Mirant Announces Agreement for Sale of Philippine Business

11 December 2006 - 11:52PM

PR Newswire (US)

ATLANTA, Dec. 11 /PRNewswire-FirstCall/ -- Mirant Corporation

(NYSE:MIR) announced today that it has entered into a definitive

purchase and sale agreement with a consortium of The Tokyo Electric

Power Company, Incorporated and Marubeni Corporation for the sale

of its Philippine business for a purchase price of $3.424 billion

plus working capital at the closing. After the payment of related

debt (estimated to be $642 million at the closing), the net

proceeds to Mirant are expected to be $3.152 billion. The

transaction is expected to close in the second quarter of 2007

after the satisfaction of certain conditions, including the Sual

plant being operational. Mirant's financial advisor for the sale is

Credit Suisse. "The Philippines is a good environment for foreign

investment and has been a wonderful place for us to do business,"

said Edward R. Muller, Chairman and Chief Executive Officer of

Mirant Corporation. "We wish the Tokyo Electric- Marubeni

consortium and the Philippine people great success." The amount of

net operating loss carryforwards (NOLs) that are available in 2007

to offset the taxable gain resulting from this transaction

(expected to be approximately $1.1 billion), results of other

transactions expected to close in 2007 and Mirant's other

anticipated taxable income for the year will depend on whether

Mirant elects to be treated under section 382(l)(5) or section

382(l)(6) of the Internal Revenue Code, an election that Mirant

must make not later than September 17, 2007. Although the ultimate

decision on this election will depend on Mirant's anticipated

overall 2007 tax position, it is more likely than not that Mirant

will elect to determine its NOLs under section 382(l)(5). Upon

completion of the transaction, Mirant expects to record a pre-tax

book gain of approximately $2.2 billion. As previously announced,

Mirant plans to continue returning cash to its shareholders upon

completion of its planned asset and business sales. The amount of

cash returned will be determined based on the outlook for the

continuing business (1) to preserve the credit profile of the

continuing business, (2) to maintain adequate liquidity for

expected cash requirements including, among other things, capital

expenditures for the continuing business, and (3) to retain

sufficient working capital to manage fluctuations in commodity

prices. Mirant is a competitive energy company that produces and

sells electricity in the United States, the Caribbean, and the

Philippines. Mirant owns or leases approximately 17,300 megawatts

of electric generating capacity globally. The company operates an

asset management and energy marketing organization from its

headquarters in Atlanta. For more information, please visit

http://www.mirant.com/. Cautionary Language Regarding

Forward-Looking Statements Some of the statements included herein

involve forward-looking information. Mirant cautions that these

statements involve known and unknown risks and that there can be no

assurance that such results will occur. There are various important

factors that could cause actual results to differ materially from

those indicated in the forward-looking statements, such as, but not

limited to, the ability of Mirant to satisfy the conditions to

closing of the transaction, including its ability to complete the

repairs to the Sual plant and return it to operation and the

absence of any material adverse change that would prevent closing,

and other factors discussed in Mirant's Form 10-K for the year

ended December 31, 2005, and its Form 10-Q for the quarter ended

September 30, 2006. Mirant undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. DATASOURCE: Mirant

Corporation CONTACT: Media, Mary Ann Arico, +1-678-579-7553, or ,

or Investor Relations, Mary Ann Arico, +1-678-579-7553, or , or

Sarah Stashak, +1-678-579-6940, or , or Stockholder inquiries,

+1-678-579-7777 , all of Mirant Corporation Web site:

http://www.mirant.com/

Copyright

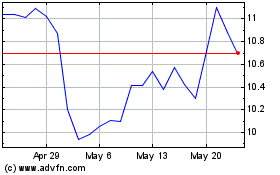

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mirion Technologies (NYSE:MIR)

Historical Stock Chart

From Jul 2023 to Jul 2024