Copper Fox Closes Carmax Investment

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 29, 2014) -

Copper Fox Metals Inc. ("Copper Fox" or the "Company")

(TSX-VENTURE:CUU) is pleased to announce that it has, through a

wholly owned subsidiary, closed a previously announced non-brokered

private placement (the "Private Placement") in Carmax Mining Corp.

("Carmax") (TSX-VENTURE:CXM) pursuant to which Copper Fox has

indirectly acquired 20,000,000 units of Carmax for an aggregate

subscription price of $1 million. Units (each a "Unit") were

subscribed for at a price of $0.05 per Unit and consisted of one

previously unissued common share ("Share") and one common share

purchase warrant ("Warrant") of Carmax. Each Warrant is exercisable

for a period of 24 months from the closing date of the Private

Placement and entitles the holder, on exercise, to purchase one

additional common share of Carmax at a price of $0.075 per

share.

Carmax is in the process of completing a further private

placement for an aggregate of 4,000,000 Units with investors other

than Copper Fox (the "Second Placement") which is expected to close

in the first week of June.

Prior to the completion of the Private Placement, Copper Fox and

its subsidiaries held no common shares or other securities of

Carmax. After giving effect to the acquisition of the Units, Copper

Fox beneficially owns and controls 20,000,000 Shares of Carmax,

representing approximately 42% of the issued and outstanding common

shares of Carmax on an undiluted basis as at the date hereof (based

on a total of 47,515,997 common shares of Carmax issued and

outstanding with no effect being given to the Second Placement).

Copper Fox also holds Warrants issued pursuant to the Private

Placement which entitle Copper Fox to indirectly acquire an

additional 20,000,000 common shares of Carmax, which together with

the above noted Shares represent approximately 59% of the issued

and outstanding common shares of Carmax, calculated on a

partially-diluted basis assuming the exercise of all Warrants

issued pursuant to the Private Placement held by Copper Fox, but

with no effect being given to the Second Placement.

Copper Fox, through its aforementioned wholly owned subsidiary,

entered into a subscription agreement (the "Subscription

Agreement") with Carmax to acquire the Units, and such Subscription

Agreement contained representations, warranties and covenants of

the respective parties that are standard and customary in

agreements of this nature, including representations that allow

reliance on applicable Canadian private placement prospectus

exemptions. Moreover, pursuant to the Subscription Agreement Carmax

granted Copper Fox certain rights, including, but not limited

to:

- the right to nominate two members to the Board of Carmax at

each annual meeting of Carmax's shareholders;

- the pre-emptive right to participate in any equity financing of

Carmax, so as to maintain its pro rata percentage shareholding in

Carmax; and

- the right to make top-up investments in Carmax, by way of

future private placements, so as to maintain its pro rata

percentage shareholding in Carmax.

The aforementioned rights are, however, subject to Copper Fox

and its affiliates maintaining ownership of 20% of Carmax's issued

and outstanding common shares.

Pursuant to the Subscription Agreement, Carmax has agreed to use

the proceeds of the Private Placement to carry out a field program

on its Eaglehead property this summer. Please refer to our previous

new release dated April 10, 2014 for more information on the

Eaglehead property.

Copper Fox acquired the Units for investment purposes. Depending

on economic and financial conditions, Copper Fox may acquire

further common shares of Carmax (through market or private

transactions) from time to time for investment purposes.

Upon the closing of the Private Placement, Elmer Stewart was

appointed to the Board of Caramx.

Elmer B. Stewart, President and CEO of Copper Fox stated,

"We are looking forward to working with Carmax to advance the

exploration and develop the potential of the Eaglehead property.

This investment provides Copper Fox significant exposure to a

large, advanced copper-molybdenum-gold-silver property in northern

British Columbia. This investment follows our strategy to locate,

explore and add value through the exploration and development of

large copper deposits located in North America."

About Copper Fox

Copper Fox is a Canadian resource development company listed on

the TSX-Venture Exchange (TSX-VENTURE:CUU) with offices in Calgary,

Alberta and Miami, Arizona. In addition to Copper Fox's 25%

interest in the Schaft Creek Joint Venture, Copper Fox holds,

through Desert Fox Copper Inc. (a wholly owned subsidiary of Copper

Fox) and its wholly-owned subsidiaries, the Sombrero Butte copper

project in the Bunker Hill Mining District, Arizona and the Van

Dyke oxide copper project in the Globe-Miami Mining District,

Arizona. Desert Fox Copper Inc. has opened an operations office in

Miami, Arizona to advance the work required on the Van Dyke copper

project to a Preliminary Economic Assessment. For further

information on these projects, please refer to the Company's

website at www.copperfoxmetals.com.

This news release is being issued pursuant to Part 3 of National

Instrument 62-103 The Early Warning System and Related

Take-Over Bid and Insider Reporting Issues ("NI 62-103") of

the Canadian Securities Administrators. A copy of the report filed

by Copper Fox in connection with the Private Placement will be

available on Carmax's SEDAR profile and can be directly obtained

from Copper Fox by contacting Copper Fox at the below numbers, in

each case, within two days after the date hereof.

| On behalf of the Board of Directors |

|

| Elmer B. Stewart |

| President and Chief Executive Officer |

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within

the meaning of the Canadian securities laws. Forward-looking

information is generally identifiable by use of the words

"believes," "may," "plans," "will," "anticipates," "intends,"

"budgets", "could", "estimates", "expects", "forecasts", "projects"

and similar expressions, and the negative of such expressions.

Forward-looking information in this news release includes, but is

not limited to: the rights of Copper Fox to purchase additional

common shares under pursuant to the Warrants; the timing of the

completion of the Second Placement; the nature of certain

nomination and anti-dilution rights granted by Carmax to Desert Fox

in connection with its investment in Carmax and the conditionality

of such rights; the possibility that Copper Fox may acquire

additional common shares of Carmax for investment purposes; the use

of the proceeds of the Private Placement to fund exploration on the

Eaglehead property; Copper Fox's intention to work with Carmax to

advance the exploration and development of the Eaglehead property;

and the filing and availability of the report to be filed in

association with this news release pursuant to NI 62-103.

In connection with the forward-looking information contained in

this news release, Copper Fox has made numerous assumptions. While

Copper Fox considers these assumptions to be reasonable, these

assumptions are inherently subject to significant uncertainties and

contingencies. Additionally, there are known and unknown risk

factors which could cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking information contained herein. Known risk factors

include, among others: the Second Placement may not complete; the

actual mineralization in the Eaglehead property deposit may not be

as favorable as suggested by resource estimates; the possibility

that future drilling and geophysical exploration on the Eaglehead

property may not occur on a timely basis, or at all; fluctuations

in copper and other commodity prices and currency exchange rates;

uncertainties relating to interpretation of drill results and the

geology, continuity and grade of the mineral deposit; uncertainty

of estimates of capital and operating costs, recovery rates, and

estimated economic return; the need to obtain additional financing

to develop properties and uncertainty as to the availability and

terms of future financing; the possibility of delay in exploration

or development programs or in construction projects and uncertainty

of meeting anticipated program milestones; and uncertainty as to

timely availability of permits and other governmental

approvals.

A more complete discussion of the risks and uncertainties facing

Copper Fox is disclosed in Copper Fox's continuous disclosure

filings with Canadian securities regulatory authorities at

www.sedar.com. All forward-looking information herein is qualified

in its entirety by this cautionary statement, and Copper Fox

disclaims any obligation to revise or update any such

forward-looking information or to publicly announce the result of

any revisions to any of the forward-looking information contained

herein to reflect future results, events or developments, except as

required by law.

Investor line1-866-913-1910or Lynn Ball at1-604-689-5080

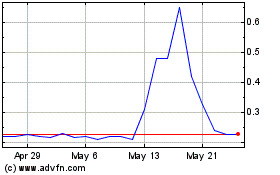

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Apr 2024 to May 2024

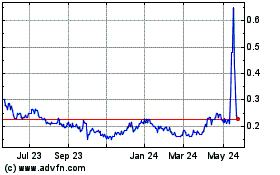

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From May 2023 to May 2024