Immunotec Inc. (TSX VENTURE:IMM), a Canadian based company and a leader in the

wellness industry (the "Company" or "Immunotec"), today released its second

quarter 2013 financial results for the three- and six- month periods ended 30

April 2013.

"Immunotec's results are testimony to our founders' vision for bringing improved

health and wellness to our product and opportunity customers. We thank our

independent consultants, employees and external partners who collaborate every

day to make this possible." said Mr. Charles L. Orr, Immunotec's Chief Executive

Officer.

Highlights for the second quarter of fiscal 2013

-- Total Revenue for the three-month period reached $12.6M, an increase of

10.6% as compared to the same period in the previous year. Total revenue

in the six-month period reached $24.8M, an increase of 10.4% as compared

to the same period in the previous year.

-- Network sales in the three-month period reached $11.2M, an increase of

9.0% as compared to the same period in the previous year. Network sales

in the six- month period reached $22.4M, an increase of 10.7% as

compared to the same period in the previous year.

-- Selected expenses,(1) defined as administrative, marketing and selling,

quality and development expenses in the three-month period ended 30

April 2013, amounted to $3.0M or 23.9% of total revenues, which compares

favourably to 24.6% for the same period in the previous year. In the

six-month period, these expenses amounted to $5.9M or 23.9% of total

revenues, also comparing favourably to 25.9% the same period of the

previous year.

-- Adjusted EBITDA,(1) in the three-month period ended 30 April 2013

improved to $0.9M or 7.4% of total revenues, compared to $0.2M or 1.6%

of total revenues for the same period in the previous year, a

significant improvement. For the six-month period, Adjusted EBITDA(1)

amounted to $1.8M or 7.1% of total revenues, also a significant

improvement.

-- Net profit for the three-month period ended 30 April 2013 amounted to

$0.7M; a significant improvement over a net loss of $0.1M for the same

period in the previous year. For the six-month period ended 30 April

2013, net profit amounted to $1.2M, also a significant improvement over

a loss of $0.1M in the same period in the previous year.

(1) Refer to the non-GAAP financial measures section of Management's

Discussion and Analysis.

About Immunotec Inc.

Immunotec is a world-class business opportunity supported by unique,

scientifically proven products that improve wellness. Headquartered with

manufacturing facilities near Montreal, Canada, the Company also has

distribution capacities to support its commercial activities in Canada and

internationally to the United States, Mexico, Europe and the Caribbean.

The Company files its consolidated financial statements, its management and

discussion analysis report, its press releases and such other required documents

on the SEDAR database at www.sedar.com and on the Company's website at

www.immunotec.com. The common shares of the Company are listed on the TSX

Venture Exchange under the ticker symbol IMM.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS: Certain statements contained in

this news release are forward-looking and are subject to numerous risks and

uncertainties, known and unknown. For information identifying known risks and

uncertainties and other important factors that could cause actual results to

differ materially from those anticipated in the forward-looking statements,

please refer to the heading Risks and Uncertainties in Immunotec's most recent

Management's Discussion and Analysis, which can be found at www.sedar.com.

Consequently, actual results may differ materially from the anticipated results

expressed in these forward-looking statements.

SUPPLEMENTAL INFORMATION

Immunotec Inc.

Interim Consolidated Statements of Financial Position

30 April 31 October

2013 2012

(Canadian dollars) $ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

ASSETS

Current assets

Cash 3,364,901 3,779,089

Trade and other receivables 1,308,887 1,688,279

Inventories 3,205,946 2,601,079

Prepaid expenses 478,595 374,774

----------------------------------------------------------------------------

8,358,329 8,443,221

Non-current assets

Property, plant and equipment 5,833,889 5,931,470

Intangible assets 1,407,804 1,621,830

Goodwill 833,559 833,559

Other non- current assets 3,824,319 3,102,151

----------------------------------------------------------------------------

11,899,571 11,489,010

----------------------------------------------------------------------------

20,257,900 19,932,231

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES

Current liabilities

Bank indebtedness - 5,000

Payables 1,597,624 1,545,310

Accrued liabilities 3,121,910 3,151,212

Provisions 233,488 491,776

Deferred revenue and customer deposits 476,840 630,240

Income taxes 28,596 54,859

Current portion of long- term debt 119,246 117,120

----------------------------------------------------------------------------

5,577,704 5,995,517

Long- term debt 1,902,031 1,964,336

----------------------------------------------------------------------------

7,479,735 7,959,853

----------------------------------------------------------------------------

EQUITY

Share capital 3,448,285 3,462,503

Contributed surplus 13,223,374 13,259,401

Accumulated other comprehensive income (151,266) 179,531

Deficit (3,742,228) (4,929,057)

----------------------------------------------------------------------------

12,778,165 11,972,378

----------------------------------------------------------------------------

20,257,900 19,932,231

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Immunotec Inc.

Interim Consolidated Statements of Income (Loss)

For the three-and six-month periods ended 30 April

Three months Six months

2013 2012 2013 2012

(Canadian dollars except

for the number of

shares) $ $ $ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenues

Network sales 11,200,095 10,277,123 22,400,589 20,238,165

Other revenue 1,430,248 1,142,964 2,409,113 2,225,090

----------------------------------------------------------------------------

12,630,343 11,420,087 24,809,702 22,463,255

Cost of sales

Cost of goods sold 2,231,194 1,935,261 4,219,646 3,791,383

Sales incentives -

Network 5,596,762 5,407,413 10,978,737 10,371,660

Other variable costs 992,357 1,088,149 2,067,599 2,037,160

----------------------------------------------------------------------------

Margin before expenses 3,810,030 2,989,264 7,543,720 6,263,052

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Expenses

Administrative 1,536,284 1,378,453 2,975,830 2,999,778

Marketing and selling 1,256,541 1,248,505 2,495,615 2,405,769

Quality and

development costs 225,685 183,460 452,720 406,133

Depreciation and

amortization 219,924 223,658 440,596 463,262

Other expenses 16,063 11,706 20,514 21,847

----------------------------------------------------------------------------

Operating income (loss) 555,533 (56,518) 1,158,445 (33,737)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net finance expenses

(income) (267,745) 124,857 (335,619) 80,373

----------------------------------------------------------------------------

Profit (loss) before

income taxes 823,278 (181,375) 1,494,064 (114,110)

Income taxe expense

(recovery)

Current 4,417 13,298 5,509 15,455

Deferred 160,285 (85,747) 301,726 (27,047)

----------------------------------------------------------------------------

Net profit (loss) 658,576 (108,926) 1,186,829 (102,518)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total basic and diluted

net profit (loss)

common per share 0.01 (0.00) 0.02 (0.00)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Weighted average number

of common shares

outstanding during the

period

Basic and diluted 69,681,982 69,994,300 69,767,670 69,994,300

----------------------------------------------------------------------------

Immunotec Inc.

Interim Consolidated Statements of Cash Flows

For the six-month periods ended 30 April

2013 2012

(Canadian dollars) $ $

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Operating activities

Net profit (loss) 1,186,829 (102,518)

Adjustments for:

Depreciation 197,712 185,685

Amortization 242,884 277,577

Unrealized foreign exchange differences (331,625) (46,253)

Net interest expense on finanical

liabilities measured at amortized cost 37,697 39,734

Deferred income taxes 301,726 (27,047)

Share- based compensation 20,514 21,847

Interest paid (37,697) (42,129)

Interest received - 2,395

----------------------------------------------------------------------------

Cash prior to working capital variation 1,618,040 309,291

Net change in non- cash working capital (1,649,133) 422,569

----------------------------------------------------------------------------

Net cash (used in) provided by operating

activities (31,093) 731,860

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Investing activities

Additions to property, plant and equipment (77,907) (314,823)

Additions to intangible assets (27,423) (83,057)

----------------------------------------------------------------------------

Net cash used in investing activities (105,330) (397,880)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Financing activities

Bank indebtedness (5,000) -

Reimbursement of long- term debt (60,179) (55,982)

Repurchase of shares (70,759) -

Reimbursment of other liability - (200,203)

----------------------------------------------------------------------------

Net cash used in financing activities (135,938) (256,185)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net (decrease) increase in cash during the

period (272,361) 77,795

Cash - Beginning of the period 3,779,089 2,561,969

Effect of foreign exchange rate fluctuations

on cash (141,827) (13,627)

----------------------------------------------------------------------------

Cash - End of the period 3,364,901 2,626,137

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Immunotec Inc.

Patrick Montpetit

Chief Financial Officer

(450) 510-4527

www.immunotec.com

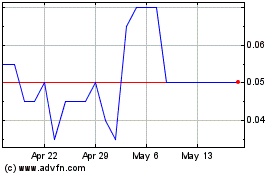

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Apr 2024 to May 2024

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From May 2023 to May 2024