Suncor Energy declares dividend

06 May 2020 - 9:21AM

The convergence of two global events has created a turbulent market

situation. The COVID-19 pandemic and the associated rapid demand

reduction and the crude oil supply shock as a result of the OPEC+

production decisions are expected to keep crude oil prices lower

for at least the next 12-24 months. The fundamentals necessary for

a recovery include: product demand returning as a result of global

economies restarting and oil production and inventories coming back

into balance. Given the unprecedented size of global crude

inventories, we know that bringing the market back into balance

will take some time, although the exact pace is uncertain.

In order to maintain the financial health and

resiliency of the company to navigate the current market

conditions, the company has reduced operating costs by $1 billion

(10%) compared to 2019 levels. It has also increased its liquidity

by $4 billion. In addition, we have reduced 2020 capital

expenditures by $1.9 billion (33%) compared to the original 2020

plan.

“Suncor’s Board of Directors remains committed to

leveraging our long life, low decline resource base and providing

the energy that society needs, while continuing to return value to

shareholders,” said Mark Little, president and chief executive

officer. “However, after taking significant action in reducing

capital and operating costs, the Board believes that reducing the

current level of dividends is required to drive down the cash

breakeven of the company to a WTI price of US$35 per barrel.

As a result, the Board has decided to reduce the quarterly cash

dividend by 55% to $0.21 per common share from $0.465 per common

share.” This dividend will be payable on June 25, 2020 to

shareholders of record at the close of business on June 4,

2020.

At a WTI price of US$35 per barrel, all planned

operating and administration costs, sustaining capital and

dividends can be covered from operating revenue, once demand

returns. These actions not only support a strong balance sheet, the

financial health of the company, including Suncor’s high investment

grade credit ratings, but also increases the resiliency of the

company allowing it to maintain its focus on long term value

creation. “The combination of these steps taken will keep the

company strong and position us to outperform as markets recover,”

said Little.

Legal Advisory – Forward-Looking

Information

This news release contains certain forward-looking

information and forward-looking statements (collectively referred

to herein as "forward-looking statements") within the meaning of

applicable Canadian and U.S. securities laws. Forward-looking

statements in this news release include references to: Suncor's

expectations surrounding the impacts of the COVID-19 pandemic and

the associated demand reduction, including that crude oil prices

will be lower for at least the next 12-24 months and the

fundamentals necessary for a recovery; Suncor's target to reduce

total operating costs by $1 billion compared to 2019 levels and its

plan to reduce 2020 capital expenditures by $1.9 billion compared

to the original 2020 plan; Suncor's Board of Directors commitment

to continuing to return value to shareholders and its belief that

reducing the current levels of dividends will drive down the cash

breakeven of the company to a WTI price of US$35 per barrel, and

the basis for such belief; Suncor's belief that, at a WTI price of

US$35 per barrel, all planned operating and administration costs,

sustaining capital and dividends can be covered from operating

revenue, once demand returns, and the basis for such beliefs; and

Suncor's expectation that the steps it is currently taking will

help keep the company strong and position it to outperform as

markets recover. In addition, all other statements and

information about Suncor's strategy for growth, expected and future

expenditures or investment decisions, commodity prices, costs,

schedules, production volumes, operating and financial results and

the expected impact of future commitments are forward-looking

statements. Some of the forward-looking statements may be

identified by words like "will", "expected", "focus", "planned",

"believe", "anticipated", "target" and similar expressions.

Forward-looking statements are based on Suncor's

current expectations, estimates, projections and assumptions that

were made by the company in light of information available at the

time the statement was made and consider Suncor's experience and

its perception of historical trends, including expectations and

assumptions concerning: the current and potential adverse impacts

of the COVID-19 pandemic; the accuracy of reserves and resources

estimates; commodity prices and interest and foreign exchange

rates; the performance of assets and equipment; capital

efficiencies and cost-savings; applicable laws and government

policies; future production rates; the sufficiency of budgeted

capital expenditures in carrying out planned activities; the

availability and cost of labour, services and infrastructure; the

satisfaction by third parties of their obligations to Suncor; the

development and execution of projects; and the receipt, in a timely

manner, of regulatory and third-party approvals.

Forward-looking statements are not guarantees of

future performance and involve a number of risks and uncertainties,

some that are similar to other oil and gas companies and some that

are unique to Suncor. Suncor's actual results may differ materially

from those expressed or implied by its forward- looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor's most recently filed Management's Discussion &

Analysis, together with Suncor's most recently filed Annual

Information Form, Form 40-F and Annual Report to Shareholders and

other documents Suncor files from time to time with securities

regulatory authorities describe the risks, uncertainties, material

assumptions and other factors that could influence actual results

and such factors are incorporated herein by reference. Copies of

these documents are available without charge from Suncor at 150 6th

Avenue S.W., Calgary, Alberta T2P 3E3; by email request to

invest@suncor.com; by calling 1-800-558-9071; or by referring to

suncor.com/FinancialReports or to the company's profile on SEDAR at

sedar.com or EDGAR at sec.gov. Except as required by applicable

securities laws, Suncor disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

Suncor Energy is Canada's leading integrated energy

company. Suncor's operations include oil sands development and

upgrading, offshore oil and gas production, petroleum refining, and

product marketing under the Petro-Canada brand. A member of Dow

Jones Sustainability indexes, FTSE4Good and CDP, Suncor is working

to responsibly develop petroleum resources while also growing a

renewable energy portfolio. Suncor is listed on the UN Global

Compact 100 stock index. Suncor's common shares (symbol: SU) are

listed on the Toronto and New York stock exchanges.

For more information about Suncor, visit our web

site at suncor.com, follow us on Twitter @Suncor or

together.suncor.com

| Investor

inquiries: |

800-558-9071 |

| |

invest@suncor.com |

| |

|

| Media inquiries: |

1-833-296-4570 |

| |

media@suncor.com |

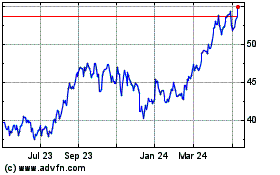

Suncor Energy (TSX:SU)

Historical Stock Chart

From Mar 2025 to Apr 2025

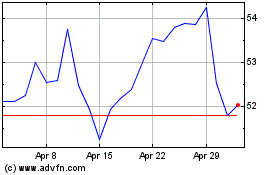

Suncor Energy (TSX:SU)

Historical Stock Chart

From Apr 2024 to Apr 2025