Big Banc Split Corp. Announces Extension of Term and Increased Distribution Rates For Class A Shares and Preferred Shares

30 September 2023 - 6:34AM

(TSX: BNK, BNK.PR.A) Big Banc Split Corp. (the “Company”) is

pleased to announce that the board of directors of the Company has

approved an extension of the maturity date of the Company’s class A

shares (“Class A Shares”) and preferred shares (“Preferred Shares”)

for an additional 3-year term to November 30, 2026 (the “New Term”)

along with a significant increase in distribution rates for both

Class A Shares and Preferred Shares. Effective December 1, 2023,

the monthly distribution on Class A Shares will increase to $0.12

per Class A Share (or $1.44 per annum), representing a 14.8% yield

per annum based on the closing price as at September 28, 2023. The

monthly distributions on Preferred Shares will increase to $0.07

($0.84 per annum), representing an 8.4% yield on the par value of

$10.00 per Preferred Share (the “Preferred Share Distribution

Rate”). Purpose Investments Inc. (“Purpose”) is the manager,

portfolio manager and promoter of the Company and provides all

administrative services required by the Company.

“Having carefully assessed the portfolio of the

Company and its yield-generating potential, we are pleased to

provide shareholders with an extension of the Company’s maturity

date, along with material increases in monthly distribution rates

on both the Class A Shares and Preferred Shares,” said Vlad

Tasevski, Head of Asset Management and Head of Investors and

Institutional Partners at Purpose Investments Inc. “We believe the

Preferred Shares offer a very competitive combination of attractive

monthly distributions and downside protection, while the Class A

shares combine the opportunity for an enhanced capital appreciation

with an attractive double-digit distribution yield per annum. We

believe this emphasis on yield is consistent with our medium-term

market outlook for the Company’s Portfolio,” added Tasevski.

The Company invests on an approximately equally

weighted basis in a portfolio (the “Portfolio”) of equity

securities (the “Portfolio Shares”) of the following publicly

traded Canadian banks: Bank of Montreal; Canadian Imperial Bank of

Commerce; National Bank of Canada; Royal Bank of Canada; The Bank

of Nova Scotia; and The Toronto-Dominion Bank. In order to seek

additional returns and enhance the Portfolio’s income, Purpose

Investments Inc. (“Purpose Investments”), the Company’s manager,

may write covered call options and cash-covered put options in

respect of some or all of the Portfolio Shares held in the

Portfolio.

In connection with the extension, holders of

Class A Shares and Preferred Shares who do not wish to continue

their investment in the Company will be able to retract their

Preferred Shares or Class A Shares, as applicable, on November 30,

2023, pursuant to a special retraction right and receive a

retraction price that is calculated in the same way that such price

would be calculated if the Company were to terminate on November

30, 2023. Pursuant to this option, the retraction price may be less

than the market price if the Class A Share or Preferred Share, as

applicable, is trading at a premium to net asset value. To exercise

this retraction right, shareholders must provide notice to their

investment dealer by October 31, 2023, at 5:00 p.m. (Toronto time).

Alternatively, shareholders may sell their Preferred Shares and/or

Class A Shares through their securities dealer at the market price

at any time, potentially at a higher price than would be achieved

through retraction, or shareholders may take no action and continue

to hold their Class A Shares or Preferred Shares.

About Purpose Investments

Inc.Purpose Investments is an asset management company

with more than $16 billion in assets under management. Purpose

Investments has an unrelenting focus on client-centric innovation,

offering a range of managed and quantitative investment products.

Purpose Investments is led by well-known entrepreneur Som Seif and

is a division of Purpose Unlimited, an independent,

technology-driven financial services platform that is reshaping the

industry by connecting and creating opportunities across asset

management, wealth management and small business financial

services.

For further information, please contact:Keera Hart

Keera.Hart@kaiserpartners.com 905-580-1257

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the investment funds on

the Toronto Stock Exchange. If the securities are purchased or sold

on the Toronto Stock Exchange or other market, you may pay more

than the current net asset value when buying shares of the

investment fund and may receive less than the current net asset

value when selling them. Investment funds are not guaranteed, their

values change frequently, and past performance may not be

repeated.

Commissions, trailing commissions, management

fees and expenses may all be associated with investment Fund

investments. The prospectus contains important detailed information

about the investment Fund. Please read the prospectus before

investing. There is no assurance that any Fund will achieve its

investment objective, and its net asset value, yield, and

investment return will fluctuate from time to time with market

conditions. Investment Fund securities are not covered by the

Canada Deposit Insurance Corporation or by any other government

deposit insurer. Investment Funds are not guaranteed, their values

change frequently, and past performance may not be repeated.

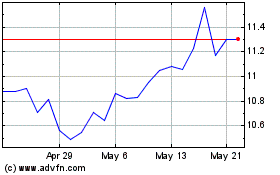

Big Banc Split (TSX:BNK)

Historical Stock Chart

From Jan 2025 to Feb 2025

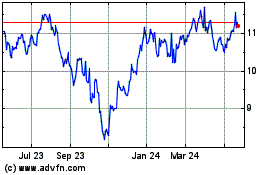

Big Banc Split (TSX:BNK)

Historical Stock Chart

From Feb 2024 to Feb 2025