess of loss treaty with a $20 million limit on losses in excess

of $20 million." Segment Earnings Net income for the property and

casualty segment decreased $9.5 million for the quarter and

increased $17.4 million for the year compared to the 2004 periods.

The $20.3 million pretax of catastrophe costs incurred in the

fourth quarter of 2005 was attributed primarily to an estimated $15

million of losses and loss adjustment expenses related to Hurricane

Wilma, a $1 million increase in the estimated net losses from

Hurricane Rita and a $1.3 million assessment from Louisiana related

to Hurricane Katrina. In the fourth quarter of 2004, catastrophe

costs of $12.3 million pretax were due primarily to a re-estimate

of expected net losses and reinsurance reinstatement premiums

related to Hurricanes Charley, Frances, Ivan and Jeanne. In

addition to catastrophes, earnings for the fourth quarter of 2005

were also negatively effected by severe winter weather in early

December, primarily impacting the auto line. The reserve studies as

of December 31, 2005 and 2004 identified favorable development of

prior years' reserves of $5.3 million in the current quarter and

adverse development of $3.8 million in the fourth quarter of 2004.

These year-end studies also resulted in recognition of favorable

property and casualty claim and claim expense reserve development

for the first three quarters of each year totaling $5 million in

2005 and $13 million in 2004. Annuity segment net income of $3.2

million for the fourth quarter was $0.3 million less than in the

prior year. The current period reflected decreased amortization of

deferred policy acquisition costs and value of acquired insurance

in force, while the fourth quarter of 2004 included a favorable

accrual adjustment to federal income tax expense. For the year

ended December 31, 2005, annuity segment net income increased $2.5

million primarily as a result of the contingent income tax

liability reductions recorded in the second and third quarters of

2005. Annuity segment earnings for the current periods also

reflected declines in the interest margin. For the quarter, life

segment net income decreased slightly compared to prior year. For

full year 2005, life segment net income decreased $1.4 million

primarily as a result of an increase in the effective income tax

rate recorded in the third quarter. Segment Revenues The company's

premiums written and contract deposits increased slightly compared

to the fourth quarter of 2004 and decreased 3 percent compared to

full year 2004 with the effect of property and casualty reinsurance

reinstatement premiums representing one-half percentage point of

the annual decline. For property and casualty, full year premiums

written declined, as increases in average auto and homeowners

premium per policy -- which were moderated to some extent by the

improvement in quality in the books of business -- were more than

offset by the decline in policies in force and the higher level of

reinsurance reinstatement premiums. In the third and fourth

quarters, the growth in new scheduled annuity deposits exceeded the

reduction in single premium and rollover deposit receipts. However,

the full year decrease in annuity new contract deposits compared to

2004 was due primarily to a reduction in single premium and

rollover deposits, partially offset by growth in new scheduled

annuity deposit receipts. Full year deposits to fixed accounts

decreased 7 percent, reflecting the current interest rate

environment, while variable annuity deposits increased 4 percent

compared to the prior year. Life segment insurance premiums and

contract deposits decreased 3 percent compared to full year 2004,

reflecting the shift in sales mix toward partner products. Sales

and Distribution Compared to record levels of annuity sales in the

prior year, total new annuity sales decreased 4 percent in 2005.

This decline was narrowed during the third and fourth quarters as

the level of annuity new business from independent agents increased

following a transition period to implement the company's desired

shift in mix of business from this channel. Improved auto and

property sales in the fourth quarter of 2005 -- driven by gains in

average agent productivity for these products -- pushed these lines

to full year growth over 2004. Total career agent sales for the

year decreased compared to 2004 reflecting a modest decline in

average overall productivity per agent. Horace Mann's career agency

force totaled 855 agents at December 31, 2005. "The total number of

agents increased sequentially in each of the four quarters of 2005

and was up 7 percent for the full year. The number of experienced

agents -- a key component of the total agency force -- increased

more than 10 percent during 2005 and showed growth in each of the

last seven quarters," Lower said. "We anticipate continued,

although more modest, growth in our agency force in 2006." Horace

Mann -- the largest national multiline insurance company focusing

on educators' financial needs -- provides auto and homeowners

insurance, retirement annuities, life insurance and other financial

solutions. Founded by educators for educators in 1945, the company

is headquartered in Springfield, Ill. For more information, visit

http://www.horacemann.com/ . Statements included in this news

release that are not historical in nature are forward-looking

within the meaning of the Private Securities Litigation Reform Act

of 1995 and are subject to certain risks and uncertainties. Horace

Mann is not under any obligation to (and expressly disclaims any

such obligation to) update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Please refer to the company's Quarterly Report on

Form 10-Q for the quarter ended September 30, 2005 and the

company's past and future filings and reports filed with the

Securities and Exchange Commission for information concerning the

important factors that could cause actual results to differ

materially from those in forward-looking statements. HORACE MANN

EDUCATORS CORPORATION Digest of Earnings and Highlights (Dollars in

Millions, Except Per Share Data) Quarter Ended Year Ended December

31, December 31, % % 2005 2004 Change 2005 2004 Change DIGEST OF

EARNINGS Net income $16.1 $28.3 -43.1% $77.3 $56.3 37.3% Net income

per share: Basic $0.37 $0.66 -43.9% $1.80 $1.32 36.4% Diluted

(A)(B) $0.35 $0.61 -42.6% $1.67 $1.25 33.6% Weighted average number

of shares and equivalent shares: Basic 43.0 42.8 42.9 42.8 Diluted

(A)(B) 48.0 47.5 47.9 47.3 HIGHLIGHTS Operations Insurance premiums

written and contract deposits (C)(D) $242.7 $242.0 0.3% $972.6

$998.4 -2.6% Return on equity (E) 13.2% 10.3% Property &

Casualty GAAP combined ratio 96.9% 88.2% 95.6% 100.5% Effect of

catastrophe costs on the Property & Casualty combined ratio

14.5% 8.4% 12.3% 13.4% Experienced agents 600 539 11.3% Financed

agents 255 261 -2.3% Total agents 855 800 6.9% Additional Per Share

Information Dividends paid $0.105 $0.105 - $0.42 $0.42 - Book value

(F) $13.51 $13.45 0.4% Financial Position Total assets $5,835.9

$5,371.9 8.6% Short-term debt - 25.0 Long-term debt 190.9 144.7

Total shareholders' equity 580.6 576.2 0.8% (A) Effective December

31, 2004, the Company adopted EITF Consensus 04-8, "The Effect of

Contingently Convertible Instruments on Diluted Earnings per

Share". The Company's Senior Convertible Notes represent 4.3

million equivalent shares and have annual interest expense of $2.7

million after tax. Diluted per share information for all periods is

presented on a basis consistent with this consensus. (B) As

prescribed by U.S. generally accepted accounting principles, the

quarter earnings per share amounts were computed discretely and the

antidilutive effects of potential common shares outstanding were

excluded from weighted average shares and equivalent shares -

diluted for the third quarter of 2005 and 2004. Accordingly, the

sum of the per share amounts for the four quarters does not equal

the year-to- date per share amount. (C) As a result of catastrophes

in the third quarter of both 2005 and 2004, the Company incurred

additional ceded premiums, to reinstate its property and casualty

reinsurance coverage, of $0.5 million and $1.0 million for the

three months and $9.9 million and $5.0 million for the years ended

December 31, 2005 and 2004, respectively. Excluding these

reinstatement premiums from both years, the percentage changes were

0.1% and -2.1% for the three and twelve months ended December 31,

2005, respectively. (D) Reflecting resolution of the challenge to

automobile rates in North Carolina, in the fourth quarter of 2004

the Company returned to policyholders $4.0 million of previously

escrowed premiums, resulting in a reduction to written premiums.

Excluding the escrow payment and the reinstatement premiums

described in note (C), the written premium growth rates were -1.5%

and -2.5% for the three and twelve months ended December 31, 2005,

respectively. (E) Based on trailing 12-month net income and average

quarter-end shareholders' equity. (F) Before the fair value

adjustment for investments, book value per share was $12.85 at

December 31, 2005 and $11.45 at December 31, 2004. Ending shares

outstanding were 42,972,028 at December 31, 2005 and 42,846,643 at

December 31, 2004. - 1 - HORACE MANN EDUCATORS CORPORATION

Statements of Operations and Supplemental GAAP Consolidated Data

(Dollars in Millions) Quarter Ended Year Ended December 31,

December 31, % % 2005 2004 Change 2005 2004 Change STATEMENTS OF

OPERATIONS Insurance premiums written and contract deposits (A)

$242.7 $242.0 0.3% $972.6 $998.4 -2.6% Insurance premiums and

contract charges earned (A) $170.0 $172.9 -1.7% $664.9 $674.7 -1.5%

Net investment income 49.7 47.9 3.8% 194.6 191.4 1.7% Realized

investment gains 0.7 2.9 9.8 12.2 Total revenues 220.4 223.7 -1.5%

869.3 878.3 -1.0% Benefits, claims and settlement expenses 114.1

106.5 442.7 484.4 Interest credited 29.8 28.1 115.9 108.7 Policy

acquisition expenses amortized 17.1 18.2 71.5 70.0 Operating

expenses 35.4 34.3 3.2% 131.2 132.7 -1.1% Amortization of

intangible assets 0.8 2.2 5.1 6.0 Interest expense (B) 2.3 1.7 8.9

6.8 Total benefits, losses and expenses 199.5 191.0 4.5% 775.3

808.6 -4.1% Income before income taxes 20.9 32.7 -36.1% 94.0 69.7

34.9% Income tax expense (C) 4.8 4.4 16.7 13.4 Net income $16.1

$28.3 -43.1% $77.3 $56.3 37.3% ANALYSIS OF PREMIUMS WRITTEN AND

CONTRACT DEPOSITS (A) Property & Casualty Automobile and

property (voluntary) $131.7 $132.1 -0.3% $535.2 $552.5 -3.1%

Involuntary and other property & casualty 2.0 0.8 11.7 9.8

Total Property & Casualty 133.7 132.9 0.6% 546.9 562.3 -2.7%

Annuity deposits 79.9 78.6 1.7% 320.1 327.0 -2.1% Life 29.1 30.5

-4.6% 105.6 109.1 -3.2% Total $242.7 $242.0 0.3% $972.6 $998.4

-2.6% ANALYSIS OF SEGMENT NET INCOME (LOSS) Property & Casualty

$11.1 $20.6 -46.1% $45.0 $27.6 63.0% Annuity 3.2 3.5 -8.6% 15.1

12.6 19.8% Life 3.3 3.7 -10.8% 13.4 14.8 -9.5% Corporate and other

(D) (1.5) 0.5 3.8 1.3 Net income 16.1 28.3 -43.1% 77.3 56.3 37.3%

Catastrophe costs, after tax, included above (E) (13.2) (8.0)

(45.0) (49.1) (A) See additional information on page 1 regarding

the effects of property and casualty catastrophe reinsurance

reinstatement premiums and escrowed North Carolina automobile

premiums. (B) The year ended December 31, 2005 includes costs of

$0.5 million as a result of retiring the 6 5/8% Senior Notes due

2006. (C) The year ended December 31, 2005 reflects reductions of

$9.1 million as a result of closing tax years 1998 through 2001 in

the third quarter and tax years 1996 and 1997 in the second quarter

with favorable resolution of the contingent tax liabilities. The

Company also received interest on income tax refunds of $1.4

million pretax in the second quarter reflected as a reduction to

year-to-date Operating Expenses above. (D) The Corporate and Other

segment includes interest expense on debt and the impact of

realized investment gains and losses and other corporate level

items. The Company does not allocate the impact of corporate level

transactions to the insurance segments consistent with management's

evaluation of the results of those segments. See detail for this

segment on page 4. (E) Net of anticipated recoveries from the

Company's underlying catastrophe reinsurance program and, in 2004,

from the Florida Hurricane Catastrophe Fund. Includes allocated

loss adjustment expenses and catastrophe reinsurance reinstatement

premiums. - 2 - HORACE MANN EDUCATORS CORPORATION Supplemental

Business Segment Overview (Dollars in Millions) Quarter Ended Year

Ended December 31, December 31, % % 2005 2004 Change 2005 2004

Change PROPERTY & CASUALTY Premiums written (A)(B) $133.7

$132.9 0.6% $546.9 $562.3 -2.7% Premiums earned (A) 139.7 143.8

-2.9% 549.6 561.3 -2.1% Net investment income 8.5 8.3 2.4% 33.2

33.8 -1.8% Losses and loss adjustment expenses (LAE) 101.8 95.2

398.0 439.3 Operating expenses (includes policy acquisition

expenses amortized) 33.1 32.8 0.9% 126.8 126.3 0.4% Income before

tax 13.3 24.1 -44.8% 58.0 29.5 96.6% Net income 11.1 20.6 -46.1%

45.0 27.6 63.0% Net investment income, after tax 7.2 7.0 2.9% 28.2

28.6 -1.4% Catastrophe costs, after tax (C) 13.2 8.0 45.0 49.1

Catastrophe losses and LAE, before tax (D) 19.8 11.3 59.3 70.5

Reinsurance reinstatement premiums, before tax 0.5 1.0 9.9 5.0

Operating statistics: Loss and loss adjustment expense ratio 72.9%

66.2% 72.4% 78.3% Expense ratio 24.0% 22.0% 23.2% 22.2% Combined

ratio 96.9% 88.2% 95.6% 100.5% Effect of catastrophe costs on the

combined ratio 14.5% 8.4% 12.3% 13.4% Automobile and property

detail: Premiums written (voluntary) (A)(B) $131.7 $132.1 -0.3%

$535.2 $552.5 -3.1% Automobile (B) 92.5 93.5 -1.1% 381.1 398.2

-4.3% Property 39.2 38.6 1.6% 154.1 154.3 -0.1% Premiums earned

(voluntary) (A) 135.3 140.3 -3.6% 538.8 552.0 -2.4% Automobile 94.8

101.5 -6.6% 386.0 404.2 -4.5% Property 40.5 38.8 4.4% 152.8 147.8

3.4% Policies in force (voluntary) (in thousands) 797 818 -2.6%

Automobile 531 545 -2.6% Property 266 273 -2.6% Voluntary

automobile operating statistics: Loss and loss adjustment expense

ratio 70.7% 64.7% 68.2% 70.6% Expense ratio 24.5% 21.8% 23.4% 22.0%

Combined ratio 95.2% 86.5% 91.6% 92.6% Effect of catastrophe costs

on the combined ratio 1.1% 0.2% 1.5% 1.0% Total property operating

statistics: Loss and loss adjustment expense ratio 75.4% 67.4%

80.5% 96.9% Expense ratio 23.6% 22.3% 23.3% 22.6% Combined ratio

99.0% 89.7% 103.8% 119.5% Effect of catastrophe costs on the

combined ratio 45.7% 29.1% 39.3% 47.7% Prior years' reserves

favorable (adverse) development, pretax Voluntary automobile $3.5

$(3.8) $8.8 $(3.8) Total property 1.8 - 4.3 - Other property and

casualty - - - - Total 5.3 (3.8) 13.1 (3.8) (A) Amounts are net of

additional ceded premiums to reinstate the Company's property and

casualty catastrophe reinsurance coverage as quantified above. (B)

After return of escrowed North Carolina automobile premiums of $4.0

million for the three and twelve months ended December 31, 2004.

(C) Net of anticipated recoveries from the Company's underlying

catastrophe reinsurance program and, in 2004, from the Florida

Hurricane Catastrophe Fund. Includes allocated loss adjustment

expenses and catastrophe reinsurance reinstatement premiums. (D)

Amounts for the three and twelve months ended December 31, 2005

include the Company's $1.3 million assessment from the Louisiana

Citizens Fair and Coastal Plans. In addition, the amount for the

twelve months ended December 31, 2005 includes the Company's $1.8

million assessment from the Florida Citizens Property Insurance

Corporation. The Company intends to assess its Louisiana and

Florida property policyholders, respectively, to recoup these

amounts. - 3 - HORACE MANN EDUCATORS CORPORATION Supplemental

Business Segment Overview (Dollars in Millions) Quarter Ended Year

Ended December 31, December 31, % % 2005 2004 Change 2005 2004

Change ANNUITY Contract deposits $79.9 $78.6 1.7% $320.1 $327.0

-2.1% Variable 39.5 36.9 7.0% 137.8 132.0 4.4% Fixed 40.4 41.7

-3.1% 182.3 195.0 -6.5% Contract charges earned 4.6 4.3 7.0% 17.9

16.7 7.2% Net investment income 28.9 27.7 4.3% 112.9 109.4 3.2% Net

interest margin (without realized gains) 7.8 8.0 -2.5% 31.4 33.7

-6.8% Mortality gain (loss) and other reserve changes (0.4) 0.2

(0.8) (1.2) Operating expenses (includes policy acquisition

expenses amortized) 7.0 7.7 -9.1% 28.5 28.4 0.4% Income before tax

and amortization of intangible assets 5.0 4.8 4.2% 20.0 20.8 -3.8%

Amortization of intangible assets 0.5 1.9 3.7 4.5 Income before tax

4.5 2.9 55.2% 16.3 16.3 - Net income 3.2 3.5 -8.6% 15.1 12.6 19.8%

Pretax income increase (decrease) due to valuation of: Deferred

policy acquisition costs $0.2 $(0.8) $(1.8) $(1.2) Value of

acquired insurance in force 0.5 (0.9) 0.2 (0.9) Guaranteed minimum

death benefit reserve (0.2) - (0.6) - Annuity contracts in force

(in thousands) 162 159 1.9% Accumulated value on deposit $3,295.4

$3,081.0 7.0% Variable 1,333.7 1,254.8 6.3% Fixed 1,961.7 1,826.2

7.4% Annuity accumulated value retention - 12 months Variable

accumulations 91.5% 92.9% Fixed accumulations 94.5% 95.5% LIFE

Premiums and contract deposits $29.1 $30.5 -4.6% $105.6 $109.1

-3.2% Premiums and contract charges earned 25.7 24.8 3.6% 97.4 96.7

0.7% Net investment income 12.5 12.3 1.6% 49.3 49.5 -0.4% Income

before tax 5.3 4.8 10.4% 22.3 22.0 1.4% Net income 3.3 3.7 -10.8%

13.4 14.8 -9.5% Pretax income increase (decrease) due to valuation

of: Deferred policy acquisition costs $0.1 $- $0.7 $(0.4) Life

policies in force (in thousands) 237 252 -6.0% Life insurance in

force (in millions) $13,142 $13,223 -0.6% Lapse ratio - 12 months

(Ordinary life insurance) 6.5% 7.2% CORPORATE AND OTHER (A)

Components of gain (loss) before tax: Realized investment gains

$0.7 $2.9 $9.8 $12.2 Interest expense (2.3) (1.7) (8.9) (6.8) Other

operating expenses (0.6) (0.3) (3.5) (3.5) Income (loss) before tax

(2.2) 0.9 (2.6) 1.9 Net income (loss) (1.5) 0.5 3.8 1.3 (A) The

Corporate and Other segment includes interest expense on debt and

the impact of realized investment gains and losses and other

corporate level items. The Company does not allocate the impact of

corporate level transactions to the insurance segments consistent

with management's evaluation of the results of those segments. - 4

- HORACE MANN EDUCATORS CORPORATION Supplemental Business Segment

Overview (Dollars in Millions) Quarter Ended Year Ended December

31, December 31, % % 2005 2004 Change 2005 2004 Change INVESTMENTS

Annuity and Life Fixed maturities, at market (amortized cost 2005,

$2,923.5; 2004, $2,694.1) $2,967.2 $2,820.4 Short-term investments

7.1 17.3 Short-term investments, securities lending collateral

184.7 0.1 Policy loans and other 88.7 83.1 Total Annuity and Life

investments 3,247.7 2,920.9 11.2% Property & Casualty Fixed

maturities, at market (amortized cost 2005, $734.5; 2004, $705.1)

738.3 720.8 Short-term investments 1.4 14.7 Short-term investments,

securities lending collateral 8.3 - Other 0.6 0.6 Total Property

& Casualty investments 748.6 736.1 1.7% Corporate investments

0.2 0.2 Total investments 3,996.5 3,657.2 9.3% Net investment

income Before tax $49.7 $47.9 3.8% $194.6 $191.4 1.7% After tax

34.0 32.8 3.7% 133.1 131.1 1.5% Realized investment gains (losses)

by investment portfolio included in Corporate and Other segment

income Property & Casualty $(0.4) $1.7 $1.9 $6.6 Annuity - -

7.9 3.7 Life 1.1 1.4 - 2.1 Corporate and Other - (0.2) - (0.2)

Total, before tax 0.7 2.9 9.8 12.2 Total, after tax 0.4 1.9 6.4 7.9

Per share, diluted $0.01 $0.04 $0.13 $0.17 OTHER INFORMATION End of

period goodwill asset $47.4 $47.4 End of period property and

casualty net reserves (A): December 31, 2005 $311.1 September 30,

2005 334.3 June 30, 2005 314.8 March 31, 2005 313.2 December 31,

2004 309.3 December 31, 2003 283.7 December 31, 2002 231.0 December

31, 2001 241.6 December 31, 2000 223.0 December 31, 1999 206.8 (A)

Unpaid claim and claim expense reserves net of anticipated

reinsurance recoverables and reduced for checks issued and

outstanding. - 5 - First Call Analyst: FCMN Contact:

ruffatk1@mail.horacemann.com DATASOURCE: Horace Mann Educators

Corporation CONTACT: Dwayne D. Hallman, Senior Vice President -

Finance, of Horace Mann Educators Corporation, +1-217-788-5708 Web

site: http://www.horacemann.com/

Copyright

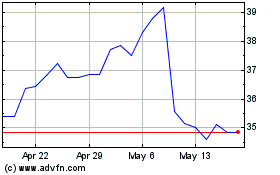

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jul 2023 to Jul 2024