PCN, PTY, PGP, PHK, PKO, RCS, PCM, PFL and PFN Declare Monthly Common Share Dividends

02 February 2012 - 8:00AM

Business Wire

The Boards of Trustees of PIMCO Corporate & Income Strategy

Fund (NYSE: PCN), PIMCO Corporate & Income Opportunity Fund

(NYSE: PTY), PIMCO Global StocksPLUS® & Income Fund (NYSE:

PGP), PIMCO High Income Fund (NYSE: PHK), PIMCO Income Opportunity

Fund (NYSE: PKO), PIMCO Strategic Global Government Fund, Inc.

(NYSE: RCS), PCM Fund, Inc. (NYSE: PCM), PIMCO Income Strategy Fund

(NYSE: PFL) and PIMCO Income Strategy Fund II (NYSE: PFN)

(collectively, the “Funds”) announced today that they have declared

the following dividends on the Funds’ common shares:

Per Common Share

PIMCO Corporate & Income Strategy

Fund

$0.10625

PIMCO Corporate & Income Opportunity

Fund

$0.115

PIMCO Global StocksPLUS® & Income

Fund

$0.18335

PIMCO High Income Fund

$0.121875

PIMCO Income Opportunity Fund

$0.19

PIMCO Strategic Global Government Fund,

Inc

$0.08

PCM Fund, Inc

$0.08

PIMCO Income Strategy Fund

$0.075

PIMCO Income Strategy Fund II

$0.065

The dividends will be payable on March 1, 2012 to shareholders

of record on February 13, 2012, with an ex-dividend date of

February 9, 2012.

At January 31, 2012, the Funds’ net assets were

approximately:

(in millions) PIMCO Corporate &

Income Strategy Fund (a) $679.5 PIMCO Corporate &

Income Opportunity Fund (a) $1,333.7 PIMCO Global StocksPLUS® &

Income Fund $119.6 PIMCO High Income Fund (a) $1,214.7 PIMCO Income

Opportunity Fund $354.9 PIMCO Strategic Global Government Fund, Inc

$357.3 PCM Fund, Inc. $113.8 PIMCO Income Strategy Fund (a) $337.9

PIMCO Income Strategy Fund II (a) $709.9

(a) Net assets are inclusive of Preferred Shares of $169

million, $325 million, $292 million, $78,975,000 and $161 million

for PCN, PTY, PHK, PFL and PFN, respectively.

The Funds are closed-end management investment companies. The

primary objective of PCN is to seek high current income with

secondary objectives of capital preservation and appreciation. The

investment objective of PTY is to seek maximum total return through

a combination of current income and capital appreciation. The

primary objective of PGP is to provide total return through a

combination of current income, current gains and long-term capital

appreciation. PHK’s primary objective is to seek high current

income with capital appreciation as a secondary objective. PKO’s

investment objective is to seek current income as a primary focus

and also capital appreciation. RCS’s primary objective is to

generate a level of income higher than that generated by

high-quality, intermediate-term U.S. debt securities, with a

secondary objective of seeking to maintain volatility in the net

asset value of its shares comparable to that of high-quality,

intermediate-term U.S. debt securities. PCM seeks high current

income as a primary objective and capital gains as a secondary

objective. PFL and PFN’s investment objective is to seek high

current income, consistent with the preservation of capital. There

can be no assurance that the Funds will meet their stated

objectives.

Allianz Global Investors Fund Management LLC (“AGIFM”), an

indirect, wholly-owned subsidiary of Allianz Asset Management of

America, L.P. (formerly Allianz Global Investors of America, L.P.),

serves as the Funds’ investment manager and is a member of

Munich-based Allianz Group. Pacific Investment Management Company

LLC, an AGIFM affiliate, serves as the Funds’ sub-adviser.

The Funds’ daily New York Stock Exchange closing prices, net

asset values per share, as well as other information, including

updated portfolio statistics and performance are available at

http://www.allianzinvestors.com/closedendfunds or

by calling the Funds’ shareholder servicing agent at (800)

254-5197.

Statements made in this release that look forward in time

involve risks and uncertainties and are forward looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such risks and uncertainties include, without limitation,

the adverse effect from a decline in the securities markets or a

decline in the Funds' performance, a general downturn in the

economy, competition from other companies, changes in government

policy or regulation, inability to attract or retain key employees,

inability to implement its operating strategy and/or acquisition

strategy, and unforeseen costs and other effects related to legal

proceedings or investigations of governmental and self-regulatory

organizations. The Funds’ ability to pay dividends to common

shareholders is subject to the restrictions in their registration

statement, by-laws and other governing documents, as well as the

Investment Act of 1940.

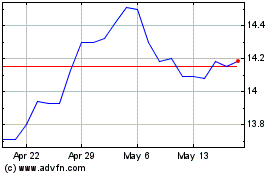

PIMCO Corporate and Inco... (NYSE:PTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

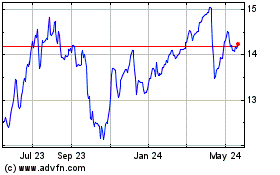

PIMCO Corporate and Inco... (NYSE:PTY)

Historical Stock Chart

From Jul 2023 to Jul 2024